Renewable Energy Certificate Market Overview:

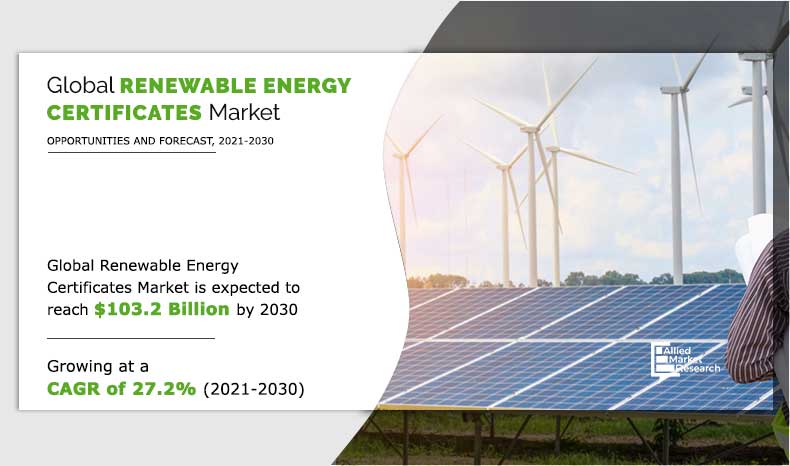

The global renewable energy certificate market size was valued at USD 9.3 billion in 2020, and is projected to reach USD 103.2 billion by 2030, with global renewable energy certificate market forecast expected at a CAGR of 27.2% from 2021 to 2030. The increase in demand for power across the globe and the state policies towards the companies to fulfil the targets needed to use renewable energy. The increase in the renewable energy market share from the roof top solar panels, micro wind turbines, and micro hydro power plants are driving the growth of the market. The government policies towards the development of these cost effective and sustainable resources are driving the growth of the market. The presence of water stream, canals and other flowing water resource places are driving the demand for mini hydro power plant. These factors majorly drive the growth of the market.

Key Market Trend and Insights

- By end use, compliance market dominates the market during the forecast period.

- By energy type, the solar energy segment holds the maximum share of the market.

- Region wise, North America is expected to grow at the highest revenue CAGR during the forecast period.

Market Size & Forecast

- 2020 Market Size: USD 9.3 Billion

- 2030 Projected Market Size: USD 103.2 Billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 27.2%

Introduction

Renewable energy certificate also known as green tags, renewable Energy Credits, or Tradable renewable Certificates which are tradable, non-tangable energy commodities in the United States that represent proof that 1MWh of electricity was generated from an eligible renewable energy source.

Market Dynamics

The incompleteness of the regulations and not completely formed organization on the basis of this market is also one of the reasons restraining the growth of the market. The favorable policies for local resources over imports to encourage local renewable energy development and to protect local or regional resources from competition from cheaper RECs from outside the region have put an unconstitutional restrain of interstate trade under the U.S. Commerce Clause. The un-awareness among the developing countries regarding the renewable energy certificates especially in India for individual people as most of the RECs produced in India are bought by the compliance market which accounts for nearly 99% hampering the growth of renewable energy certificate market.

The rapid innovation, development of communication technology and demand for power generated from renewable energy to offset the GHG emission will increase the demand for renewable energy certificate materials. The development of micro hydro power plant a type of hydro-electric power scheme that produces up to 100 KW of electricity using flowing steam or a water flow. The electricity from such systems is used to power isolated homes or communities and is sometimes connected to the public grids. In addition to this the development of micro wind turbines all over the world and their cost effectiveness and suitability to provide energy for the homes and the excess is sold to the public grids. The above-mentioned applications will provide ample opportunities for the growth of renewable energy certificate market.

Segment Overview

The renewable energy certificate market is segmented on the basis of energy type, capacity, end user and region. On the basis of energy type, the global renewable energy certificate market is segmented into solar energy, wind power, hydro-electric power, and gas power. On the basis of capacity, it is introduced as 0-1,000KWH, 1,100-5,000KWH, and more than 5,000KWH. The End user introduced in the study includes voluntary and compliance. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, North America accounts for the largest share of the market, followed by Asia Pacific and Europe.

REC Market by Energy Type

The solar renewable energy dominates the renewable energy certificate market as large scale hydropower plants does not come under the RECs category. Solar power is the conversion of energy from sunlight into electricity, either directly using photovoltaic, indirectly using concentrated solar power. Photovoltaic initially used as a source of electricity for small and medium sized applications, from calculator powered by a single solar cell to remote homes powered by off-grid rooftop PV systems. Solar PV is rapidly becoming an inexpensive, low carbon technology to harness renewable energy from the sum. In 2019, solar power generated 2.7% of the world’s electricity, growing over 24% from the previous year. As of October 2020, the cost of electricity for utility-scale solar power is around $36/MWh. The rapid development of solar power generation across the world and the increase in demand for renewable energy are driving the growth of the market. The depletion of fossil fuel resources and increase in global warming across the world has fostered the growth of the solar power generation. The government policies to develop roof top solar panels and small scale solar power generation plant. The heavy investment by the government and private institutes in the field of renewable energy especially in large scale solar power plants is driving the growth of the market. The above-mentioned applications and investments in the solar renewable energy will provide ample opportunities for the growth of the market.

By Energy Type

Solar Energy is projected to create abundant $ opportunity till 2030

REC Market by Capacity

More than 5,000 KWH dominates the renewable energy certificate market. The rapid development of solar farms, wind farms, and other renewable power generation across the world and the increase in demand for renewable energy are driving the growth of the market. The depletion of fossil fuel resources and increase in global warming across the world has led to the foresight of powerful countries to develop renewable energy. The need for fast development in the renewable energy sources led to the government policies to support household and public power generation plants to increase the renewable energy power generation. The rapid development and presence of excess power in the power generation plants led to the development of renewable energy certificate which can be used to sell the energy to the trader and the respective consumer. The above-mentioned applications and the government policies will provide ample opportunities for the renewable energy certificate market growth.

By Capacity

More than 5,000 KWh segment is projected as the most lucrative segment.

REC Market by End Use

The compliance market dominates the renewable energy certificate market due to the presence of major manufacturing industries are buying renewable energy credits to offset the GHG emissions. Major energy utility companies across the world need to have certain percentage of renewable energy credits in order to qualify certain government policies in order to offset their carbon foot print. The major manufacturing companies such as Tesla, Microsoft, Google, and other companies across the world especially in U.S have minimum requirement to have renewable energy credits to offset the GHG emissions. The increase in demand for energy and the government polices to offset the GHG emission is also major factor for the growth of the market. The increase in large scale renewable power generation and presence of excess energy in small scale power generation plants are boosting the demand for renewable energy certificates. The above-mentioned applications and the government projects will provide ample opportunities for the growth of the market.

By End Use

Voluntary segment is projected as the most lucrative segment.

Why is North America Seen as an Opportune Region?

The North America dominates the renewable energy certificate market. In the U.S., RECs are tradable, non-tangible energy commodities that represent proof that 1 MWh of electricity was generated from eligible renewable energy resources and was fed into the shared system of power lines which transport energy. There are two main markets for renewable energy certificates in the United States that is compliance markets and voluntary markets. In 2021, SREC prices range from $10 to over $400 depending on the state SREC market.

In Canada, BC hydro offers $3/MWh for “green attributes energy” on long term contracts for 20 years. The increase in the demand for power and development of renewable energy has driven the growth of the market. The established and presence of regulation for the trade of renewable energy sales are driving the growth of the market. The government policies and the development of house hold renewable energy power source have driven the growth of the market. In addition to this, the presence of highly intensive energy consuming companies in this region led to the demand for renewable energy certificate to offset their carbon footprint is also one of the driving factors for the growth of the renewable energy certificate market.

By Region

Asia-Pacific holds a dominant position in 2020

Key Renewable Energy Certificate Companies:

Major companies profiled in the renewable energy certificate industry include:

- Central Electricity Regulatory Commission

- Green-e Energy

- Environmental Tracking Network of North America

- Western Area Power Administration

- General Services Administration

- U.S. Environment Protection Agency

- Defense Logistics Agency Energy.

Due to rapidly increasing demand in the demand for energy from the renewable energy resources led the key manufacturers expand their power generation capacities in order to meet market demand across the globe. Additional growth strategies such as acquisition, and business expansion strategies, are also adopted to attain key developments in the renewable energy certificate market trends.

Key benefits for stakeholders

- This report provides a detailed quantitative analysis of the current market trends and estimations from 2020 to 2030, which assists to identify the prevailing opportunities.

- An in-depth renewable energy certificate market analysis of various regions is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the market is provided.

- Region-wise and country-wise market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2020 to 2030 in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global renewable energy certificate market.

Renewable energy certificate Market Report Highlights

| Aspects | Details |

| By ENERGY TYPE |

|

| By END USE |

|

| By CAPACITY |

|

| By Region |

|

| Key Market Players | Defense Logistics Agency Energy, Central Electricity Regulatory Commission, Environmental Tracking Network of North America, Western Area Power Administration, U.S. Environment Protection Agency, Green-e Energy, General Services Administration |

Analyst Review

The global renewable energy certificates market is expected to witness increased demand during the forecast period, due to rapid increase in the demand for energy from the sustainable energy resources across the globe throughout the forecast period.

Rapid innovation in the development of communication technology and internet is the major driving reason for the growth of the renewable energy certificate market. The increase in the awareness among the people regarding global warming caused by the thermal power plant has led to increase in the demand for renewable energy. The depletion of fossil fuel resources on the planet and the fluctuations in the market price of these raw materials is one of the major factors driving the growth of the market. The government policies and investment toward the development of renewable energy resources especially solar and wind is a major driving factor for the growth of the market. Increase in the renewable energy market share from the roof top solar panels, micro wind turbines, and micro hydro power plants drive the growth of the market. The presence of excess energy generated from the roof top panels and other resources has led to the demand for renewable energy certificates which are used as a proof to sell the power to the public grid. The presence of water canals and other flowing water resource places drive the demand for mini hydro power plant.

The increase in efficiency of energy conversion and innovation in the sustainable power generation through roof top solar panels, and small-scale hydro power plants. The rise in policies to harness energy from small scale renewable resources such as water stream, canals, and low winds. In addition, the development of micro wind turbines all over the world and their cost effectiveness and suitability to provide energy for homes and the excess is sold to public grids.

Moreover, companies are inheriting merger, and business expansion strategies to boost the growth of the renewable energy certificate market throughout the forecast period. The future demand for power from eco-friendly resources and their advantages is projected to foster the growth of the renewable energy certificate market.

Residential, commercial and industrial users are the potential customers of Renewable Energy Certificate industry

Mergers, acquisitions and partnerships are the key growth strategies of Renewable Energy Certificate Market players

To get latest version of renewable energy certificate market report can be obtained on demand from the website.

Asia-pacific will provide more business opportunities for Renewable Energy Certificate in future

Solar energy segment holds the maximum share of the Renewable Energy Certificate Market

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Increase in the environmental awareness among the people and rapid innovation and investment in the development of sustainable renewable energy resources are the key drivers and opportunities boosting the Renewable Energy Certificates market growth

Central Electricity Regulatory Commission, Green-e Energy, Environmental Tracking Network of North America, Western Area Power Administration, General Services Administration, U.S. Environment Protection Agency and Defense Logistics Agency Energy

The renewable energy certificate market is segmented on the basis of type of energy, capacity, end use, and region. On the basis of energy type, the global renewable energy certificate market is segmented into solar energy, wind power, hydro-electric power, and gas power. On the basis of capacity, it is introduced as 0-1,000KWH, 1,100-5,000KWH, and more than 5,000KWH. The end use introduced in the study includes voluntary and compliance. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA

Presence of excess power from small scale renewable energy resource is the key current trends influencing the Renewable Energy Certificate Market in the next few years

Loading Table Of Content...