Proposal Management Software Market Insights, 2031

The global proposal management software market size was valued at USD 1.8 billion in 2021, and is projected to reach USD 7 billion by 2031, growing at a CAGR of 14.8% from 2022 to 2031.

Integration with existing tools and customization is the key is boosting the growth of the proposal management software market growth. In addition, rise of cloud-based proposal solutions is positively impacts growth of the proposal management software market. However, lack of privacy and security is hampering the proposal management solution market growth. On the contrary, adoption of advanced and effective proposal tools is expected to offer remunerative opportunities for expansion during the proposal management software market forecast.

Users of proposal management software have the flexibility to customize their submissions, which is beneficial for promoting an enterprise's brand to prospective customers across the globe. This software makes it simple for multiple users to collaborate on the same document. In addition, using this software is simple for team members to collaborate on a single document while working in different time zones or countries. Software for managing proposals makes it simple for users to automate their hectic work and save time and money. Software functions as user's personal assistant.

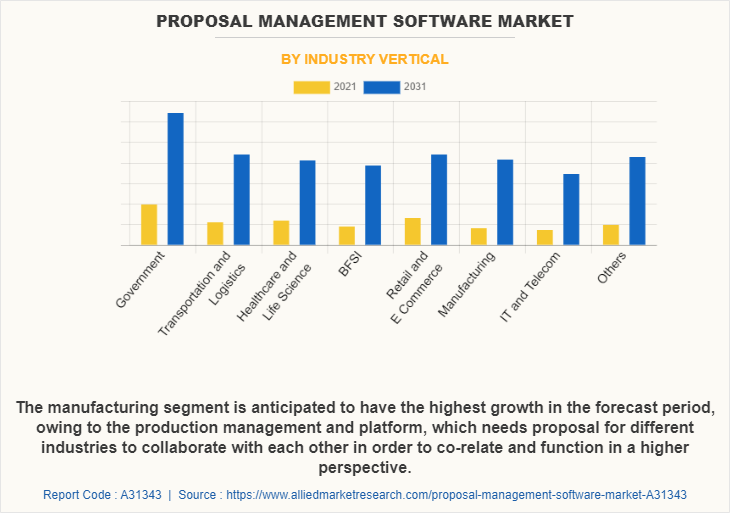

The proposal management software market is segmented on the basis of component, deployment model, enterprise size, industry vertical, and region. By component, it is segmented into software and services. The service segment is further categorized into professional service and managed service. The professional service segment is further categorized into training & education, integration & deployment, and support & maintenance, and consulting. By deployment model, the market is categorized into on-premise and cloud. By enterprise size, the market is categorized into SMEs and large enterprises. By industry vertical, it is categorized into government, transportation & logistics, healthcare & life science, BFSI, retail & e-commerce, manufacturing, IT & telecom, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the Proposal Management Software Industry include Aarav Software, Bidsketch, Better Proposals, Deltek, Inc., GetAccept, Icertis, iQuoteXpress, Inc., Ignition, Microsoft Corporation, Nusii, Proposify, PandaDoc, RFPIO, Sofon, Tilkee, WeSuite, and Zbizlink. Furthermore, it highlights the strategies of the key players to improve the market share and sustain competition.

On the basis of industry vertical, the government segment dominated the proposal management software market share in 2021, and is expected to maintain its dominance in the upcoming years. Organizations save literally thousands of hours of time eliminating the mundane and allowing teams to focus on capturing, qualifying, and creating high-quality proposal responses with basic SharePoint configurations, simple plug-ins and ‘me-too’ so called ‘off-the-shelf’ software tools. Octant’s proposal management software platform works with and like the world’s leading business solutions, allowing users to work within the applications they’re most familiar with AND within a role-tailored environment reducing training, driving user adoption, and speeding processes for fast and ongoing return on investment.

Depending on the region, North America dominated the Proposal Management Software Industry in 2021, as North America is anticipated to account for the largest share of the proposal management software market during the forecast period, owing to presence of a substantial industrial base in the U.S., government initiatives to promote innovation, and large purchasing power. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to growing economies such as India and China and cloud native countries like Japan.

Top Impacting Factors

Integration with existing tools:

An excellent proposal solution should allow to share insights with pre-existing programs. This enables seamless data sharing and collaboration among employees. This functionality enables to directly relay client information across two platforms so that it can add value to proposal easily. In addition, with this integration, one can monitor the growth of proposal without necessarily launching the proposal software. After the proposal is accepted, all one can do is sit and wait as payments roll in one after the other. If the payment methods are in place and verified, then this is a bonus for the investors.

However, one may find itself unable to receive payments as proposal software does not have a gateway linking it to the payment department. For this reason, the solution should allow the client to store and retrieve documents from the main database smoothly.

Customization is the key:

In 2021, suggestions are not only provided at a faster rate, but they are also more difficult to collect than in the past. Proposal and capture teams are getting more sophisticated, and proposal quality has improved dramatically as it grows and polish the operations. As a result, clients anticipate more knowledge and customization than they have in the past. Average number of persons that contribute to a proposal has climbed from 7 to 9 in the last year. The time spent on a proposal has grown by two hours on average (despite more widespread adoption of technology).

Companies are also throwing their hat in the ring more frequently, with an average of 2% more bids received each year. Winning a proposal will grow increasingly challenging as more firms enhance their proposal and capture teams. Companies must respond by enhancing internal procedures to focus on the proposals with the best chances of succeeding and continue to invest in high-quality proposal production. As a result of this increase, businesses will turn to automation and hiring more people. With the increased activity, the way teams have built up their proposal response procedures (together with the anticipated layoffs earlier this year) may become unsalable in the future.

Impact of COVID-19

The COVID-19 outbreak has high impact on the growth of proposal management software market, as increasing number of smartphone users, growing adoption of connected devices, and surging e-commerce sector provide lucrative opportunities for the growth of the proposal management software market. COVID has caused crises in social, economic, and energy areas and medical life globally throughout 2020. This crisis had many direct and indirect effects on all areas of society. In the meantime, the digital and artificial intelligence industry can be used as a professional assistant to manage and control the outbreak of the virus.

In post-pandemic circumstances, enterprises strived to minimize operational and running costs around all the business functions to recover the losses incurred in covid times. The COVID-19 has been affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. Shutdown of various plants and factories has affected the global supply chains and negatively impacted the manufacturing, delivery schedules, and sales of products in global market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the proposal management software market analysis from 2021 to 2031 to identify the prevailing proposal management software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the proposal management software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global proposal management software market trends, key players, market segments, application areas, and market growth strategies.

Proposal Management Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Deltek, Icertis, iQuoteXpress, wesuite, llc, Sofon, GetAccept, Nusii, Tilkee, Practice Ignition, Microsoft Corporation |

Analyst Review

In accordance with insights by CXOs of leading companies, demand for proposal management software for simulation purposes is driven by rapid rise in digitization and increase in use of cutting-edge technologies such as Industry 4.0, smart factories, robotics, and machine learning. These innovations raise likelihood that this technology will be adopted and used more widely throughout industries, including aerospace, automotive, and healthcare.

In the digital era where artificial intelligence and internet of things have taken over the world, there seems to be a comparatively less growth rate of the proposal management software market than digital marketing. Through various studies it has been observed that users of proposal management software have the flexibility to customize their submissions, which is beneficial for promoting an organization's brand to prospective customers all around the world. This software makes it simple for multiple users to collaborate on the same document. In addition, using this software, it is simple for team members to collaborate on a single document while working in different time zones or countries. Software for managing proposals makes it simple for users to automate their hectic work and save time and money. The software functions as the user's personal assistant.

Rise in adoption of cloud-based services is anticipated to play a key role in strengthening the global proposal management software market during the forecast period. In addition, growth in applications of Internet of Things (IoT) has resulted in the generation of a massive number of data.

The global proposal management software market size was valued at USD 1.8 billion in 2021, and is projected to reach USD 7 billion by 2031

The global proposal management software market is projected to grow at a compound annual growth rate of 14.8% from 2022 to 2031 to reach USD 7 billion by 2031.

The key players operating in the market include Aarav Software, Bidsketch, Better Proposals, Deltek, Inc., GetAccept, Icertis, iQuoteXpress, Inc., Ignition, Microsoft Corporation, Nusii, Proposify, PandaDoc, RFPIO, Sofon, Tilkee, WeSuite, and Zbizlink.

North America is anticipated to account for the largest share of the proposal management software market.

Furthermore, integration with existing tools and customization is the key is boosting the growth of the proposal management software market. In addition, the rise of cloud-based proposal solutions is positively impacting the growth of the proposal management software market.

Loading Table Of Content...