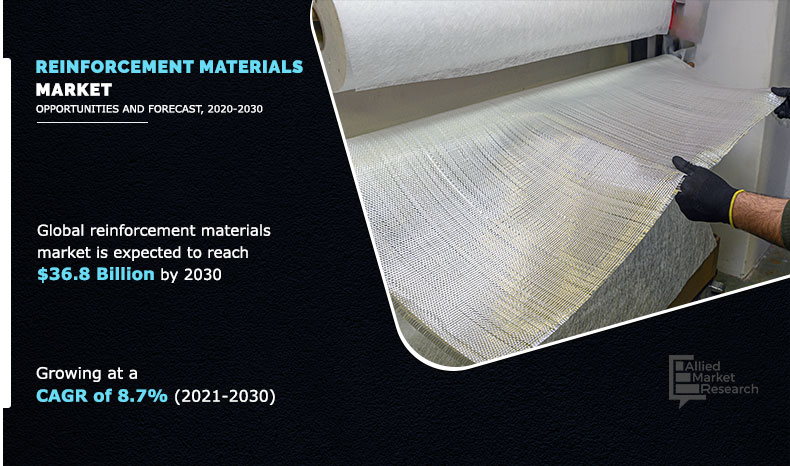

The global reinforcement materials market was valued at $16.3 billion in 2020, and is projected to reach $36.8 billion by 2030, growing at a CAGR of 8.7% from 2021 to 2030.

Reinforcement offers versatility in manufacturing with improved and optimized material properties. Particulate plastic reinforcements are also used in modern manufacturing methods such as injection molding, resulting in overall operating cost reduction. Natural fibers such as flax, jute, kenaf, hemp and sisal provide various benefits, such as weight reduction, cost reduction and recyclability. Reinforcements are used for enhancing properties such as stiffness and strength in composite materials. Glass fibers are considered the main reinforcements for polymer matrix composites, due to properties such as low moisture resistance, high electrical insulating properties and superior mechanical properties, depending on the alumina-lime-borosilicate composition.

For trucks and vehicles, reinforcement materials are used in tires owing to properties such as excellent abrasion, puncture and tear resistance resulting in long service life. Military reinforcement applications include the lightweight armor solution for ballistic assault protection. Continuous reinforcements are used in non-prestressed reinforced concrete to increase the structure's load-bearing ability by supplying high tensile strength and discontinuous reinforcements to increase the durability needed to change crack paths and crack mechanisms. However, the costly and complicated method of carbon fiber processing, problems related to the recycling and disposal of glass fibers and the heavy weight of particulate matter reinforced composites are hampering the growth of the demand for reinforcing materials. On the other hand, new advances in carbon/glass hybrid structures and the growing adoption of carbon fiber reinforced polymers in the medical industry are expected to provide significant market player opportunities during the forecast period.

The global reinforcement materials market is segmented based on material type, end-user, and region. By material type, the market is classified into glass fiber (roving, woven roving, fabrics, CSM/CFM, chopped strand, and others), carbon fiber (woven fabric, thermoset UD prepreg, thermoset fabric prepreg, thermoplastic prepreg, raw fiber, and molding compounds), aramid fiber (para-aramid fiber, and meta-aramid fiber & others), natural fiber (hemp, flax, kenaf, jute, and others), and steel rebar. According to end-user, it is divided into construction, aerospace & defense, transportation, wind energy, consumer goods, industrial, and others. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some of the key players operating in the global reinforcement materials market are BASF SE, Bast Fibers LLC, Binani Industries, DuPont, Honeywell International Inc., Hyosung Corporation, NFC FIBERS GMBH, Owens Corning, Teijin Limited, and Toray Industries Inc.

Global Reinforcement Materials Market, By Material Type

By material type, the glass fiber has emerged as the biggest product segment on the global market for reinforcement material. Glass fiber topped the reinforcement materials market in terms of volume and value owing to its benefits like its weight reduction and durability.

By Material Type

Glass Fiber is projected as the most lucrative segment.

Global Reinforcement Materials Market, By End-User

By the end-user, construction provided the largest share of the revenue. Reinforcement materials are extensively used in construction industry for basic foundation, constructing building and maintenance activities. Reinforcement materials are used for enforcing the mechanical properties of the building, and helps in making the structure stronger and stiffer.

By End-user

Construction is projected as the most lucrative segment.

Global Reinforcement Materials Market, By Region

By region, Asia-Pacific is a significant contributor to the global demand for reinforcing materials. Asia-Pacific region held the largest share of more than 41.4% in the reinforcement materials market in the year 2020. The rapid urbanization, the increase in investment for defense goods in developing economies like China and India have contributed to the increase in demand for reinforcement materials market.

By Region

Asia-Pacific holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Key Benefits For Stakeholders

- The report provides an in-depth analysis of the reinforcement materials market forecast along with the current and future market trends.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the global reinforcement materials industry for strategy building.

- A comprehensive reinforcement materials market analysis covers factors that drive and restrain market growth.

- The qualitative data in this report aims on market dynamics, trends, and developments.

Impact Of Covid-19 On The Reinforcement Materials Market

- The entire planet is now fighting against the virulent Covid-19 pandemic. Today we are witnessing the unbounded global spread of the disease. Unfortunately, it affects each of us, either directly or covertly. The virus outbreak has made many industries to shut down due to lack of raw material availability and disruptions in the supply chain. The worldwide lockdown has suspended the activities of construction and many other industries which results in declining the demand for reinforcement materials.

- For many countries the economy has dropped due to the halt of several industries, especially transport and supply chain. Because of lockdown, the product’s upcoming demand is hindered, as there is no development. Reinforcement materials are primarily used in manufacturing, aerospace & defense, transportation, and wind energy; and as a reaction to the national lockdown, these sectors were experiencing a sudden decline in growth rates. Consequently, there is a significant decrease in the market for construction materials in the first quarter of 2020, which is projected to continue in the next six months as well.

- The global pandemic has affected almost every sector in the world. The aramid fiber market is moderately affected, owing to disruptions in the global supply chain and hindrance in the refining and petrochemicals activities, which constitutes major end-users of aramid fiber. The market is highly dependent on the oil & gas, automotive, chemical, and telecommunication industries.

Reinforcement Materials Market Report Highlights

| Aspects | Details |

| By MATERIAL TYPE |

|

| By END-USER |

|

| By Region |

|

| Key Market Players | TORAY INDUSTRIES INC., HYOSUNG CORPORATION, BINANI INDUSTRIES, BAST FIBERS LLC, HONEYWELL INTERNATIONAL INC., DUPONT, BASF SE, NFC FIBERS GmbH, OWENS CORNING, TEIJIN LIMITED |

Analyst Review

According to the CXO of the leading companies, in its business life cycle, the global demand for reinforcement materials is heading into a period of growth stabilization. The factors driving the global market for reinforcement materials are growth in demand from the automotive & construction sector and low investment cost of glass fiber among other composites. In the building industry, glass fiber-reinforced material is commonly used for non-structural elements such as facades, doors, pipes, and channels. In addition, transport is the largest revenue-generating segment for reinforcement materials and the forecast duration is projected to remain the same. However, Asia-Pacific is one of the main contributors to the global demand for reinforcing content. Rapidly expanding urbanization and new infrastructure combined with growing high-end investment in defense products in emerging economies such as India and China, have fuelled growth in the region's reinforcement content.

The Reinforcement Materials Market is worth because the reinforcement material composite is lighter in weight as compared to individual components, resulting in increased applications in the automotive, aerospace & defense, and construction industries.

The Global Reinforcement Materials Market is projected to grow at CAGR of 8.7% during the forecast period

Glass fiber is the leading segment in the Reinforcement Materials Market

Growing reinforcement materials use in aircraft manufacturing and increasing demands in the automotive industry for lightweight materials are driving Reinforcement Materials Market

BASF SE, Bast Fibers LLC, Binani Industries, DuPont, Honeywell International Inc.,Toray Industries Inc. are the leading players in Reinforcement Materials Market

Rise in the construction industry, increasing focus on green buildings, and growing demand for value added glass products are some of the major trends favoring the market growth.

Asia-Pacifc region hold the highest share in the Reinforcement Materials Market

New advances in carbon/glass hybrid structures and the growing adoption of carbon fiber reinforced polymers in the medical industry are expected to drive the Reinforcement Materials Market

Loading Table Of Content...