Proteomics Market Research, 2035

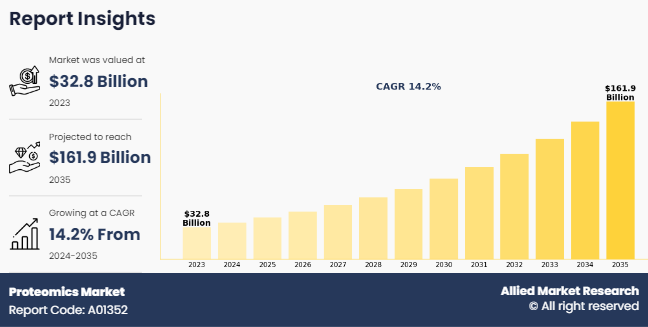

The global proteomics market size was valued at $32.8 billion in 2023, and is projected to reach $161.9 billion by 2035, growing at a CAGR of 14.2% from 2024 to 2035. The growth of the proteomics market is driven by a surge in prevalence of chronic diseases. According to the International Agency for Research on Cancer, it was estimated that there were 20 million new cancer cases in 2022. The growing prevalence of chronic diseases has fueled the demand for an effective diagnosis technique. In addition, the rising adoption of proteomics in the drug discovery and development has contributed significantly to the growth of the market.

Proteomics is a field of study within biology that focuses on the comprehensive analysis of proteins present in biological systems. Proteins are crucial molecules that perform a vast array of functions within cells, tissues, and organisms, acting as enzymes, structural components, signaling molecules, and much more. The goal of proteomics is to understand the structure, function, and interactions of proteins within a given biological system. This involves identifying all the proteins present (the proteome), characterizing their modifications, determining their abundance, and studying how they interact with other molecules such as DNA, RNA, and other proteins. The global proteomics market has witnessed significant growth over the past few years, owing to increased utility of proteomics in the diagnosis of diseases and identification of potential new drugs for the treatment of various diseases.

Key Takeaways

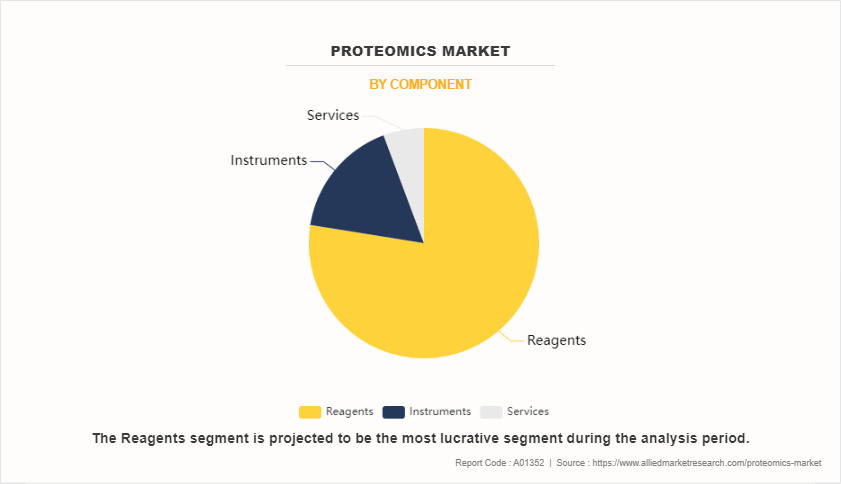

- On the basis of component, the reagent segment dominated the market in terms of revenue in 2023.

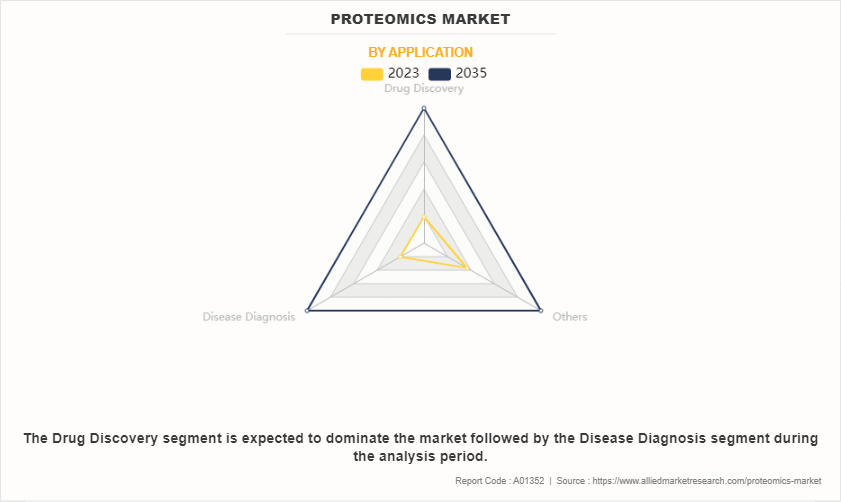

- On the basis of application, the drug discovery segment dominated the market in terms of revenue in 2023.

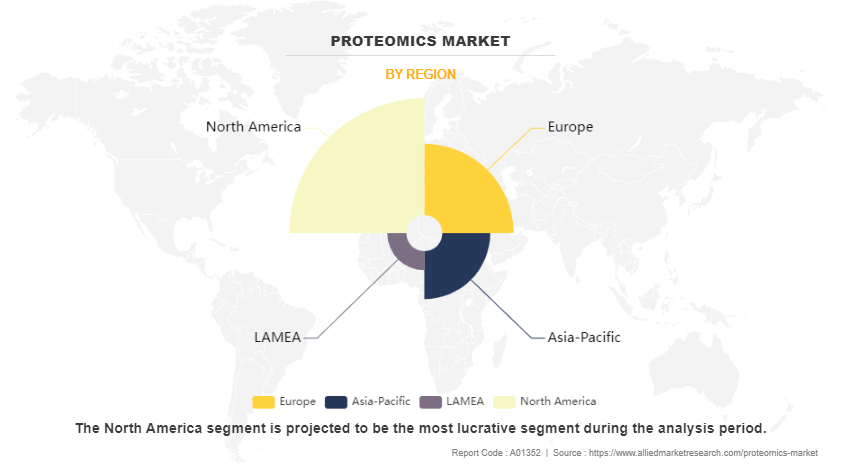

- On the basis of region, North America dominated the market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The proteomics market size is expected to grow significantly owing to rise in adoption of proteomics for drug discovery, significant rise in research and development activities in field of proteomics and increase in adoption of proteomics for diseases diagnosis. Proteomics enables a comprehensive understanding of the protein landscape within cells and tissues, offering insights into disease mechanisms at a molecular level. This deeper understanding has become crucial in identifying potential drug targets more accurately and efficiently. For instance, according to a 2024 article by the National Library of Medicine, it was reported that single cell proteomics analysis of drug response has shown its potential as a drug discovery platform.

Moreover, advancements in proteomic technologies have enhanced their sensitivity, throughput, and ability to analyze large datasets rapidly. This has expedited the discovery and validation of protein targets, thereby streamlining the drug development process. Thus, the rise in adoption of proteomics in drug discovery and development process is expected to drive the proteomics market growth. Furthermore, according to the proteomics market trends analysis, significant rise in research and development activities in the field of proteomics has emerged as major driver for the proteomics market, catalyzing advancements in healthcare, drug discovery, and personalized medicine. In addition, technological advancements in the analytical instruments such as mass spectrometry, protein microarrays, and bioinformatics tools has enabled the researchers to get deeper understanding of the proteomics, which further contributes to the research and development of the proteomics technology. Thus, rise in research and development activities is expected to drive the growth of the proteomics market size.

In addition, according to proteomics market forecast analysis, rise in adoption of the proteomics for disease diagnosis is expected to significantly contribute to the growth of the market. One of the key factors fueling the adoption of proteomics in disease diagnosis is its ability to detect and quantify proteins associated with specific diseases or conditions more accurately than traditional methods. By analyzing protein profiles, proteomics enables the identification of disease-specific biomarkers that can aid in early detection, prognosis, and treatment monitoring. According to a 2023 article by the National Library of Medicine, it was reported that by identifying changes in protein expression in the blood or other biological samples, proteomic biomarkers can be used to detect the disease at an earlier stage and improve the chances of successful treatment.

Moreover, according to proteomics market opportunity analysis, proteomics can enhance the understanding of disease biology at a molecular level, which is crucial for developing targeted therapies and precision medicine approaches. For instance, according to a 2021 article by the National Library of Medicine, it was reported that cancer proteomics unraveled key information in mechanistic studies on tumor growth and metastasis, which has contributed to the identification of clinically applicable biomarkers as well as therapeutic targets. The use of proteomic technologies, such as mass spectrometry and protein microarrays, has significantly advanced the ability to profile complex protein mixtures in clinical samples, allowing for more accurate and comprehensive disease diagnosis. Thus, the rise in the adoption of proteomics for disease diagnosis is expected to significantly contribute to the proteomics market growth.

Segments Overview

The proteomics market is segmented on the basis of component, application, and region. By component, the market is divided into reagents, instruments and services. By application, the market is divided into drug discovery, diseases diagnosis, and other. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), LA (Brazil, Colombia, Argentina, and rest of LA), and MEA (GCC, South Africa, North Africa, and rest of MEA).

By Component

The reagent segment dominated the global proteomics market share in 2023, and is expected to remain dominant during the forecast period. This is attributed to the fact that reagents are fundamental components in proteomic experimentation. They are required for various processes such as protein extraction, purification, labeling, and analysis. As proteomics research advances and becomes more sophisticated, the demand for specialized reagents tailored to specific techniques and applications increases.

By Application

The drug discovery segment dominated the global proteomics market share in 2023, and is expected to remain dominant during the forecast period. This is attributed to high adoption of proteomics in preclinical trials of new drug candidate. Proteomics provides valuable insights into the structure, function, and interactions of proteins within biological systems. Understanding these aspects is crucial for identifying potential drug targets. By studying the proteome, researchers can identify specific proteins associated with diseases, leading to the development of targeted therapies. This targeted approach enhances the efficiency and effectiveness of drug discovery, resulting in a higher success rate for bringing new drugs to market.

By Region

The proteomics industry is analyzed across North America, Europe, Asia-Pacific, LA, and MEA. North America accounted for a major share of the proteomics market in 2022 and is expected to maintain its dominance during the forecast period. This is attributed to well-developed healthcare infrastructure, strong presence of major key players and high adoption of the proteomics for drug discovery and development However, Asia-Pacific is expected to register the highest CAGR during the forecast period owing to rise in prevalence of chronic diseases.

Competition Analysis

Competitive analysis and profiles of the major players in proteomics market, such as Bio-Rad Laboratories Inc, Thermo Fisher Scientific Inc., Danaher Corporation, Bruker Corporation, Waters Corporation, Perkin Elmer Inc, Horiba Ltd., Merck KGaA, Agilent Technologies Inc., Li-Cor Inc. Major players have adopted collaboration, and product launch as a key developmental strategy to improve the product portfolio of the proteomics market.

Recent Development in the Proteomics Industry

- In August 2022, Bruker Corporation launched the new nanoElute 2 nano-LC, of MetaboScape and TASQ 2023 software supporting fluxomics, and with latest advances in PaSER intelligent acquisition to enhance research in protein-protein interactions (PPIs) and metaproteomics applications.

- In March 2021, Thermo Fisher Scientific, collaborated with Protein Metrics, a developer of world-class software tools for protein characterization, to provide advanced mass spectrometry data processing and analysis capabilities to drive innovation across the full spectrum of biopharmaceutical and proteomics applications, from R&D to quality control.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the proteomics market analysis from 2023 to 2035 to identify the prevailing proteomics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the proteomics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global proteomics market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the proteomics market players.

- The report includes the analysis of the regional as well as global proteomics market trends, key players, market segments, application areas, and market growth strategies.

Proteomics Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 280 |

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bruker Corporation, Li-Cor Inc, Danaher Corporation, Perkin Elmer Inc, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Horiba Ltd., Merck KGaA, Waters Corporation, Bio-Rad Laboratories Inc |

Analyst Review

This section provides various opinions of CXOs in the proteomics market. Proteomics, the study of proteins and their functions within biological systems, holds immense promise in revolutionizing healthcare by enabling personalized medicine, biomarker discovery, and drug development. The market's expansion is driven by several key factors, including advancements in mass spectrometry and bioinformatics technologies, growing demand for precision medicine solutions, and increasing investments in research and development. Moreover, the rise of chronic diseases, such as cancer and cardiovascular disorders, has heightened the urgency for more effective diagnostic and therapeutic approaches, further fueling demand for proteomic solutions. However, despite these opportunities, the proteomics market faces challenges such as the complexity of data analysis, standardization issues, and high costs associated with technology adoption and implementation. To capitalize on the market's potential, key players must prioritize innovation, collaboration, and investment in infrastructure to overcome these barriers.

The forecast period for Proteomics Market is 2023-2032.

The total market value of Emphysema Treatment Market is $32.8 billion in 2023.

The base year is 2023 in Proteomics Market.

The market value of Proteomics Market in 2035 is expected to be $161.9 billion.

The reagent segment is the most influencing segment in the Proteomics Market.

Major key players that operate in the Proteomics Market are Bio-Rad Laboratories Inc, Thermo Fisher Scientific Inc., Danaher Corporation, Bruker Corporation, Waters Corporation, Perkin Elmer Inc

Proteomics is a field of study within molecular biology that focuses on the large-scale analysis of proteins. It encompasses various techniques aimed at understanding the structure, function, and interactions of proteins within a biological system

The Proteomics Market growth is driven by increasing emphasis on research in the life sciences sector. As scientific understanding deepens and technological advancements accelerate, the demand for proteomics solutions has grown exponentially.

Loading Table Of Content...

Loading Research Methodology...