The global power-to-gas market size was valued at $30.3 million in 2021, and is power-to-gas industry is projected to reach $84.4 million by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Power-to-gas technology adopts the electrolysis process to produce hydrogen gas from renewable or excess electricity that is available. The first step in the process is to produce synthetic hydrogen (H2) from water and renewable power via electrolysis. This hydrogen can be used directly as a final energy carrier or converted to methane, synthesis gas, electricity, liquid fuels, or chemicals during the second stage process. Under the second stage process, hydrogen reacts with carbon dioxide to produce methane.

Power to gas system is an effective way of integrating renewables sources with power generation sources. The aim of this technology is to store energy for long term by converting it to other easily storable energy carriers, and at the same time reduces the load on the electricity grid by controlling operations. The converted hydrogen and methane can also be converted back into electricity, as it can be used as backup power source.

The increase in demand for renewable hydrogen, which has the potential to decarbonize multiple sectors is expected to drive the market growth. The driver for the growth of the market is the cost reduction of the electrolyzer technology. According to the International Energy Agency, the electrolyzer stacks are responsible for 50% and 60% of the capital expenditure, and remaining factors like power electronics, gas-conditioning, and plant components are accounting for the remainder of the expenditure, which is a factor hampering the power-to-gas market growth.

Air quality regulations are increasing the need for hydrogen as a clean fuel for clean transport emissions across the globe. Energy storage provision has started to become an obligatory requirement in areas, including California. The grid balancing and rapid response demand-side services are offering high proportion of integration of renewable energy supply. Also, auto OEMs are rolling out Fuel Cell Electric Vehicles (FCEVs), which require high purity hydrogen fuel. The Global Hydrogen Refuelling Station infrastructure programmes are underway with remarkable deployment plans. In addition, the price volatility of fossil fuels is driving an industrial substitution to more sustainable chemical processes, which is the major factor augmenting the growth of the power to gas market.

The presence of the latest development in the hydrogen production technology, and hydrogen engine technology is expected to have a positive impact on the growth of the market. For instance, The Hydrogen Council, a CEO-led Initiative of 92 global companies to develop the hydrogen economy, published report on January 19, 2021, which says that low carbon hydrogen supply at scale is economically and environmentally feasible. ThyssenKrupp AG is currently setting up a new facility in Varennes, Qubec, Canada, with an aim to generate 11,100 metric tons of green hydrogen per year. On January 13, 2021, Linde PLC Company announced that it plans to build the worlds largest electrolyzer plant by the third quarter of 2022. According to the EU member states, the target for complete hydrogen mobility is expected to be completed by 2030. Majority of hydrogen required is anticipated to be supplied by power-to-gas companies.

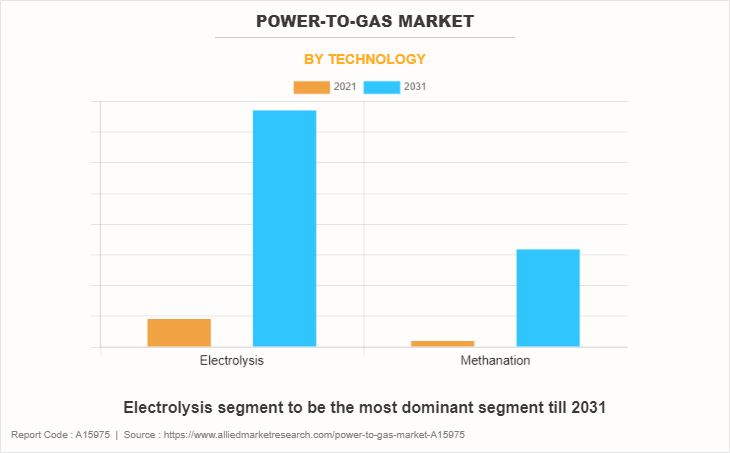

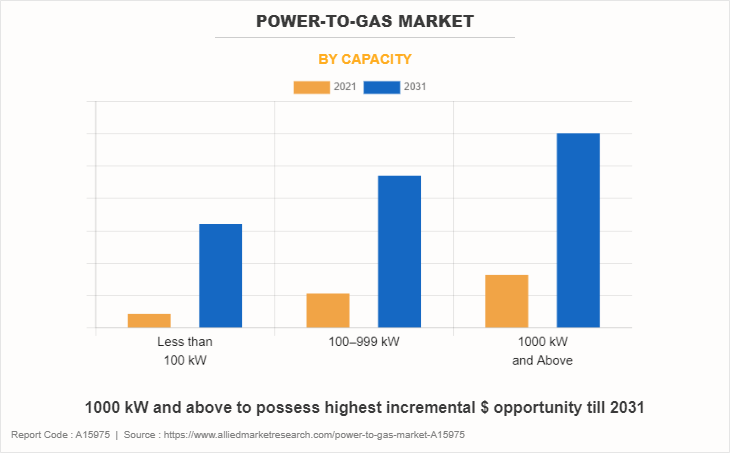

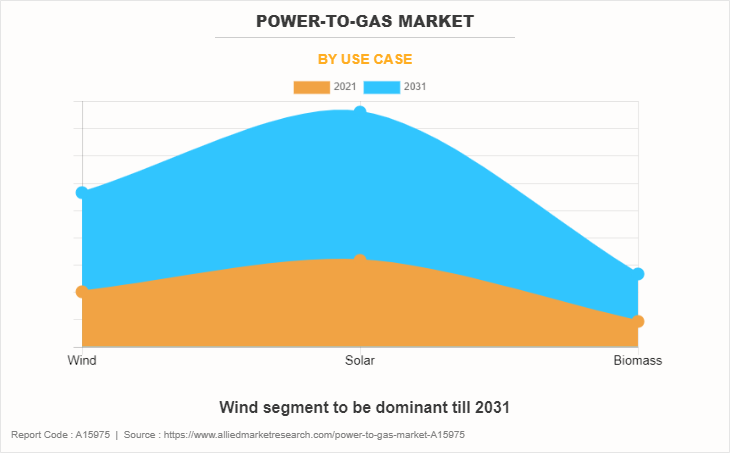

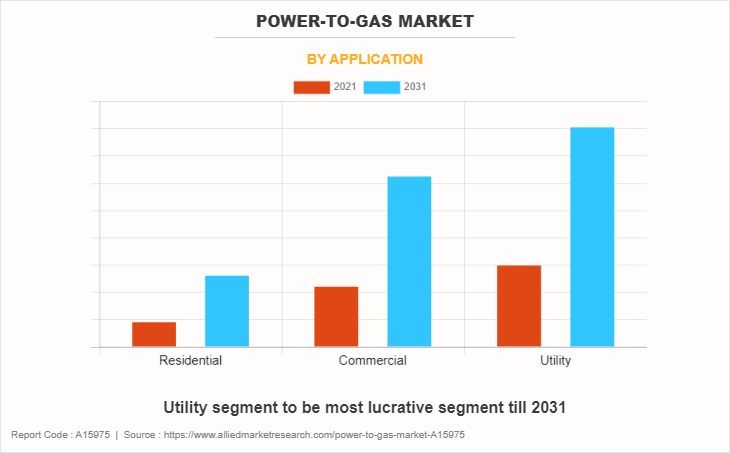

On the basis of technology, the market is segmented into electrolysis and methanation. On the basis of capacity, the market is bifurcated into less than 100KW, 100-999KW, and 1000KW and above. On the basis of use case, the market is segmented into wind, solar, and biomass. On the basis of application, the market is segmented into residential, commercial, and utility. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Europe accounts for the largest power-to-gas market share, followed by North America and Asia-Pacific.

The major companies profiled in this report include, Hydrogenics, ITM Power, McPhy Energy, Siemens AG, MAN Energy Solutions, Nel Hydrogen, ThyssenKrupp, Electrochaea, Exytron, GreenHydrogen, Hitachi Zosen Inova Etogas, Fuelcell Energy, Avacon, Carbotech, and Aquahydrex. Rapid development of industrialization and modernization and exhaustion of fossil fuel resources have led to the innovation of alternative fuels such as hydrogen. The increase in the demand for hydrogen in various sectors has fuelled the growth of power to gas market. Additional growth strategies such as expansion of production capacities, acquisition, partnership, and research & innovation in the solar energy application have led to attain key developments in the global power to gas market trends.

The Europe market is shared between various countries such as France, Germany, Italy, Spain, UK, and others. Germany, Italy, and UK are countries in Europe that use the most solar energy. The presence of stringent regulations regarding the reduction of carbon footprint across the country and rapid development in recent years, which lead to surpassing the expectations in terms of steep cost reduction, user-friendliness, and its commercial applications in variety of sector have fuelled manufacturers to expand their manufacturing capabilities. Intense R&D activities and the pressure of people awareness regarding the prospects of hydrogen fuel cell on environment have a positive impact on the market growth.

European Union and various national associations with corporate members are helping policy makers to enable power to gas technology to deliver its immense potential to meet the EU 2030 targets, while providing maximum benefit for Europe climate, and significantly contribute to the European Green Deal. Technological advances and lower costs of capital have propelled renewables into the mainstream energy market. Furthermore, the boom of green investments in Europe and the ambitious policies are expected to dominate the global renewable energy in terms of capacity, technology development, and energy demand. The above mentioned initiatives are major factors expected to drive the power-to-gas market forecast growth in this region during the forecast period.

The electrolysis segment dominates the global power to gas market. Electrolysis is a process where hydrogen is produced from the splitting of water molecules and does not involve fossil fuels. Hydrogen generated from this kind of process is generally known as green hydrogen but this method is generally more expensive than the fossil-fuel production method.

The increase in awareness among the people regarding the greenhouse gases and increasing demand for the energy and fossil fuels have driven the growth of the electrolysis process in the power to gas market. Around 4% of global hydrogen production came from electrolysis in 2020, which was around 8GW. The rapid development in various technologies and electrical efficiency of these hydrogen generators are important factors for the growth of the hydrogen production technology. Increase in investment among the developing countries across the globe towards the production of green hydrogen to reach net zero carbon targets by 2050 have driven the market.

The 1000KW and above segment dominates the global power to gas market. Above 1000KW capacity of power to gas technology is used in large scale utilities or industries, which are heavy consumers of electricity. The need for power for manufacturing various chemical industries, automotive industries, and others have led to the search for efficient alternative to provide clean energy source for sustainability.

The presence of various advantages of utilization of the renewable energy sources to power various industries and in the presence of low demand for power, the excess energy generated from the renewable power plants are converted to valuable fuels through power to gas technology for future utilization. Such factors are expected to drive the growth of the market.

The solar segment dominates the global power to gas market. The rapid industrialization and decrease in fossil fuel resources across the globe have led to demand for alternative fuel source such as hydrogen. Increase in the utilization hydrogen in green energy vehicle, such as hydrogen car is also a factor driving the growth of the market. Rise in demand and need for efficient energy storage technology has led to the demand for the power to gas technology products in various power consuming industry.

The increase in the demand for power due to rapid industrialization and modernization has propelled the application of solar energy sector. The application of solar power generation devices in large scale malls and other commercial buildings need highly efficient storage systems and low cost solar panels to generate power at its peak demand, which is a major reason for the growth of the solar energy industry. Hence, storing electricity during off peak period in remote areas or during seasonal variations is a major factor driving the utilization of solar in the power to gas market.

The utility segment dominates the global power to gas market. Large scale wind & solar farms generate huge amount of renewable energy. During the peak utilization time, energy generated from these renewable energy sources is directly fed to the power gird or is used by manufacturing companies and nearby residential complexes. Power to gas technology is used to save excess renewable energy in an efficient way, where electricity is used to power electrolyser and produce hydrogen, which can be used to produce various commercial gases such as methane.

The rapid industrialization and decrease in fossil fuel resources across the globe have led to demand for alternative fuel sources, such as hydrogen. Increase in utilization of hydrogen in green energy vehicle, such as hydrogen car is also a factor driving the growth of the market. The rise in demand and need for efficient energy storage technology has led to the demand for the power to gas products in various power consuming industries. The wide range of utilization of hydrogen in various industrial applications provide ample opportunities for the growth of the power to gas market.

COVID-19 analysis:

COVID-19 has severely impacted the global economy with devastating effects on global trade, which has simultaneously affected households, business, financial institution, industrial establishments, and infrastructure companies. The novel coronavirus has affected several economies and caused lockdown in many countries, which has limited the growth of the market. The COVID-19 pandemic has had a severe impact on the power to gas market. There is a significant drop in demand in the global gas market. Chemical production, transportation, and industrial production industries were hampered for around four to six months due to the COVID-19 pandemic. The current expansion plans of electrolysis and methanation have been delayed by minimum one year. In the long term, the pandemic may prove to be beneficial to the power to gas market. Global governments are expected to focus on green gas and reduction of harmful emissions into the environment.

After the global vaccination, governments of various countries have taken initiatives to increase the investment in the renewable energy related industries, especially solar and wind power systems. Increase in investment is mostly to improve the national energy security during the pandemic and other crisis. The presence of above mentioned activities and change in policies due to the outbreak of the COVID-19 pandemic have positive impact on the development of the market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power-to-gas market analysis from 2021 to 2031 to identify the prevailing power-to-gas market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the power-to-gas market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global power-to-gas market trends, key players, market segments, application areas, and market growth strategies.

Power-to-gas Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 84.4 million |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 286 |

| By Application |

|

| By Technology |

|

| By Capacity |

|

| By Use Case |

|

| By Region |

|

| Key Market Players | Exytron GmbH, Cummins Inc., Avacon AG, Electrochaea, Siemens, Green Hydrogen Systems, CarboTech, AquaHydrex, Hitachi Zosen Inova AG, Thyssenkrupp AG, ITM Power, Nel Hydrogen, FuelCell Energy Inc., MAN Energy Solutions, McPhy Energy |

Analyst Review

The global power-to-gas market is expected to witness increase in demand during the forecast period, due to rapidly growing awareness among people regarding the advantages of the green energy and high efficiency conversion of solar panel, which has led to the utilization of excess solar energy through power-to-gas technology.

Increase in demand for green hydrogen in the food & beverages, medical, chemical, petrochemicals, electronics, and glass industries have positive impact on the power-to-gas market. Rise in concern about carbon emissions, as well as need to decarbonize manufacturing, commercial, transportation, and power sectors have compelled countries to reduce their reliance on fossil fuel-based systems and increase investment to green alternatives. Furthermore, increase in the presence of excess power from the renewable energy source during the low demand for power has led to the application of power-to-gas technology to convert the excess energy into valuable fuels, which can be used in various industries and as a fuel in the transportation sector.

The rapidly increasing electricity demand, government policies toward use of green energy, and development of various eco-friendly hydrogen production technologies are some of the key factors expected to drive demand for the power-to-gas market during the forecast period. In addition, investments of government bodies and various policies to innovate various products based on hydrogen fuel cells as an energy source and to create synthetic fuels using hydrogen, and carbon as raw materials have also created opportunities for the growth of the power-to-gas market.

Regulations to promote hydrogen production technologies and increase in market share of renewable energy in power generation are the key factors boosting the Power-to-Gas Market growth

The market value of Power-to-Gas in 2031 is expected to be US$ 84.4 Million

Hydrogenics, ITM Power, McPhy Energy, Siemens AG, MAN Energy Solutions, Nel Hydrogen, ThyssenKrupp, Electrochaea, Exytron, GreenHydrogen, Hitachi Zosen Inova Etogas, Fuelcell Energy, Avacon, Carbotech, and Aquahydrex.

Utility based industry is projected to increase the demand for Power-to-Gas Market

The power to gas market is segmented on the basis of technology, capacity, use case, application, and region. On the basis of technology, the market is segmented into electrolysis and methanation. On the basis of capacity, the market is bifurcated into less than 100KW, 100-999KW, and 1000KW and above. On the basis of use case, the market is segmented into wind, solar, and biomass. On the basis of application, the market is segmented into residential, commercial, and utility. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Increase in utilization of hydrogen and CNG in transportation sector is the Main Driver of Power-to-Gas Market

After the global vaccination, governments of various countries have taken initiatives to increase the investment in the renewable energy related industries, especially solar and wind power systems. Increase in investment is mostly to improve the national energy security during the pandemic and other crisis. The presence of above mentioned activities and change in policies due to the outbreak of the COVID-19 pandemic have positive impact on the development of the market during the forecast period.

Loading Table Of Content...

Loading Research Methodology...