Power Plant Boiler Market Research, 2031

The global power plant boiler market size was valued at $19.0 billion in 2021, and power plant boiler industry is projected to reach $31.1 billion by 2031, growing at a CAGR of 5.1% from 2022 to 2031.

Report Key Highlighters:

- The power plant boiler market has been analyzed in value. The value of the power plant boiler market is analyzed in millions of USD.

- The global power plant boiler market is fragmented in nature with many players such as General Electric (GE), Siemens AG, Babcock & Wilcox Enterprises, Inc., Mitsubishi Hitachi Power Systems, Ltd., Doosan Heavy Industries & Construction Co., Ltd., Bharat Heavy Electricals Limited (BHEL), Alstom SA, Harbin Electric Corporation, Dongfang Electric Corporation Limited, and Kawasaki Heavy Industries, Ltd. This report also offers key strategies such as product launches, acquisitions, mergers, expansion, etc. of various manufacturers of pipeline equipment.

- Primary interviews with raw material suppliers, wholesalers, suppliers, and manufacturers of the power plant boiler market have been conducted by the report analysts to understand the market trends, growth factors, pricing, and key players’ competitive strategies.

A power plant boiler is a large, complex piece of equipment that is used to generate steam to drive a turbine and produce electricity. The basic function of a power plant boiler is to convert water into steam using heat generated from the combustion of fuel, typically coal, natural gas, or oil.

The steam produced by the boiler is then directed to a turbine that converts the thermal energy of the steam into mechanical energy to drive an electric generator. Power plant boilers come in various sizes and types, such as multi-tube boilers, modular boilers, and once-through boilers, and they are designed to operate at high pressures and temperatures. Power plant boilers are critical components of any thermal power plant, and their efficiency and reliability are essential for the economic and safe operation of the power plant.

The growth of the power plant boiler market is driven by the rise in the demand for energy, technological advancements in power plant boiler designs and materials, rise in awareness of environmental issues, and the need for sustainable energy sources. These positive factors are the major reasons for the power plant boiler market growth.

The future of power generation belongs to ultra-supercritical boilers

Ultra-supercritical boilers are a new generation of steam generators that operate at higher temperatures and pressures than supercritical boilers. These advanced boilers offer several benefits, including higher efficiency, reduced emissions, and lower fuel consumption. They are expected to play a critical role in the future of power generation as the world shifts toward more sustainable and efficient energy systems. Ultra-supercritical boilers operate at temperatures and pressures above the supercritical point of water, which is approximately 25 MPa and 600°C.

This high-pressure, high-temperature operation increases the efficiency of the boiler, reduces the emissions of greenhouse gases, and lowers the fuel consumption required to generate power. One of the primary benefits of ultra-supercritical boilers is their higher efficiency. These boilers can achieve efficiencies of up to 45%, which is significantly higher than the 33% efficiency of subcritical boilers.

This means that ultra-supercritical boilers can generate more power with less fuel consumption, resulting in lower operating costs and lower emissions of greenhouse gases. Another benefit of ultra-supercritical boilers is their reduced emissions. These boilers produce significantly fewer emissions of nitrogen oxides (NOx), sulfur dioxide (SO2), and carbon dioxide (CO2) than subcritical boilers. This reduction in emissions makes ultra-supercritical boilers environment-friendly and in line with the growing demand for sustainable energy systems.

Ultra-supercritical boilers are also flexible and can accommodate a broader range of fuels. This flexibility allows power plant operators to switch between different fuel sources, such as coal, natural gas, and biomass, depending on availability and cost. Several leading manufacturers, including General Electric, Mitsubishi Heavy Industries, and Siemens, offer ultra-supercritical boilers. These companies have developed a range of advanced technologies to improve the efficiency, reliability, and flexibility of ultra-supercritical boilers.

The adoption of ultra-supercritical boilers is expected to increase as the world shifts toward sustainable and efficient energy systems. These advanced steam generators offer several benefits over conventional subcritical boilers, including higher efficiency, reduced emissions, and lower fuel consumption. They are a critical component of modern power plants and are expected to play a significant role in the global transition toward a sustainable and energy-efficient future.

Wide utilization of circulating fluidized bed boilers in power generation

Circulating fluidized bed (CFB) boilers have gained significant popularity in the power generation industry due to their high efficiency, fuel flexibility, and low emissions. They are used in a wide range of applications, including coal-fired power plants, biomass power plants, and waste-to-energy facilities. CFB boilers work by circulating a fluidized bed of particles through a combustion chamber, where they react with fuel to produce steam. The bed material is typically made up of sand or limestone, which provides a large surface area for heat transfer and reduces emissions. The fluidization process also allows for better mixing of the fuel and air, which leads to efficient combustion.

One of the key benefits of CFB boilers is their fuel flexibility. They can use a wide range of fuels, including coal, biomass, and waste materials. This flexibility allows power plants to switch between fuels based on availability and cost, making them economically competitive. CFB boilers also have a higher combustion efficiency compared to conventional boilers, which means they can extract more energy from the fuel and produce more power.

CFB boilers are also known for their low emissions. The fluidized bed of particles provides a large surface area for combustion, which allows for more complete combustion of the fuel. This results in lower emissions of nitrogen oxides (NOx), sulfur dioxide (SO2), and particulate matter (PM). In addition, CFB boilers can use limestone as a bed material, which can capture and remove sulfur from the flue gas. Another advantage of CFB boilers is their ability to operate at lower temperatures and pressures, which reduces the risk of corrosion and erosion. This results in longer boiler life and lower maintenance costs. CFB boilers also have a smaller footprint compared to conventional boilers, which makes them easier to install and operate.

Several leading companies in the power generation industry, including General Electric, Siemens, and Mitsubishi Heavy Industries, manufacture CFB boilers. These companies offer a range of CFB boiler designs to meet the specific needs of power plants around the world. In conclusion, circulating fluidized bed (CFB) boilers offer several benefits over conventional boilers, including high efficiency, fuel flexibility, low emissions, and lower maintenance costs.

They are widely utilized in the power generation industry for a range of applications, including coal-fired power plants, biomass power plants, and waste-to-energy facilities. The adoption of CFB boilers is expected to increase with the rise in demand for efficient and environment-friendly power generation systems. They are a critical component of modern power plants and are expected to play a significant role in the global transition toward a more sustainable and energy-efficient future.

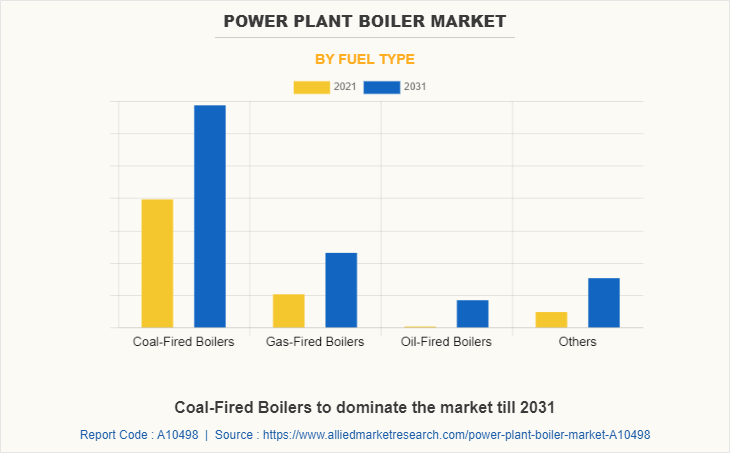

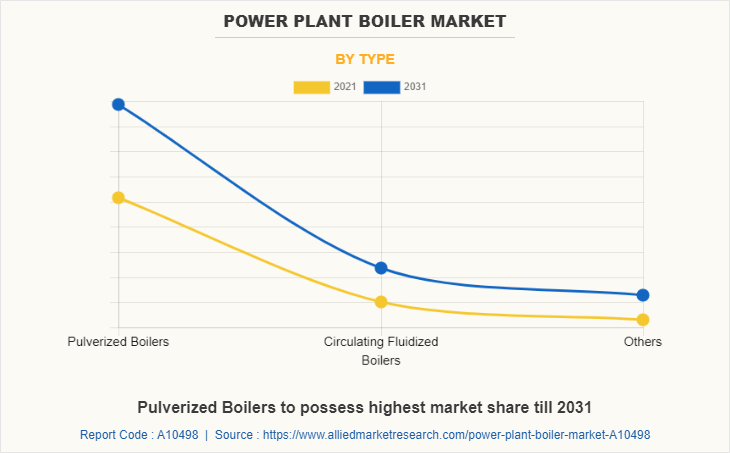

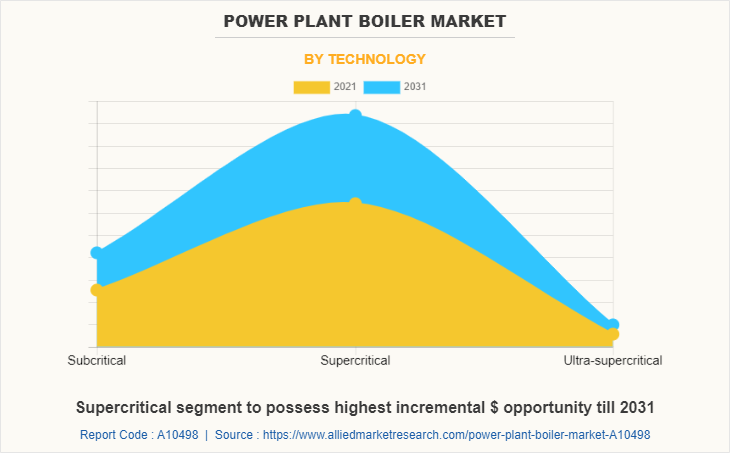

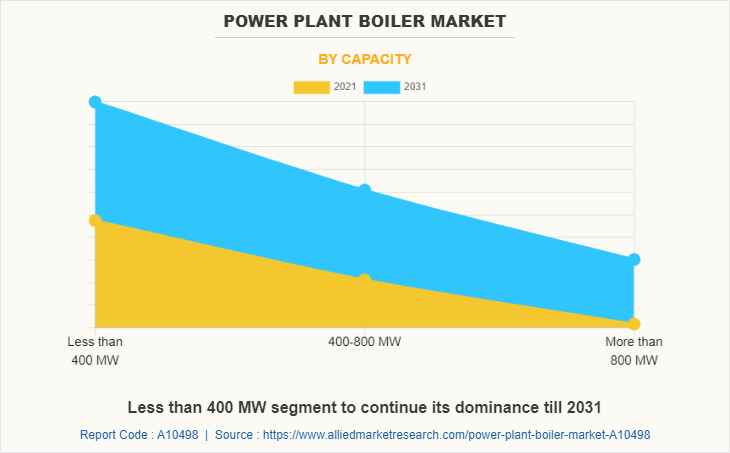

The global power plant boiler market forecast is segmented into fuel type, type, technology, and capacity. By fuel type, the market is divided into coal-fired boilers, gas-fired boilers, oil-fired boilers, and others. By type, the market is classified into pulverized boilers, circulating fluidized boilers, and others. By technology, the market is categorized into subcritical, supercritical, and ultra-supercritical. By capacity, the market is fragmented into less than 400 MW, 400-800 MW, and more than 800 MW. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By fuel type, the market is divided into coal-fired boilers, gas-fired boilers, oil-fired boilers, and others. The coal-fired boilers segment accounted for the largest revenue share in the global power plant boiler market in 2021 attributed to the presence of abundant coal reserves in developing countries such as India and China which are still highly dependent on coal-fired thermal power plants to generate power.

By type, the market is divided into the pulverized boiler, circulating fluidized boiler, and others. The pulverized boiler segment accounted for the largest revenue share in the global power plant boiler market in 2021 attributed to the wide utilization of this type of boiler in the power generation plants related to coal-fired thermal power plants. There is a high demand for pulverized boilers as most of the developing countries in the Asia-Pacific region are highly dependent on coal-fired power plants.

On the basis of technology, the supercritical segment accounted for more than 60% of the power plant boiler market share in 2021 and is expected to maintain its dominance during the forecast period owing to the increase in the demand for energy-efficient power plants that are more efficient and eco-friendlier than subcritical boilers. Furthermore, ongoing construction activities related to infrastructure in developed and developing countries have a significant impact on the demand for energy which led to the demand for supercritical boilers.

By capacity, the market is divided into less than 400 MW, 400-800 MW, and Above 800 MW. The less than 400 MW segment accounted for the largest revenue share in the global power plant boiler market in 2021 attributed to the surge in the demand for power plant boilers in the construction of small-scale power plants and renewable power plants where fuels are renewable and eco-friendly.

Region-wise, Asia-Pacific accounted for the largest market share in the market and is projected to grow at a CAGR of 5.4% during the forecast period. The countries in this region are developing at a rapid pace and the presence of most of the developing countries in this region has led to a surge in the demand for electricity which led to the construction of power plants. Hence, the presence of construction of infrastructure related to power generation has increased the demand for power plant boilers.

In addition, the presence of investment toward the development of various infrastructures and construction of manufacturing facilities in developing countries such as India and China is projected to provide lucrative opportunities for the growth of the power plant boiler market. North America, consisting of the U.S., Canada, and Mexico, is a significant market for power plant boilers due to favorable policies, high energy consumption, and rise in demand for energy.

The U.S. holds a significant portion of the market share and is expected to grow due to the presence of favorable policies and technological advancements. The demand for power generation infrastructure in Canada is expected to increase due to significant investment in natural resources and industrial sectors. Mexico is also a growing market for power plant boilers, driven by the country's rapid economic development. The growth in demand for energy, the shift towards cleaner energy sources, and the need to replace aging power plant infrastructure are key trends and opportunities driving the market growth in North America. In addition, the expansion of the natural gas industry is having a positive impact on the market.

Europe is a fast-growing market for power plant boilers due to favorable government policies, a focus on eco-friendly solutions, and technological advancements. Germany is a key player in the European market with a growing demand for more efficient and environment-friendly power plant boilers. Europe's commitment to achieving carbon neutrality by 2050 is driving the adoption of renewable energy technologies, creating opportunities for power plant boilers. The growing popularity of electric vehicles is also creating demand for energy generation supported by power plant boilers. Overall, Europe presents a range of opportunities for the power plant boiler market in the coming years. The Asia-Pacific region dominates the power plant boiler market and is analyzed across China, Japan, India, South Korea, Australia, and the Rest of Asia-Pacific.

The Asia-Pacific region is experiencing rapid economic growth and an increase in energy consumption. There is a focus on environment-friendly energy sources to meet this demand while reducing greenhouse gas emissions. The development of advanced power plant boilers is seen as a key solution to this challenge. Countries such as China, Japan, and India are investing in new technology and manufacturing techniques to improve efficiency and reduce the cost of power plant boilers.

The surge in industrial infrastructure in developing countries has led to the construction of coal and gas-fired power plants, further boosting demand for power plant boilers. The region's high demand for energy, rapid urbanization, and focus on sustainability are driving the adoption of power plant boilers. In addition, the surge in use of electric vehicles and portable electronic gadgets is driving the construction of power plants that will further drive the growth of the power plant boiler market. Overall, the Asia-Pacific region presents significant opportunities for the growth of the power plant boiler market.

LAMEA, which includes Brazil, Saudi Arabia, South Africa, and the rest of the region, has abundant fossil fuel resources, leading to an increase in demand for power generation facilities. Brazil, with a rapidly growing economy and high electricity demand, will have a significant impact on the demand for power plant boilers. Saudi Arabia and South Africa also have growing infrastructure, boosting the demand for power generation facilities and power plant boilers. The surge in urbanization, industrialization and utilization of consumer electronic gadgets is expected to drive the demand for power plant boilers in the region, providing ample opportunities for market development.

Impact of Covid-19 on the global power plant boiler market

The decrease in energy demand resulted in a decrease in the demand for power plant boilers. Furthermore, the supply chain disruptions and labor shortages caused by the pandemic impacted the manufacturing and construction of power plant boilers. Project delays and cancellations due to the uncertain economic environment also led to a slowdown in market growth. The COVID-19 pandemic has had a short-term impact on the power plant boiler market, but the long-term outlook for the market remains positive.

The market post-pandemic period is driven by factors such as rising energy demand, increasing focus on reducing greenhouse gas emissions, and government initiatives promoting renewable energy sources. The adoption of digital technologies and the use of advanced materials in power plant boilers are expected to drive innovation and improve the efficiency of power plant operations. The power plant boiler market is expected to play a critical role in the global transition toward a more sustainable and energy-efficient future.

Competitive Landscape

Key players in the market are General Electric (GE), Siemens AG, Babcock & Wilcox Enterprises, Inc., Mitsubishi Hitachi Power Systems, Ltd., Doosan Heavy Industries & Construction Co., Ltd., Bharat Heavy Electricals Limited (BHEL), Alstom SA, Harbin Electric Corporation, Dongfang Electric Corporation Limited, and Kawasaki Heavy Industries, Ltd. These players have adopted various strategies to gain a higher share or retain leading positions in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power plant boiler market analysis from 2021 to 2031 to identify the prevailing power plant boiler market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the power plant boiler market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global power plant boiler market trends, key players, market segments, application areas, and market growth strategies.

Power Plant Boiler Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 31.1 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 329 |

| By Fuel Type |

|

| By Type |

|

| By Technology |

|

| By Capacity |

|

| By Region |

|

| Key Market Players | Siemens AG, Babcock & Wilcox Enterprises, Inc., Dongfang Electric Corporation Limited, Mitsubishi Hitachi Power Systems, Ltd., Alstom SA, Bharat Heavy Electricals Limited, Harbin Electric Corporation, Kawasaki Heavy Industries, Ltd., Doosan Corp., General Electric |

Analyst Review

As per CXO Perspective, the global power plant boiler market is expected to witness increased demand during the forecast period. The surge in the demand for reliable and highly efficient power generation equipment is projected to significantly impact the market's development.

Power plant boilers are a type of equipment used to generate steam that is used to produce electricity in power plants. The boilers are designed to burn fossil fuels such as coal, oil, and natural gas, or other types of fuel such as biomass, to create heat that is used to produce high-pressure steam. The high-pressure steam then drives turbines that are connected to generators, which convert the mechanical energy of the turbines into electrical energy that can be used to power homes, businesses, and industries. Power plant boilers are typically large, complex systems that require skilled operators to maintain and operate them safely and efficiently.

The power plant boiler market is primarily driven by the increase in demand for electricity around the world, which has led to the construction of new power plants and the expansion of existing ones. In addition, the growing focus on clean energy and reducing carbon emissions has led to the adoption of more efficient and eco-friendly boilers that can run on renewable fuels such as biomass and waste heat.

The market is also influenced by government policies and regulations aimed at promoting the use of clean energy sources and reducing greenhouse gas emissions. Technological advancements in boiler design and surge in demand for energy storage solutions are also contributing toward the growth of the power plant boiler market.

The global power plant boiler market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Among the analyzed regions, the Asia-Pacific region has dominated the market due to the increase in demand for electricity, rapid industrialization, and urbanization in countries like China, India, and Japan. The region has also witnessed significant investments in renewable energy projects, which have led to the adoption of advanced power plant boilers that are efficient and eco-friendly.

Furthermore, government initiatives aimed at reducing carbon emissions and increasing the share of renewable energy in the energy mix have also contributed toward the growth of the power plant boiler market in the Asia-Pacific region. Other regions such as Europe and North America also have a significant presence in the market.

Increase in demand for energy and rise in awareness of environmental issues and the need for sustainable energy solutions are the key factors boosting the Power plant boiler market growth.

Power generation application is projected to increase the demand for Power plant boiler Market

General Electric (GE), Siemens AG, Babcock & Wilcox Enterprises, Inc., Mitsubishi Hitachi Power Systems, Ltd., Doosan Heavy Industries & Construction Co., Ltd., Bharat Heavy Electricals Limited (BHEL), Alstom SA, Harbin Electric Corporation, Dongfang Electric Corporation Limited, and Kawasaki Heavy Industries, Ltd.

The market value of Power plant boiler in 2031 is expected to be $31.1 billion

The global power plant boiler market analysis is segmented into fuel type, type, technology, and capacity. By fuel type, the market is divided into coal-fired boilers, gas-fired boilers, oil-fired boilers, and others. By type, the market is classified into pulverized boilers, circulating fluidized boilers, and others. By technology, the market is categorized into subcritical, supercritical, and ultra-supercritical. By capacity, the market is fragmented into less than 400 MW, 400-800 MW, and more than 800 MW. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Technological advancements in power plant boiler designs and materials is the Main Driver of Power plant boiler Market.

The market post-pandemic period is driven by factors such as rising energy demand, increasing focus on reducing greenhouse gas emissions, and government initiatives promoting renewable energy sources. The adoption of digital technologies and the use of advanced materials in power plant boilers are expected to drive innovation and improve the efficiency of power plant operations.

Loading Table Of Content...

Loading Research Methodology...