Residential Air Filter Market Research, 2031

The global residential air filter market was valued at $3.5 billion in 2021 and is projected to reach $7.1 billion by 2031, growing at a CAGR of 7.3% from 2022 to 2031.

The residential air filter industry is expected to witness growth during the forecast period, owing to growth in the sales of HVAC systems and air conditioners. Heating, ventilation, and air-conditioning (HVAC) systems have been a household staple in Western countries for a long time. On the other hand, air-conditioners are far more common in the Asia-Pacific region. However, both the equipment are sold in large numbers globally in all regions. The market for this equipment is fairly well-established and results in consistent sales every year.

The market is also expected to be driven by an increase in policies and awareness to maintain indoor air quality (IAQ). Indoor air quality (IAQ) comprises various types and sources of pollutants inside residential buildings. It is an important cause of premature deaths and diseases in developing economies. Indoor air pollution has immediate as well as long-term effects on occupants, which has gained the attention of governments. Laws and regulations to maintain indoor air quality have been announced by governments of many countries. This is expected to boost the market for residential air filters. Furthermore, the degradation in air quality is also expected to provide an impetus to the residential air filter industry. In the current scenario, both indoor and outdoor (ambient) air quality has degraded due to urbanization and rapid industrialization, and residential air filters help improve this air quality by cleaning the air through HVAC systems, air-conditioners, and other relevant products.

Meanwhile, the market is restrained by high initial capital requirements and operational costs. Residential air filters encounter high initial costs on account of the amount of material required to provide efficient filtration. However, such highly efficient filtration media also resists the free flow of air through HVAC systems. This in turn increases energy consumption by HVAC equipment. On the other hand, the opportunity during the forecast period lies in the higher focus on the use of nanotechnology for residential air filters.

A residential air filter is a device used for the removal of airborne particles, microorganisms, and pollutants that are hazardous to the ecosystem and health. Such particles include a wide variety such as germs, bacteria, viruses, fibers, mold, pollen, powder dust, etc. Air filters operate by drawing unclean air from surrounding areas, which then passes through its filter medium consisting of fine openings. The unwanted particles which are larger than the openings are caught in the filter medium and separated from the surrounding air. After this, the air leaves the filter with a considerable reduction in particle content. Residential air filters can be found in heating, ventilating, and air conditioning (HVAC) systems as well as air conditioners. They also need to be replaced regularly in these equipment. Residential air cleaners are required in houses because the indoor air quality can be of a degraded nature due to a variety of reasons such as vehicular traffic, urbanization, and lack of proper heating and cooking stoves.

Segment Overview

The residential air filter market is segmented into filter type and region.

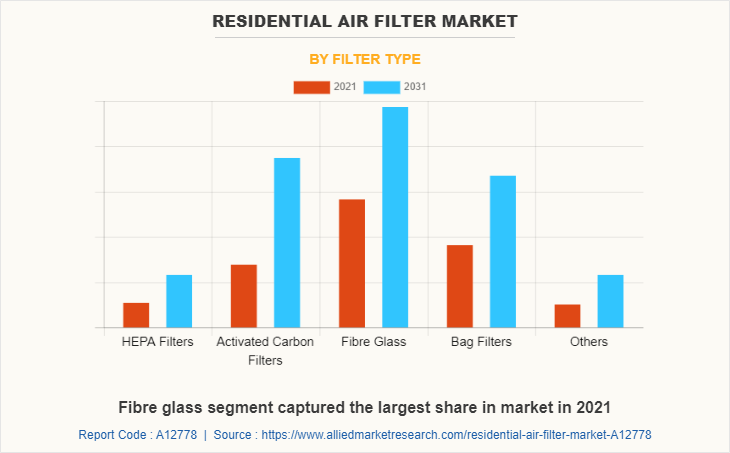

Based on filter type, it is fragmented into HEPA filters, activated carbon filters, fiberglass, bag filters, and others. The fiberglass segment dominated the residential air filter market share in terms of revenue in 2021. However, the activated carbon filters segment is expected to expand at a higher growth rate during the forecast period in the electronic residential air filters. Gases like volatile organic compounds (VOCs) are very small and not trapped by HEPA air filters. Hence, homes facing VOC problems are encouraged to use activated carbon air filters. This is a major driving factor for this type of air filter. VOCs is a large category that includes gases and cigarette smoke, as well as chemicals like formaldehyde and benzene.

In terms of region, Asia-Pacific dominated the market with the largest share in 2021. However, the LAMEA region is expected to witness the highest growth rate during the forecast period. Asia-Pacific has dominated the global market on account of high economic growth in the past decade. Asia-Pacific is now considered the growth center of the global economy owing to its large population base and strong economic growth in comparison to other regions. This has led to increased living standards among the people of that region, which has spurred the residential air filter market. However, rapid urbanization and industrialization will drive the growth of the market in the LAMEA region.

Competition Analysis

Competitive analysis and profiles of the major residential air filter market players that have been provided in the report include Camfil AB, Parker Hannifin Corporation, Daikin Industries Ltd., MANN+HUMMEL Group, Purafil Inc., Lydall-Gutsche GmbH & Co. Kg, Emerson Electric Co., 3M Company, Johnson Controls International plc, and Freudenberg Filtration Technologies SE & Co. KG. These key players adopt several strategies such as new product launch and development, acquisition, partnership and collaboration and business expansion to increase their market share in the global residential air filter market during the forecast period.

Top Impacting Factors

A top impacting factor for the global residential air filter market growth includes the growth in the sales of HVAC systems and air conditioners. These equipment are sold globally and their market is fairly well-established and results in consistent sales every year. Air conditioners are sold regularly in developed as well as developing nations. In fact, in November 2022, Daikin decided to invest US$ 711 million in India and Southeast Asia in the coming four years to manufacture smaller air conditioners and core parts. Another impacting factor is the increase in policies and awareness to maintain indoor air quality (IAQ). For instance, WHO has stated that high exposure to smoke from cooking fires results in approximately 3.8 million premature deaths every year, especially in middle- and low-income countries. This has led to several laws and regulations by governments to maintain indoor air quality. Lastly, the market is expected to be boosted by the degradation of air quality. One of the primary reasons for this air pollution is the growth in vehicular traffic in urban areas, causing health issues for people living next to busy roads. According to the World Health Organization (WHO), it is estimated that around seven million people die prematurely each year, due to combined effects of household and ambient air pollution. Meanwhile, a negatively impacting factor on the market is the high initial capital requirements and high operational costs. Residential air filters are costly because they require a considerable amount of material to be manufactured and they increase energy consumption because they resist the free flow of air through HVAC systems. However, the opportunity that will most impact the market in the coming years is that of a higher focus on the use of nanotechnology for residential air filters.

Historical Data & Information

The residential air filter market outlook is fairly competitive, owing to the strong presence of existing vendors. Market vendors are expected to gain a competitive advantage over their competitors because they can cater to market demands with a wide range of products. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies are adopted by key vendors.

Key Developments/Strategies

Camfil AB, 3M Company, Parker Hannifin Corporation, Purafil Inc., and Daikin Industries Ltd. are the top 5 companies that hold a prime share in the residential air filter market opportunity. Top market players have adopted various strategies such as product launches, contracts, and others to expand their foothold in the residential air filter market forecast.

- In December 2021, Camfil AB announced that it will build a new manufacturing facility in Synergy Park located in Kilgore, Texas. Working closely with Site Selection Group, LLC and KEDC (Kilgore Economic Development Corporation), Camfil plans to invest more than US$ 50 million in the facility, which will add more new jobs.

- In February 2020, Parker HVAC Filtration, a division of Parker Hannifin Corporation, launched a new line of MICROPLEAT® high-efficiency filters designed specifically for HVAC applications. The filters feature a media blend and a mini-pleat design that provide outstanding particulate removal, dust-holding capacity, and efficiency making them an excellent choice as a high-purity air filter.

- In June 2021, Daikin announced a distribution partnership with American Air Filter (AAF), a leading company in the global filtration market. This relationship will strengthen its response to the growing need for ventilation and air purification and help position it in the market as a company that provides air solutions.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the residential air filter market analysis from 2021 to 2031 to identify the prevailing residential air filter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the residential air filter market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global residential air filter market trends, key players, market segments, application areas, and market growth strategies.

Residential Air Filter Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 7.1 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 184 |

| By Filter Type |

|

| By Region |

|

| Key Market Players | mannhummel group, Emerson Electric Co., Camfil AB, 3M Company, Parker Hannifin Corporation, Freudenberg Filtration Technologies SE & Co. KG, Johnson Controls International plc, Daikin Industries Ltd., Purafil Inc., Lydall-Gutsche GmbH & Co. Kg |

Analyst Review

The degrading quality of air in urban areas is expected to boost demand for heating, ventilation, and air conditioning (HVAC) equipment such as HVAC systems and air conditioners, which, in-turn, would drive growth of the residential air filter market. Rise in pollution on account-of vehicular traffic and industrial development, especially in countries such as India and China is affecting people’s health. This has created awareness for air quality maintenance in indoor spaces, which is expected to influence growth of the residential air filter market.

With the spread of coronavirus, people have realized the importance of indoor air quality (IAQ) in residences and homes, owing to government-imposed lockdowns. Concerns related to COVID-19 virus and similar bacteria and viruses that spread through air have highlighted the role of HVAC systems in residential spaces.

Guidelines and regulations specifically aimed towards HVAC products and general ventilation rules in the post-pandemic world can curb the risk of spreading the virus through air conditioning systems and air ducts. In addition, organizations such as the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) have developed strategies and resources including differential room pressurization, dilution variation, source capture variation, and ultraviolet germicidal irradiation (UVGI) to assist in maximizing the role of HVAC filtration systems in creating a positive impact on the coronavirus spread.

Demand for operation and maintenance of pre-installed systems is expected to rise significantly post-COVID. The government-imposed lockdowns and restrictions on people’s movements have stopped people from carrying-out proper maintenance of their systems. They are expected to take these actions in the post-COVID period. Thus, the service industry is anticipated to surge back in the future. Further, developments in HVAC filter technologies such as disinfection of filters and use of UV light in filter system can promote growth of the HVAC market even after the pandemic ends. Such technologies, along with research and development of nanotechnology for use in residential air filters is also expected to help the market in the long-term.

The estimated market size of residential air filter market is $3,538.67 million

Fibre glass segment is the leading filter type of residential air filter market

Asia-Pacific is the largest regional market of residential air filter market

The residential air filter market is estimated to expand at 7.3% CAGR during the forecast period of 2022-31.

The top companies which hold market share in residential air filter market are Camfil AB, Parker Hannifin Corporation, Daikin Industries Ltd., MANN+HUMMEL Group, Purafil Inc., Lydall-Gutsche GmbH & Co. Kg, Emerson Electric Co., 3M Company, Johnson Controls International plc, and Freudenberg Filtration Technologies SE & Co. KG.

Loading Table Of Content...