Peripheral Artery Disease Market Research, 2035

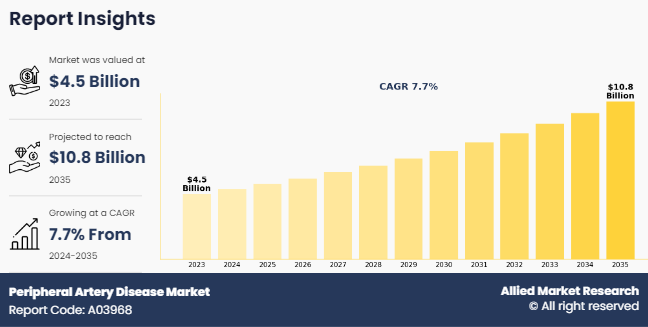

The global peripheral artery disease market was valued at $4.5 billion in 2023, and is projected to reach $10.8 billion by 2035, growing at a CAGR of 7.7% from 2024 to 2035. The growth of the peripheral artery disease market is driven by a surge in prevalence of peripheral artery disease. According to the 2023 report by the National Library of Medicine, it was reported that peripheral artery disease affects over 200 million adults worldwide. Furthermore, rise in adoption of the minimally invasive procedures is also expected to contribute significantly in the growth of the market.

Peripheral artery disease is a condition characterized by narrowing or blockage of the arteries, primarily in the legs, due to the buildup of fatty deposits called plaque. This restricts blood flow to the limbs, leading to symptoms such as leg pain, cramping, weakness, and numbness, particularly during physical activity. Peripheral artery disease is often associated with other cardiovascular conditions such as coronary artery disease, heart attack, and stroke, as they share similar risk factors such as smoking, diabetes, high blood pressure, and high cholesterol levels. Treatment for peripheral artery disease aims to manage symptoms, prevent complications, and improve circulation.

Key Takeaways

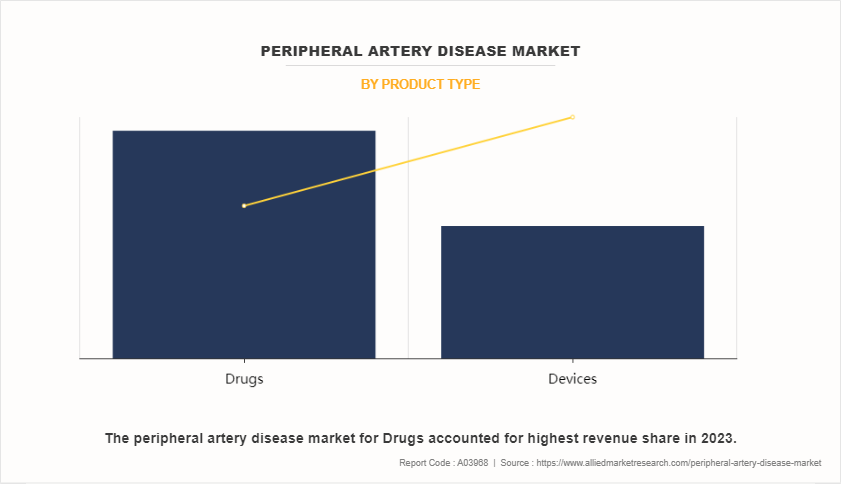

- On the basis of product type, the drugs segment dominated the market in terms of revenue in 2023.

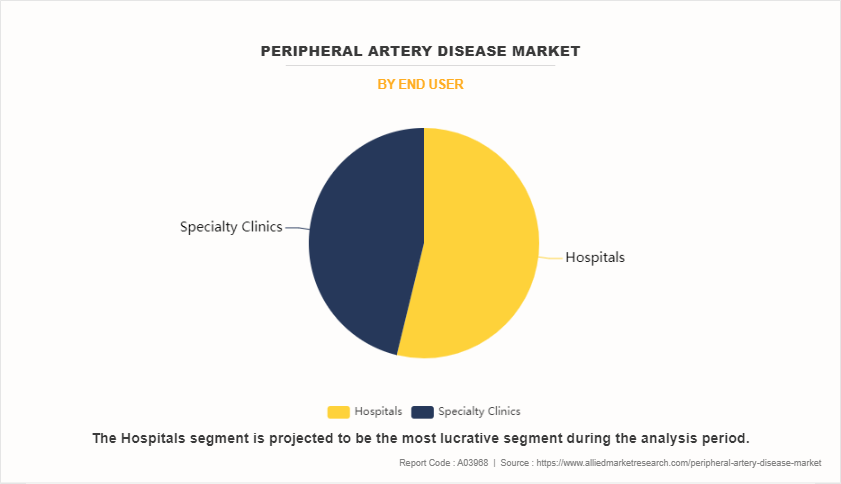

- On the basis of end user, the hospital segment dominated the market in terms of revenue in 2023. However, the specialty clinics segment is expected to register the highest CAGR during the forecast period.

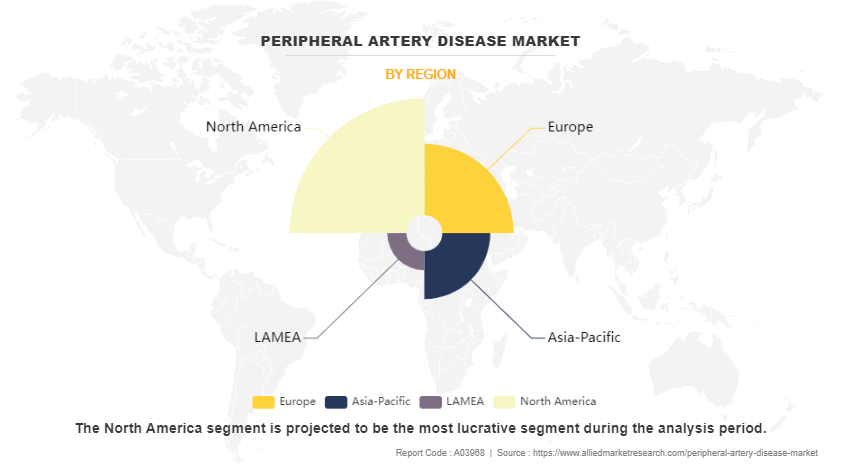

- On the basis of region, North America dominated the market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The peripheral artery disease market size is expected to grow significantly owing to rise in prevalence of peripheral artery disease, surge in geriatric population, and technological advancement in peripheral artery disease treatment devices. According to a 2023 article by American College of Cardiology, it was estimated that around 200 million people worldwide has peripheral artery disease. This increase in prevalence is attributed to several interconnected factors, including rising rates of obesity and diabetes, and a surge in lifestyle-related risk factors such as smoking and sedentary lifestyles. According to the World Health Organization, it was estimated that in 2022, 1 in 8 people in the world were living with obesity.

Moreover, the global obesity epidemic and growth in prevalence of diabetes contribute substantially to the rise in peripheral artery disease cases, as both conditions are strongly associated with the development and progression of peripheral artery disease. Additionally, unhealthy lifestyle habits such as smoking and physical inactivity further exacerbate the risk, leading to a greater burden of peripheral artery disease across populations worldwide. The growing incidence of peripheral artery disease has resulted in rising demand for effective treatment options of peripheral artery disease. Thus, the rise in prevalence of peripheral artery disease is expected to significantly contribute to the growth of peripheral artery disease market size.

Furthermore, according to the peripheral artery disease market forecast analysis rise in geriatric population is expected to drive the peripheral artery disease market growth. As people age, the risk of developing peripheral artery disease significantly increases, making the elderly population particularly susceptible to this vascular condition. For instance, according to a 2023 article by the Institute of Health Metrix and Evaluation, it was reported that the global prevalence of peripheral artery disease was higher in older people. Aging leads to structural and functional changes in blood vessels, including arterial stiffening, endothelial dysfunction, and the accumulation of atherosclerotic plaque, all of which contribute to the development and progression of peripheral artery disease.

The growing prevalence of peripheral artery disease among the elderly population underscores the urgent need for effective management strategies and healthcare interventions tailored to address the unique needs and challenges of elderly patients. Healthcare providers and policymakers are increasingly recognizing the importance of early detection, comprehensive risk factor management, and timely intervention to minimize the impact of peripheral artery disease on the health and well-being of elderly individuals. Thus, the rise in geriatric population is expected to drive the growth of peripheral artery disease market.

In addition, according to peripheral artery disease market opportunity analysis the technological advancement in minimally invasive surgeries is expected to drive the growth of the market. Minimally invasives surgeries have revolutionized the field of vascular interventions by offering less invasive alternatives to traditional open surgeries, resulting in reduced patient discomfort, shorter hospital stays, faster recovery times, and improved outcomes. The development of sophisticated catheter-based devices and techniques has expanded the range of minimally invasive treatment options available for peripheral artery disease. These include advanced angioplasty balloons, drug-coated balloons, atherectomy devices, and stents specifically designed for peripheral vascular interventions. These devices offer greater flexibility, deliverability, and efficacy, allowing clinicians to effectively treat complex lesions and improve long-term patency rates while preserving normal vascular anatomy.

Segments Overview

The peripheral artery disease industry is segmented by product type, end user, and region. By product type the market is bifurcated into drugs and devices. By end user, the market is divided into hospitals, specialized clinics and ambulatory surgeries centers.

By Product Type

The drugs segment dominated the global peripheral artery disease market share in 2023, and is expected to remain dominant during the forecast period. This is attributed to the fact that drugs offer a non-invasive treatment option for peripheral artery disease patients, especially those with mild to moderate symptoms. Many patients prefer drug therapy over invasive procedures such as surgery or angioplasty due to the reduced risk and inconvenience associated with drug treatments.

By End User

The hospital segment dominated the global peripheral artery disease market share in 2022, owing to the fact that hospitals often have specialized facilities, equipment, and healthcare professionals dedicated to treating peripheral artery disease. These facilities include catheterization labs, operating rooms, and vascular intervention suites equipped with advanced imaging technologies such as angiography and ultrasound. Moreover, hospitals usually have multidisciplinary teams comprising vascular surgeons, interventional radiologists, cardiologists, and other specialists who collaborate to provide comprehensive care for peripheral artery disease patients.

By Region

The peripheral artery disease market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA). North America accounted for a major share of the peripheral artery disease market in 2023. This is attributed to well-developed healthcare infrastructure, strong presence of major key players and rise in prevalence of peripheral artery disease. However, Asia-Pacific is expected to register the highest CAGR during the forecast period owing to rise in geriatric population and developing healthcare infrastructure.

Competitive Analysis

Competitive analysis and profiles of the major players in peripheral artery disease market, such as Philips N.V., Braun Melsungen AG, Medtronic, Bayer AG, Boston Scientific Corporation, Becton Dickinson and Company, Terumo Medical Corporation, Biotronik, Cardinal Health, Abbott. Major players have adopted product approval as a key developmental strategy to improve the product portfolio of the peripheral artery disease market.

Recent Development in the Peripheral Artery Disease Industry

- In January 2022, Cook Medical received a breakthrough device designation from the United States Food and Drug Administration (FDA) for a groundbreaking drug-eluting stent designed for below the knee (BTK) applications.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the peripheral artery disease market analysis from 2023 to 2035 to identify the prevailing peripheral artery disease market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the peripheral artery disease market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global peripheral artery disease market trends, key players, market segments, application areas, and market growth strategies.

Peripheral Artery Disease Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 280 |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Koninklijke Philips N.V., Becton Dickinson and Company, Medtronic, Terumo Medical Corporation, Abbott Laboratories, Boston Scientific Corporation, Bayer AG, Cardinal Health, Biotronik SE & Co. KG, B. Braun Melsungen AG |

Analyst Review

This section provides various opinions of CXOs in the peripheral artery disease market. Peripheral artery disease, characterized by the narrowing of arteries in the limbs due to plaque buildup, affects millions worldwide and poses significant challenges for both patients and healthcare systems. Over recent years, the PAD market has seen notable advancements in diagnosis, treatment, and management strategies. Therapeutic interventions have evolved significantly, with a shift towards minimally invasive procedures such as angioplasty, stenting, and atherectomy. These approaches offer reduced recovery times and lower complication rates compared to traditional open surgeries, leading to improved patient outcomes and cost-effectiveness. Additionally, advancements in drug therapies, including antiplatelet agents and novel anticoagulants, play a crucial role in managing PAD and reducing associated cardiovascular risks.

The total market value of Peripheral Artery Disease Market is $4.5 billion in 2023.

The market value of Peripheral Artery Disease Market in 2035 is expected to be $10.8 billion.

The forecast period for Peripheral Artery Disease Market is 2023-2032.

Major key players that operate in the Peripheral Artery Disease Market are Philips N.V., Braun Melsungen AG, Medtronic, Bayer AG, Boston Scientific Corporation, and Becton Dickinson and Company,

The base year is 2023 in Peripheral Artery Disease Market.

The drug segment is the most influencing segment in the peripheral artery disease market.

The Peripheral Artery Disease Market growth is driven by rise in geriatric population, and technological advancements in minimally invasive surgical technology.

Peripheral artery disease is a condition characterized by the narrowing or blockage of arteries that supply blood to the limbs, typically the legs. This occurs due to the buildup of fatty deposits (plaques) in the arteries, a process known as atherosclerosis

Loading Table Of Content...

Loading Research Methodology...