Organic Feminine Care Market Research, 2031

The global organic feminine care market size was valued at $2.2 billion in 2021, and is projected to reach $3.9 billion by 2031, growing at a CAGR of 6.2% from 2022 to 2031.Organic feminine care products refer to those feminine care products that are manufactured using organically produced raw materials like organic cotton and organic rubber. The disposal of organic feminine care products has an extremely minimal impact on the environment. The significant growth in the generation of huge plastic waste due to the accumulation of sanitary pads and tampons poses a huge threat to the marine and soil environment.

The organic feminine care market is segmented into Age Group, Product Type, Nature and Distribution Channel.

According to the United Nations Environment (UNEP), around 49 billion and 19 billion single-use menstrual products are consumed each year in the European Union (EU) and the U.S., respectively. Menstrual products are single-use and contain a variety of materials, making recycling problematic from a technical and cost standpoint. As a result, the vast majority of these products are burned or disposed of in landfills. In the U.S. and Europe, respectively, 87% and 80% of all plastic manufactured are discarded in landfills, where the components can take up to 500 years to disintegrate, potentially releasing hazardous chemicals into the environment and creating microplastics that endanger health of the ecosystem. There is a growth in the market for organic feminine care products, especially in industrialized nations like North America and Europe. This is due to growth in worries over the accumulation of plastic waste and sustainability.

Furthermore, an increase in awareness regarding the hazardous chemicals used in the manufacturing of conventional feminine hygiene products significantly fuels the growth of the organic feminine care market demand across the globe. Traditional, commercially available sanitary pads contain hazardous chemicals such as dioxin (made from chlorine bleaching to whiten tampons and pads), rayon, metal dyes that cause allergies-, and highly processed wood pulp. These chemicals are carcinogenic and also have a negative impact on the environment when disposed of. Rise in government initiatives to curb the use of plastic across developed and developing economies coupled with the rise in consciousness of consumers regarding the environment and eco-friendlier products are the major factors that are expected to foster the global organic feminine care market growth during the forecast period.

The population of working women has grown in recent years all over the world, including in countries like the U.S., the UK, India, and others. For instance, North America, particularly the U.S., had a growth in the number of women in employment. In recent years, women made up almost 47.1% of the labor force in the U.S. In addition, the UK saw a rise in the proportion of female employees. As a result, the number of working women has increased, increasing the price of feminine hygiene products, which has in turn increased demand for those items globally and boosted the overall growth of the market.

Consumers, particularly in industrialized nations, increasingly consider brand names, emblems, certifications, and product reviews while making purchases of conventional or organic goods. Consumer purchasing decisions are significantly influenced by certifications and emblems. According to a survey on “Attitudes of women toward certification logos, labels, and advertisements for organic disposable sanitary pads,” the advertisements, logos, and certifications on organic sanitary pads have a positive impact on the consumers buying decisions. Logos and certifications help organic sanitary pads project a favorable image that greatly supports a number of factors, including safety for the human body, good absorbency, environmental friendliness, and comfort. The purchasing decisions of customers are positively impacted by the strong associations of security, dependability, and environmental friendliness with the certifications and logos on organic sanitary pads. In addition, throughout the projection period, government laws concerning organic certifications in developed countries like the U.S., the UK, France, and Germany are anticipated to fuel market expansion.

In underdeveloped nations like India, over 12% of women use commercial feminine hygiene items like sanitary pads, tampons, and pantyliners. The majority of women use homemade goods due to their limited access to or poor price of the products. Products for menstruation that are organic cost substantially more than those that are conventional. Higher costs than conventional cotton is associated with the manufacturing of organic raw materials like cotton and its certification. The high expense of commercially accessible organic feminine care products, which serves as a primary limitation, is mostly due to this.

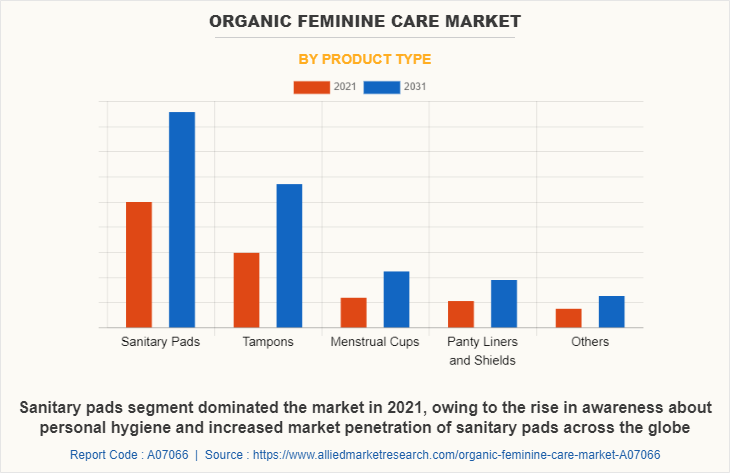

The organic feminine care market analysis shows the market is segmented based on product type, nature, age group, distribution channel, and region. On the basis of product type, the market is classified into sanitary pads, tampons, menstrual cups, panty liners & shields, and others. Sanitary pads segment is further categorized based on size into regular, large, and extra-large. Tampons segment is categorized into light (3 mL), regular (5 mL), and super (12 mL). The menstrual cup is bifurcated into small and large.

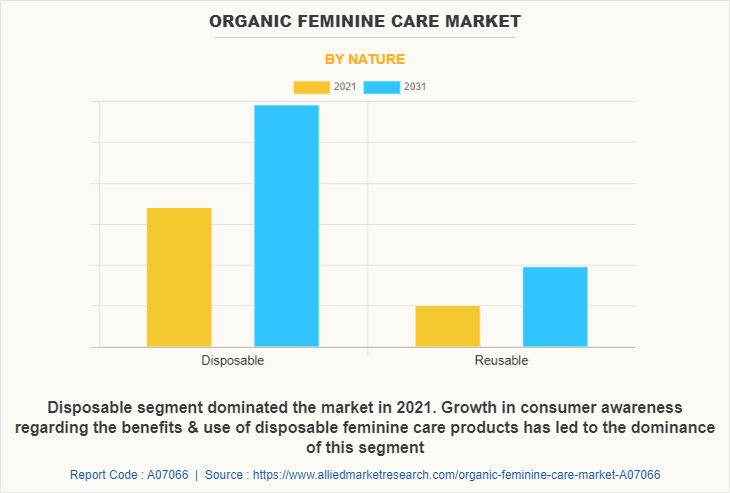

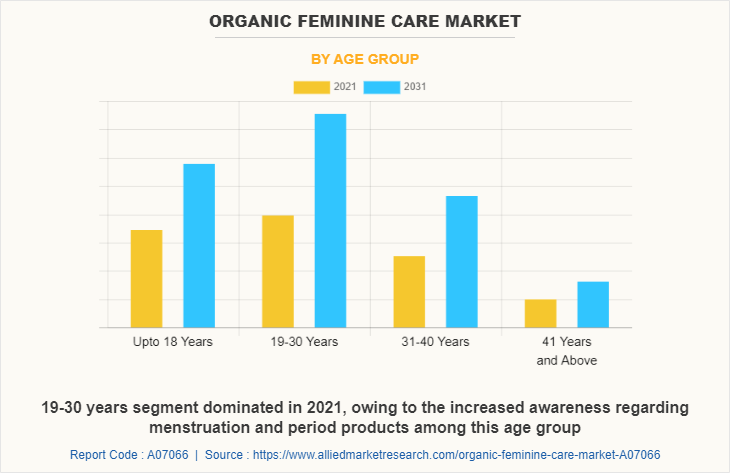

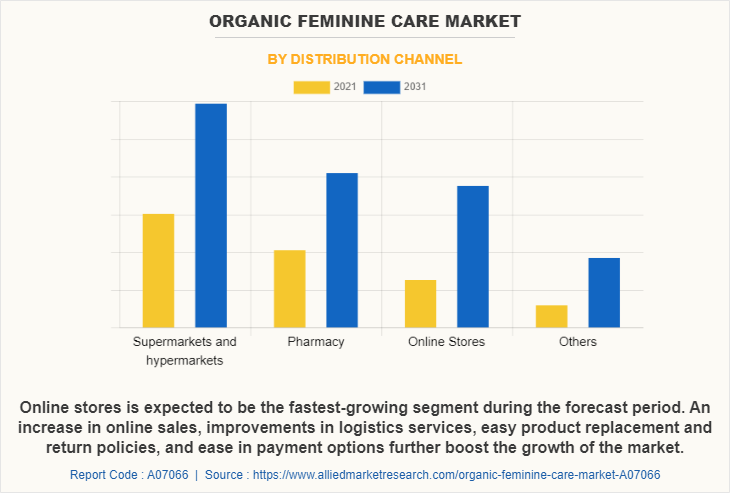

On the basis of nature, the market is bifurcated into disposable and reusable. On the basis of age group, it is segmented into up to 18 years, 19-30 years, 31-40 years, and 41 years & above. On the basis of distribution channel, the market is segregated into supermarkets and hypermarkets, pharmacies, online stores, and others. On the basis of region, the organic feminine care market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

According to the organic feminine care market forecast, on the basis of product type, the sanitary pads segment is expected to remain dominant throughout the forecast period. It accounted for 45.7% of the organic feminine care market share in 2021. Growth in awareness of personal hygiene is a key driver of the global demand for organic sanitary products. The demand for organic sanitary pads has also increased as a result of rising disposable income, numerous marketing promotions, government efforts, and educational campaigns. Companies in wealthy nations can introduce added items to keep up with the competition. Manufacturers need to produce these products at competitive rates to boost the use of organic sanitary pads in emerging markets.

As per the organic feminine care market trends, depending on the nature, reusable is anticipated to be the fastest-growing segment during the forecast period. The reusable items contribute to resource conservation, waste reduction, and pollution reduction. Therefore, the aforementioned advantages of utilizing reusable items significantly foster the market growth for reusable organic feminine care products. The need for organic reusable feminine care products is also predicted to rise due to issues including increased plastic waste and period poverty in developing economies, which have a direct impact on market growth and consumer purchasing decisions.

On the basis of age group, 31-40 years is the largest and fastest-growing segment. Women who are employed and in college typically make up this group. The market is anticipated to develop at the highest CAGR given that this sector includes women who are aware of their periods and period care products. Growth in consumer awareness and rise in disposable income are anticipated to help the market in significant expansion. Customers in this age group are challenging the notion that menstruation is taboo. The large population that falls within this age group is the major contributor to the growth in demand for organic feminine care products.

On the basis of distribution channel, the online stores segment is expected to be the fastest-growing segment during the forecast period. Online shopping has emerged as a major trend, due to the widespread penetration of the internet. As a result, pure-play online is becoming increasingly popular with consumers because of the ease of purchasing, constant support, and availability of a wide selection. Online sales channels have expanded customer reach, which has led to their development as a vital source of income for many businesses. The expansion of the market is also aided by an increase in online sales, better logistical services, simple product replacement, and return procedures, and simple payment alternatives.

The rapid growth in the number of internet users across the globe presents a lucrative growth opportunity for organic feminine hygiene product vendors. According to the International Telecommunication Union (ITU), in 2022, about 66% of the global population had access to the internet, which was only 29% in 2010. Therefore, a rapid shift of the population to digital platforms has significantly fostered the growth of the online retail platform, which is expected to positively impact the growth of the organic feminine care industry during the forecast period.

On the basis of region, Europe dominated the market in 2021, followed by North America, and Asia-Pacific. The European Union consumes over 49 billion single-use menstrual products annually, according to the United Nations Environment Programme (UNEP). According to a report by Wen UK, over 90% of a period pad is plastic and the remaining 10% is pulp, while only 6% of a tampon is made of plastic and the remaining 94% is either cotton, rayon, or a combination of the two. The efforts of the government to reduce plastic consumption and promote sustainability, together with the increasing usage of environmentally friendly raw materials, have greatly aided the expansion of the organic feminine care sector in Europe. The market for organic feminine care is expanding as a result of rise in disposable income, rise in demand for organic personal care products, and successful marketing tactics utilized by manufacturers such as product launches and collaboration. In Europe, there is a change in market for sanitary protection as tampons and underwear are preferred by women of all ages. In addition, Europe, particularly western European nations, has the greatest tampon penetration and acceptance rates, which is fueling the expansion of the organic feminine care industry.

North America is expected to be the fastest-growing market during the forecast period. According to the United Nations Environment (UNEP), around 19 billion single-use menstrual products are consumed each year in the U.S. There is a rise in demand for organic feminine care products in North America as people become more conscious of the dangers that plastic and chemical wastes pose to the environment. Furthermore there is a significant rise in demand for organic goods in the U.S. as a result of growth in health consciousness of the nation. According to the Organic Trade Association (OTA), organic sales topped $63 billion between 2020 and 2021, growing by $1.4 billion (2%) overall during the year. Non-food sales reached $6 billion (7% growth) during the period.

Unilever PLC, Kao Corporation, Procter & Gamble Co., Eco Femme, Ontex BV, Bodywise (UK) Limited, Corman S.p.A., Unicharm Corporation, Women's India Personal Care Pvt. Ltd., TOP Organic Project, The Honey Pot Company, LLC., Apropos, The Honest Company, Inc., GladRags, and Organic Initiative Limited.. are the major companies profiled in the organic feminine care market report. These manufacturers are constantly engaged in various developmental strategies such as partnerships, mergers, acquisitions, and new product launches to gain a competitive edge and exploit the prevailing organic feminine care market opportunities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the organic feminine care market analysis from 2021 to 2031 to identify the prevailing organic feminine care market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the organic feminine care market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global organic feminine care market trends, key players, market segments, application areas, and market growth strategies.

Organic feminine care Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.9 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Age Group |

|

| By Product Type |

|

| By Nature |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | The Honey Pot Company, LLC, Corman S.p.A., Ontex BV, Eco Femme, Procter & Gamble Co., Kao Corporation, GladRags, Apropos, TOP Organic Project, Bodywise (UK) Limited, Women's India Personal Care Pvt. Ltd., The Honest Company, Inc., Unicharm Corporation, Unilever PLC, Organic Initiative Limited |

Analyst Review

Players operating in the organic feminine care market have adopted key developmental strategies such as product launches and awareness campaigns on period poverty to fuel demand for feminine care products in the market. In addition, they have also emphasized continuous innovations in their products to maintain a strong foothold in the market and to boost the feminine care demand for the product globally. In addition, to cater to the rise in needs of female consumers, manufacturers are continuously developing innovative and eco-friendlier feminine care products in the market.

CXOs further added that the rise in consciousness regarding maintaining personal hygiene among female consumers as well as the working women population propels the growth of the organic feminine care market. The global organic feminine care market has witnessed significant growth in the past couple of years. Europe emerged as the largest market owing to the higher penetration of organic sanitary pads and tampons in this region. Personal hygiene awareness campaigns taken up by government agencies have contributed to the increase in demand for sanitary products in this region, though menstrual hygiene is still a social taboo in developing regions like Asia.

Moreover, personal care products including organic feminine care products have witnessed prominent adoption in developing countries such as India, owing to a rise in consumer awareness, an increase in disposable income, and a surge in the need for feminine hygiene products. Furthermore, the increase in penetration of various online portals globally and the rise in the number of offers or discounts attract a large consumer base to purchase organic feminine care products through online channels.

The global organic feminine care market size was valued at $2,182.2 million in 2021 and is estimated to reach $3,921.9 million by 2031, growing at a CAGR of 6.2% from 2022 to 2031. An increase in awareness regarding the hazardous chemicals used in the manufacturing of conventional feminine hygiene products significantly fuels the growth of the organic feminine care market demand across the globe.

The organic feminine care market report is available on request on the website of Allied Market Research.

The forecast period considered in the global organic feminine care market report is from 2022 to 2031. The report analyzes the market sizes from 2022 to 2031 along with the upcoming market trends and opportunities. The report also covers the key strategies adopted by the key players operating in the market.

Unilever PLC, Kao Corporation, Procter & Gamble Co., Eco Femme, Ontex BV, Bodywise (UK) Limited, Corman S.p.A., Unicharm Corporation, Women's India Personal Care Pvt. Ltd., TOP Organic Project, The Honey Pot Company, LLC., Apropos, The Honest Company, Inc., GladRags, and Organic Initiative Limited are the major companies profiled in the organic feminine care market report.

The organic feminine care market analysis shows the market is segmented based on product type, nature, age group, distribution channel, and region. On the basis of product type, the market is classified into sanitary pads, tampons, menstrual cups, panty liners & shields, and others. Sanitary pads segment is further categorized based on size into regular, large, and extra-large. Tampons segment is categorized into light (3 mL), regular (5 mL), and super (12 mL). The menstrual cup is bifurcated into small and large. On the basis of nature, the market is bifurcated into disposable and reusable. On the basis of age group, it is segmented into up to 18 years, 19-30 years, 31-40 years, and 41 years & above. On the basis of distribution channel, the market is segregated into supermarkets and hypermarkets, pharmacies, online stores, and others. On the basis of region, the organic feminine care market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

Asia-Pacific is expected to witness remarkable growth during the forecast period. In addition, the rise in the personal care industry, owing to the presence of high-potential markets such as India and China is expected to drive the growth of the organic feminine care market. Moreover, urbanization and industrialization in this region are also expected to drive the growth of the organic feminine care market.

On the basis of region, Europe dominated the market in 2021, followed by North America, and Asia-Pacific. The European Union consumes over 49 billion single-use menstrual products annually, according to the United Nations Environment Programme (UNEP). The market for organic feminine care is expanding as a result of rise in disposable income, rise in demand for organic personal care products, and successful marketing tactics utilized by manufacturers such as product launches and collaboration.

The increased health consciousness among the consumers owing to the rise in prevalence of various infectious diseases like COVID-19, is expected to boost the demand for the organic products across the globe. The rising consumer expenditure on health and wellness is a major factor that may positively influence the organic feminine care market growth in the post-COVID period.

Loading Table Of Content...