Open Banking Market Overview

The global open banking market was valued at $13.9 billion in 2020, and is projected to reach $123.7 billion by 2031, growing at a CAGR of 22.3% from 2022 to 2031. Growing adoption of digital banking, supportive regulations, fintech innovation, improved customer experience, data transparency, and increased collaboration between banks and fintechs, enhancing efficiency and financial accessibility contribute to the growth of the market.

Market Dynamics & Insights

- The open banking industry in Europe held the largest share in 2020.

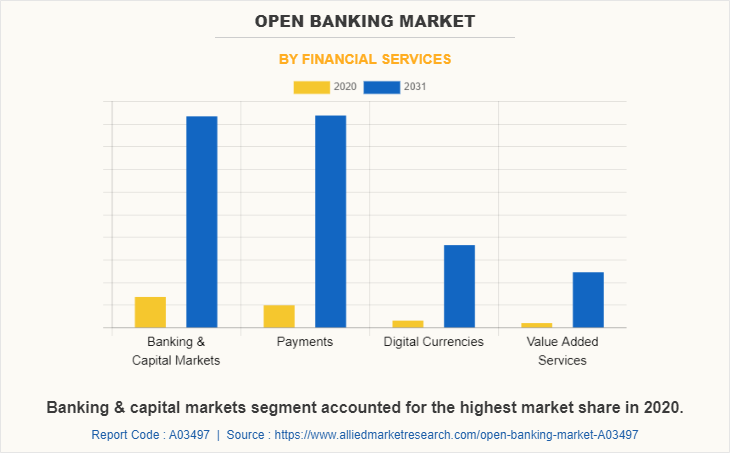

- By financial services, the banking & capital markets segment held the largest share in the open banking market size for 2020.

- By distribution channel, the app market segment acquired a major share of the open banking market.

Market Size & Future Outlook

- 2020 Market Size: $13.9 Billion

- 2030 Market Size: $123.7 Billion

- CAGR (2022-2031): 22.3%

- Europe: Dominated market share in 2020

What is Meant by Open Banking

Open banking is a financial service which includes sharing of financial information electronically. Furthermore, open banking services make use of application programming interface (APIs) to carry out a secure transfer of financial data. In addition, the financial information is exchanged between banks and third-parties service providers. An open API offers security to private data of customers, such as a third party’s service providers collect user’s transaction history and patterns, which provides easy access to openly available data such as a bank’s product offerings. Thus, the financial information collected for a customer is utilized in developing advanced applications which are aimed at improving consumer experience associated with the use of financial services.

The major factor which contributes toward the growth of the open banking market includes an increase in the number of people using new wave apps and services. In addition, an upsurge in customer engagement and attending banking customers need boost the growth of the open banking market. Furthermore, there are a lot of benefits associated with an open banking platform and are advantageous for all parties involved in the financial services sector, including banks, enterprises, Fintechs, and innovators. This is an important factor that fosters the growth of open banking market. However, an increase in events of online fraud and data insecurity is expected to restrict the open banking market growth. On the contrary, significant increase in the collaboration of financial service providers, and traditional banking with FinTech is expected to be opportunistic for the open banking market growth.

The report focuses on growth prospects, restraints, and trends of the open banking market outlook. The study provides Porter’s Five Forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the data analytics in banking market outlook.

The open banking market is segmented into Financial Services and Distribution Channel.

Open Banking Market Segment Review

The open banking market is studied on the basis of financial services, distribution channel, and region. By financial service, the market is divided into bank & capital market, payments, digital currencies, and others. As per distribution channel, it is classified into bank channels, app market, distributors, and aggregators. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By financial service, the banks & capital segment acquired the majority of the open banking market share in 2020. This is attributed to the fact that banking and capital markets utilize open banking services to collect customer related demographical information to increase their reach and to acquire new customers. In addition, the concept of open banking is fairly new for banking and capital markets.

Region-wise, Europe acquired the majority of open banking market size in 2020. This is attributed to growth in open banking platform and need to increase security of online payments. Furthermore, the government directives for banks to mandatorily open APIs is another factor that boosts the growth of the market in this region.

The key players operating in the open banking market forecast include as Banco Bilbao Vizcaya Argentaria. S.A., Credit Agricole, Deposit Solutions, Finastra, Jack Henry & Associates, Inc., Nordigen Solutions, Revolut Ltd., Societe Generale, Tink (Visa Inc.), and Yapily Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the open banking industry.

What are the Top Impacting Factors in Open Banking Market

Potential benefits of open banking

Open banking is beneficial across the value chain of financial services industry, including consumers, businesses, Fintech companies, banks, and financial institutions. A customer in financial services receives access to better banking services, along with access to innovative and personalized financial products through the implementation of open banking across the industry. A customer can reap benefit of choice as they have multiple options or service providers to choose from for their financial needs. Open banking pushes banks to provide more customized and relevant product offerings to the customers by understanding their demographics, requirements, and other credible financial information such as KYC documents. These customized offerings help a customer in the decision-making process and enhance the overall value of the financial service/product. Open banking is an easy way for bank to extend their services.

The open banking platforms are beneficial to banks to understand their customers as well as competitors by open banking companies. Moreover, it helps banks to enhance their services and product offerings, and further deliver better customer service and engagements. Open banking offers easy operations that help customers to access the required information in a consolidated form. Further, it enhances centralization model for the banking services. Through these banks achieve full control over various services, such as advice, loans, transfers, and financing, which are offered to the customers.

Increase in adoption of new applications and services

Open banking related third-party providers and banks developed applications that help customers to attain consolidated details of their accounts from various financial service providers. Furthermore, the use of these applications and services helps manage customer data and money. In addition, these series also offer advice to customers for improved management of their wealth. Customers are enhanced with digital services from open banking and other banking sectors. According to the Forrester Research report 2019, a total of 34% of European adults use an application or bank’s mobile website for banking activities. Furthermore, 64% of the adults are expected to adopt open banking in the coming years. In addition, open banking is expected to create a new and advanced channel for banks to connect with customers. This is also anticipated to provide opportunity to the third-party services for development of better applications and services. This offers financial institution to launch applications and other innovative services to improve overall open banking experience. The increase in the open banking adoption of new applications and services help customers to opt for better experience and drive the overall market growth

Improved overall customer engagement with open banking API’s

Open banking API offers a unique way to improve customer needs by providing easy accessibility to the customers. The banking and financial firm provides its own application programming interfaces (APIs) that allow the third parties and banks to provide innovative services, which further offer expected growth in the financial revenue. In addition, an open banking application platform encourages customers to engage with their financial data in an innovative way. Further, banks are recognizing the potential of open banking and enhancing services offering customer experience and customer engagement. Hence, open banking demands new approaches to drive customer engagement. This in turn is anticipated to drive the growth of the open banking market.

Although the market is anticipated to grow over the forecast period, open banking challenges such as concerns regarding growing cyber-attacks and online fraud. Open banking encourages the sharing of critical customer information, which raises concerns over data security and privacy protection.

Report Coverage & Deliverables

Type Insights

Examination of open banking as a transformative in open banking policy and open banking service model, detailing its impact on the financial sector and its role in promoting innovation and competition.

Technology Insights

Analysis of open banking growth driven by advancements in APIs, cloud solutions, and secure data sharing technologies, highlighting how these innovations are shaping the open banking domain.

Application Insights

Evaluation of open banking share across various financial applications, identifying key areas where Open Banking is making significant contributions and noting emerging trends.

Regional Insights

Overview of open banking value across different regions, providing a detailed assessment of adoption rates, market dynamics, and regional variations in implementation and impact.

Key Companies & Market Share Insights

Profile of major open banking companies in the Open Banking landscape, including their market share, strategies, and competitive positioning, offering a comprehensive view of the market structure and key influencers.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the open banking market analysis from 2020 to 2031 to identify the prevailing open banking market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the open banking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as open banking market trends, key players, market segments, application areas, and market growth strategies.

Open Banking Market Report Highlights

| Aspects | Details |

| By Financial Services |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Finestra, Jack Henry & Associates, Inc., Credit Agricole, Deposit Solutions, Nordigen Solutions, BBVA SA, Societe Generale, Yapily Ltd., Revolut Ltd., Tink |

Analyst Review

Open banking is a new concept and the growth of the market is expected to increase owing to favorable government regulations which guide the use of open banking platforms in various financial and banking services. Moreover, launch of new type of digital currencies by the central governments of various countries is projected to surge the demand for open banking platforms through which digital currencies can be used. In addition, various key players across the globe are collaborating to develop advanced open banking platforms which is another major factor that boosts the growth of the market. Furthermore, the surge in the use of online platforms for making payments is contributing toward the growth of the open banking market.

The COVID-19 outbreak has a positive impact on the open banking market. Furthermore, the pandemic has promoted the usage payment gateways such as PhonePe, Paytm, and Google Pay to manage recurring billing which are used in open banking. This, as a result, fosters the demand for open banking, thereby accelerating the growth of the market.

The open banking market is fragmented with the presence of regional vendors such as Banco Bilbao Vizcaya Argentaria. S.A., Credit Agricole, Deposit Solutions, Finastra, Jack Henry & Associates, Inc., Nordigen Solutions, Revolut Ltd., Societe Generale, Tink (Visa Inc.), and Yapily Ltd. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for open banking across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The open banking market is estimated to grow at a CAGR of 22.3% from 2022 to 2031.

The open banking market is projected to reach $123.65 billion by 2031.

Potential benefits of open banking, increase in adoption of new applications and services and improved overall customer engagement with open banking APIs majorly contribute toward the growth of the market.

The key players profiled in the report include Banco Bilbao Vizcaya Argentaria. S.A., Credit Agricole, Deposit Solutions, Finastra, Jack Henry & Associates, Inc., Nordigen Solutions, Revolut Ltd., Societe Generale, Tink (Visa Inc.), and Yapily Ltd.

The key growth strategies of open banking market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...