Radiology Information System Market Size & Trends

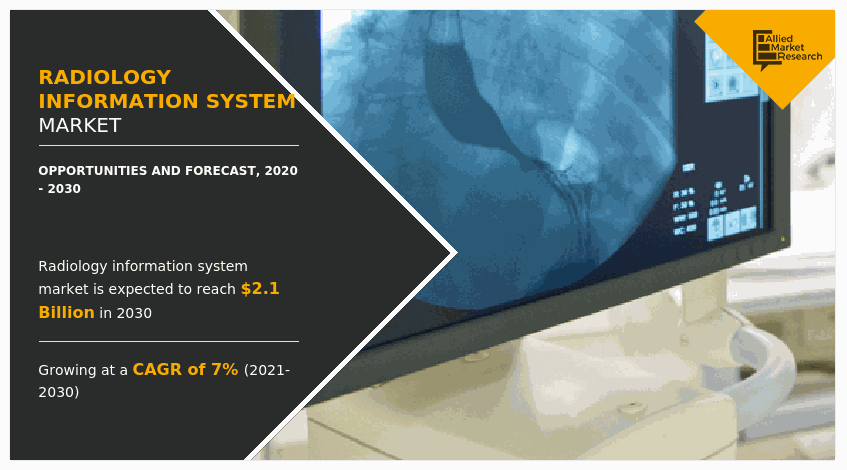

The global radiology information system (RIS) market size was $1,051.60 million in 2020, and is projected to reach $2,141.50 million by 2030, growing at a CAGR of 7% from 2021 to 2030. The radiology information system (RIS) is extensively used for data management in radiology departments. It offers different functions, such as resource management, patient scheduling, procedure billing, and results distribution. It is a type of health or hospital information system (HIS), which automates and manages various processes in the radiological department.

The rise in global population has significantly increased the number of patients suffering from chronic diseases. Furthermore, the number of patients suffering from chronic diseases, such as heart diseases, diabetes, and arthritis has significantly increased in the past few decades. This fuels the demand for radiological tests, and is a major driver in radiology information system market growth. Furthermore, radiology information systems increase the efficiency of record keeping and billing activities. Also, healthcare facilities, such as hospitals are increasingly adopting cloud technology and related to services to enhance the efficiency of their operations. In addition, the large investment for healthcare facilities in developed countries propels the radiology information system market share.

According to World Health Organization, the number of people aged 60 years and older was 1 billion in 2019, and is expected to reach 1.4 billion by 2030 and 2.1 billion by 2050. This increased the number of patients suffering from various chronic diseases. For instance, according to Centers for Disease Control and Prevention, an entity of the U.S. Department of Health & Human Services, as of 2021, 6 in every 10 U.S. adults have a chronic disease and 4 in every 10 U.S. adults have two or more chronic diseases. This significantly increases the use of radiology information systems to enhance the operating efficiency of healthcare facilities. Furthermore, various governments across the globe are increasing their expenditure on healthcare facilities. For instance, according to the U.S. Centers for Medicare & Medicaid Services, U.S. healthcare spending reached $4.1 trillion or $12,530 per person, witnessing a rise of 9.7% in 2020 and health spending accounted for 19.7% of the U.S. GDP.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic increased the importance of government healthcare facilities, thereby increasing healthcare spendings across the globe. Furthermore, the number of COVID-19 cases are expected to reduce in the near future as the vaccine for COVID-19 is introduced in the market. This has led to the reopening of companies involved in development of radiology information systems. This will help the market to recover by the start of 2022. After COVID-19 infection cases begin to decline, companies must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working. The awareness regarding efficient operations of healthcare facilities caused by the COVID-19 pandemic is expected to positively influence the radiology information system market size.

Furthermore, the capabilities of radiology information systems to track patients’ record in the radiology department, enable scheduling of appointments, and improve the efficiency of billing activities, make it a desirable solution for healthcare facilities. In addition, advancement in healthcare facilities of developing countries is a major radiology information systems market opportunity.

Market Segmentation

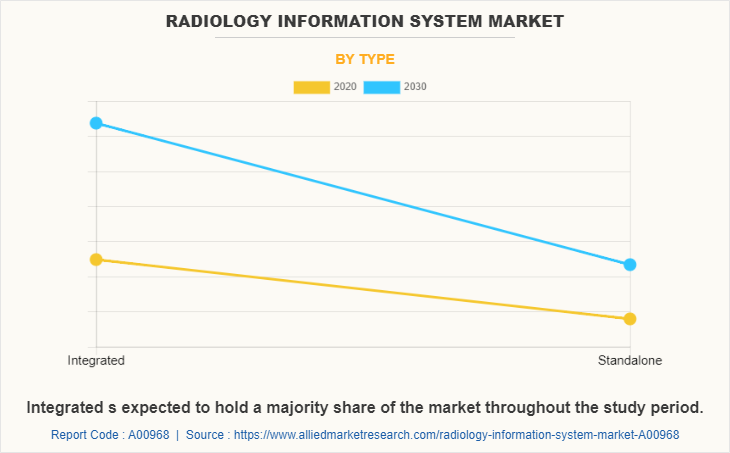

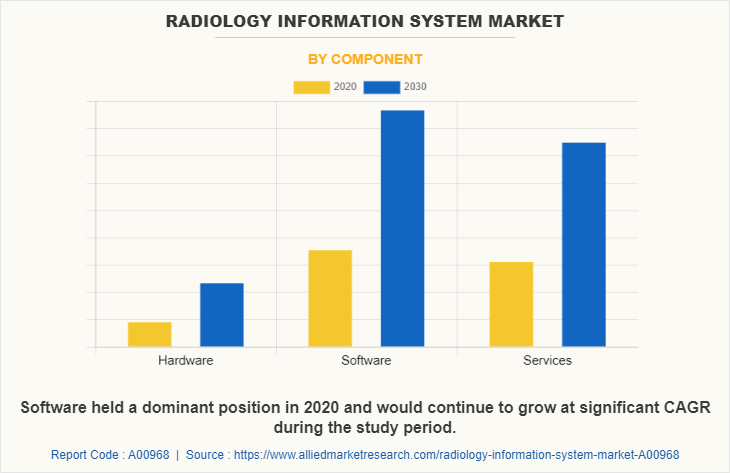

The radiology information system market is segmented on the basis of type, component, deployment mode, end user, and region. By type, the market is categorized into integrated radiology information systems and standalone radiology information systems. On the basis of component, it is categorized into services, software and hardware. On the basis of deployment mode, it is segmented into web-based, on-premise, and cloud-based. On the basis of end user, it is segmented into hospitals, office-based physicians and healthcare payers.

Regional/Country Market Outlook

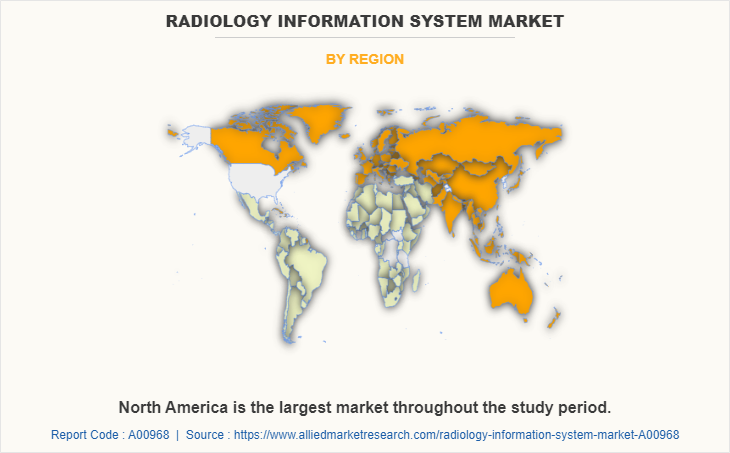

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in 2020, accounting for the highest radiology information system market share, and Asia-Pacific region is anticipated to grow rapidly throughout the forecast period. This is attributed to increase in population and rise in spending of healthcare facilities.

Competitive Landscape

Key companies profiled in the radiology information system market report include, Epic Systems Corporation, MedInformatix, Inc., GE Healthcare, Carestream Health, Inc., Cerner Corporation, Merge Healthcare Incorporated, Allscripts Healthcare Solutions, Inc., McKesson Corporation, Koninklijke Philips N.V., and Siemens Healthineers, Inc.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging radiology information system market trends and dynamics.

- In-depth radiology information system market analysis is conducted by constructing market estimations for key market segments between 2021 and 2030.

- Extensive analysis of the radiology information system industry is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing radiology information system market opportunities.

- The global radiology information system market forecast analysis from 2021 to 2030 is included in the report.

- The key players within radiology information system market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the radiology information system industry.

Radiology Information System Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Component |

|

| By Deployment Mode |

|

| By End User |

|

| By Region |

|

| Key Market Players | IBM, Siemens AG, General Electric Company, Carestream Health, Inc, Allscripts Healthcare Solutions, Inc., Cerner Corporation, epic systems corporation, Koninklijke Philips N.V., McKesson Corporation, MedInformatix, Inc |

Analyst Review

The radiology information system market has witnessed significant growth in past few years, owing to rapid growth of the pharmaceutical industry across the globe and increase in spending on healthcare facilities in developing countries.

The rise in demand for medical services fueled by increase in global population and rise in geriatric population boosts the demand for radiology information system in the healthcare industry. Furthermore, rise in the number of patients suffering from chronic diseases, such as cancer, heart disease, stroke, diabetes, and arthritis increases the demand for effective radiology information system. Also, use of radiology information system enhances efficiency in patient and bill tracking activities. In addition, increase in adoption of cloud-based technologies in the healthcare industry, positively influences the growth of the radiology information system market.

Moreover, supportive government initiatives and rapid growth of the healthcare industry in emerging countries provides lucrative growth opportunities for the radiology information system market.

The product launch is key growth strategy of radiology information system industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

North America is the largest regional market for Radiology Information System.

In 2020, $1,051.6 million is the estimated industry size of Radiology Information System.

Epic Systems Corporation, MedInformatix, Inc., GE Healthcare and Carestream Health, Inc. are some of the top companies to hold the market share in Radiology Information System

Loading Table Of Content...