Psoriasis Therapeutics Market Research, 2031

The global psoriasis therapeutics market size was valued at $22.9 billion in 2021, and is projected to reach $55.8 billion by 2031, growing at a CAGR of 9.3% from 2022 to 2031. Psoriasis is considered to be a persistent skin disorder that is characterized mainly by skin irritation and scaly rashes where skin cells multiply up to 10 times faster than normal. It is an autoimmune noncontagious disorder characterized by rapid and excessive proliferation of skin cells, resulting in patches of abnormal skin. It is considered a long-term skin disorder characterized by plaques and thickened skin. It majorly affects knees, elbows, and scalp. Major objective of treatment for this disease is to stop skin cells from growing quickly. Therapeutic approach for psoriasis depends upon severity and amount of skin affected by the same.

The major factors that fuel the growth of the psoriasis therapeutics market size are increase in the incidence of psoriasis along with skin disorders associated with it globally. In addition, rising awareness among people regarding different treatments available in the market supplements the growing demand for psoriasis therapies which further drive psoriasis therapeutics market growth.

However, health risks posed due to the medication along with high costs of therapies restrain the growth of the psoriasis therapeutics market. On the other side, increase in development of new biologics and novel pipeline drugs will offer psoriasis therapeutics market opportunity during forecast period. For instance, in April 2019, Novartis AG announced that the China Health Authority NMPA approved Cosentyx, the first-in-class interleukin-17A inhibitor for moderate-to-severe plaque psoriasis in adult patients who are candidates for systemic therapy or phototherapy.

The psoriasis therapeutics market is segmented on the basis of drug class, type, route of administration and region. On the basis of drug class, the market is classified into TNF-alpha inhibitors, interleukin inhibitors and others. Interleukin inhibitors further segmented by distribution channel, including hospital pharmacies, drug stores & retail pharmacies, and online providers. On the basis of type, it is segmented into plaque psoriasis, psoriatic arthritis and others. On the basis of route of administration, it is segmented into oral. topical and parenteral. Furthermore, regionally, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

COVID-19 Impact Analysis

The COVID-19 pandemic initially had a negative growth impact on the psoriasis therapeutics industry, mainly because of the guidelines published by various regulatory bodies suggesting that patients receiving psoriasis therapeutics are at more risk of infecting COVID-19. In March 2020, the International Psoriasis Council (IPC) recommended physicians discontinue or postpone the prescription of immunosuppressant medications. However, later in September 2020, researchers from the Perelman School of Medicine at the University of Pennsylvania and 16 other research institutions from the United States and Canada, in collaboration with the National Psoriasis Foundation, created guidelines to care for patients with psoriasis during the coronavirus pandemic. The scientists found no evidence that medical interventions to treat psoriasis and psoriatic arthritis should be interrupted or altered to minimize COVID-19 risks. This guideline is further expected to resume market growth during psoriasis therapeutics market forecast.

Global Psoriasis Therapeutics Market Segment Analysis

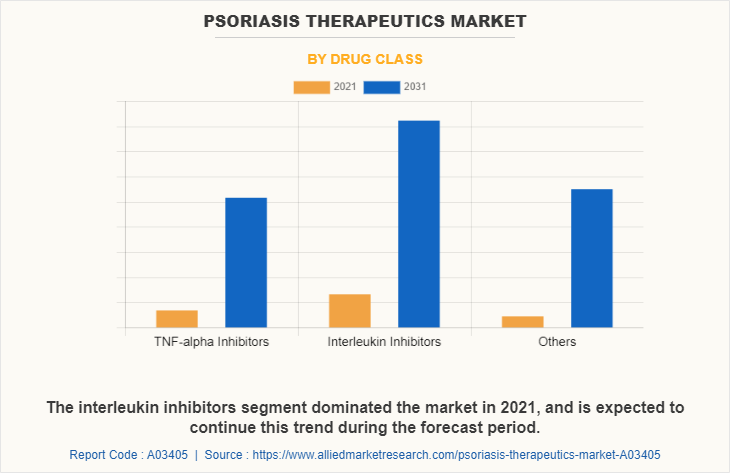

By Drug Class

On the basis of drug class, the psoriasis therapeutics market is divided into TNF-alpha Inhibitors, interleukin inhibitors and others. The interleukin inhibitor segment was the major revenue contributor in psoriasis therapeutics market share in 2021, and is anticipated to continue this trend during the forecast period, owing to, improved safety and efficacy of TNF-alpha inhibitors as compared to other classes of psoriasis drugs classes, as well as increase in adoption of interleukin inhibitors by patient with psoriasis.

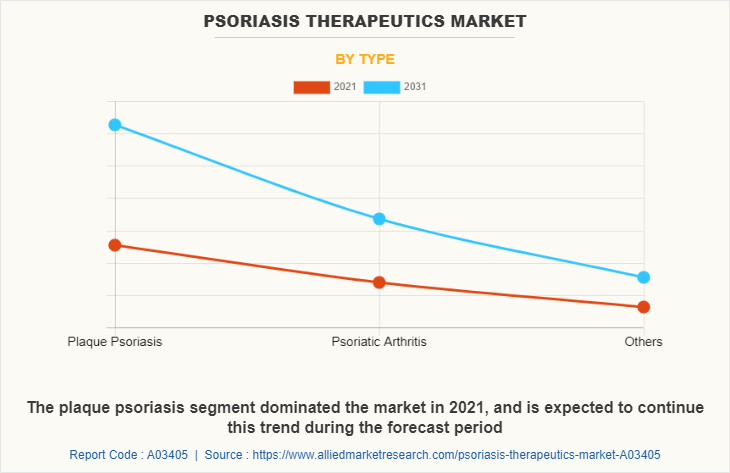

By Type

On the basis of type, the market is divided into plaque psoriasis, psoriatic arthritis and others. The plaque psoriasis segment held largest share in the psoriasis therapeutics industry in 2021, and is anticipated to continue this trend during the forecast period, owing to increase in prevalence of Plaque psoriasis patient pool which also increase adoption of medication for the treatment of Plaque psoriasis.

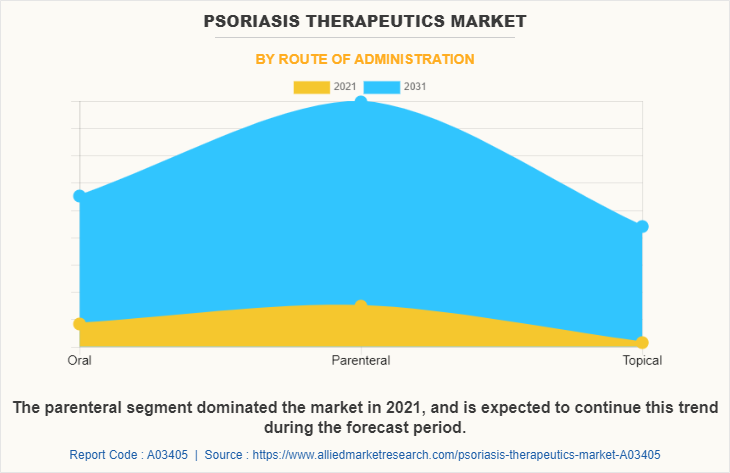

By Route of Administration

On the basis of route of administration, the market is divided into oral, topical and parenteral. The parenteral segment was the major revenue contributor in 2021, and is anticipated to continue this trend during the forecast period, owing to growth in in launch of new drugs to be administered through injection or intravenous (IV) infusion, and surge in the adoption of biologics for the treatment of psoriasis.

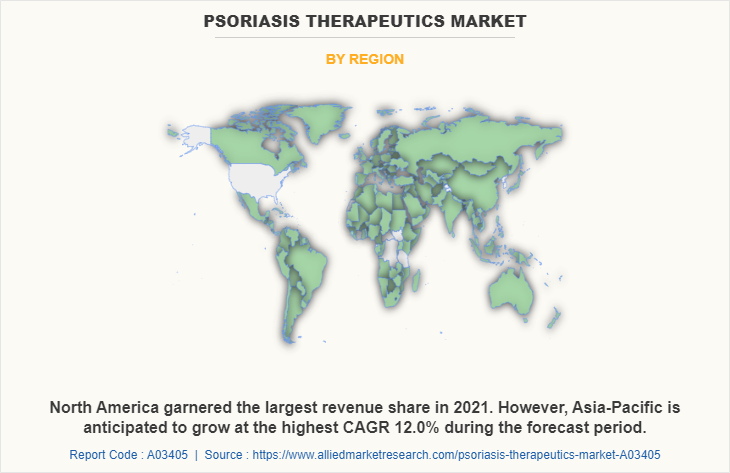

By Region

On the basis of region, the psoriasis therapeutics market are studies across North America, Asia-Pacific, Europe, and LAMEA. North America dominated the market in 2021, accounting for the highest psoriasis therapeutics market share, and is anticipated to maintain this trend during the forecast period. This is attributed to presence of major key players in the region as well as increase in prevalence of psoriasis patient in countries such as U.S. Furthermore, high disposable income among the people in North America has driven the development in healthcare industry due to affordability to invest in highly advanced medication that meets the targeted medical need of the people which further propel the market growth in the region.

On the other side, Asia pacific is projected to register the highest CAGR during the forecast period. This is attributed to rise in the number of key players for manufacturing psoriasis products; increase in prevalence of skin disease such as psoriasis and rise in population in India who are more susceptible to psoriasis further boost the growth of the market. Furthermore, rise in number of government approaches to raise awareness among the population regarding ill effects of prolonged psoriasis further drive growth of the market in the region.

Competition Analysis

The major companies profiled in the report include AbbVie Inc., Amgen Inc., Bausch Health Companies Inc, Eli Lilly and Company, Johnson & Johnson (J&J), Leo Pharma A/S, Novan, Inc., Novartis AG, Pfizer Inc., Viatris Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the psoriasis therapeutics market analysis from 2021 to 2031 to identify the prevailing psoriasis therapeutics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the psoriasis therapeutics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global psoriasis therapeutics market trends, key players, market segments, application areas, and market growth strategies.

Psoriasis Therapeutics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 55.8 billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 242 |

| By Drug Class |

|

| By Type |

|

| By Route of Administration |

|

| By Region |

|

| Key Market Players | Bausch Health Companies Inc., Novan Inc. (EPI Health LLC), Novartis AG, Abbvie Inc., Pfizer Inc., Johnson and Johnson, Eli Lilly and Company, Amgen Inc., Viatris Inc. (Mylan NV), LEO Pharma |

Analyst Review

Psoriasis is a form of chronic inflammatory disease, which affects fingers and toes of patients and gradually affects skin and nails. The clinical symptoms of psoriatic arthritis are axial disease, enthesitis, dactylitis, and peripheral arthritis. Treatment of psoriasis can be done using different drug types such as NSAIDs, DMARDs, and biologics.

Increase in awareness programs regarding psoriasis therapies, rise in prevalence of psoriasis, stressful lifestyle resulting in overstimulation of immune system, and surge in R&D for innovation of new products significantly boost growth of the psoriasis therapeutics market. Moreover, strong pipeline of biosimilars & biologic products, rise in geriatric population, presence of large patient pool, and rise in adoption of novel treatments drive the market growth. However, high treatment costs are expected to restrain growth of the market.

North America is expected to remain dominant during the forecast period, owing to increase in prevalence of psoriasis, presence of pipeline drugs under various stages of clinical trials, and increase in patient pool suffering from psoriatic arthritis. However, Asia-Pacific is expected to offer lucrative opportunities to key players during the forecast period, owing to development of the healthcare sector, along with rise in demand for psoriasis therapeutics products.

The total market value of Psoriasis Therapeutics market is $22,870.34 million in 2021.

The base year is 2021 in Psoriasis therapeutics market

The market value of Psoriasis Therapeutics market in 2031 is $55,757.68 million.

Top companies such as AbbVie Inc., Amgen Inc., Bausch Health Companies Inc, Eli Lilly and Company, Johnson & Johnson (J&J), Leo Pharma A/S, Novan, Inc., Novartis AG, Pfizer Inc., and Viatris Inc. held a high market position in 2021.

The forecast period for Psoriasis Therapeutics market is 2022 to 2031

The interleukin inhibitors segment is the most influencing segment owing to improved safety and efficacy of TNF-alpha inhibitors as compared to other classes of psoriasis drugs classes, as well as increase in adoption of interleukin inhibitors by patient with psoriasis.

Increase in geriatric population, growth in prevalence of plaque and psoriatic arthritis, favorable reimbursement policies, and rise in prescription volume of biological products. are some factors which boost growth of the market.

Loading Table Of Content...