Rapid Acting Insulin Market Share & Trends

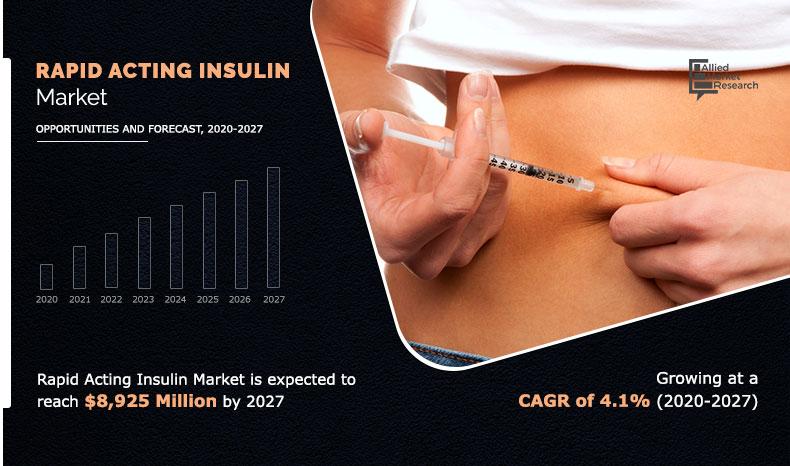

The global rapid acting insulin market size was valued at $7,100 million in 2019, and is projected to reach $8,925 million by 2027 at a CAGR of 4.1% from 2020 to 2027. Rapid acting insulin is one of the fastest acting insulin that starts working within 15 minutes of its introduction. Action of this insulin is supposed to last for 5 hours. Some of the rapid acting insulin available in the market are Humalog, Fiasp, NovoRapid, Apidra and others.

The COVID-19 outbreak that started from Wuhan city of China has now wide spread globally. Almost every nation is dealing with the outbreak. Furthermore, most of the markets have observed a drop down, owing to the lockdown situation declared by the government of various countries. However, the outbreak of COVID-19 is expected to contribute to the growth opportunities for industries wherein the treatment and management of chronic conditions are carried out. According to an article by the American Diabetes Association in 2020, people with diabetes are more likely to have serious complications from COVID-19. Furthermore, having heart disease or other complications in addition to diabetes could worsen the chance of getting seriously ill from COVID-19 as more than one condition makes it harder for patients to fight the infection. This helped major players to adopt various strategies to gain maximum share during the COVID-19 outbreak. For instance, in April 2020, in response to the emergency caused by COVID-19, Eli Lilly and Company introduced the Lilly Insulin Value Program. This program allows anyone with commercial insurance and those without insurance at all to fill their monthly prescription of Lilly insulin for $35. Furthermore, the program became effective from the given date and covered most Lilly insulin, including all Humalog (insulin lispro injection 100 units/mL) formulations. On the side, there is no supply shortage of rapid acting insulin.

Key Market Dynamics

The growth of the global rapid acting insulin market is majorly driven by the surge in prevalence of diabetes worldwide, increase in investment in research and development (R&D) for human recombinant insulin is expected to drive the need for insulin used in management of diabetes thereby boosting the growth of the market. Furthermore, sedentary & unhealthy lifestyles double the risk of diabetes, because of overweight or obesity, an unhealthy diet and physical inactivity, which account for about 80% of the increase in prevalence of diabetes. However, the reluctance in adoption of rapid acting insulin due to the side effect, such as hypoglycemia, may hinder the growth of the industry. Conversely, untapped market and undiagnosed population in developing regions are expected to provide lucrative growth opportunities for the rapid acting insulin market growth.

The global rapid acting insulin market is segmented on the basis of product type, indication, distribution channel, and region. By product type, the market is segregated into insulin lispro, insulin aspart, and insulin glulisine. Depending on indication, it is fragmented into type 1 diabetes and type 2 diabetes. Furthermore, the market is divided on the basis of distribution channel into hospital pharmacies, drug stores & retail pharmacies, and online providers. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Market Segmentation

By product type, the insulin lispro segment is anticipated to grow with the largest rapid acting insulin market share over the forecast period. This is attributed to better advantages posed by the product, which include faster subcutaneous absorption, earlier & greater insulin peak, and shorter duration of action. This contributes to help the industry generate higher revenue through insulin lispro.

By Product Type

Insulin Lispro is projected as one of the most lucrative segment.

By indication, the type 2 diabetes segment occupied the largest share of the market, owing to rise in urbanization, unhealthy diet, and reduced physical activity leads to rise in the number of people with type 2 diabetes which will further boost the rapid acting insulin market growth.

By Indication

Type 2 Diabetes holds a dominant position in 2019 and would continue to maintain the lead over the forecast period.

By distribution channel, the drug stores & retail pharmacies segment occupied the largest share of the market, owing to availability of drug store & retail pharmacy stores everywhere. In addition these pharmacies provide alternate options for insulin, if the ones prescribed are not available.

By Region

Asia-Pacific region would exhibit the highest CAGR of 4.1% during 2020-2027.

Regional/Country Market Outlook

North America accounted for the largest share of revenue in 2019, and is anticipated to maintain its dominance from 2020 to 2027 due to increasing incidences of diabetes and geriatric population, thereby driving the region’s rapid acting insulin market. On the other side, Asia-Pacific is expected to register the highest CAGR in the rapid acting insulin market in future, owing to westernized lifestyle behaviors and the increased prevalence of obesity. This is expected to boost the rapid acting insulin market over the forecast period.

Competitive Landscape

Some of the key players operating in the rapid acting insulin market include ADOCIA SAS, Biocon Limited, Eli Lilly and Company, Gan & Lee Pharmaceuticals, Geropharm LLC, Mannkind Corporation, Novo Nordisk A/S, Sanofi S.A., and Wockhadt Ltd.

Key Benefits for Stakeholders

- This report entails a detailed quantitative analysis along with the current global rapid acting insulin market trends from 2020 to 2027 to identify the prevailing opportunities along with the strategic assessment.

- The rapid acting insulin market forecast is studied from 2020 to 2027.

- The rapid acting insulin market size and estimations are based on a comprehensive analysis of key developments in the industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market.

- Key players are profiled and their strategies are analyzed thoroughly to understand the competitive outlook of the global rapid acting insulin market.

Rapid Acting Insulin Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Indication |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Wockhadt Ltd., Novo Nordisk A/S, Geropharm LLC, ADOCIA SAS, Mannkind Corporation, Sanofi S.A., Eli Lilly And Company, Biocon Limited, Gan & Lee Pharmaceuticals |

Analyst Review

In accordance to several interviews conducted, the rapid acting insulin market is expected to witness a significant growth owing to sedentary & unhealthy lifestyles increase all causes of mortality, double the risk of diabetes, because of overweight or obesity, an unhealthy diet and physical inactivity, which account for about 80% of the increase in prevalence of diabetes.

Furthermore, surge in prevalence of diabetes worldwide is the major factor that contributes toward growth of the rapid acting insulin market. In addition increase in government expenditure on healthcare also propel the market growth.

Increasing incidences of diabetes and geriatric population, are anticipated to drive the growth in North America On the other side, Asia-Pacific is expected to register the highest CAGR in the rapid acting insulin market in future, owing to westernized lifestyle behaviors and the increased prevalence of diabetes. This is expected to boost the rapid acting insulin market over the forecast period.

The total market value of Rapid Acting Insulin Market is $7,100.4million in 2019.

The forcast period for Rapid Acting Insulin Market is 2020 to 2027

The market value of Rapid Acting Insulin Market in 2020 is $6,736.9 million.

The base year is 2019 in Rapid Acting Insulin Market

Top companies such as, ADOCIA SAS, Biocon Limited, Eli Lilly And Company, Gan & Lee Pharmaceuticals, Geropharm LLC, Mannkind Corporation, Novo Nordisk A/S, Sanofi S.A., and Wockhadt Ltd. held a high market position in 2019. These key players held a high market postion owing to the strong geographical foothold in regions.

Lispro, product type segment is the most influencing segment, owing to the better advantages posed by the product, which includes faster subcutaneous absorption, an earlier and greater insulin peak, and a shorter duration of action, which is driving the growth of the global Rapid acting insulin market

The major factor that fuels the growth of the rapid acting insulin market includes, the surge in the availability of continuous glucose monitoring. Furthermore, the sedentary, unhealthy lifestyle adapted by the population due to increase in working population would contribute to market growth. The family diabetic history, however is also a major factor causing the surge in demand for rapid acting insulin. In addition to this, the steep rise in the research and development in the human recombinant insulin would propel the growth of the market are expected to boost the market growth.

North America accounted for the largest share of revenue in 2019, and is anticipated to maintain its dominance from 2020 to 2027, owing to increasing incidences of diabetes and geriatric population. However, Asia-Pacific is expected to grow at the highest CAGR, owing to favorable government policies and increasing R&D initiatives by key manufacturers.

Diabetes is a chronic, metabolic disease characterized by elevated levels of blood glucose (or blood sugar), which leads over time to serious damage to the heart, blood vessels, eyes, kidneys and nerves.

Rapid-acting insulin, is a type of synthetic (man-made) insulin which is injectable and is prescribed for people with diabetes to help control blood glucose (blood sugar) levels. It is absorbed into the bloodstream within minutes,to mimic the action of bolus insulin, the surge of insulin released by the pancreas in response to the ingestion of food.

Loading Table Of Content...