Plant Based Diet Market Research, 2032

The global plant based diet market size was valued at $44.9 billion in 2022, and is projected to reach $227.2 billion by 2032, growing at a CAGR of 17.7% from 2023 to 2032.

A plant-based diet, commonly referred to as a vegan or vegetarian diet, is one that emphasizes consuming food that are produced from plants while reducing or eliminating the consumption of animal products. The main components of a plant-based diet are fruits, vegetables, whole grains, legumes, nuts, and seeds. These food supply important nutrients such as vitamins, minerals, fiber, and antioxidants and serve as the basis of the diet.

Market Dynamics

Plant-based food products are increasingly in demand from consumers. This need is being driven by factors including environmental awareness, ethical concerns, and the desire for a wider variety of food. Customers are actively looking for plant-based substitutes for conventional animal-based products, which is fostering industry expansion. In terms of product promotions, the market for plant-based food is significantly growing. Many different plant-based substitutes for meat, dairy, eggs, and other animal-based products are being developed and introduced by companies. This includes ready-to-eat plant-based meals, dairy-free milk and cheeses, plant-based protein powders, and plant-based burgers and sausages. More consumers are entering the market as a result of the diversity and availability of plant-based products.In the plant based diet market, innovations and advances in food technology are essential.

To make plant-based products that are more realistic and appealing, companies are adopting new strategies and methodologies. This includes developing flavor profiles and textures that mimic the sensory experience of products derived from animals, as well as using alternative protein sources including pea protein, soy protein, and mycoprotein (from fungi). Technological advancement is a major factor behind product development and market adoption. Plant-based food products are becoming easier to find in a variety of retail settings, including supermarkets, specialty health food stores, e-commerce, and even local grocers. Plant-based options are now more widely accessible and convenient for consumers across different regions due to this improved retail distribution network.

The foodservice sector, which includes restaurants, cafes, and fast-food chains, has started to acknowledge the desire for plant-based alternatives. Many restaurants are adding plant-based options to their current menus or creating special plant-based menus. In addition to catering to the expanding plant-based consumer base, this trend also makes alternatives made from plants more accessible to a larger audience. Data from PitchBook shows that in 2020, investments in plant-based food companies reached a record high of $3.1 billion, more than triple the sum invested in 2019. The increased investment in the plant-based food and beverage industry reflects the growing interest in and confidence in plant based diet market.

The plant based diet market has drawn large investments and acquisitions from both well-known food corporations and venture capital organizations. To penetrate or increase their plant based diet market share, significant companies in the food sector are investing in and acquiring plant-based startups and brands. The influx of money and knowledge is fueling the growth of the market as well as increasing product development and marketing initiatives.The market for plant-based diets is being supported by laws and policies being implemented by governments in various areas.

This entails promoting wholesome and sustainable eating practices, rewarding those who make plant-based food, and putting labeling rules for goods made from plants into place. The assistance of the government affects customer behavior, fosters a positive business climate, and promotes market expansion. The acceptability of plant-based diets among consumers is significantly influenced by education and awareness initiatives. Actively promoting the advantages of a plant-based diet through educational initiatives, social media, and other avenues of communication are health experts, dietitians, environmental groups, and animal welfare organizations. These initiatives help spread awareness and support plant-based diets among consumers.

In some areas, especially rural ones, or nations with little exposure to plant-based diets, there are fewer plant-based food options available and accessible. People find it difficult to locate a wide variety of plant-based products and ingredients as a result of this. Food derived from plants, particularly processed versions, cost more than those derived from animals. A totally plant-based diet is out of reach for some people due to this price discrepancy, especially those with lower incomes. As the market grows and economies of scale are achieved, the cost disparity is gradually reducing.

Due to taste and texture expectations, some people can find it difficult to switch to a plant-based diet. People who are used to particular tastes and sensations are put off by plant-based substitutes because they don't always exactly duplicate the sensory experience of animal-based products. While a well-designed plant-based diet contains all the nutrients required, some nutrients are more difficult to obtain in appropriate amounts. Vitamin B12, iron, calcium, omega-3 fatty acids, and complete proteins are important elements to pay attention to in plant-based diets. For those who consume only plants, careful dietary selection or supplementation is necessary to provide sufficient nutrition.

People who eat a plant-based diet face difficulties as a result of social situations and cultural norms. It might be challenging to live a plant-based lifestyle when eating out, going to social events, or having meals with relatives and friends who have different dietary preferences. Due to the requirement for extra meal planning, product shopping, and food preparation, some people view a plant-based diet as less convenient.

Plant-based diet adoption is hampered by inaccurate information or a lack of awareness. The nutritional value, flavor, or variety of food made from plants are misunderstood by certain people. Dispelling misconceptions and promoting the advantages and viability of a plant-based diet require education and accurate information. It might be difficult to switch to a plant-based diet for certain people due to their emotional and psychological ties to specific animal-based products. The psychological hurdle to adopting a plant-based lifestyle is the ability to modify deeply ingrained food choices and habits that have been formed over a lifetime.

The COVID-19 epidemic has had positive as well as negative impacts on the market for plant-based diets. The plant based diet market demand has increased as a result of the pandemic's increased public interest in health and wellness. Many individuals are now more concerned about their immune systems and general health, and they are turning to plant-based diets as a method to enhance their well-being. On the other hand, the pandemic has impacted the accessibility of several plant-based products by disrupting the world's food supply chain. Production, distribution, and accessibility of plant-based food products have been impacted by lockdowns, traffic restrictions, and labor shortages. Some businesses experienced difficulties locating ingredients, which resulted in temporary shortages of certain products made from plants.

Segmental Review

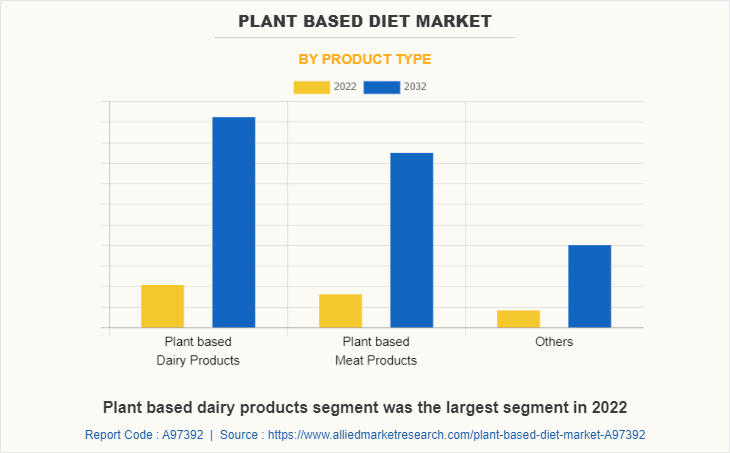

The plant based diet market is segmented on the basis of product type, source, distribution channel, and region. On the basis of product type, the market is divided into plant based dairy products, plant based meat products, and others. Further, plant based dairy products are segmented into plant based yogurt, plant based milk, and plant based frozen desserts.

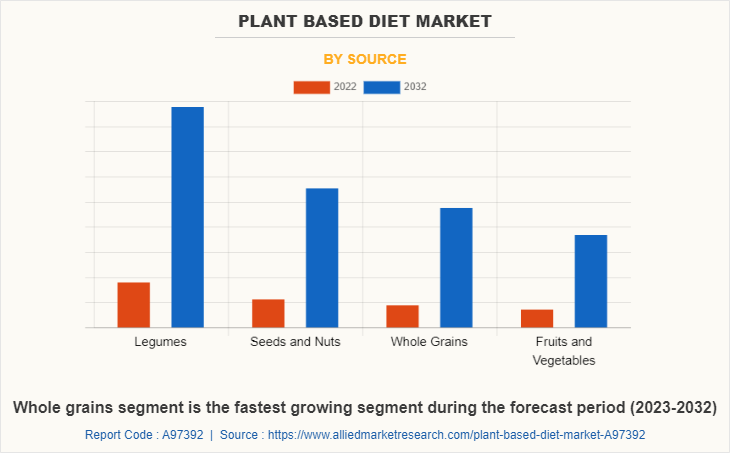

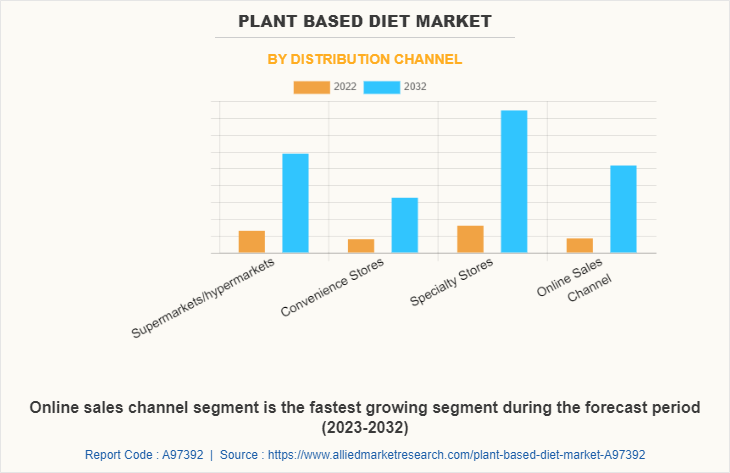

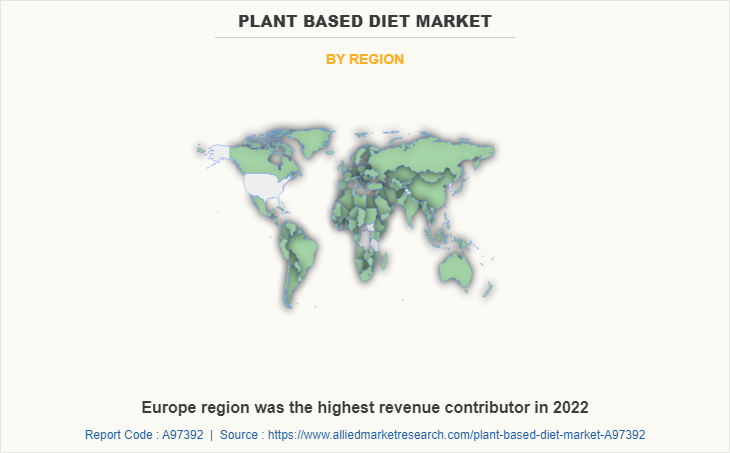

On the basis of source, the plant based diet market size is categorized into legumes, seeds and nuts, whole grains, and fruits and vegetables. On the basis of distribution channel, it is classified into supermarkets/hypermarkets, convenience stores, specialty stores, and online sales channel. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product type

The plant based dairy products segment, as per product type, dominated the global plant based diet market in 2022 and is anticipated to maintain its dominance throughout the forecast period. For health and environmental concerns, more consumers are switching to plant-based diets. Since they often include less calories, saturated fat, and cholesterol than dairy-based counterparts, plant-based dairy products are frequently seen as healthier substitutes. Additionally, concerns about the negative effects of animal agriculture on the environment and the treatment of animals have influenced many customers to prefer alternatives made from plants, which has fueled market expansion.

By source

The legumes segment dominates the global plant based diet market share on the basis of source. The availability of products and meals made from legumes is expanding in both foodservice and retail locations. In order to meet the rising demand for plant-based options, supermarkets are expanding their selection of plant-based products to include a variety of legume-based options. Additionally, chains of restaurants and fast food outlets are utilizing legumes in innovative ways on their menus.

By distribution channel

The specialty stores segment exhibits the fastest growth in the global plant based diet market. Specialty stores give customers high-quality customer care, thorough product descriptions, and expert advice, all of which help these products sell better. Additionally, these stores advertise the sales of both national and private-label products within their establishments.

By region

On the basis of region, Europe dominated the plant based diet industry and is expected to account for the largest share during the plant based diet market forecast period. In North America, the popularity of vegan food delivery services is growing. Direct delivery of easy, pre-made plant-based meals and recipe kits to customers' doors is offered by these providers. They provide convenient and healthy plant-based solutions for people who don't have time to plan and prepare meals.

Competition analysis

The major players analyzed in the plant based diet market are Atlantic Natural Food LLC, Beyond Meat, Inc., Califia Farms, LLC, Conagra Brands, Inc, Danone S.A., Royal DSM N.V., Glanbia PLC, Harmless Harvest, Impossible Food Inc., Lightlife Food Inc (Maple Leaf Food Inc.), Nestle S.A., Noumi Ltd., SunOpta Inc., The Hain Celestial Group, Inc., and Tyson Food Inc.

Some examples of product launch in the market

- Glanbia PLC launched Gold Standard Plant Protein powder, which is made from vegan ingredients, under its Optimum Nutrition brand. This launch expanded its product offering in the plant-based product category.

- Follow Your Heart part of Danone S.A. launched three new cheese products under its plant-based cheese products line. This launch includes Dairy-Free Bleu Cheese Crumbles, Dairy-Free Finely Shredded Cheddar, and Dairy-Free Finely Shredded Mozzarella.

- Nestle S.A., launched Wunda which is a pea-beverage. With this launch, it has expanded its product portfolio in plant-based nutritional drinks.

Some examples of acquisition in the market

- Above Food Inc. acquired Atlantic Natural Foods, which is a plant-based products manufacturing company. This acquisition will expand its current plant-based product offering through brands such as Loma Linda, and Neat. This will further strengthen its business position in the market.

- Danone S.A. acquired Follow Your Heart, which manufactures various plant-based products including cheese. With this acquisition, it has expanded its product offering and strengthened its business in the plant-based cheese market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the plant based diet market analysis from 2022 to 2032 to identify the prevailing plant based diet market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plant based diet market segmnetation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global plant based diet industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plant based diet market trends, key players, market segments, application areas, and plant based diet market growth strategies.

Plant based Diet Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 227.2 billion |

| Growth Rate | CAGR of 17.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Product Type |

|

| By Source |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Beyond Meat, Inc., Conagra Brands, Inc., Glanbia PLC, Nestle S.A., Above Food Inc., The Hain Celestial Group, Inc., DANONE S.A., Tyson Foods, Inc., Maple Leaf Foods Inc., DSM-Firmenich AG |

Analyst Review

The perspectives of the leading CXOs in the plant based diet industry are presented in this section. Consumers' concerns about climate change and animal welfare, their desire to transition to more sustainable food systems, their desire to consume less meat, and the emergence of the flexitarian diet have all contributed to the rapid expansion of the plant-based food market. Flexitarians consume mostly plants but occasionally indulge in moderate amounts of meat or dairy. In addition to vegetarians and vegans, several companies that are entering the markets for plant-based meat and dairy are targeting flexitarian consumers. The current best practice for new businesses entering the market is to keep clear of making the message "too vegan" and instead concentrate on messaging on "taste, flavor, occasions, and price" to entice customers.

The CXOs further added that one of the food industry's fastest-growing trends is "free-from". Diets free of soy and gluten have quickly emerged as the nutritional trend with the quickest rate of growth, due to their therapeutic and health benefits. The rise in food sensitivities, regional dietary preferences, an increase in the diagnosis of coeliac disease, and the concept of utilizing food as medicine are primarily responsible for the surge in soy and gluten-free food products. For instance, a lot of people have allergies and intolerances to soy protein, which cause eye irritation, stomach issues, and other symptoms that, in extreme circumstances, necessitate hospitalization. Furthermore, one of the most well-liked dietary trends worldwide is the gluten-free diet.

The global plant based diet market size was valued at $44.9 billion in 2022, and is projected to reach $227.2 billion by 2032

The global Plant based Diet market is projected to grow at a compound annual growth rate of 17.7% from 2023 to 2032 $227.2 billion by 2032

The major players analyzed in the plant based diet industry are Atlantic Natural Food LLC, Beyond Meat, Inc., Califia Farms, LLC, Conagra Brands, Inc, Danone S.A., Royal DSM N.V., Glanbia PLC, Harmless Harvest, Impossible Food Inc., Lightlife Food Inc (Maple Leaf Food Inc.), Nestle S.A., Noumi Ltd., SunOpta Inc., The Hain Celestial Group, Inc., and Tyson Food Inc.

On the basis of region, Europe dominated the market and is expected to account for the largest share during the plant based diet market forecast period

Rise in the vegan population, The surge in demand for plant-based food and beverages

Loading Table Of Content...

Loading Research Methodology...