Power Plant EPC Market Overview

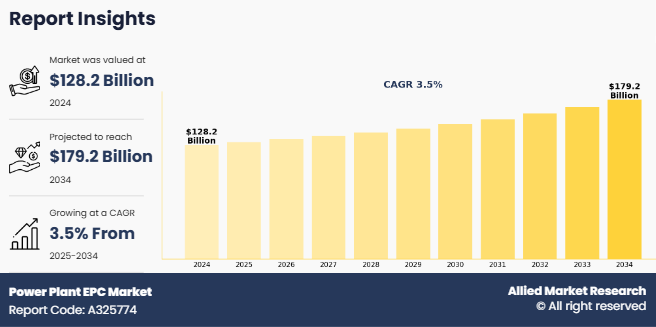

The global power plant EPC market size was valued at USD 128.2 billion in 2024, and is projected to reach USD 179.2 billion by 2034, growing at a CAGR of 3.5% from 2025 to 2034.

The power plant EPC market forecast growth, driven by increasing investments in renewable energy, modernization of existing infrastructure, and global efforts toward sustainable power generation. Engineering, procurement, and construction in power plants encompass the complete process of designing, sourcing, and building power generation facilities, ensuring projects are delivered efficiently, safely, and on schedule. This approach integrates technical expertise with project management to optimize performance and cost-effectiveness.

Introduction

EPC, which stands for engineering, procurement, and construction, is a form of contracting arrangement commonly used in large-scale infrastructure projects, especially in the energy and utilities sector. In a power plant EPC industry, a single entity is responsible for all activities from design, procurement of equipment and materials, construction, commissioning, and delivery of the facility to the client in a ready-to-operate state. The EPC contractor owes the full risk for the project schedule, budget, and performance once the contract is signed. This model ensures accountability and provides clients with cost and timeline certainty. This contracting mode ensures timely and effective delivery of thermal, nuclear, hydroelectric, and renewable power generation projects across the globe.

The engineering phase of a power plant EPC project is the foundation on which the entire development is built. It begins with extensive feasibility studies that evaluate the technical, economic, and environmental viability of the project. Once a project is deemed feasible, detailed plant design and layout planning is undertaken, which includes process engineering, mechanical system design, civil and structural engineering, as well as electrical and instrumentation system planning. Particular attention is given to optimizing plant performance and efficiency while ensuring compliance with safety and environmental standards. Additionally, grid interconnection designs are developed to ensure the plant's seamless integration into the regional or national power grid. Environmental considerations are addressed through impact assessments, which identify potential ecological consequences and outline mitigation strategies to align with regulatory requirements.

Key Takeaways

- The power plant EPC market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global power plant EPC markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the power plant EPC market are Bechtel Corporation, Siemens Energy, General Electric Company, LARSEN & TOUBRO LIMITED, Tata Projects Limited, Hyundai Engineering & Construction Co., Ltd, MITSUBISHI HEAVY INDUSTRIES, LTD, Valmet, Fluor Corporation, Technip Energies N.V., and others.

Market Dynamics

Shift toward renewable energy integration is expected to drive the growth of the power plant EPC market. The growing emphasis on renewables has opened a vast array of opportunities for EPC contractors. These firms are increasingly being awarded turnkey contracts for the design, procurement, and execution of renewable energy projects. Unlike traditional thermal plants, renewable installations often require specialized technical know-how, modular project planning, and faster implementation timelines areas where experienced EPC players can add considerable value. As the demand for decentralized, clean energy systems continues to surge, especially in developing regions, EPC companies are well-positioned to capitalize on this shift and expand their renewable project portfolios. Pradhan Mantri Surya Ghar Muft Bijli Yojana (launched February 2024): aimed to install rooftop solar for 10 million households and provide up to 300 units/month of free electricity. Combined with concessional loans and direct subsidies via MNRE, this target represents one of India’s largest residential solar integration efforts.

However, fluctuations in raw material and equipment costs is expected to restrain the growth of power plant EPC market. One of the major challenges faced by power plant EPC contractors is the volatility in raw material and equipment costs. Materials such as steel and cement, which are fundamental to the construction phase, often experience price fluctuations due to changes in global demand, supply chain disruptions, or geopolitical tensions. Similarly, the cost of specialized equipment—such as turbines, generators, boilers, and transformers can vary significantly based on international trade dynamics, technological advancements, and manufacturing bottlenecks. These cost variations can have a direct impact on the overall project budget and margins. In many EPC contracts, especially fixed-price ones, any unexpected increase in input costs must be absorbed by the contractor, leading to potential financial strain or delays. Moreover, fluctuations in fuel prices for thermal power projects—can also affect the long-term viability of the plant and the interest of investors.

Segments Overview

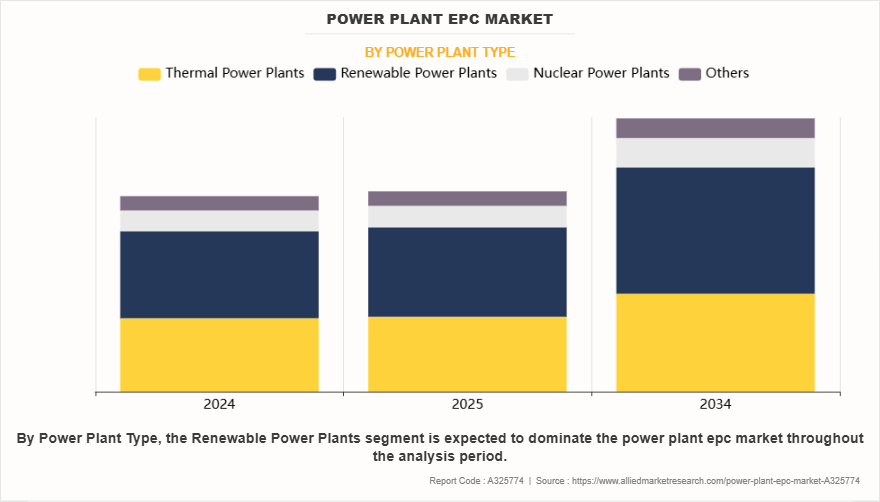

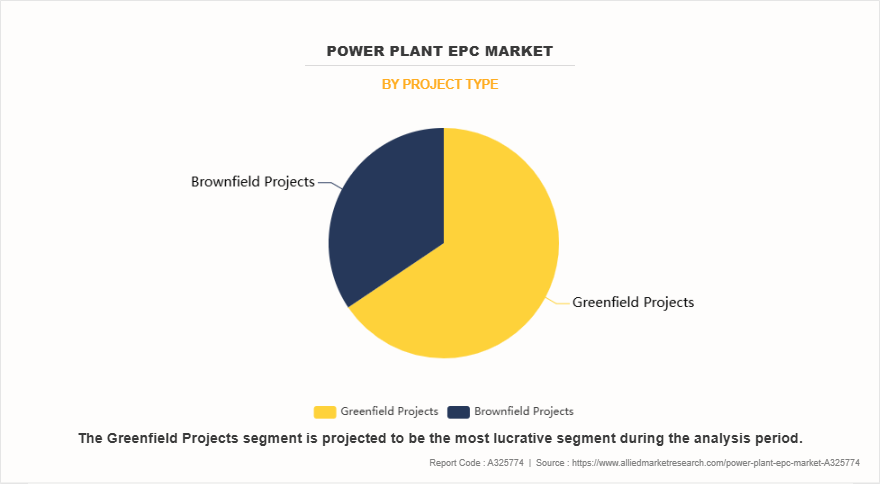

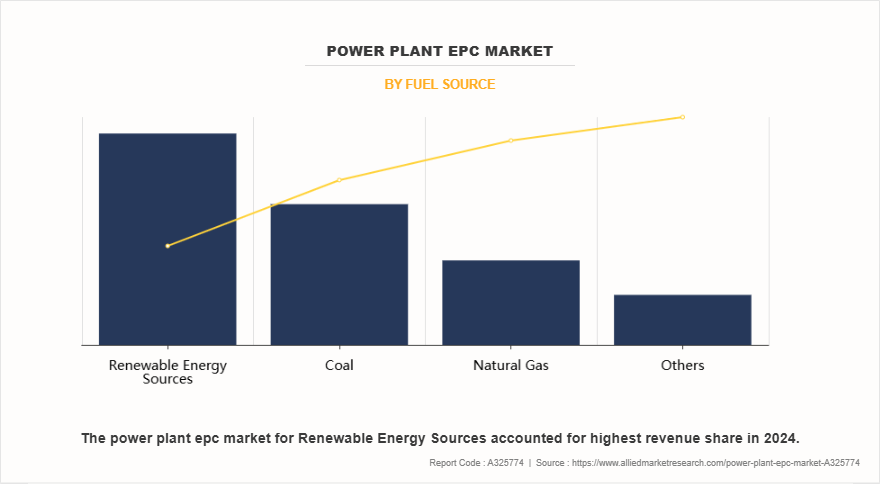

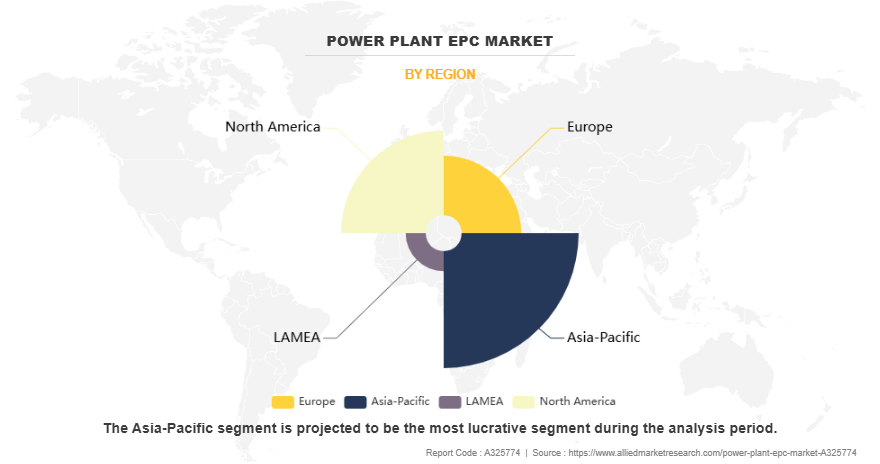

The power plant EPC market is segmented into power plant type, project type, fuel source, and region. On the basis of power plant type, the market is divided into thermal power plants, renewable power plants, nuclear power plants, and others. On the basis of project type, the market is classified into greenfield projects, and brownfield projects. On the basis of fuel source, the market is categorized into coal, natural gas, renewable energy sources, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of power plant type, the renewable power plants segment dominated the power plant EPC market share in 2024. In India, SJVN awarded Tata Power Solar the EPC for a 1 GW solar project in Bikaner, Rajasthan, at an estimated 631.3 million (₹54.91 billion), billed at the time as India’s biggest solar EPC contract; execution was slated within 24 months from the EPC issue date. Moreover, in Poland’s flagship offshore wind program, PGE and Orsted let an EPC contract for four 375-MW offshore substations on the Baltica 2 wind farm to a Semco Maritime–PTSC M&C consortium (with ISC Consulting Engineers and Hyundai Electric as key subcontractors). The substations package is a core balance-of-plant EPC scope for the 1.5-GW project.

On the basis of project type, the greenfield projects segment dominated the power plant EPC market in 2024. In greenfield power plant projects, EPC contractors contribute significantly to overcoming challenges such as site preparation, logistics management, and the integration of new technology. Since the projects are located in undeveloped areas, contractors must handle land clearing, access road construction, and utility connections alongside the core plant setup. In Greece, Mytilineos advanced the 826 MW Agios Nikolaos CCGT as a newbuild anchor for the country’s transition away from lignite; financing documents and project brief describe a greenfield plant at the Agios Nikolaos Energy Complex. In Mozambique, Globeleq’s 450 MW Central Térmica de Temane (gas[1]to-power) broke ground, kicking off full EPC execution of a new plant to deliver power under a 25-year tolling agreement with EDM.

On the basis of fuel source, the renewable energy sources segment dominated the power plant EPC market in 2024. In August 2023, Moss Landing emerged as one of the world’s largest battery storage facilities through staged EPC installations and a series of BESS subprojects led by utilities and independent developers. Major partners, including PG&E and Tesla, commissioned significant storage blocks such as a 182.5 MW / 730 MWh system.

Based on region, Asia-Pacific was the highest revenue contributor in the power plant EPC market. China remains the single largest market for large-scale power-plant EPC work. Traditional EPC activity for coal plants continues (including domestically and in some overseas projects completed earlier), yet new-build momentum is increasingly towards large wind, solar and supportive grid investments; policymakers and developers are also expanding battery energy storage to firm intermittent renewables. In February 2025, China witnessed a surge in coal-power proposals and continued large utility-scale solar and CSP builds. New and revived coal proposals peaked in 2022–2023 before easing in 2024, while massive solar rollouts (including plans for very large projects on the Tibetan Plateau) and growing CSP activity marked the renewables side EPC work ranged from large PV farms and CSP plants to grid and transmission upgrades to absorb western-region generation.

Key Market Players

Power plant EPC key companies include such as Bechtel Corporation, Siemens Energy, General Electric Company, LARSEN & TOUBRO LIMITED, Tata Projects Limited, Hyundai Engineering & Construction Co., Ltd, MITSUBISHI HEAVY INDUSTRIES, LTD, Valmet, Fluor Corporation, Technip Energies N.V., and others.

Recent Key Developments in Power Plant EPC Market

In August 2022, Mmadinare Solar Power Station located in Botswana by Scatec secured authorization to proceed with the first 60 MW phase of the planned 120 MW solar facility in Mmadinare. The project marked a milestone in Botswana’s renewable energy roadmap, aimed at reducing reliance on imported electricity. Scatec was selected as the EPC contractor, responsible for engineering, procurement, and construction of the plant.

In December 2024, Saudi Power Procurement Company plans to award EPC contracts for three greenfield thermal plants totaling 7.2 GW. SEPco 3 (China) and Doosan Enerbility (South Korea) to handle EPC for PP12 (1.8 GW); Acwa Power to develop Marjan and Hajr projects.

In January 2025, Essar Energy Transition finalized an EPC agreement with ENKA to develop a 350 MW low-carbon hydrogen production facility (HPP1) at Ellesmere Port. The project, backed by UK government support, represents one of the country’s largest hydrogen initiatives. It is designed to accelerate the shift towards cleaner fuels, reduce industrial emissions, and strengthen the UK’s net-zero strategy.

In May 2025, the Atomic Energy Regulatory Board (AERB) granted siting consent for the proposed Mahi Banswara nuclear power project in Rajasthan, paving the way for its construction. The project will comprise four units of 700 MW each, based on the indigenous IPHWR-700 reactor design.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power plant epc market analysis from 2024 to 2034 to identify the prevailing power plant epc market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the power plant epc market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global power plant epc market trends, key players, market segments, application areas, and market growth strategies.

Power Plant EPC Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 179.2 billion |

| Growth Rate | CAGR of 3.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 334 |

| By Power Plant Type |

|

| By Project Type |

|

| By Fuel Source |

|

| By Region |

|

| Key Market Players | Tata Projects Limited, MITSUBISHI HEAVY INDUSTRIES, LTD., Larsen & Toubro Limited, Fluor Corporation, Valmet Corporation, Technip Energies N.V., General Electric Company, Siemens Energy, Bechtel Corporation, Hyundai Engineering & Construction Co., Ltd |

Analyst Review

According to the opinions of various CXOs of leading companies, increase in demand for reliable power supply drive the growth of the power plant EPC market. Industrial expansion is major contributor to rising electricity demand. Sectors such as manufacturing, data centers, mining, oil & gas, and heavy engineering consume massive amounts of energy for operations. As developing economies like India, China, and parts of Southeast Asia continue to industrialize, the need for additional and more reliable power generation becomes urgent. This translates into new opportunities for EPC firms to design and construct thermal, renewable, and hybrid power plants tailored to industrial zones. In November 2023, Vox Power announced the introduction of the VCCR300 Conduction Cooled Power Series, a robust, rugged, and highly reliable DC/DC power supply capable of silently delivering 300 Watts of power. The VCCR300 Series provides a wider DC input voltage range, including the standard 48V, 72V, 96V, and 110V railway battery requirements as outlined in EN50155.

However, fluctuating costs of steel, cement, and equipment project budgets is expected to restrain the growth of power plant EPC market. Power plants, whether thermal, hydro, or renewable-based, require substantial quantities of steel, cement, and specialized equipment such as turbines, boilers, and transformers. These materials often account for a large portion of the total project cost, and any price fluctuation can significantly alter financial planning. For EPC contractors, such unpredictability creates difficulties in cost estimation and bidding, as contracts are usually signed months or even years before actual procurement takes place. Steel prices, for instance, are highly sensitive to global supply-demand dynamics, trade tariffs, and raw ore costs. A sudden spike in steel prices can inflate structural and equipment costs for power plants, while falling prices may squeeze margins if EPC firms had already committed to higher procurement rates.

The major prominent players operating in the power plant EPC market include Bechtel Corporation, Siemens Energy, General Electric Company, LARSEN & TOUBRO LIMITED, Tata Projects Limited, Hyundai Engineering & Construction Co., Ltd, MITSUBISHI HEAVY INDUSTRIES, LTD, Valmet, Fluor Corporation, Technip Energies N.V., and others.

The global power plant EPC market was valued at $128.2 billion in 2024, and is projected to reach $179.2 billion by 2034, growing at a CAGR of 3.5% from 2025 to 2034.

Asia-Pacific is the largest region for power plant EPC market.

Greenfield projects is the leading project type of the power plant EPC market.

Surge in demand for renewable energy are the upcoming trends of power plant EPC market.

Loading Table Of Content...

Loading Research Methodology...