Quality and Lifecycle Management Software Market Overview

The global quality and lifecycle management software market was valued at $24.4 billion in 2022, and is projected to reach $49.7 billion by 2032, growing at a CAGR of 7.5% from 2023 to 2032.

Increase in adoption of medium-sized business and increase in use of high-tech connected devices and factories is boosting the growth of the global quality and life cycle management software market. In addition, increase in use of digital transformation technology is positively impacts the quality and lifecycle management software market growth. However, lack of interoperability and integration of complex system and Inadequate quality control and production planning is hampering the quality and life cycle management software market growth. On the contrary, increasing integration of product life-cycle management (PLM) solutions with IoT platform is expected to offer remunerative opportunities for expansion of the quality and life cycle management software market during the forecast period.

Quality and lifecycle management (QLM) is a systematized approach to managing all facets of product quality, reliability, and risk throughout the product development lifecycle. Methods fully incorporate all phases of the supply chain and involve all suppliers with stake in product quality from conception to manufacturing. Moreover, QLM manages all of the information and processes at every step of a product or service lifecycle across globalized supply chains. This includes the data from items, parts, products, documents, requirements, engineering change orders, and quality workflows

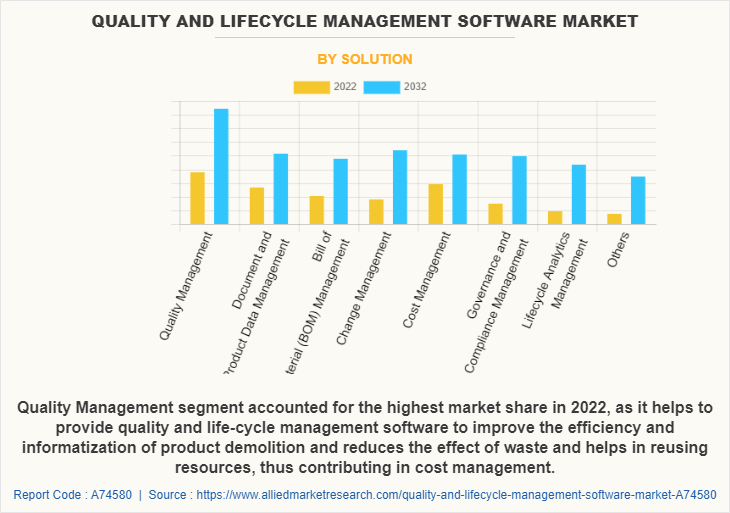

The quality and lifecycle management software market are segmented on the basis of by solution, deployment mode, enterprise size, industry vertical, and region. On the basis of solution, the market is categorized into bill of material (BOM) management, document and product data management, quality management, change management, cost management, governance & compliance management, lifecycle analytics management, and others. On the basis of deployment mode, the market is fragmented into on-premise, and cloud. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. By industry vertical, it is classified into aerospace & defense, IT & telecom, automotive and transport industry, retail & consumer goods, healthcare & life science, and others. By region, the quality and lifecycle management software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of solution, the quality management segment holds the largest quality and lifecycle management software market size owing to, increase in demand for quality and services. However, the bill of material management segment is expected to grow at the highest rate during the forecast period as it helps to improve the quality of the end product, ensure traceability, manage component lifecycles, and facilitate collaboration between different teams.

Region wise, the quality and lifecycle management software market share was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to technological infrastructure in the region combined with the high adoption of advanced technologies. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to increase in automotive production and sales of trucks and buses in countries such as India, China, and ASEAN countries, as well as a growing automotive components sector.

The key players that operate in the quality and lifecycle management software industry are Autodesk Inc, IBM Corporation, Micro Focus, Microsoft Corporation, Dassault Systemes, Oracle Corporation, SAP SE, SAS Institute Inc., Siemens AG, and Arena Solutions. These players have adopted various strategies to increase their market penetration and strengthen their position in the quality and lifecycle management software industry.

Top Impacting Factors

Increase in Adoption of Medium-sized Business

The increase in adoption of medium-sized business across the globe is propelling the growth of the quality and lifecycle management software market as the operations of medium-sized business are becoming more complex and managing product quality. Adopting quality and lifecycle management software for their businesses helps to manage this complexity by providing tools for collaboration, automation, and real time visibility in the product development process, which drives the growth of the market. Moreover, adopting quality and lifecycle management software by medium sized businesses helps to compete more effectively with larger organizations by streamlining their product development process.

In addition, by improving product quality these businesses can be more agile and responsive to changing market conditions. For instance, in June 2020, ETQ, a leading provider of quality management solutions (QMS) partnered with Epicor Software Corporation to deliver Epicor QMS, powered by ETQ Reliance®, a powerful, flexible, and easy-to-use QMS solution available to mid-market organizations. Such demands are driving the growth of the quality and lifecycle management software market.

Increase in Use of high-tech Connected Devices and Factories

Increase in use of high-tech connected devices and factories is an ever-evolving industry, and opportunities emerge regularly. The digital transformation trends are encouraging the companies in industries such as heavy manufacturing and automation, to focus on developing and adopting next generation smart products and factories. In addition, these smart products and factories are quite complex in developing in terms of connectivity, security compliances, functionalities, and other.

Furthermore, to build these connected products efficiently, manufacturing companies need a solution that includes mechanical, electrical, and software capabilities. To develop these connected products, software providers are focused on developing quality lifecycle management software infused with advance functionalities such as 3D designing, and simulation to authenticate the complex behavior of smart products and production system. Therefore, increasing demand for connected devices is expected to drive the growth of the quality and lifecycle management software market.

Digital Capabilities

The development and quick delivery of products are the main goals of quality life cycle management software. Digital quality lifecycle management (QLM) solutions are being developed by industry participants to increase delivery and material handling productivity. Suppliers, producers, logistics companies, and retailers may effectively coordinate product development, order fulfilment, and data tracking through the usage of supply chain software. Manufacturing, maintenance, and distribution processes are improved, leading to higher efficiency, when sophisticated technologies like AI, machine learning, IoT, and automation are integrated into QLM. These technologies can foresee failure before it occurs, allowing the supply chain to run without interruption. These technologies are being used more frequently to improve connectivity, transparency, and QLM efficiency.

Key Benefits

The key benefits of quality life cycle management software include gaining a better collaboration with suppliers, better quality control, shipping optimization, reduced inventory, improved risk mitigation and better visibility and data analytics. Behavior analytics can also help businesses identify trends in customer behavior, gain insights into customer preferences, and optimize business processes. Additionally, effective quality life cycle management software is crucial for business performance and can have a range of benefits, including the streamlined flow of goods and services as well as improved customer satisfaction.

Government Regulations

Government and public services organizations are unlocking the true potential of quality life cycle management software as they strive to deliver value to the public more efficiently and effectively. In fact, to remain resilient in times of disruption, mission-ready organizations ensure operations and quality life cycle management software practices are set up for success. In addition, various trade requirements are implemented on daily basis, which gives rise to the continuous transformation of the supply chain domain. The government regulations impact on every supply chain, whether a public company or a private supplier.

In addition to the regulations legislated by different governments, companies must also answer to some of the agencies and adhere to a range of industry standards. Industry standards which impact quality life cycle management software include, RoHS, REACH, the FDA, U.S. Customs and Border Protection's Automated Commercial Environment (ACE) system, the U.S. Securities and Exchange Commission, and OSHA. Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) it is the EU rule that regulates chemicals. It governs chemicals considered as substances of high concern, listed by the EU. According to this regulation, anything that contains SVHC chemicals greater than 0.1% of the mass of the object must need to report to the EU. The 2019 NDAA and a supply chain bill by the U.S.: This bill states, how the U.S. government contractors requires to monitor their supply chains.

The provisions of this bill include prohibitions on utilizing certain Chinese companies for contractor deliverables, requirements to voluntarily disclose vulnerabilities, and the establishment of a new Federal Acquisition Security Council. Section 889 of 2019 NDAA forbids the procurement of certain services and technologies from companies connected with the People's Republic of China. For instance, U.S. government has implemented conflict minerals as defined under the Dodd-Frank Act it included a provision that public companies must be able to prove their sourced minerals are not coming from places that are financing conflict in the Democratic Republic of the Congo or an adjoining country, according to Source Intelligence.

Key Benefits for Stakeholders

The study provides an in-depth analysis of the global quality and lifecycle management software market forecast along with current & future trends to explain the imminent investment pockets.

Information about key drivers, restraints, & opportunities and their impact analysis on global quality and lifecycle management software market trends is provided in the report.

The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The quality and lifecycle management software market analysis from 2023 to 2032 is provided to determine the market potential.

Quality and Lifecycle Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 49.7 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Solution |

|

| By Deployment Mode |

|

| By Region |

|

| Key Market Players | SAP SE, Siemens AG, SAS Institute Inc., Microsoft Corporation, Dassault Systemes, Arena Solutions, Micro Focus, Oracle Corporation, IBM Corporation, Autodesk Inc. |

Analyst Review

Quality management software helps organizations to reduce product and operating costs while helping them to improve product quality. In addition, quality management software is necessary to capture various complaints, defects, and non-conformances. Moreover, it helps to identify, analyze, and share critical product quality data, which helps the design, manufacturing, and quality improvement teams share and analyze their views. Furthermore, the advancements in security measures in cloud-based databases have further bolstered the demand for hosted solutions. Thus, hosted quality management allows organizations to identify, analyze, and share critical product quality data in a secure environment at any given location. These benefits have necessitated the urgency of hosted quality management solutions for organizations to maintain their competitiveness in their respective industry vertical.

The global quality and life cycle management software market is expected to register high growth due to increase in demand in small and medium business across consumer goods and retail are expected to drive industry growth. Thus, increase in adoption of quality and life cycle management software, owing to its security is one of the most significant factors driving the growth of the market. With surge in demand for quality and life cycle management software, various companies have established alliances to increase their capabilities. For instance, in April 2022, HIMA a global leader of safety related automation solutions partnered with Mangan Software Solutions (MSS) help to optimize the safety of the process industry worldwide. In addition, HIMA offering a TÜV-certified cloud-based platform that provides digitalization of the entire functional safety lifecycle.

In addition, with further growth in investment across the world and the rise in demand for quality and life cycle management software, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in February 2022, KloudPLM launched Cloud-First, PLM platform built on Salesforce.com, that allows organizations to streamline and automate their entire product development cycle.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, March 2022, Hexagon acquired ETQ, LLC to provides an enterprise view of quality management across the entire product lifecycle.

The quality and lifecycle management software market is estimated to grow at a CAGR of 7.5% from 2023 to 2032.

The quality and lifecycle management software market is projected to reach $ 49.7 billion by 2032.

Increase in adoption of medium-sized business and increase in use of high-tech connected devices and factories is boosting the growth of the global quality and life cycle management software market. In addition, increase in use of digital transformation technology is positively impacts growth of the quality and life cycle management software market.

The key players profiled in the report include Autodesk Inc, IBM Corporation, Micro Focus, Microsoft Corporation, Dassault Systemes, Oracle Corporation, SAP SE, SAS Institute Inc., Siemens AG, and Arena Solutions.

The key growth strategies of quality and lifecycle management software market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...