Refinance Market Research, 2032

The global refinance market was valued at $19.9 billion in 2022, and is projected to reach $44.6 billion by 2032, growing at a CAGR of 8.7% from 2023 to 2032.

Refinancing is the process of changing the conditions of a preexisting credit agreement, typically one that involves a loan or mortgage. When a person or company chooses to refinance a financial obligation, they are essentially looking to adjust the interest rate, the repayment schedule, and/or other contract terms in a way that benefits them. If accepted, a new contract extension that replaces the initial one is given to the borrower. Moreover, refinance provides immediate cash influx for urgent financial needs. Sometimes, refinance may reduce the value their asset holds.

Rising government initiatives and programs and an increase in the adoption of digital technologies for refinancing are boosting the growth of the global refinance market. in addition, the emergence of online refinance applications the positively impacts growth of the global market. However, a lack of awareness and accessibility about refinancing services security issues, and privacy concerns is hampering the refinance market growth. On the contrary, the enactment of technologies in existing product lines and the untapped potential of emerging economies is expected to offer remunerative opportunities for the expansion of the refinance market during the forecast period.

The refinance market is segmented into Type, Lenders and End User.

Segment Review

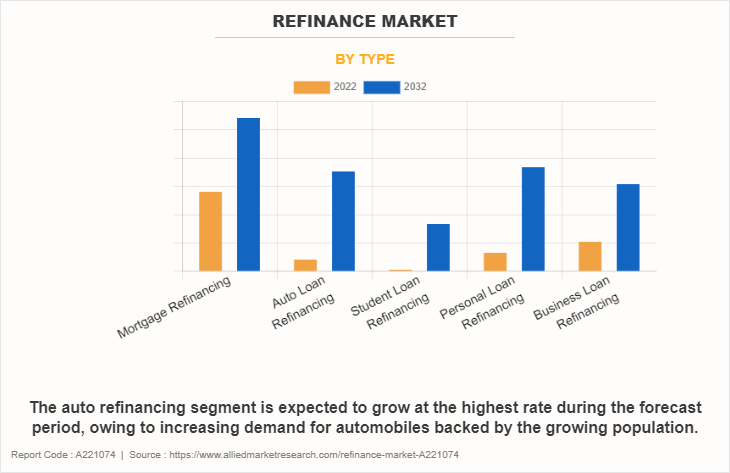

The refinance market is segmented on the basis of type, lenders, end user, and region. On the basis of type, the market is categorized into mortgage refinancing, auto loan refinancing, student loan refinancing, personal loan refinancing, and business loan refinancing. On the basis of lender, the market is fragmented into banks, NBFC’s, and Others. On the basis of end user, the market is bifurcated into individual and business. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of type, the mortgage refinancing segment holds the highest refinance market size, owing to increase in technical improvements in mortgage lending for underwriting automation and the use of machine learning in lending markets. However, the auto refinancing segment is expected to grow at the highest rate during the forecast period, owing to the rising number of auto loan, including refinancing.

Region wise, the refinance market share was dominated by North America in 2022 and is expected to retain its position during the forecast period. The growth can be attributed to the presence of a large number of prominent players in the region, such as WELLS FARGO & COMPANY, Bank of America, and ALLY FINANCIAL INC, among others. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the growing urban population adopting home loans and the rising mortgage loan offerings, including refinancing across the region.

The key players that operate in the refinance industry are Wells Fargo & Company, Bank of America Corp., Ally Financial Inc JPMorgan Chase & Co, Rocket Companies, Inc., Citigroup Inc., RefiJet, Better Holdco, Inc, loanDepot, Inc, and Caliber Home Loans, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the refinance industry.

Key Findings of the Study

Key Benefits

A refinance market occurs when the terms of an existing loan, such as interest rates, payment schedules, or other terms, are revised. Borrowers tend to refinance when interest rates fall. Refinancing involves the re-evaluation of a person or business's credit and repayment status. At the same time, banks and financial institutes are offering numerous refinance options to customers with fixed-rate mortgages and lower interest rates. The aforementioned factors are expected to act as growth impellers for the industry. Numerous players are focusing on developing and launching home refinance solutions to help customers qualify for refinancing options. Such product launches are aimed at providing a better customer experience to the customers. For instance, in July 2021, Ally Home, the lending arm of Ally Bank that caters to residential mortgages, launched RefiNow, a home financing option. RefiNow caters to the needs of customers facing difficulties in qualifying or ending up with slower refinancing due to barriers such as lower income levels.

Borrowers refinance market their existing loans to benefit from reduced monthly payments so that borrowers can pay faster, modify their loan terms, and cash out the home equity value are also major factors contributing to the industry’s growth. Cash-out refinance is a mortgage refinance that enables borrowers to liquidate home equity built up over the years by paying the original mortgage.

In a cash refinance, a new mortgage refi rates is obtained, which is higher than the original mortgage, by leveraging the home as collateral. The difference is paid out to the borrower in cash, which acts as a significant factor contributing to the market growth. The obtained cash can then be used to pay off the debt, eliminate the high-interest rates on credit cards, make home improvements, and invest in savings.

Digital Capability

Digital transformation aims to integrate computer technologies into an organization's business processes, strategies, and products. Organizations implement digital transformation to improve employee and customer engagement and services and increase competitiveness. Moreover, In the banking sector, digital transformation requires migrating to digital and online services. It typically requires making changes to backend processes to facilitate automation and digitization. To compete with digital-native companies, banks must deliver an end-to-end digital customer experience, integrating the technologies to perform previously manual tasks. In addition, the increase in adoption of technologies such as the cloud-based refinance, big data, and artificial intelligence (AI) is changing the landscape of the refinance industry.

In addition, the integration of such technologies with the banking process assists in advancing their visualization capabilities, resolving customer queries, and making complicated data usable. Moreover, these technologies help in increasing connectivity and providing advanced security methods in banks & financial institutions. For instance, according to SAS insights, 30% of the employees in the banking industry rely on and trust AI driven outputs and utilize them for enhanced business analysis.

Furthermore, AI-based refinance market provides real time insights to end-users and helps to improve network security, accelerating digital businesses and refinance offerings a better customer experience. The rising adoption of such technologies is expected to create numerous opportunities for players in the market. Key companies focus on completing partnerships and collaborations with other players to launch advance solutions based on core technologies such as AI and others. For instance, in January 2023, Temenos launched the next generation of its AI-driven, corporate Lending solution to enable banks to consolidate global commercial loan portfolios and unify servicing all on the Temenos banking platform.

Furthermore, Cloud computing is the most popular technology in banking and finance. Cloud-based services improve operations, increase productivity, and deliver products and services instantly. Integrating with the cloud also allows banks to use banking APIs. These APIs facilitate data sharing and improve the overall customer experience.

Digital assistants and chatbots leverage AI-based banking tools to provide customers with the information they need to solve various problems. AI is also useful for analyzing and managing data, securing it, and improving the customer experience. For example, AI-based analytics can process consumer data in seconds to detect recurring patterns. Machine learning is a related concept, allowing banks to collect, store, and compare customer data in real time. One of the main benefits of using ML for banking is fraud detection. Machine learning solutions can easily detect changes in user behavior and take rapid, preventative action.

Moreover, the solution simplifies complex loan processing and lifecycle management across lending lines and geographies, addressing the needs of large tier one as well as regional banks, many of which are struggling to seize the growth opportunity in corporate lending due to disparate systems and a lack of integration. These technical developments in improved AI standards will significantly pave numerous opportunities for global refinance market growth.

Top Impacting Factors

Rise in Government Initiatives and Programs

An increase in government initiatives and programs to assist low-income people in obtaining the benefits of lower interest rates in mortgages is one of the significant factors driving the refinance market growth. Moreover, the government has introduced refinance instruments to assist people in obtaining the benefits of refinancing loans, which is anticipated to drive market growth. For instance, some of the government initiatives in the U.S. include Federal Housing Administration (FHA) refinance loans, the U.S. Department of Veterans Affairs (VA) refinance loans, and the U.S. Department of Agriculture (USDA) refinance loans. In addition, various governments globally are partnering with market players across the globe to increase productivity. For instance, TCS partnered with Saudi Real Estate Refinance Company (SRC) and implemented a single, integrated technology platform for its core operations to refinance real estate. Therefore, a rise in such developing strategies leads to the refinance market growth.

Adoption of Digital Technologies for Refinancing

Technological advancements and innovations in the financial industry have the potential to reshape the refinancing market. Digital platforms, online loan marketplaces, and automated underwriting systems have streamlined the refinancing process, making it more accessible and convenient for borrowers. Technology-driven solutions also facilitate quicker loan approvals and enhance the overall customer experience. In addition, increase in demand for refinance process from developing nations, high government taxes, and stringent policies, further boost the growth of the refinance market.

Moreover, with further growth in investment globally and rise in demand for digital technology, various companies have expanded their current product portfolio with increased diversification among customers further boost the growth of the market. For instance, in May 2023, Temenos launched a fully integrated front-to-back, mortgage solution with a smart decision engine powered by Explainable AI, helping lenders to deliver a personalized digital mortgage experience while reducing their costs and time to close, which in turn drives the growth of the refinance market.

Restraints

Lack of Awareness and Accessibility about Refinancing Services

Lack of awareness and understanding of refinancing options, as well as borrowers’ willingness to explore refinancing opportunities, hampers the market growth. Factors such as education, financial literacy programs, and consumer confidence in the financial system can impact borrowers’ decision-making processes regarding refinancing, thus hampering the growth of the market. Furthermore, lack of accessibility to the financial institutions providing mobile money systems along with reliability issues can be a few factors restraining the growth of the refinance market.

Furthermore, there are many reasons for the industry’s persistent lack of accessibility. This lack of accessibility is attributable to easy access to financial services, especially in remote or underserved areas, which are unable to benefit from the convenience and efficiency offered by mobile money. Moreover, reliability issues such as network infrastructure, internet connectivity and payment processing systems restrain market growth. In regions with limited or unstable internet access, conducting digital transactions can be challenging. In addition, the availability of secure and efficient payment infrastructure in remote areas or developing countries may be inadequate, which hampers the growth of the refinance market.

Opportunities

Increase in Adoption of Advance Technologies in Existing Product lines and Untapped Potential of Emerging Economies

BFSI companies are increasing investments in machine learning and AI solutions to transform financial institute’s management for providing enhanced services to the end users and to automate the necessary solutions. In addition, with rise in complexity and competition in the BFSI market, the demand for industry-specific solutions increased to meet the goals of the companies and AI-based financial solutions are helping Fintech and other industries to enhanced their security and upsurge their revenue opportunity, which drives the growth of the refinance market. Furthermore, AI and machine learning can assist financial institutes at various stages of risk management process ranging from identifying risk exposure, measuring, estimating, to assessing its effects.

Moreover, increasing investments in AI and machine learning refinance offers the potential to transform the area of automation for time-consuming, mundane processes, and offering a far more streamlined and personalized customer experience, which is enhancing the growth of the market. In addition, major financial institutes such as the Bank of America, JPMorgan, and Morgan Stanley, are investing heavily in ML technologies to develop automated investment advisors and train systems to detect flags such as money laundering techniques and for other fraud cases, which in turn is expected to provide lucrative opportunities for the growth of the refinance market

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Refinance market analysis from 2023 to 2032 to identify the prevailing refinance market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Refinance market segmentation assists to determine the prevailing refinance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global refinance market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global refinance market trends, key players, market segments, application areas, and market growth strategies.

Refinance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 44.6 billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 294 |

| By Type |

|

| By Lenders |

|

| By End User |

|

| By Region |

|

| Key Market Players | Rocket Companies, Inc., Caliber Home Loans, Inc., Ally Financial Inc., RefiJet, Bank of America Corporation, Better Holdco, Inc., Wells Fargo & Company, Citigroup Inc., loanDepot.com, LLC, JPMorgan Chase & Co |

The Refinance market is estimated to grow at a CAGR of 8.7% from 2023 to 2032.

The Refinance market is projected to reach $ 44,628.02 million by 2032.

Asia-Pacific is expected to witness significant growth during the forecast period.

Rising government initiatives and programs and an increase in the adoption of digital technologies for refinancing are boosting the growth of the global refinance market. in addition, the emergence of online refinance applications the positively impacts growth of the refinance market. However, a lack of awareness and accessibility about refinancing services security issues, and privacy concerns is hampering the refinance market growth. On the contrary, the enactment of technologies in existing product lines and the untapped potential of emerging economies is expected to offer remunerative opportunities for the expansion of the refinance market during the forecast period.

Wells Fargo & Company, Bank of America Corp., Ally Financial Inc JPMorgan Chase & Co, Rocket Companies, Inc., Citigroup Inc., RefiJet, Better Holdco, Inc, loanDepot, Inc, and Caliber Home Loans, Inc.

Loading Table Of Content...

Loading Research Methodology...