The global railway signaling system market was valued at $12.8 billion in 2021, and is projected to reach $21.7 billion by 2031, growing at a CAGR of 5.5% from 2022 to 2031.

Rail signaling system also referred to as railroad signaling is a system through which the movement of trains is controlled. Railway signaling system is utilized to prevent railway traffic from collision of one train wagon with other trains; derailment of train wagons; and collision of train with railway assets. It also assists in detection of train positions and provides information related to routes and stations. In addition, types of railway signals comprise permissive signals and absolute signals.

Development of advanced train signaling systems offer enhanced service to mass transit passengers in terms of safety, comfort, reliability and dependability. They also ensure optimum usage of track capacity and efficient management of transport network and infrastructure. Rail signaling systems enable trains to operate safely at shorter headways and provide rapid recovery in an event of disturbance, thereby offering improved passenger service and increased line capacity. Adoption of advanced rail signaling systems results in benefits such as reduced maintenance costs, greater safety, superior operational flexibility, improved reliability, and more predictable operation.

Increase in government spending on railway projects, growth in demand for safety and compliance in rail transit, and increase in demand for passenger & freight capacity are the major factors that propel the market growth. However, lack of skilled staff in developing countries and lack of technology infrastructure in developing countries are the major factors that hamper growth of the market. Furthermore, adoption of autonomous trains, and technological advancements in signaling systems are the factors expected to offer growth opportunities during the forecast period.

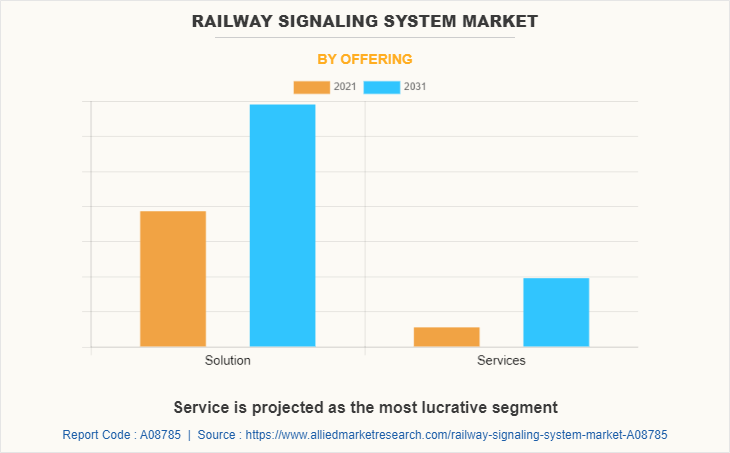

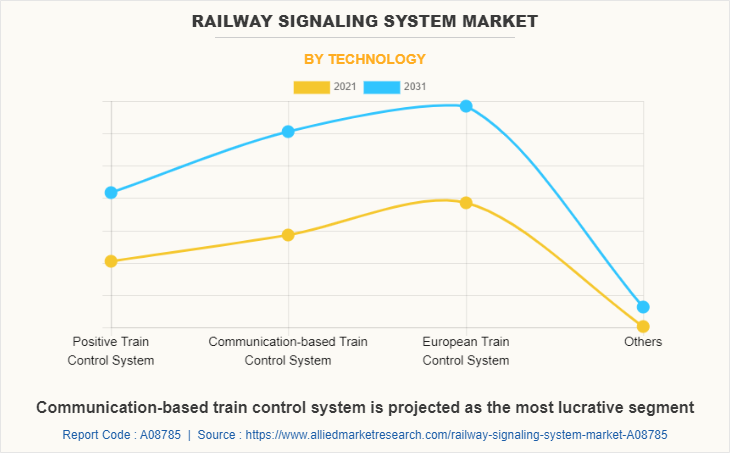

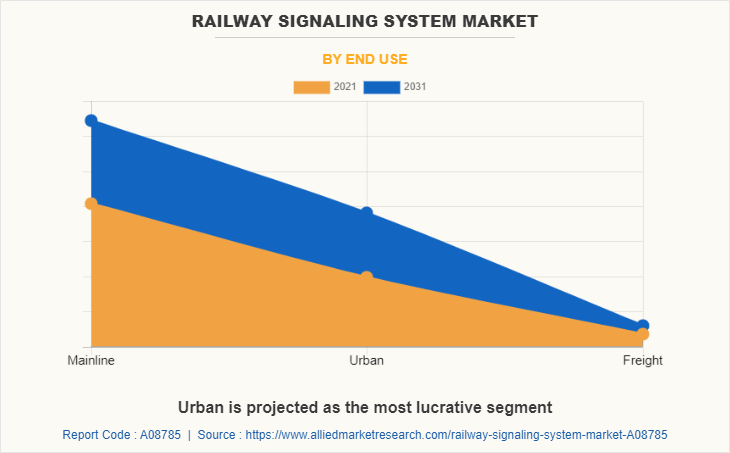

The rail signaling system market is segmented on the basis of offering, technology, end use, and region. By offering, it is segmented into solution and services. By technology, it is classified into positive train control system, communication-based train control system, European train control system, and others. By end use, it is categorized into mainline, urban, and freight. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

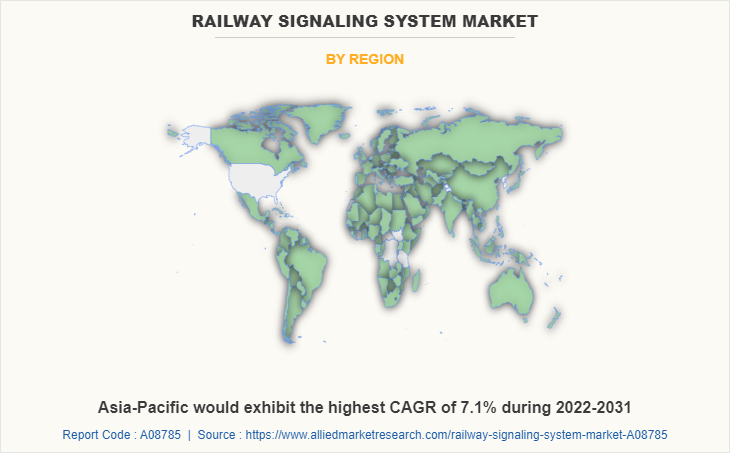

Europe comprises the UK, Germany, France, Spain, Italy, and rest of Europe. Europe has one of the advanced railway sectors across the globe. Countries such as France, Germany, and others in the region are highly developed in terms of train automation, and are presently equipped with fully automated trains. They serve passenger as well as freight segment within their country, and most of them are automatically controlled from the control station. Such trains are well-equipped with latest technologies and are continuously upgraded to meet the latest trends. Advancements in the railway infrastructure and penetration of digital solution in railways are the leading factors that boost demand for railway signaling systems across Europe. In addition, increase in government activities toward adoption of green mobility and introduction of railways that operate on alternative fuel are expected to create lucrative growth opportunities for the railway signaling system market in the region.

Significant initiatives & investing plans by the UK government for expansion of existing rail networks is the primary factor anticipated to boost the growth of the rail signaling system market in the UK. For instance, in March 2020, UK government announced to invest around $47 billion in the railway sector to support continued growth of passenger and cargo railways in the country. In addition, government announced plans to remove all diesel-only trains from the network by 2040 to reduce carbon emissions by improving infrastructure, and supporting the deployment of lower carbon technologies.

The leading rolling stock companies are announcing plans to accelerate development and adoption of hydrogen-based trains in the UK, which increases the demand for railway signaling systems. For instance, in July 2020, Eversholt Rail and Alstom, leading rolling stock companies announced investment of around $1 million in British hydrogen trains, developing an entirely new class of trains, that increases the demand for railway signaling systems.

Some leading companies profiled in the report comprises Alstom SA, Angelo Holding SRL (MERMEC S.p.A.), Belden Inc., Cisco Systems Inc., Hitachi Ltd. (Hitachi Rail), IBM Corporation, Huawei Technologies Co. Ltd., Nokia Corporation, Siemens AG, and Wabtec Corporation. The leading companies are adopting strategies such as product launch and collaboration to strengthen their market position. In December 2021, Alstom SA, in partnership with Cylus, integrated its CBTC an advanced rail cybersecurity solution on the Tel-Aviv Red line to improve the protection of the line’s signaling and train control systems.

In May 2022, Hitachi Rail launched innovations and product improvements at the 2022 Railway Systems Supplies, Inc. (RSSI) Communication & Signaling (C&S) exhibition in Kansas City, Missouri. The products include PTC onboard system, railcar telematics product line, and others. In May 2022, Huawei launched the Future Railway Mobile Communication System at Asia Pacific Rail 2022 and Huawei Global Rail Summit 2022. This development leverages the Future Railway Mobile Communication System (FRMCS) to drive the digital transformation of railway transportation from the perspectives of industry trends, spectrum selection, networking architecture, and key wireless technologies, providing significant references to the planning and construction of the future mobile communication systems for railways.

Increase in government spending on railway projects

Governments of many countries are approving new railway projects, including new lines and doubling of existing lines. In addition, they are committed to keeping people safe by improving rail safety and increasing public awareness and confidence in rail transportation system. Furthermore, China is investing heavily in the construction of railway networks. Major railway projects are under development and in construction stage in various countries. For instance, in 2020, around $245 billion was spent on public transport and railroad construction in the U.S. In addition, the Government spent $16.5 million under the rail safety improvement program to support 16 new projects and initiatives. In addition, the Government of India plans to spend $704.2 million on railway projects till 2023.

Furthermore, India also announced its rail budget for enhancing its railway infrastructure. For instance, in February 2022, the railway ministry of India announced $32.7 billion for rail in its national budget, along with an increased commitment toward rolling stock and infrastructure development. Thus, these types of investments by governments on rail projects are anticipated to drive the railway signaling system market during the forecast period.

Growth in demand for safety and compliance in rail transit

Growth in demand for safety and compliance in rail transit leads to adoption of improved infrastructure for railway. For instance, in June 2022, the Federal Railroad Administration (FRA) announced over $368 million in Consolidated Rail Infrastructure and Safety Improvements (CRISI) grant program to fund 46 projects in 32 states and the District of Columbia. These investments are expected to play a crucial role in modernizing rail infrastructure and supply chains in the region, helping to reduce crowding and getting people and goods where they need to go quickly and more at a reasonable cost.

In addition, to improve infrastructure of railways, governments of various countries are collaborating with rail signaling system companies to increase connectivity and expansion of railway transit including overhaul, deployment of cloud-based applications, and monitoring of trains. For instance, in March 2022, Alstom SA signed a contract to provide its Urbalis CBTC signaling system, along with 20 years of maintenance and 37 Metropolis trains to Santiago, Chile. Therefore, rise in demand for safety and compliance in rail transit is expected to support growth of the railway signaling system market.

Increase in demand for passenger and freight capacity

The railway industry has witnessed significant growth in passenger ridership as compared to other public transit, owing to its fare frequency and overall commute time. According to the Organization for Economic Cooperation and Development (OECD), passenger transport by rail for million passenger-kilometers has witnessed steady growth in the past decade.

China registered 0.37 million rail passenger–kilometers in 1998, which reached 1.41 million rail passenger-kilometers in 2018. Moreover, India registered 0.40 million rail-kilometers in 1998, which reached 1.16 million rail passenger-kilometers in 2017. Moreover, in 2019, the U.S. witnessed around 60% increase in rail ridership since 1997, and is expected to continue the same trend in the future. Rail transit in the U.S. holds around 48% of the total public transit. Railway has witnessed a significant rise in ridership, and is expected to continue in the upcoming years. Rail signaling system is expected to deliver various services such as smooth passenger & freight operations management, safety & security monitoring, and rail communication & networking, which are expected to cater to changing demands for passengers along with reducing commute time and enhancing travel experience.

Lack of technology infrastructure in developing countries

In developing countries, poor telecommunication infrastructure and limited access to smart devices are expected to hamper the railway signaling system market during the forecast period. High cost of internet access also acts as a limitation for rail signaling systems. Standardization across data standards, wireless protocols, and technologies have evolved as organizations increasingly adopt IoT technologies, follow ambient computing technology, and offer various IoT solutions.

According to the Union of International Associations (UIA) organization 2021 report, in some countries, basic infrastructure is lacking. In other places, the infrastructure is inadequate as of age, state of disrepair, or incompetent management. Furthermore, developing countries constantly lack suitable physical and social infrastructure and their considerable improvement is essential for rapid economic development. In these countries, excluding a few cities and towns, most areas are not aided by modern transport and communications and electric power is limited.

Moreover, in many of the less developed countries, transport problems have been a major force to inhibit industrialization altogether. This problem is witnessed in its most striking form in countries such as Afghanistan, Bolivia, Lesotho, and Nepal, where the landscape reaches up to the highest mountains in the world and makes rail construction extremely costly. Thus, lack of technology infrastructure in developing countries is expected to hamper the railway signaling system market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the railway signaling system market analysis from 2021 to 2031 to identify the prevailing railway signaling system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the railway signaling system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global railway signaling system market trends, key players, market segments, application areas, and market growth strategies.

Railway Signaling System Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 21.7 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 265 |

| By Offering |

|

| By Technology |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Hitachi Ltd., Belden Inc., Alstom SA, Siemens AG, Huawei Technologies Co Ltd, Cisco Systems Inc, IBM CORPORATION, Angelo Holding SRL, Nokia Corporation, Wabtec Corporation |

Analyst Review

The global railway signaling system market is expected to witness growth during the forecast period owing to greater need to offer passenger safety and rise in government spending on construction of railway projects. There has been increasing focus on improving rail infrastructure and related safety and signaling systems. Governments and railway organizations across the globe are providing funds to enhance rail infrastructure as well as to improve signaling systems. For instance, in June 2021, the Indian Railways announced plans to spend $7,658.73 million in next five years for modernization of signaling and telecommunication systems.

Increase in adoption of autonomous trains is expected to offer growth opportunities to the market in the coming years. Autonomous trains are automated transit systems, operated automatically without any human involvement and are monitored from the control station. These trains operate with higher frequencies having the capability of transporting a large number of passengers and freights at a faster pace compared to road transport. Various countries are focused on developing, testing, and adopting autonomous train technology to reduce human intervention and participation. For instance, in May 2021, France's national state-owned railway company SNCF and its partners Alstom, Bosch, Spirops, Thales and the Railenium Technology Research Institute began testing a modified Regio 2N regional train as a prototype autonomous regional train for France’s rail network.

The top companies in the market include Alstom SA, Angelo Holding SRL (MERMEC S.p.A.), Belden Inc., Cisco Systems Inc., Hitachi Ltd. (Hitachi Rail), IBM Corporation, Huawei Technologies Co. Ltd., Nokia Corporation, Siemens AG, and Wabtec Corporation.

The global railway signaling system market was valued at $12.8 billion in 2021, and is projected to reach $21.7 billion by 2031, registering a CAGR of 5.5% from 2022 to 2031.

The largest regional market is Europe.

The leading application is mainline.

The upcoming trends include rise in development of autonomous trains and greater adoption of communication-based train control systems.

Loading Table Of Content...