Red Wine Market Summary

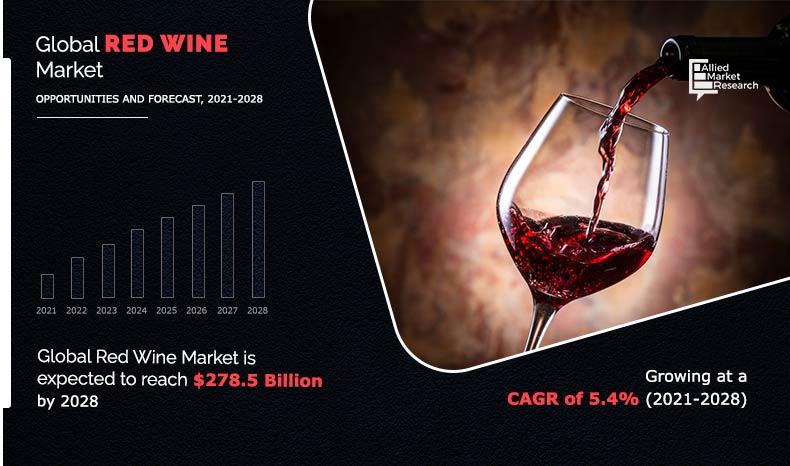

The red wine market size was valued at $182.0 billion in 2020, and is projected to reach $278.5 billion by 2028, registering a CAGR of 5.4% from 2021 to 2028.

Key Market Trends and Insights

Region wise, Europe generated the highest revenue in 2020.

The global red wine market share was dominated by the mass segment in 2020 and is expected to maintain its dominance in the upcoming years

The cabernet sauvignon segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2020 Market Size: USD 182.0 Billion

- 2028 Projected Market Size: USD 278.5 Billion

- Compound Annual Growth Rate (CAGR) (2021-2028): 5.4%

- Europe: Generated the highest revenue in 2020

Market Dynamics

Red wine is produced by fermenting the dark colored grapes and the color of the red wine varies from light to dark depending over the acid present in the wine. The older the wine the darker the color, this occurs due to the reaction between the molecules present in the wine with aging. Much of the red-wine production process; therefore, involves extraction of color and flavor components from the grape skin. It is a delicacy around the world. The cabernet sauvignon wine segment led in terms of the market share in 2020, and is expected to retain its dominance during the forecast period.

Lucrative packaging in terms of wine includes color, shape, and packaging of the red wine container. The key red wine market players are investing into packaging and labeling to get distinctiveness and centrality in their products. Moreover, the key players are coming up with new packaging styles which are handy and attractive. Likewise, in Australia, some market players introduced red wine packaging in can and are selling their wines in 250 ml cans with ring-pull tabs. In addition, the cans are made of aluminum and have a shelf life of five years, and are convenient for single or two-glass servings. Therefore, the packaging is the key attracting factor which is pulling the consumers to try or purchase different red wine options available in the market. Also, rise in awareness and acceptance toward recycling of used beverage containers among consumers is fueling the need for lucrative packaging of red wines. These factors are propelling high demand for red wine majorly across the regions of Western Europe and North America markets.

Nevertheless, the industry faces multiple challenges including but not limited to counterfeiting, adulteration, and deception. Adulteration of red wine results in a big loss to the key players as there is a large number of counterfeited wines in the red wine market. In China, approximately 50% of the foreign wines were found to be fake. Also, it was estimated that 70% of Château Lafite Rothschild bottles sold in China were fake and 60% of the wines sold in China as French wines were fake, which shows that wine counterfeiting is one of the major trends in the Chinese market, which is one of the biggest markets of the world. Furthermore, counterfeiting of established brands often tarnishes the brand image and brand loyalty; such malpractices challenges the market expansion of leading players operating in the market.

Segment Overview

The red wine market is segmented on the basis of product type, pricing, distribution channel, and region. By product type, the market is categorized into cabernet sauvignon wine, merlot wine, syrah/shiraz wine, and others. By pricing, the market is divided into mass and premium. By distribution channel, the market is categorized into on-trade and off-trade. Region wise the market is categorized into North America (U.S., Canada and Mexico), Europe (UK, Germany, France, Italy, Spain, Russia, Portugal. and rest of Europe), Asia-Pacific (China, India, Japan, and rest of Asia-Pacific) and LAMEA (Brazil, Argentina, South Africa, and rest of LAMEA).

By Product Type

Merlotsegment would exhibit the highest CAGR of7.4% during 2021-2028.

On the basis of product type, the global market is categorized into cabernet sauvignon wine, merlot wine, syrah/shiraz wine, and others. In 2020, the cabernet sauvignon wine segment accounted for the highest market share owing to its richness in flavor and tannins, which is good for brain and also it fights inflammation.

By Pricing

Premium segment would exhibit the highest CAGR of 6.8% during 2021-2028.

On the basis of pricing, the red wine industry is bifurcated into mass and premium. The mass segment leads in terms of market share and is contributing to more than half of the red wine revenue. However, the premium segment is expected to be the fastest growing segment during the forecast period.

By Distribution Channel

On-Trade segment would exhibit the highest CAGR of 6.0% during 2021-2028.

On the basis of distribution channel, the market is classified into on-trade and off-trade. The off-trade segment is dominating the market. However, the on-trade segment is expected to grow with the highest CAGR during the forecast period.

By Region

Asia Pacific region would exhibit the highest CAGR of 7.0% during 2021-2028.

Competition Analysis

Some of the major players profiled in the red wine market analysis include The Carlyle Group, Brown-Forman, Campari Group, Castel Winery Plc., Caviro sca, Constellation Brands, Inc., Rémy Cointreau, The Wine Group, Treasury Wine Estates, and Viña Concha y Toro.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging red wine market trends and opportunities.

- The report provides detailed qualitative and quantitative analysis of the current trends and future estimations that help evaluate the prevailing red wine market opportunities in the market.

- The red wine market forecast is offered along with information related to key drivers, restraints, and opportunities.

- The market analysis is conducted by following key product positioning and monitoring the top competitors within the market framework.

- The report provides extensive qualitative insights on the potential and niche segments or regions exhibiting favorable red wine market growth.

Red Wine Market Report Highlights

| Aspects | Details |

| By PRODUCT TYPE |

|

| By PRICING |

|

| By DISTRIBUTION CHANNEL |

|

| By Region |

|

| Key Market Players | TREASURY WINE ESTATES LIMITED, THE WINE GROUP, CAVIRO SCA, CONSTELLATION BRANDS, INC., CAMPRI GROUP, THE BROWN–FORMAN CORPORATION, CASTEL WINERY PLC., THE CARLYLE GROUP, REMY COINTREAU SA, VIÑA CONCHA Y TORO SA |

Analyst Review

In view of CXO, mass produced red wines are highly prevalent in developed countries of the Asia-Pacific region such as India however, the premium red wine segment has seen a surge in demand from the past half decade. In addition, urbanization, rising disposable income, and growth in middle class population has positively impact the premium red wine market. With growing number of pubs, bars, and breweries serving alcoholic beverages, premium red wine are driving the market expansion in both developed and developing economies. CXO further added, with increased awareness and consciousness, consumers now a days are scrutinizing food as well as beverages labels these days, with wines being no exception. Clean label, organic, natural, no additives, GMO free alcohol including red wine have been successfully launched in the market. For instance, Santa Julia Organic have launched organic red wine in malbec and cabernet catergory. With more players entering into organic market the market for organic red wine likely to gain high traction with new flavours and offerings to lure consumers. Counterfeiting and adulteration of red wines negatively impacts the market expansion. High extent of counterfeiting can be witnessed in developing countries such as India and China. The counterfeiting were as high as 50% for foreign liquors in some provinces of China. Counterfeiting negatively impacts the brand image and overall market growth thus act as a major challenge for engagged stakeholders.

The red wine market size was valued at $182.0 billion in 2020, and is projected reach $278.5 billion by 2028

The global Red Wine market is projected to grow at a compound annual growth rate of 5.4% from 2021 to 2028 $278.5 billion by 2028

Some of the major players profiled in the red wine market analysis include The Carlyle Group, Brown-Forman, Campari Group, Castel Winery Plc., Caviro sca, Constellation Brands, Inc., Rémy Cointreau, The Wine Group, Treasury Wine Estates, and Viña Concha y Toro.

Asia Pacific region would exhibit the highest CAGR

Increasing on-premise consumption and rapid premiumization drive the growth of the global red wine market.

Loading Table Of Content...