Premise Cable Market Summary, 2032

The global premise cable market was valued at $7.3 billion in 2022, and is projected to reach $19.6 billion by 2032, growing at a CAGR of 10.5% from 2023 to 2032. Premise Cables are the wiring that is used to connect LAN and phone equipment within a building. It is made up of vertical and horizontal cable that runs from a central location such as a server room throughout the building to the individual desktops.

There are various advantages to having a premise cable such as streamlined communication infrastructure, reliable performance, and future scalability. Its standardized design ensures compatibility across various devices and systems, reducing complexity during installation and maintenance. The organized cabling system minimizes signal interference, leading to dependable data transmission and reduced downtime.

The market is segmented into Type, Cable Type and Application.

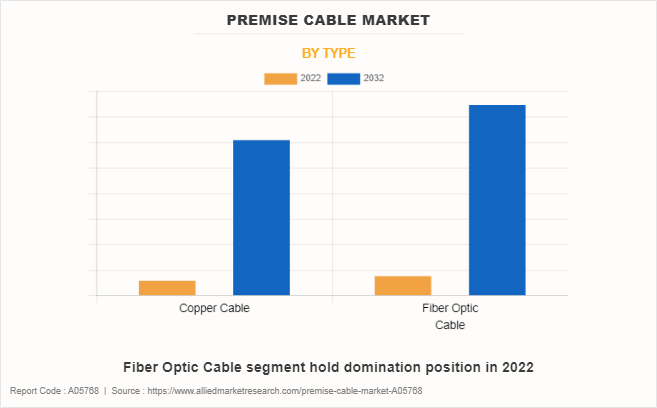

On the basis of type, the market is bifurcated into copper cable, and fiber optic cable. In 2022, fiber optic cable segment acquired the largest share and is expected to grow at a significant CAGR from 2023 to 2032.

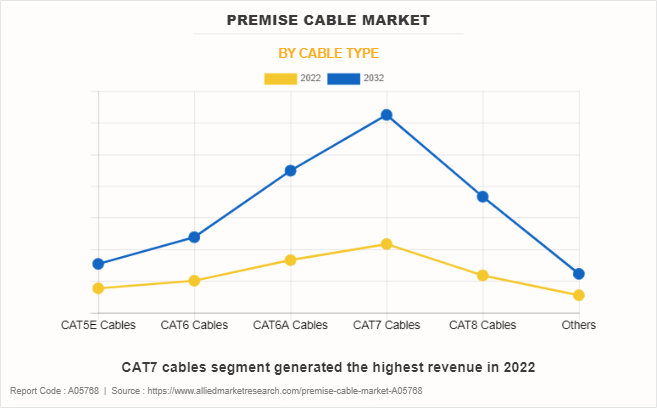

On the basis of cable type, the market is divided into CAT5E Cables, CAT6 Cables, CAT6A Cables, CAT7 Cables, CAT8 Cables, and Others. In 2022, CAT7 segment dominate the market in terms of revenue.

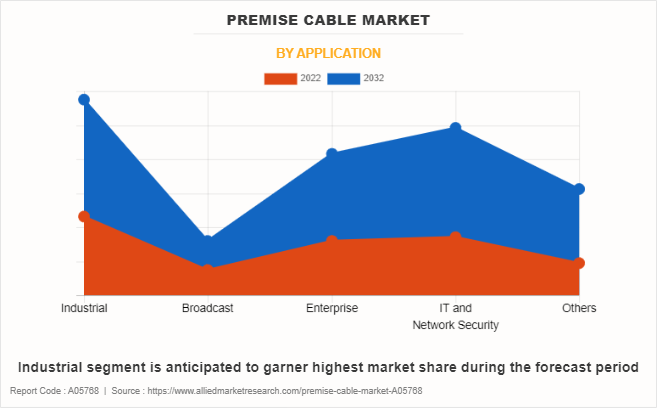

On the basis application, the market is segmented into industrial, broadcast, enterprise, IT and network security, and others. In 2022, Industrial segment dominate the market in terms of revenue.

Region-wise, the premise cable industry are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). In 2022, Asia-Pacific Premise cable industry is expected to grow at the highest CAGR during the forecast period.

One of the important drivers of the market is the rise in demand from the buildings and construction industry as modern buildings become increasingly reliant on advanced communication technologies and smart infrastructure, the need for efficient and organized connectivity solutions becomes paramount. Premise cable addresses this demand by providing a standardized and versatile network framework that supports a wide array of communication services, including data, voice, and video.

For instance, Siemon launched Siemon ConvergeIT solution is designed to provide a structured cabling framework that accommodates various services, including ethernet networking, voice, video, and building management systems. As a result, demand for premise cables is projected to increase as the need for data center, more intuitive consumer devices such as smart TVs, security systems, smart appliances, and voice assistants across end user verticals are anticipated to grow throughout the forecast period, which in turn is projected to boost the market growth.

Furthermore, the surge in demand for broadband services and connections across the globe is driving the growth of the market. This surge in demand is driven by the increasing reliance of individuals, businesses, and institutions on seamless and fast Internet access for diverse applications.

Premise cables play an important role in facilitating these broadband services by serving as the physical medium through which data is transmitted within buildings and facilities. The rise in the need for activities such as streaming, online collaboration, remote work, cloud services, e-commerce, and digital entertainment further emphasizes the significance of premise cables in ensuring effective and uninterrupted connectivity.

On the other hand, high costs associated with research and development proficiencies hinder the growth of the market. The investment required for advancing premise cable technologies through research and development can be substantial, encompassing activities such as developing new cable materials, enhancing transmission capabilities, and refining overall performance standards.

Moreover, the expense of installing and maintaining premise cable systems in buildings, which involves skilled labor, specialized equipment, and adherence to structured cabling standards, can further elevate costs. These high costs can be a roadblock, especially for small businesses and organizations with limited budgets, and hinder the adoption and use of premise cable technology.

In addition, the increase in demand for high-speed connectivity systems presents a compelling opportunity for the market. The increase in demand for data-intensive applications such as streaming, cloud computing, and IoT, presents a significant opportunity for the premise cable market. Premise cables serve as the essential backbone for enabling fast and reliable data transmission within buildings and facilities, making them integral to meeting the growing need for seamless communication.

Segment Overview

The global premise cable market is segmented on the basis of type, application, cable type, and region. By type, the market is bifurcated into copper cable and fiber optic cable. By application, the market is segmented into industrial, broadcast, enterprise, IT and network security, and others. By cable type, the market is divided into CAT5E Cables, CAT6 Cables, CAT6A Cables, CAT7 Cables, CAT8 Cables, and others.

The regional segmentation of the market includes North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific premise cable market share is expected to grow at the highest CAGR during the forecast period, owing to the increased investments in IT and network industries, majorly in central and southern regions.

Top Impacting Factors

The premise cable market size is anticipated to expand significantly during the forecast period owing to the surge in demand for broadband services and connections across the globe. In addition, the rise in demand from buildings and construction industry fuels the market growth.

Moreover, the premise cable market is anticipated to benefit owing to the increase in demand for high-speed connectivity systems and is expected to present enormous opportunities for the market over the forecast period. On the other hand, the high costs associated with the research and development proficiencies are anticipated to restrain the premise cable market growth during the forecast period.

Competitive Analysis

The key players profiled in the report include Anixter Inc., Belden Inc, HellermannTyton, Hitachi, Ltd., Nexans S.A., Prysmian group, SAB Brockskes GmbH & Co. KG, Schneider Electric, Siemens, and Siemon. These key players have adopted strategies, such as product portfolio investments, expansion, and product launch to enhance their position in the premise cable market.

Historical Data & Information

The premise cable market demand is highly competitive, owing to the strong presence of existing vendors. Vendors in the premise cable market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to market demands. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

such as Anixter Inc., Belden Inc, HellermannTyton, Hitachi, Ltd., Nexans S.A., Prysmian group, SAB Brockskes GmbH & Co. KG, Schneider Electric, Siemens, and Siemon are the top companies holding a prime share in the global market. Top market players have adopted various strategies, such as expansion and investment to expand their foothold in the premise cable market forecast.

In January 2022, The UK manufacturer HellermannTyton conducted phase-II of a major expansion of its factory at the International Medical and Technology Park in Plymouth. The multi-million-pound investment will see the site double in size to support market growth and increase its capacity, with HellermannTyton anticipating the project will generate many new job opportunities on completion.

In February 2022, The Siemon Company launched its new ultra-low-loss single mode MTP cabling system that exhibits a considerable margin over IEEE 400 Gigabit channel limits as proven through third-party testing.

In October 2021, Prysmian Group extended its partnership with Openreach, the UK's largest digital network business, with a new three-year contract. Prysmian Group will provide innovation and expertise to support Openreach's updated Full Fibre broadband build plan which will be fundamental to the UK Government achieving its target of delivering 'gigabit-capable broadband' to 85% of the UK by 2025.

In August 2021, Prysmian Group, world leader in the energy and telecom cable systems industry, announced today it is investing $85 million in major equipment and technology upgrades at plants in North America, enabling the company to meet growing production needs for telecom customers.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the premise cable market analysis from 2022 to 2032 to identify the prevailing premise cable market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the premise cable market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global premise cable market trends, key players, market segments, application areas, and premise cable market outlook and market growth strategies.

Premise Cable Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 19.6 billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Cable Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | anixter inc., Siemens, SAB Bröckskes GmbH & Co. KG, HellermannTyton, Siemon, Hitachi, Ltd., Belden Inc., Nexans S.A., Prysmian Group, Schneider Electric |

Analyst Review

The global premise cable market holds high potential for the semiconductor industry. The business scenario witnesses an increase in the demand for Premise cable devices, particularly in developing regions, such as China, Japan, India, the U.S., the UK, Germany, and others. Companies in this industry have been adopting various innovative techniques to provide customers with advanced and innovative product offerings.?

The rise in demand from the buildings and construction industry, and surge in demand for broadband services and connections across the globe drive the growth of premise cable market. However, high costs associated with research and development proficiencies impedes market growth. Further, an increase in demand for high-speed connectivity systems is expected to create lucrative opportunities for the key players operating in the market.??

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by the market players. For instance, in February 2022, the Siemon Company, a leading global network infrastructure specialist, announced that its new ultra-low-loss single mode MTP cabling system exhibits considerable margin over IEEE 400 Gigabit channel limits as proven through third-party testing.

The Premise Cable Industry is driven by the expansion of smart building systems and IoT.

Anixter Inc., Belden Inc, HellermannTyton, Hitachi, Ltd., Nexans S.A., Prysmian group, SAB Brockskes GmbH & Co. KG, Schneider Electric, Siemens, and Siemon are the top companies holding a prime share in the global premise cable market.

North America is the largest regional market for premise cable

The premise cable market was valued at $7.3 billion in 2022 and is estimated to reach $19.6 billion by 2032.

The premise cable market to grow at a CAGR of 10.5% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...