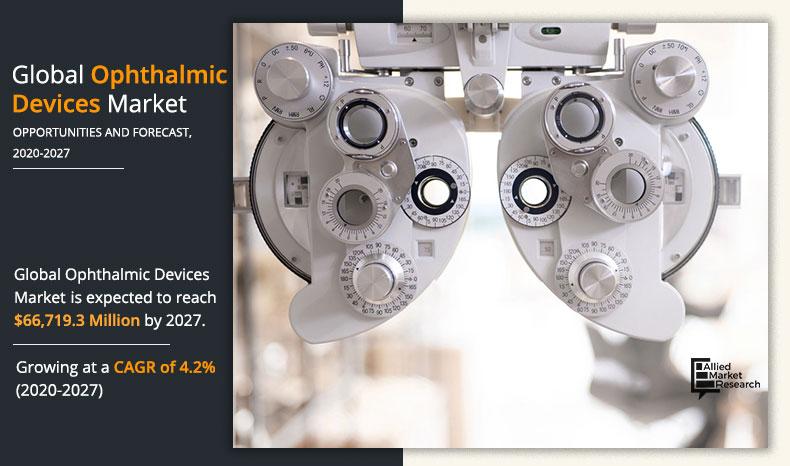

Ophthalmic Devices Market Outlook 2027

The global ophthalmic devices market size was valued at $53,428.8 million in 2019, and is projected to reach $66,719.3 million by 2027, registering a CAGR of 4.2% from 2020 to 2027.Ophthalmology is a branch of medical science that deals with the structure, function, and various eye diseases. Ophthalmic devices are medical equipment designed for diagnosis, surgery, and vision correction. These devices gain increased importance and adoption due to high prevalence of various ophthalmic diseases such as glaucoma, cataract, and other vision-related issues.

Increase in prevalence of ophthalmic diseases such as cataract and glaucoma is a key factor that significantly drives the growth of the global ophthalmic devices market. In addition, surge in penetration of digital devices, including laptops, smartphones, and computers, e-readers; rapid technological advancements such as introduction of intraocular lenses (IOLs); and increase in focus on customer training and education among eye care professionals regarding eye diseases and associated complications notably contribute toward the growth of the global market. Furthermore, increase in R&D activities for novel devices development related to vision error and rise in awareness related to devices used in the field of ophthalmology are expected to propel the market growth. However, low awareness about eye-related diseases and dearth of skilled professionals are expected to hamper the growth of the market. On the contrary, the emerging countries such as China and India possess high growth potential, owing to the improving healthcare infrastructure in these countries.

The emergence of the novel coronavirus SARS-CoV-2 has created a major international public health challenge. This has impacted all sectors, disrupting the supply chain and creating a shortage of supplies. As the government has imposed lockdown, ophthalmology surgeries have been postponed. This is attributed to the fact that ophthalmologists are at high risk, considering the proximity to patients when diagnosing patients. Furthermore, the government has imposed guidelines for practice such as the use of teleophthalmology services for patients who require urgent follow-up.

Depending on product function, the report segments the global ophthalmic devices market into ophthalmic surgical devices, diagnostic devices, and vision care devices. The ophthalmic surgical devices segment is further categorized into refractive error surgical devices, glaucoma surgical devices, cataract surgical devices, and vitreoretinal surgical devices. The cataract surgery devices segment garnered the largest share in ophthalmic surgical devices market in 2019, owing to increase in prevalence of cataract each year, which resulted in increase in number of surgeries.

The global ophthalmic diagnostic devices segment is subdivided into refractors, corneal topography systems, retinal ultrasound systems, fundus camera, ophthalmoscopes, optical coherence tomography systems, perimeters, slit lamps, and tonometer. The optical coherence tomography systems (OCT) dominates the market in 2019, and is expected to continue the trend during the forecast period. This is attributed to extensive use of optical coherence tomography systems in drug discovery and their technological benefits such as ability to visualize in-depth structures of the eye, surface tissue, and vascular systems.

The vision care devices segment is bifurcated into contact lenses and spectacle lenses. The contact lenses segment is estimated to grow at the highest CAGR of 3.9% from 2020 to 2027. This is attributed to increase in preference for contact lenses over prescription eyeglasses, due to changes in lifestyle and increase in demand for innovative lenses.

Region wise, the ophthalmic devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America ophthalmic devices market accounted for the largest share in 2019; however, Asia-Pacific is anticipated to register the highest CAGR of 4.6% throughout the forecast period. According to the Center for Diseases Control and Prevention, diabetic retinopathy is expected to account for major cause of blindness in the U.S. From 2010 to 2050, the number of Americans with diabetic retinopathy is expected to nearly double from 7.7 million to 14.6 million. Glaucoma further contributes toward the loss of vision and blindness.

By Product Function

Surgical devices is projected as one of the most lucrative segments.

Asia-Pacific is projected to witness significant growth during the forecast period, due to increase in the incidence of ophthalmic diseases such as cataract, glaucoma, age-related macular degeneration (AMD), and refractive errors. Moreover, rise in geriatric population and increase in inclination toward surgical procedures for treatment contribute toward the ophthalmic devices market growth. Furthermore, large number of patients operated with glaucoma and cataract in the Asian countries provide major opportunity for manufacturers, which they can capitalize on to increase their ophthalmic devices market share

Ophthalmology devices market is highly competitive in nature, as major players are focusing on development and launch of innovative products to strengthen their foothold in the competitive market. The key players operating in the global ophthalmic devices market include Novartis AG, Carl Zeiss Meditec AG, Essilor International S.A., HAAG-Streit Holding AG, HOYA Corporation, Johnson & Johnson, Nidek Co., Ltd., Topcon Corporation, Valeant Pharmaceuticals International, Inc., and Ziemer Ophthalmic Systems AG. The other players in the industry are Sonomed Escalon, Hoya Group, Gulden Ophthalmics, FCI Ophthalmics, Glaukos Corporation, and STAAR Surgical.

These market players are adopting strategies such as mergers & acquisitions, product launch, and geographical expansions to attain maximum share of the industry and to strengthen their product portfolio. Furthermore, key players in the market are increasing their R&D investments to attain competitive advantage.

By Region

North America segment holds a dominant position in 2019 and Asia-Pacific segment will lead over the forecast period.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global ophthalmic devices market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers ophthalmic devices market analysis from 2020 to 2027, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis on region assists to understand the regional ophthalmic devices market and facilitate the strategic business planning and determine prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook of the global ophthalmic devices market growth.

Key Market Segments

By Product Function

- Ophthalmic Surgical Devices

- Refractive Error Surgical Devices

- Glaucoma Surgical Devices

- Cataract Surgery Devices

- Vitreoretinal Surgical Devices

- Ophthalmic Diagnostic Devices

- Refractors

- Corneal Topography Systems

- Retinal Ultrasound Systems

- Fundus Camera

- Ophthalmoscopes

- Optical Coherence Tomography Systems

- Perimeters

- Slit Lamps

- Tonometer

- Ophthalmic Vision Care Devices

- Contact Lenses

- Spectacle Lenses

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Rest of LAMEA

List of key players profiled in the report

- Novartis AG

- Carl Zeiss Meditec AG

- Essilor International S.A.

- HAAG-Streit Holding AG

- Johnson & Johnson

- Nidek Co., Ltd.

- Topcon Corporation

- Valeant Pharmaceuticals International, Inc.

- Ziemer Ophthalmic Systems AG

- Hoya Corporation

Ophthalmic Devices Market Report Highlights

| Aspects | Details |

| By PRODUCT FUNCTION |

|

| By Region |

|

| Key Market Players | BAUSCH HEALTH COMPANIES INC., .HAAG-STREIT HOLDING AG, JOHNSON & JOHNSON, NIDEK CO., LTD., .HOYA CORPORATION, TOPCON CORPORATION, ZIEMER OPHTHALMIC SYSTEMS AG, ESSILOR INTERNATIONAL S.A., NOVARTIS AG (ALCON-A DIVISION OF NOVARTIS), CARL ZEISS MEDITEC AG |

Analyst Review

The ophthalmic devices market is expected to witness steady growth in the future. The market has drawn the interest of the healthcare industry, owing to increase in prevalence of eye-related diseases, globally.

The ophthalmic devices market is dominated by well-established players; hence, the market witnesses intense competition. The adoption of these devices has increased considerably, owing to increase in prevalence of eye-related diseases, which propels the market growth. In addition, increase in product launches is expected to contribute toward the growth market. As per the analysis in the report, the use of ophthalmic devices is highest in North America, owing to higher number of product approvals, followed by product launches.

Ophthalmology is a branch of medical science that deals with the structure, function, and various eye diseases

Ophthalmologic devices is a medical equipment designed for diagnosis, surgery, and vision correction

The base year calculated is 2019 in the report.

The total value of ophthalmic devices market was $53,428.8 million in 2019.

The forecast period in the report is from 2020-2027.

The market value of opthalmic devices market in 2027 was $66,719.3 million.

Rising prevalence of eye related diseases, technological advancements and increases awareness among people will drive the market according to the KOLs

The market has drawn the interest of the healthcare industry, owing to an increase in prevalence of eye-related diseases, globally.

Vision care segment holds the maximum market share.

Asia-Pacific has the highest growth rate in the market which is growing due to the contribution of the following emerging countries such as India with a CAGR of 4.6%. increase in the incidence of ophthalmic diseases such as cataract, glaucoma, AMD, and refractive errors. Moreover, a rise in geriatric population and increase in inclination toward surgical procedures for treatment contribute toward the market growth.

Loading Table Of Content...