Powered Surgical Instrument Market Overview:

Powered surgical instruments are precisely designed technological instruments that are used during surgical procedures. These instruments provide greater efficiency and reduce the time required for a surgery. These instruments provide precision drilling, cutting, sculpting, shaving, ultrasonic cell disruption, and other practices used in orthopedic surgery, neurosurgery, oral, plastic reconstructive, and other surgical procedures. The global powered surgical instrument market size was valued at $1,943 million in 2017 and is projected to reach $2,731 million by 2025, growing at a CAGR of 4.2% from 2018 to 2025.

The growth of the global powered surgical instrument market is attributed to increasing volume of surgical procedures and rising demand for non-invasive as well as minimally invasive surgeries. Other factors that drive the powered surgical instrument market include increase in geriatric population and rise in prevalence of chronic diseases. However, factors such as insufficient quality assurance and constant pressure on healthcare providers to reduce costs are expected to restrain the growth of the market. On the contrary, growing medical tourism in developing countries is expected to provide lucrative opportunities for the growth of the global powered surgical instrument market.

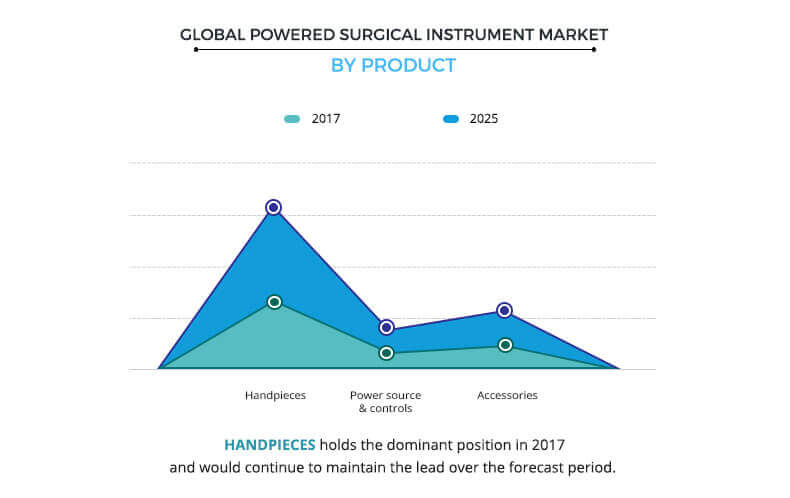

Product segment review

Based on product, the market is segmented into handpieces, power source & controls, and accessories. Handpieces segment is further divided into drill systems, reamer systems, saw systems, stapler, shavers, and others. Power source & controls segment is further divided into batteries, electric consoles, and pneumatic regulators. Accessories segment is further bifurcated into surgical accessories and electrical accessories. The handpieces segment generated the highest revenue in 2017 and is anticipated to maintain its dominance throughout the forecast period. This is attributed to the rising demand for minimally invasive surgery and adoption of technologically advanced surgical instruments. Thus, the demand for handpieces is increasing due to features such as high power, high efficiency, and lightweight, which in turn fuels the growth of the global powered surgical instrument market.

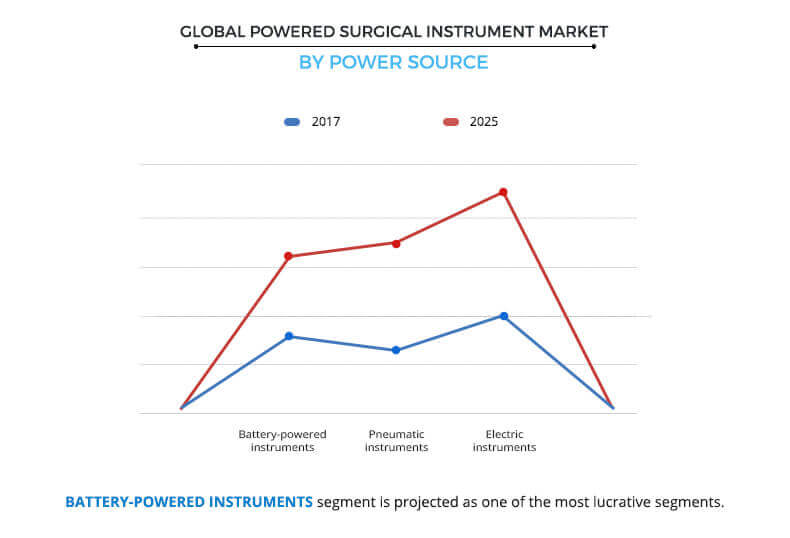

Power source segment review

Based on power source, the market is categorized into battery-powered instruments, pneumatic instruments, and electric instruments. The battery-powered instruments segment is projected to exhibit the highest growth during the forecast period. This is attributed to the fact that battery-powered instruments are cordless, lightweight, efficient, and rechargeable and provide comfort during the surgery, hence the demand of battery-powered instruments is increasing.

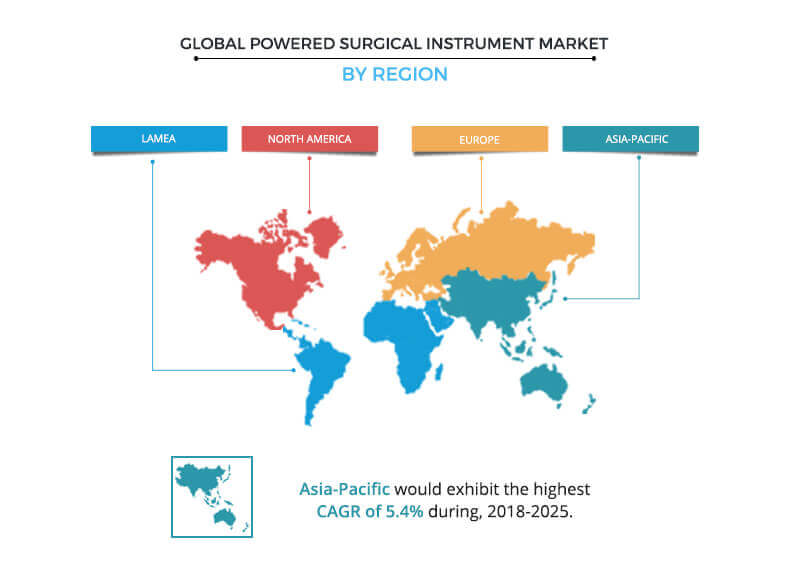

Region segment review

Region wise, the global powered surgical instrument market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific would exhibit the highest CAGR during the forecast period. This is attributed to increase in aging population, high prevalence of chronic diseases, and rise in demand of minimally invasive surgery.

The report provides a comprehensive analysis of the key players operating in the global powered surgical instrument market namely, AlloTech Co. Ltd., Conmed Corporation.Depuy Synthes (Johnson & Johnson), Medtronic plc, Stryker Corporation, Zimmer Biomet, adeor Medical AG, Smith & Nephew plc, B. Braun Melsungen AG, and MicroAire Surgical Instruments, LLC.

The other players in the value chain include De Soutter Medical Ltd., GEISTER Medizintechnik GmbH, Peter Brasseler Holdings, LLC, Ruijin Medical Instrument & Device Co., Ltd., Intrauma S.p.A., and others.

Key Benefits for Powered Surgical Instrument Market:

This report presents a detailed quantitative analysis of the current market trends and future estimations from 2018 to 2025, which assists in identifying the lucrative opportunities in the market.

An in-depth analysis of various regions is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

A comprehensive analysis of the factors that drive and restrain the growth of the global powered surgical instrument market is provided.

An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

Powered Surgical Instrument Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Power Source |

|

| By Application |

|

| By Region |

|

| Key Market Players | CONMED Corporation, MicroAire Surgical Instruments, LLC., Medtronic Plc. (Covidien Ltd.), Smith & Nephew Plc., adeor Medical AG, Johnson & Johnson (DePuy Synthes), B. Braun Melsungen AG, AlloTech Co., Ltd., Zimmer Biomet Holdings, Inc., Stryker Corporation |

Analyst Review

Powered surgical instruments are technologically advanced surgical instruments that assist in various surgeries, such as orthopedic surgery, neurosurgery, ENT surgery, cardiovascular surgery, oral & maxillofacial surgery, and others. These instruments are high-powered, lightweight, efficient, and portable, which provide comfort to the surgeons during the surgery.

Rising healthcare expenditure, increasing prevalence of chronic diseases globally, and growing aging population are expected to boost the growth of the global powered surgical instrument market. However, insufficient quality assurance and lack of proper sterilization practices are expected to hinder the growth of the global market.

The electric instruments segment presently dominates the market due to lower prices and higher efficiency of these instruments, which are used in various surgeries such as orthopedic surgery, ENT surgery, neurosurgery, plastic surgery, cardiothoracic surgery, and others. However, the battery-powered instruments segment is expected to grow with the highest rate during the forecast period, due to the fact that these devices are cordless, rechargeable, and provide more comfort during the surgery.

North America accounted for the highest revenue share to the global powered surgical instrument market in 2017, and is expected to remain dominant throughout the forecast period, due to well-established healthcare infrastructure, initiation of R&D activities regarding development of technologically advanced surgical devices, and increase in aging population. However, Asia-Pacific is expected to grow at the highest CAGR during the forecast period due to rise in medical tourism and high prevalence of chronic diseases in this region. In addition, Asia-Pacific and LAMEA are expected to provide lucrative opportunities to the key players during the forecast period, due to high aging population and rise in demand for minimally invasive surgeries.

Loading Table Of Content...