Pork Jerky Market Research, 2031

The global pork jerky market size was valued at $745.9 million in 2021, and is projected to reach $1.4 billion by 2031, growing at a CAGR of 7.1% from 2022 to 2031.

The pork jerky market is segmented into Consumption, Nature, Type and Distribution Channel.

Pork jerky is a part of the processed pork meat market. It is lean-trimmed pork meat that are cut into strips and dried in order to prevent spoilage and extend its shelf-life. It is predominantly consumed as a snack in households in North America and Europe. Pork jerky is made using lean pork meat only wherein the meat pieces contain only 10% or lower fat content.

The rise in popularity of savory snacks among household consumers is a major factor driving the pork jerky market growth. The growing preferences for nutritional meat-based snacks among global consumers coupled with rising household income is fueling the pork jerky market demand, globally. The ease and conveniences associated with ready-to-cook pork jerky products and its longer shelf-life has boosted the demand for pork jerky among households in Europe and North America. Moreover, the rise in demand for pork meat among lower-income households is boosting the growth of the pork jerky market. According to the United States Department of Agriculture (USDA), the lower income households prefer to consume more pork meat as per the per capita pork meat consumption as compared to that of high-income households. Therefore, the rising demand for both fresh and processed pork meat among the lower income households is expected to drive the growth of the pork jerky market during the forecast period.

An increase in urbanization drives the growth of the pork jerky market. The fast-food chains, cafes, and popular hotels are limited to major cities and towns. These fast-food chains and cafes play a significant role in the sales of pork jerky. According to the United Nations, 60% of the global population is expected to live in urban areas by 2030, increasing from 55% in 2018. This provides a lucrative opportunity for pork jerky vendors to boost their revenue due to a rise in the prospected customer base. According to United Nations, North America was the most urbanized market in 2018, with around 82% of its population residing in urban cities. North America was followed by Latin America and the Caribbean (81%) and Europe (74%). Africa and Asia have the lowest level of urbanization with 43% and 50% of the population living in urban areas respectively. Africa and Asia, therefore are expected to provide significant development opportunities in the near future.

The development in cold storage technology has a favorable influence on the pork jerky market by providing ease of transportation. Meat is subjected to proteolysis or endogenic enzymatic activity that may cause the meat to develop an undesirable characteristics flavor. The cold storage system prevents this. The meat because of its chemical composition enhances the growth of microorganisms and is sensitive to oxidation. It tends to develop microbial contamination through contact with tools and equipment used while slaughtering. The cold prevents this microbial contamination in the slaughtering house which is called primary chilling.

The emerging markets such as Asia-Pacific and LAMEA are characterized by rapid population, rise in disposable income, surge in population, and increase in demand for ready-to-cook and ready-to-eat food products. Popular modern trade includes supermarkets/hypermarkets, online retailers, online food delivery platforms, and convenience stores. These popular types of modern traders have a higher penetration in urban cities. Therefore, developing markets such as Brazil, Argentina, South Africa, India, China, and Indonesia seem to offer great growth opportunities to these popular distribution channels.

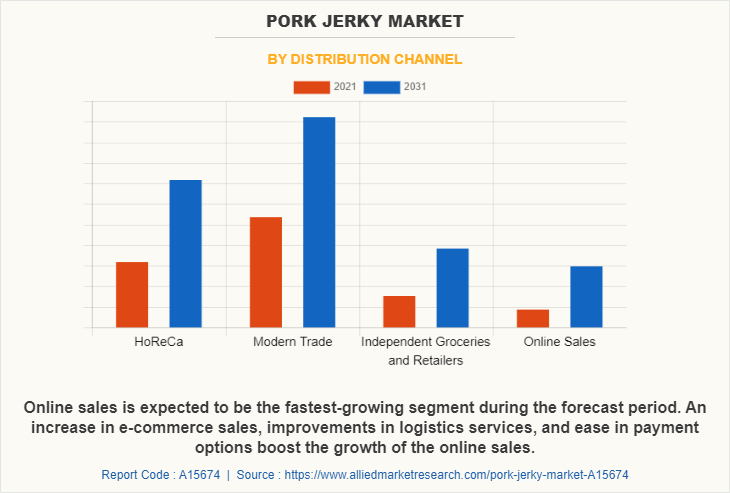

Moreover, modern trade accounts for the largest proportion of the global pork jerky market. Furthermore, the surge in penetration of HoReCa and the food chain in the developing regions and online food delivery platforms drive the demand for pork jerky in emerging markets. Therefore, the emerging markets of the Asia-Pacific and LAMEA regions are expected to positively impact the growth of the pork jerky market during the forecast period.

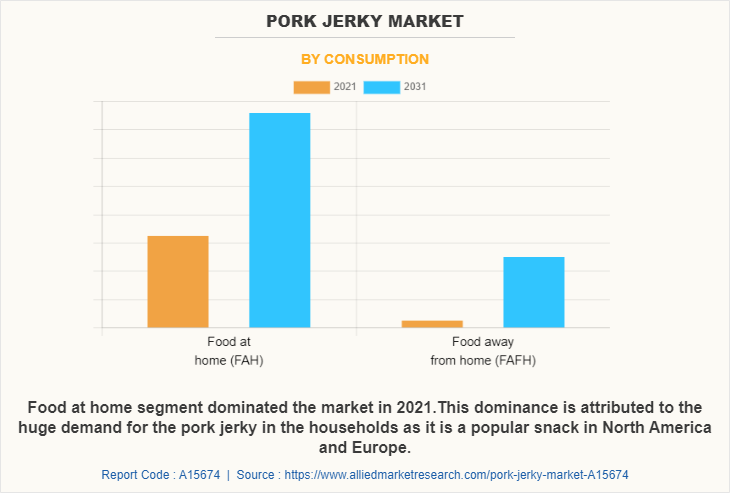

According to the pork jerky market analysis, the market is segmented based on consumption, type, nature, and distribution channel. Based on consumption, the market is segmented into food at home (FAH) and food away from home (FAFH). Both the FAH and FAFH segments are further bifurcated based on flavor into maple, sriracha applewood, pepper, and others. The others segment includes flavors like sweet, spicy, Jalapeno, and others.

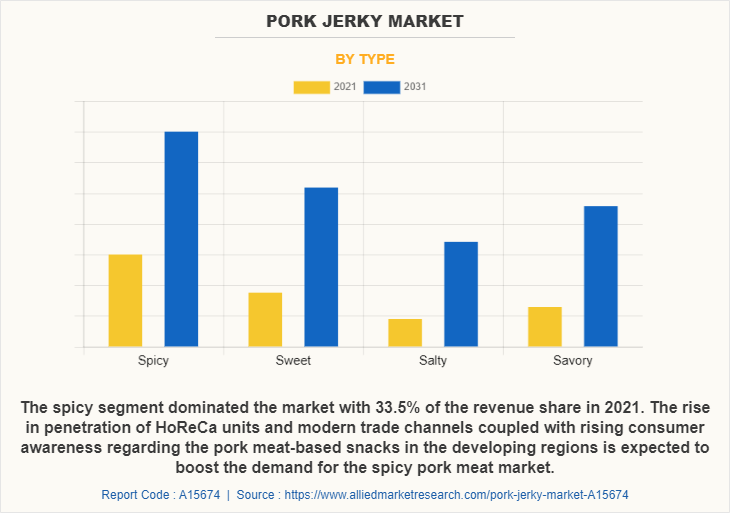

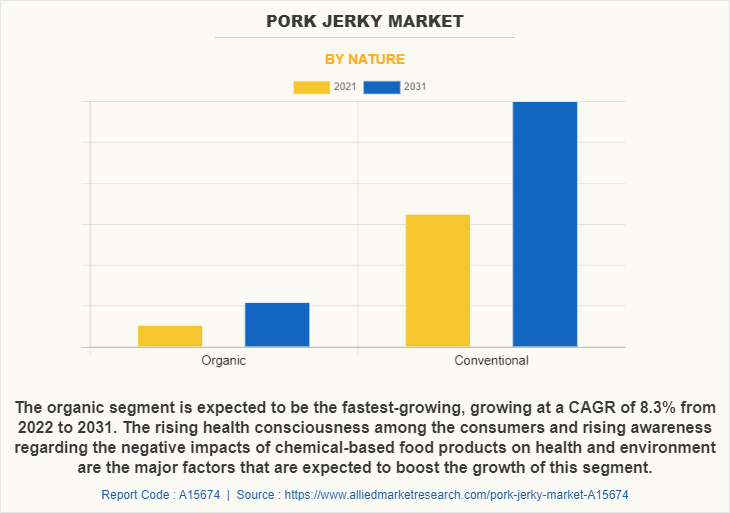

By type, it is segregated into spicy, sweet, salty, and savory. Based on the nature, the market is bifurcated into organic and conventional. Depending upon the distribution channel, market is categorized into HoReCa (hotels, restaurants, and cafes), modern trade, independent groceries and retailers, and online sales. Region-wise, the pork jerky market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

As per the pork jerky market forecast, by consumption, the food at home (FAH) accounted for 70.1% of the pork jerky market share in 2021, and is expected to sustain its dominance during the forecast period. This dominance is attributed to the huge consumption of pork jerky as a healthy snack in the households of North America and Europe.

According to the United States Depart of Agriculture (USDA), over 75% of processed pork meat are consumed at home. This segment was significantly boosted during the COVID-19 pandemic due to the closure of restaurants and increased consumption of processed food at home. The growing penetration of online groceries across the globe is expected to boost the demand for packaged pork jerky products for at home consumption, which is expected to drive the growth of the FAH segment during the forecast period.

According to the pork jerky market trends, by type, the savory is expected to be the fastest-growing segment, growing at a CAGR of 7.8% during the forecast period. The growing demand for animal protein among the non-vegetarian population and the changing taste and preferences of consumers is expected to drive the demand for savory pork jerky. The high protein content in the pork jerky along with the savory taste helps to provide necessary nutrition and helps in healthy aging. The rising demand for healthy and nutritional snacks among consumers is expected to boost the growth of the savory pork jerky segment in the global pork jerky market.

As per the pork jerky market opportunities, based on nature, the organic segment is expected to witness the highest CAGR of 8.3% from 2022 to 2031. The rising health consciousness among the consumers and rising awareness regarding the negative impacts of chemical-based food products on health and environment are the major factors that are expected to boost the growth of this segment. According to the Organic Trade Association (OTA), in 2020, U.S. witnessed an all-time high sales of organic food products.

Organic pork jerky is made from organically farmed pork meat that are processed to prepare pork jerky. Organic pork jerky is gaining rapid momentum among the jerky lovers. The growing demand for organic and natural products, as well as the health benefits of organic food products, are the two main factors driving the growth of the organic pork jerky market. According to Organic Trade Association in the year 2020-21, Organic revenues exceeded $63 billion, with total annual growth of $1.4 billion. Food sales, which accounted for more than 90% of organic sales, reached $57.5 billion (approximately 2% growth) and non-food sales reached $6.0 billion (7% growth) in U.S. Additionally, the increasing popularity of home-cooked meals and the growing number of cooking shows and blogs are also helping to drive the market growth.

Depending on the distribution channel, the modern trade segment dominated the market in terms of revenue in 2021. Modern trade includes all the organized retail formats such as hypermarkets, supermarkets, departmental stores, and mini-markets. The rising penetration of the organized retail sector in developing and underdeveloped economies is expected to boost the growth of the pork jerky market during the forecast period. The ease and convenience of shopping from organized retail chains is a major factor behind the dominance of this segment.

Modern trade channels have become popular due to the availability of a broad range of consumer goods and food & beverages under one roof, as well as adequate parking space and convenient operation timings. Furthermore, the increase in urbanization, rise in the working-class population, and competitive pricing boost the popularity of supermarkets, hypermarkets, and mini-markets. Moreover, the staff present in the stores provides information on the benefits of pork jerky and other food products. These retail formats provide products at a competitive price to customers and are usually located in easily accessible areas.

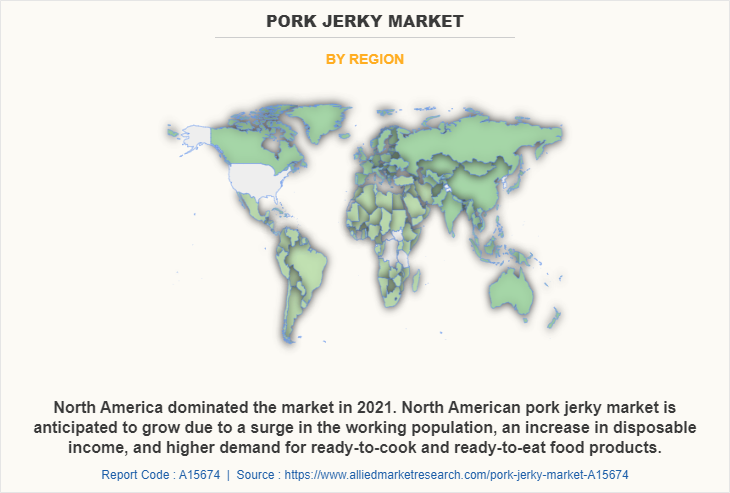

Region-wise, the pork jerky market was dominated by North America, with 38.7% share in 2021, followed by Europe. The increase in popularity of fast-food chains, cafes, and hotels has significantly enhanced the growth of the processed meat market in North America and Europe.

North American pork jerky market is anticipated to grow due to a surge in the working population, an increase in disposable income, and higher demand for ready-to-cook and ready-to-eat food products. According to the United Nations, Food and Agriculture Organization, the U.S. is one of the leading meat producers and meat consumers just after China. However, the U.S. ranks first in the consumption of pork jerky due to the larger prevalence of hotels, fast food chains, and cafes. For this, the U.S. is anticipated to maintain its dominance during the forecast period.

Asia-Pacific is expected to be the most lucrative market during the forecast period. China is the global leader in meat production and meat consumption. Developing nations like India and Indonesia are presenting substantial development opportunities due to the increase in the consumption of pork jerky across the region. Asia-Pacific is characterized by a huge population, rapid urbanization, a rise in disposable income, and an increase in e-commerce. According to the United Nations Food and Agriculture Organization, Asia-Pacific is the largest producer and consumer of meat across the globe. This provides a lucrative growth opportunity to the key players operating in the pork jerky industry. World Economic Forum, in its article, stated that China eats around 28% of the world’s meat and half of that is pork. Such huge consumption of pork will boost the market growth for the pork jerky market.

Players operating in the pork jerky industry have used a variety of developmental strategies to expand their market share, exploit the pork jerky market opportunities, and boost their profitability. The key players operating in the market include GoBacon Jerky, LLC., Conagra Brands, Inc., The Meat Makers, Divine Bovine Jerky, Wicked Cutz, Big Fork Brands, Meat Maniac, Premium Brands Holdings Corporation, Three Squirrels, Beyond Meat, Fragrant Jerky, Link Snacks, Inc., Tiki Hawaiian Gourmet Jerky, Organic Jerky Co., and Oberto Specialty Meats.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the pork jerky market size, market segments, current trends, estimations, and dynamics of the pork jerky market analysis from 2021 to 2031 to identify the prevailing pork jerky market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the pork jerky market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global pork jerky market trends, key players, market segments, application areas, and market growth strategies.

Pork Jerky Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.4 billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Type |

|

| By Consumption |

|

| By Distribution Channel |

|

| By Nature |

|

| By Region |

|

| Key Market Players | The Meat Makers, Premium Brands Holdings Corporation, Tiki Hawaiian Gourmet Jerky, Conagra Brands, Inc., Big Fork Brands, Meat Maniac, Fragrant Jerky (USA) Singapore-Style Fire-Grilled Jerky, Three Squirrels Co., Ltd., GoBacon Jerky, LLC, Link Snacks, Inc., Wicked Cutz, Beyond Meat, Divine Bovine Jerky |

Analyst Review

According to the CXOs of leading companies, the global plant-based meat industry has witnessed a notable growth since the past few years. Developed markets, including North America and Europe have witnessed a decline in per capita consumption of meats. Contrarily, preference of consumers toward mock meats (meat substitutes) has increased considerably.

Innovative product launches, such as artificial pork, and other meats resembling real meats in terms of taste and texture, have not only gained popularity amongst vegan consumers but have also attracted more number of non-vegetarians since the recent past.

Leading companies in the plant-based meat industry, such as Beyond Meat, Quorn Foods, Amy’s Kitchen, and others, have witnessed a double digit growth in their business since the past few years. Moreover, other players operating in the fast-food industry, such as KFC, McDonald’s, Burger King, and others, are anticipated to strengthen their vegan food product line with artificial pork-based products to address the growing demand for vegetarian food. Players operating in the pork jerky market have started focusing on development and launch of highly innovative substitutes of pork meat jerky to attract more number of customers. Moreover, innovative marketing and positioning strategies of players have helped to increase the overall market size.

The global pork jerky market size was valued at $745.9 million in 2021, and is projected to reach $1.4 billion by 2031

The global Pork Jerky market is projected to grow at a compound annual growth rate of 7.1% from 2022 to 2031 $1.4 billion by 2031

The key players operating in the market include GoBacon Jerky, LLC., Conagra Brands, Inc., The Meat Makers, Divine Bovine Jerky, Wicked Cutz, Big Fork Brands, Meat Maniac, Premium Brands Holdings Corporation, Three Squirrels, Beyond Meat, Fragrant Jerky, Link Snacks, Inc., Tiki Hawaiian Gourmet Jerky, Organic Jerky Co., and Oberto Specialty Meats.

Region-wise, the pork jerky market was dominated by North America

Food Industry Innovation, Ethnic Cuisine Adoption, Ingredient Labeling Regulations

Loading Table Of Content...

Loading Research Methodology...