Packaged Coconut Water Market Research, 2031

The global packaged coconut water market size was valued at $690 million in 2021, and is projected to reach $3.9 billion by 2031, growing at a CAGR of 20.5% from 2022 to 2031.

Coconut water, which is obtained from the coconut tree, is a nourishing and healthy liquid. The beverage is enriched with essential minerals, vitamins, amino acids, and electrolytes for the body. Fresh coconut water experiences increased demand due to rise in health concerns about dehydration and digestive issues. The coconut water comes in a variety of flavors, including mango, pineapple, lime, matcha tea, and others. It is a pure, sterile, sweet, and hydrating liquid that is extracted from the coconut's body. Coconut water's biochemical composition makes it the perfect hydrating and cooling beverage. The coconut tree has been referred to as the most significant and widely cultivated palm tree in the entire globe. It is a traditional medicinal as well as a tropical beverage, and because of its biochemical properties, it may be converted into wine and vinegar.

The packaged coconut water industry is expanding due to increased demand for natural sports drinks, the rise in the usage of coconut-based products in food and beverage applications, and the development of the retail industry. However, a constant decline in coconut production as contrasted to an increase in demand is limiting market expansion. On the other hand, improvements in the taste and flavor of coconut products and food and drink using coconut is projected to open up new business opportunities.

Coconut water is a perfect sports drink because of its low acidity, balanced sugar level, and isotonic mineral composition. These days, consumers prefer beverages made with natural components over those with artificial ones due to the rise in health concerns. Due to this rising demand, there is a corresponding increase in the market for packaged coconut water used as a sports beverage. In addition, packaged coconut water is slowly becoming widely accessible in a variety of retail establishments around the world. Consumers' attention is drawn to low-sugar beverages in supermarkets due to their simple and convenient availability. As a result, packaged coconut water is now more in demand. It is thought that the market's expansion will be constrained by the increase in coconut prices.

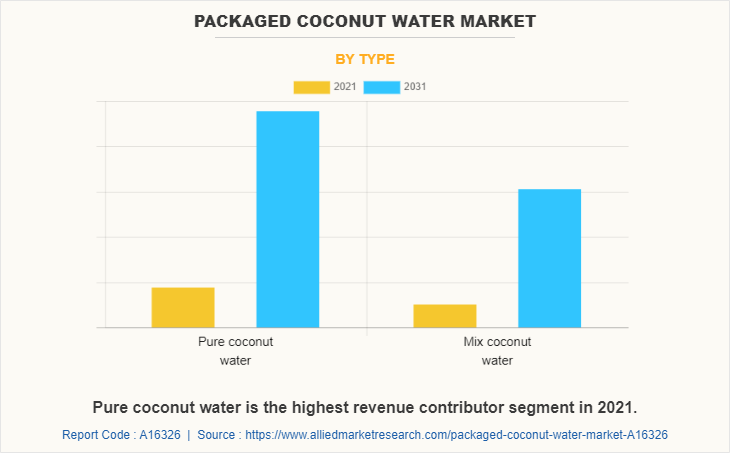

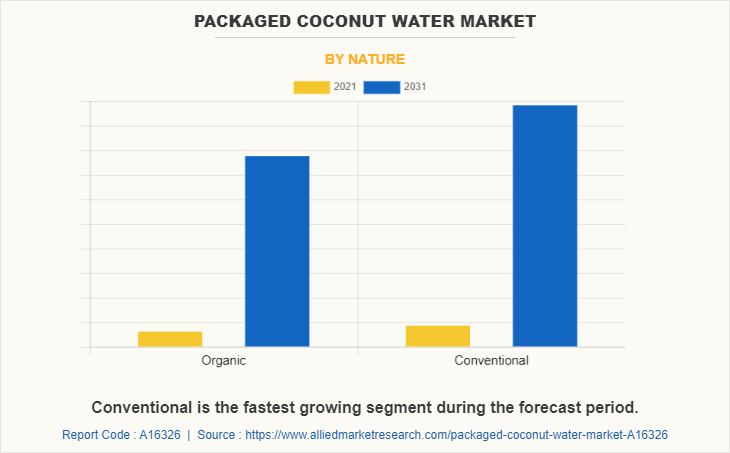

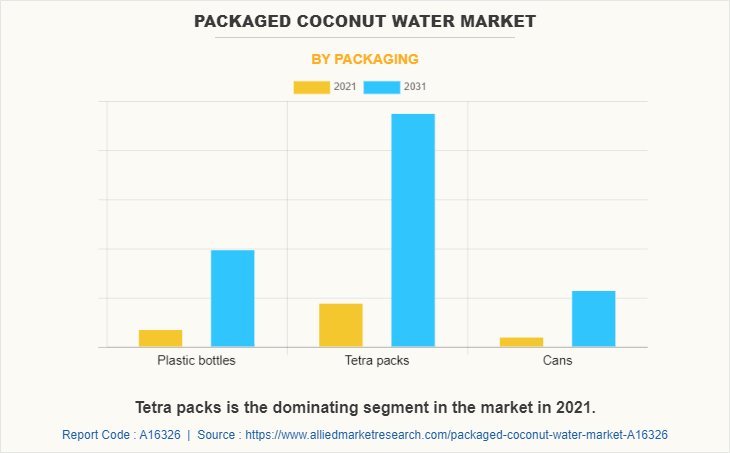

The packaged coconut water market is analyzed on the basis of type, nature, packaging, and region. By type, the market is divided into tropical and pure coconut water and mixed coconut water. Further, mixed coconut water segment is segmented into pineapple, mango, watermelon, and others. By nature, the market is divided into organic and conventional. By packaging, it is classified into plastic bottles, tetra packs, and cans. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The pure coconut water segment, as per type, dominated the global medical packaged coconut water market in 2021 and is anticipated to maintain its dominance throughout the packaged coconut water market forecast period. Fitness and health are top of mind for consumers. Consumers who are active and concerned about their health now prefer natural energy drink substitutes to those that contain caffeine and sugar. Due to its nutritional qualities, including its electrolytes and nutrients, pure coconut water is becoming more and more popular as a natural sports drink.

The conventional segment dominates the global packaged coconut water market. Conventionally grown coconut uses chemical fertilizers and pesticides that are helpful in fighting diseases and preventing pest infestations in the trees, thus ensuring proper growth and yield from the trees.

The tetra packs segment exhibits the fastest packaged coconut water market growth in the global packaged coconut water market. This packaging recyclability is one of the factors contributing to its rapid acceptance. In addition, to make it sustainable, the manufacturers have been using only FSC-certified wood. It has a good environmental profile due to its paper-based packaging, which is also incredibly simple to open and handle.

Region-wise, Asia-Pacific dominated the market with the largest packaged coconut water market share during the forecast period. Products made from coconut water are widely used in the food and beverage industries in many Asian nations. The market is expanding significantly in the region along with the increase in knowledge of coconut water as a sports or refreshment drink.

Customers are proactively focused on their health and fitness. Consumers who are active and concerned about their health now favor natural energy drink substitutes over-caffeinated and sugar-based ones. Coconut water has extremely few calories and has low levels of fats and carbohydrates. It offers a lot of antioxidants and medicinal qualities. Blood pressure, renal, and cardiovascular health are all maintained with the aid of coconut water. In addition, it aids in managing diabetes. Because coconut water has nutritional benefits like electrolytes and minerals, it is becoming increasingly popular as a natural sports drink.

Due to the rise of vegan and health-conscious consumers, the demand for beverages made from coconut has been increasing in the past. Most of the time, coconut water and coconut milk are used to make these products. Players can manufacture coconut water and milk drinks with enhanced taste and flavor, including milkshakes, energy drinks, and refreshment drinks. Drinks can have new flavors added, which results in product innovation. To improve the qualities, flavor, or nutritional value of coconut products and food and beverage items using coconut, food, and beverage firms have been investing in R&D. By increasing demand, this attracts more customers. New consumers would soon join the new flavor and taste.

Due to its rising use in the food and beverage industries, the demand for coconut products has been increasing significantly in recent years. However, despite the exponential demand, there was no rise in coconut production. In contrast, Asia, which produces more than three-fourths of the world's coconuts, has seen a modest decline in production. Due to the peak yield of coconut trees being only between the ages of 10 and 30 years, the climate conditions needed for coconut tree plantations, and the small land holdings of coconut farmers, the price of coconuts has increased significantly in the past, but producers have not increased their production capacities in response to the same. It's unlikely that the production of coconut trees will increase greatly in the near future due to the difficulty of scaling up production. Therefore, in order to make the most of their existing output and profit from this rise in demand, companies must rely on creative solutions.

The introduction of pro-coconut farming government legislation, rising investments to expand coconut cultivation, and rising labor for effective farming are presenting lucrative chances for the market's overall expansion during the forecast period. In the past, offline retailers anticipated a higher packaged coconut water market demand because they were supplying the major food needs of the urbanized population. However, in recent years, online retailers have outpaced demand and are providing discounts and making it convenient for potential customers, which is expected to encourage the expansion of the packaged coconut water market during the forecast period.

The demand for coconut water has increased globally as customers become more aware of the benefits of drinking healthy beverages. Minerals and antioxidants that the body needs are abundant in coconut water. The market for coconut cultivation is growing as a result of increased investments and pro-government legislation. Another factor boosting the market for bottled coconut water is rising urbanization in conjunction with changing dietary patterns. A significant barrier to the growth of the packaged water customer base in many countries, including the U.S. and Canada, is the high cost of coconut water. Market expansion is being hampered by the high production costs. One of the things that is challenging the market is the ambiguity around the claim made by the big companies that drinking coconut water is natural.

The major players analyzed for the packaged coconut water industry are Amy & Brian Naturals, BlueRidge, C2O Coconut Water, Celebs Coconut Corporation, CocoCoast, Elegance Brands, Inc., GraceKennedy Group, Harmless Harvest, Mojo Organics Inc., Naked Juice, NewAge Inc., PepsiCo., Taste Niravana International Inc., The Coco-Cola Company, and Wai Koko Coconut Water. Key players operating in the packaged coconut water market have adopted product launches, business expansions, and mergers & acquisitions as key strategies to expand their packaged coconut water market share, increase profitability, and remain competitive in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the packaged coconut water market size, segments, current trends, estimations, and dynamics of the packaged coconut water market analysis from 2021 to 2031 to identify the prevailing packaged coconut water market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the packaged coconut water market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global packaged coconut water market trends, key players, market segments, application areas, and market growth strategies.

Packaged Coconut Water Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.9 billion |

| Growth Rate | CAGR of 20.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Type |

|

| By Nature |

|

| By Packaging |

|

| By Region |

|

| Key Market Players | CocoCoast, Amy And Brian, Celebes Coconut Corporation, harmless harvest, Pepsico, Inc., C2o Pure Coconut Water, NewAge Inc, Taste Nirvana International Inc., The Naked Juice, blueridge restaurant group, Wai Koko Coconut Water, The Coco-Cola Company, GraceKennedy Group, Elegance Brands Inc., Mojo Organics Inc . |

Analyst Review

The perspectives of the leading CXOs in the packaged coconut water industry are presented in this section. The market is boosted by an increase in the demand for energy drinks and consumer preference for hydrating, light, and refreshing beverages over carbonated ones. Growth in the demand for pure coconut water from places like North America and Europe has resulted in an increase in the flow of exports of coconut water from Asian nations. The market for packaged coconut water is anticipated to expand dramatically over the next few years as a result of the growing public knowledge of the health benefits of coconut water. The market is also anticipated to develop as a result of the pure coconut water's health benefits, which include its use as a natural diuretic, dehydrator, digestive aid, and cholesterol-lowering product.

The CXOs further added that customers are proactively interested in fitness and wellness. Consumers who are active and concerned about their health now prefer natural energy drink substitutes to those that contain caffeine and sugar. Low quantities of lipids and carbohydrates and a very low caloric value are found in coconut water. It has a lot of antioxidants and healing effects. Blood pressure levels, kidney function, and cardiovascular health are all maintained by coconut water. It aids in managing diabetes as well. As a result of its nutritional qualities, including its electrolytes and nutrients, the demand for pure coconut water as a natural sports drink is rising quickly. This factor is fueling the market expansion for packaged coconut water.

The global packaged coconut water market size was valued at $690 million in 2021, and is projected to reach $3.9 billion by 2031

The global Packaged Coconut Water market is projected to grow at a compound annual growth rate of 20.5% from 2022 to 2031 $3.9 billion by 2031

The major players analyzed for the packaged coconut water industry are Amy & Brian Naturals, BlueRidge, C2O Coconut Water, Celebs Coconut Corporation, CocoCoast, Elegance Brands, Inc., GraceKennedy Group, Harmless Harvest, Mojo Organics Inc., Naked Juice, NewAge Inc., PepsiCo., Taste Niravana International Inc., The Coco-Cola Company, and Wai Koko Coconut Water.

Region-wise, Asia-Pacific dominated the market with the largest packaged coconut water market share during the forecast period

Loading Table Of Content...