Pharmaceutical Drug Delivery Market Research, 2032

The global pharmaceutical drug delivery market size was valued at $1,498.72 billion in 2022, and is projected to reach $2,307.27 billion by 2032, growing at a CAGR of 4.4% from 2023 to 2032. Pharmaceutical drug delivery includes the administration of medications or therapeutic substances to achieve the desired therapeutic outcomes. It involves designing and developing various methods, systems, and technologies to deliver drugs safely and effectively to specific sites in the body. It aims to optimize the effectiveness of medications, minimize potential adverse effects, improve bioavailability, and enhance patient compliance. Common drug delivery methods include oral delivery (through tablets, capsules, or liquids), injectable delivery, transdermal delivery (through patches), topical delivery (applied to the skin or mucous membranes), and other specialized approaches. These drug delivery systems facilitate the precise and controlled administration of therapeutic agents to achieve the desired therapeutic effect while ensuring patient safety and convenience.

Market Dynamics

Pharmaceutical drug delivery industry growth is driven by increase in prevalence of chronic diseases, including cardiovascular diseases, diabetes, cancer, and respiratory disorders, development of advanced drug delivery systems, and rise in product launches by market players. These conditions require long-term management and involve the use of multiple medications. Therefore, advanced drug delivery systems are being developed to improve the efficacy of treatments for these conditions. For example, the development of inhalation products with improved drug delivery techniques for asthma and chronic obstructive pulmonary disease (COPD) management has gained significant traction in recent years.

Furthermore, continuous advancements in drug delivery technologies further drives the market growth. For instance, liposomal drug delivery systems, such as Doxil (liposomal doxorubicin), have been successfully utilized for cancer treatment, which improves drug efficacy and reduces side effects. Similarly, nanotechnology and nanocarriers has revolutionized drug delivery by enhancing drug stability, solubility, and targeted delivery.In addition, growing demand for patient friendly drug delivery systems to enhance convenience and drug compliance also boost the pharmaceutical drug delivery industry growth.

Patient-friendly drug delivery systems are designed to improve the overall experience for individuals receiving medications. For instance, self-administrative medication that allow patients to inject medications by themselves. They are pre-filled with a precise dosage of medication and are designed to be user-friendly, requiring minimal technical expertise. Furthermore, extended release products are commonly used for the treatment of diabetes, rheumatoid arthritis, multiple sclerosis, and severe allergic reactions (anaphylaxis).

The growth of the pharmaceutical drug delivery market is expected to be driven by developed countries such as U.S., Canada, and Germany, due to availability of treatment options, rise in geriatric population which are highly susceptible to develop chronic diseases such as cardiovascular diseases and availability of favorable reimbursement policies. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to a rise in demand for enhanced healthcare services, and an increase in geriatric population.

However, strict regulatory requirements for drug approval and safety can pose challenges for the development and commercialization of novel drug delivery systems. Meeting regulatory standards can be time-consuming and costly, which negatively impacts the market growth. Furthermore, development and manufacturing of advanced drug delivery systems requires substantial investments in research, technology, and infrastructure. This lead to high development and production costs, which may limit the affordability and accessibility of these products and restrains the market growth. On the other hand, development of advanced drug delivery is expected to create lucrative pharmaceutical drug delivery market opportunity.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global pharmaceutical drug delivery market moderately impacted during the pandemic due to disruption in supply of pharmaceutical products. On the other hand, the demand for injectable drug delivery was increased during the pandemic due to COVID-19. Furthermore, the rise in demand for advanced pharmaceutical drug delivery systems, and the increase in prevalence of chronic diseases are expected to drive the market growth during the forecast period.

Segmental Overview

The pharmaceutical drug delivery market is segmented on the basis of route of administration, application, and region. On the basis of route of administration, the market is classified into oral drug delivery, nasal drug delivery, ocular drug delivery, topical drug delivery, and other drug delivery. As per application, the market is segmented into cancer, diabetes, cardiovascular, and others. Region wise, the pharmaceutical drug delivery market size is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

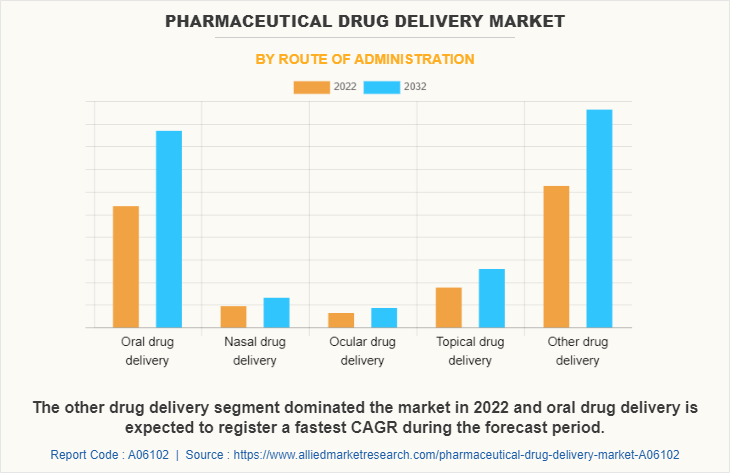

By Route of Administration

The market is segmented into oral drug delivery, nasal drug delivery, ocular drug delivery, topical drug delivery, and other drug delivery. The other drug delivery segment accounted fot ther largest pharmaceutical drug delivery market share in 2022 and is expected to remain dominant throughout the forecast period. This is attributed to an increase in use of injectable drug delivery due to rapid onset of action, targeted delivery of drug, and highly preferable for emergency use.

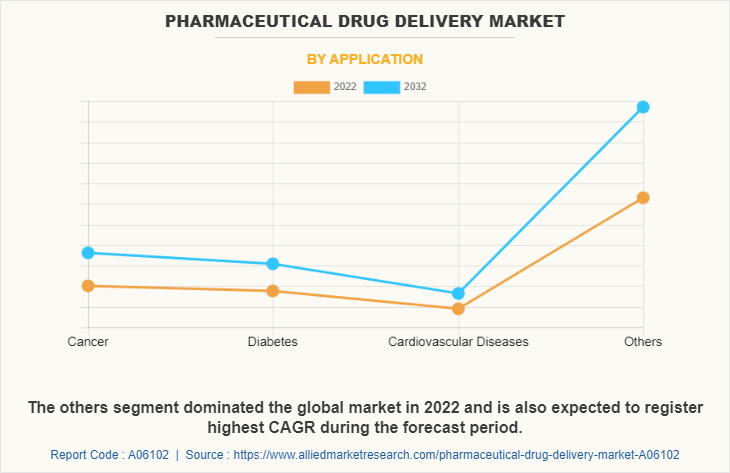

By Application

The market is segregated into cancer, diabetes, cardiovascular diseases, and others. The others segment accounted for the largest pharmaceutical drug delivery market share in 2022, and is anticipated to continue this trend during the forecast period. This is attributed to the increase in prevalence of respiratory diseases such as asthma.

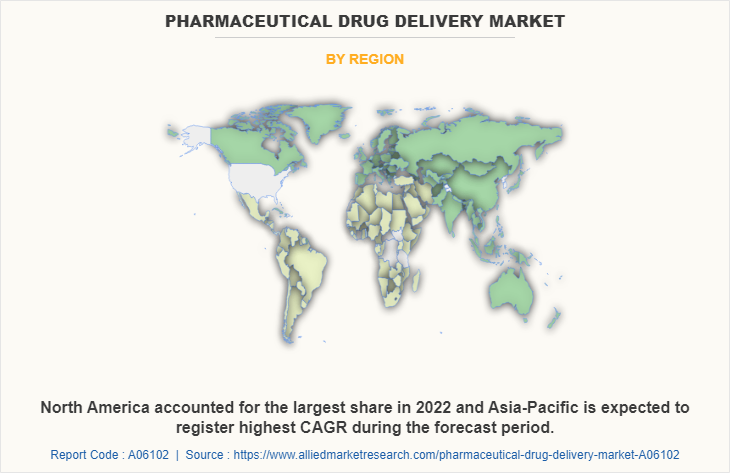

By Region

The market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share in 2022 and is expected to maintain its dominance in the pharmaceutical drug delivery market forecast. The presence of several major players, such as Pfizer Inc., Novartis AG, F. Hoffmann La-Roche Ltd., and Merck and Co., Inc. and the rise in prevalence of diabetes in the region drives the growth of the market. For instance, according to National Diabetes Statistics Report 2020 provided by Centers for Disease Control and Prevention (CDC), estimated that about 34.2 million people (10.5%) U.S. population have diabetes. As per the same source, the percentage of adults with diabetes increases with age and accounted for 26.8% among the individuals aged 65 years and above. As the prevalence of diabetes rises there is a greater demand for advanced insulin delivery, thereby driving the pharmaceutical drug delivery market growth.

In addition, strong presence of various cancer research institutes such as American Association for Cancer Research (AACR), Mayo Clinic Cancer Center, and National Cancer Institute (NCI) and strong research infrastructure, with a large number of research funding agencies has led to the development of a robust research ecosystem that supports the growth of the market. Furthermore, the increase in demand for advanced pharmaceutical drug delivery treatment further contribute toward the market growth. Moreover, easy accessibility of drug delivery systems also boost the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is

attributable to an increase in prevalence of cancer and surge in awareness about cancer treatment. Asia-Pacific region has a large population, and the prevalence of cancer is rising in recent years due to ageing population, lifestyle changes, and environmental factors. This has led to an increase in the number of patients undergoing treatment, which in turn increases the demand for pharmaceutical drug delivery. For instance, in 2020, National Institute of Cancer Prevention and Research (NICPR), estimated that about 2.7 million people in India are living with cancer. In addition, growing adoption of pharmaceutical drug delivery products further propels the market growth. Asia-Pacific offers profitable opportunities for key players operating in the market, thereby registering the fastest growth rate during the forecast period, owing to the rise in disposable income, as well as increase in healthcare expenditure.

Competition Analysis

Competitive analysis and profiles of the major players in the market, such as Bayer AG, Cipla Ltd., F. Hoffmann-La Roche Ltd., GlaxoSmithKline Plc, Johnson & Johnson, Merck & Co., Inc., Novartis AG, Amgen Inc., Pfizer Inc., Sanofi. Major players have adopted acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the pharmaceutical drug delivery market.

Recent Acquisition in the Pharmaceutical Drug Delivery Market

- In June 2022, Novartis AG, one of the global leader in pharmaceutical industry, acquired Kedalion Therapeutics and its AcuStream technology, an innovative roduct that facilitate precise dosing and accurate delivery of certain topical ophthalmic medications to the eye. This acquisition strengthened the opthalmic portfolio of the company.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pharmaceutical drug delivery market analysis from 2022 to 2032 to identify the prevailing pharmaceutical drug delivery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pharmaceutical drug delivery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pharmaceutical drug delivery market trends, key players, market segments, application areas, and market growth strategies.

Pharmaceutical Drug Delivery Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.3 trillion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 236 |

| By Route of Administration |

|

| By Application |

|

| By Region |

|

| Key Market Players | F. Hoffmann-La Roche Ltd., Johnson & Johnson, Sanofi S.A., Pfizer Inc., Novartis AG, Bayer AG, Cipla Ltd, Merck & Co., Inc., GlaxoSmithKline plc, Amgen Inc. |

Analyst Review

Pharmaceutical drug delivery refers to the process of administering medications or drugs to a patient in a controlled and targeted manner to achieve the desired therapeutic effect. The development of advanced drug delivery systems and increase in prevalence of chronic diseases primarily drive the market growth.?

Furthermore, increase in product launches by the key market players are expected to create opportunities for market growth. For instance, in February 2021, ViiV Healthcare company a subsidiary of GlaxoSmithKline plc received marketing authorization of Rukobia. Rukobia is an extended release oral drug used for the treatment of multidrug-resistant HIV-1 infection. Such product launches boost the growth of pharmaceutical drug delivery market.

The pharmaceutical drug delivery market is estimated to reach $2,307.27 billion by 2032.

The major factor that fuels the growth of the pharmaceutical drug delivery market are increase in demand for advanced drug delivery and rise in prevalence of various chronic diseases.

North America is the largest regional market for pharmaceutical drug delivery due to strong presence of market key players and increase in prevalence of various chronic diseases.

The base year is 2022 in pharmaceutical drug delivery market.

The forecast period for pharmaceutical drug delivery market is 2023 to 2032.

The total value of pharmaceutical drug delivery market is $1,498.72 billion in 2022.

Top companies such as Pfizer Inc., Johnson and Johnson, Novartis AG, and Sanofi held a high market position in 2022.

Loading Table Of Content...

Loading Research Methodology...