Residential Pest Control Products Market Summary, 2031

The global residential pest control products market size was valued at $6.6 billion in 2021, and is projected to reach $11.5 billion by 2031, growing at a CAGR of 5.8% from 2022 to 2031. Residential pest control products are intended to prevent, destroy, repel, and mitigate any kind of pests that thrive in the residential settings, such as apartment, societies, and independent homes. The most prominent types of pests that thrive in the residential setting include, rodents, flies, bed bugs, ants, termites, wasps, cockroaches, mosquitoes, spiders, and others. These pests pose a severe threat to the health of humans and pet animals as well.

The residential pest control products market is segmented into Type, Application Techniques, Pest Type and Distribution Channel.

According to the World Health Organization, for Cutaneous Leishmaniasis, the estimated number of new cases each year ranges from about 700,000 to over 1.2 million. Furthermore, over 17% of the all infectious diseases are vector borne diseases that cause over 700,000 deaths annually across the globe. Therefore, the rise in prevalence of various infectious diseases among the population owing to the insects and other pests is expected to boost the demand for the residential pest control products and drive the residential pest control products Residential Pest Control Products Market Growth.

The rising technological advances and growing adoption of digital technologies has resulted in the development of various advanced UV and LED technology-based electronic insects and fly traps that have low energy consumption, improved performance, and higher effectiveness in catching and executing different types and species of insects. These technologically advanced fly traps are expected to witness rapid traction in the market among the residential users across the developed and developing regions like Europe, Asia-Pacific, and North America.

Furthermore, the rising popularity of the organic pest control products is gaining a rapid traction among the residential consumers across the globe. The increased health consciousness regarding the adverse health impacts of traditional chemical based insecticides and pesticides, and rising demand for the eco-friendly products among the consumers are significantly fostering the demand for the organic pest control products.

The implementation of stringent government regulations pertaining to promote the application of bio-based pesticides has significantly fostered the demand for the organic pesticides in the developed regions like North America and Europe. In addition, constant changes in climatic conditions are a prominent factor for growth of pests, as pests survive at elevated temperature.

However, toxicity and health-related issues due to chemicals present in pesticides is a significant factor restraining the growth of the market. On the contrary, ongoing R&D activities to increase the dependency on bio-based pesticides are expected to offer lucrative growth opportunity.

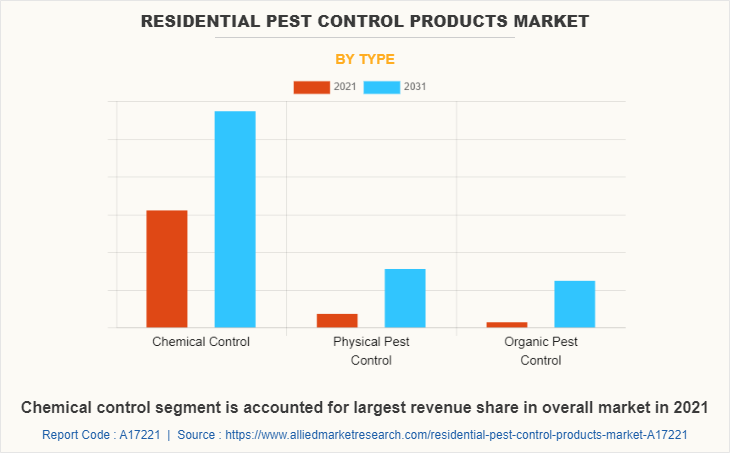

The residential pest control products market is segmented on the basis of type, application technique, pest type, distribution channel, and region. Depending on type, the market is categorized into chemical control, physical pest control, and organic pest control. The chemical control segment is further bifurcated into pesticides, rodenticides, poison baits, and others. The physical pest control segment is divided into traps and bait stations, glue boards, noicemakers, bug zappers, and others.

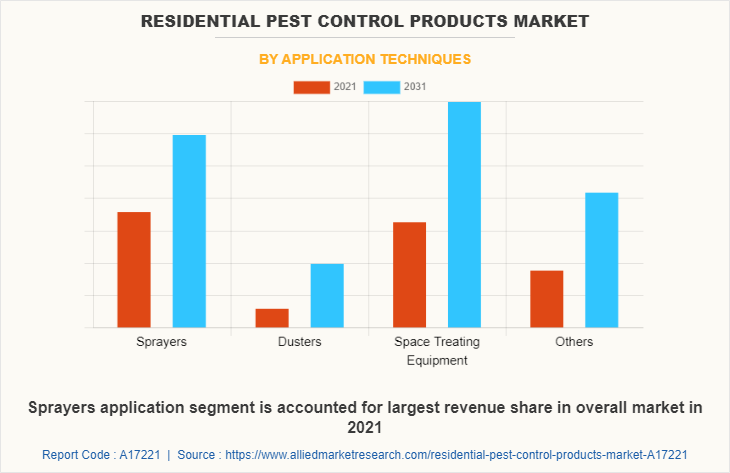

On the basis of application techniques, it is classified into sprayers, dusters, space treating equipment, and others. Further, sprayers segment is categorized into compressed air sprayer and small hand sprayers. Dusters is segmented into hand shakers, foot pump, and hand crank dusters. Space treating equipment is segregated into aerosols, fogs, mists, and others.

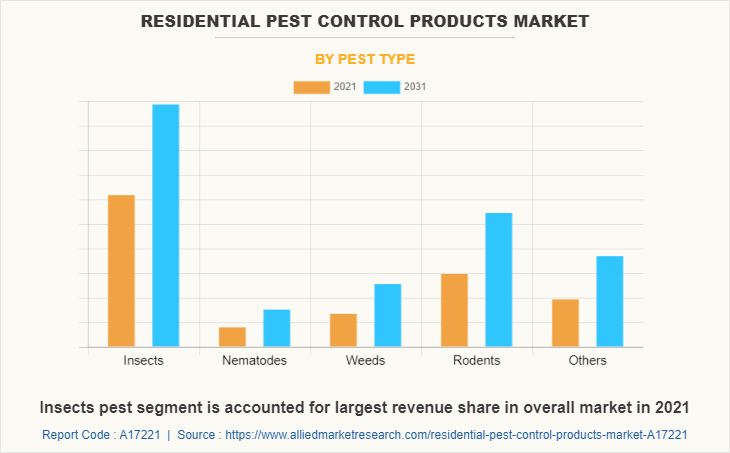

By pest type, the market is segregated into insects, nematodes, weeds, rodents, and others. Furthermore, the insects segment is categorized into chewing insect, piercing insect, and others.

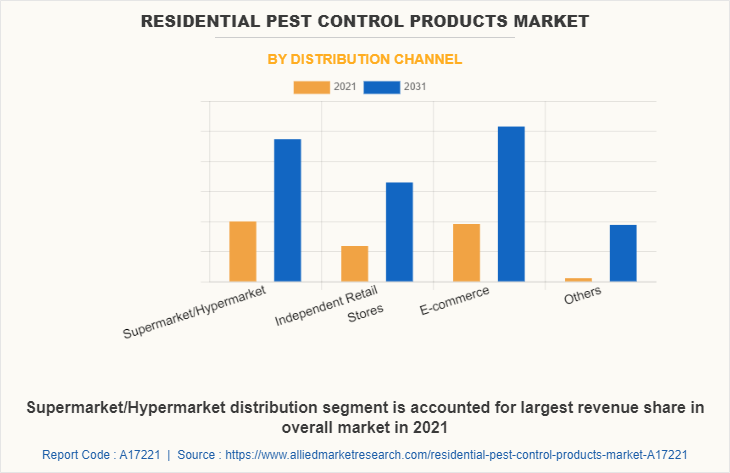

By distribution channel, the market is bifurcated into supermarket/hypermarket, independent retail stores, e-commerce, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

As per the residential pest control products market forecast, based on type, the chemical control segment dominated the market with 62.2% of the residential pest control products market share in 2021, and is expected to retain its dominance during the forecast period. The increased efficiency and effectiveness of the chemical pesticides and insecticides in killing pests has led to the dominance of this segment in the global market.

Chemical pest control method is an effective way for controlling pest in terms of scale, efficiency, and rapidity. Advantages of chemical fungicides, such as enhanced eradication of mycotoxin-producing pathogen, enhanced value per cost, and efficiency of killing fungi & spores drive the growth of chemical residential pest control products market.

For instance, Artichoke is a chemical fungicide that is manufactured by California-based company. It has earned 27 million pounds of artichokes for 1,000 pounds of chemical fungicide being manufactured. In addition, it will attract insecticides to pest colony and help eradicate completely.

By application techniques, the sprayers segment dominated the Residential Pest Control Products Market Size in 2021. The higher efficiency is a prominent factor that sprayers are chosen for use in residential applications by a huge number of residential users. The easy availability and easy to use features of the sprayers has boosted the growth of the segment across the globe. Using pesticides for preventing pests has been made easier with the aid of sprayers. The insecticide can be distributed evenly in all places with the help of a sprayer.

Spraying is a technique to control pests by adding organic chemicals to water and using a nozzle to make the solution shoot out of the nozzle. There are an estimated 30 million living insect species, according to research by Terry Erwin of the Smithsonian Institution's Department of Entomology in the forest canopy of Latin America. With a single pesticide bottle, hundreds of bugs can be eliminated by simply spraying it around the places in a particular household space.

By pest type, the insects segment garnered a market share of 46.7% in 2021. The presence of huge insect population as pests in residential settings across the globe has led to the dominance of this segment in the market. According to research by Terry Erwin of the Smithsonian Institution's Department of Entomology in the forest canopy of Latin America, the number of living insect species is estimated to be 30 million. The most major diseases caused by insects include, cholera, dysentery, typhoid fever, leprosy, malaria, and dengue.

According to the World Health Organization, malaria infection caused by the Anopheline mosquitoes, infects around 219 million people, and it results in over 400,000 deaths annually, across the globe. The rising incidences of various infectious diseases among the global population is significantly boosting the growth of the insects segment in the globaResidential Pest Control Products Industry.

Depending on distribution channel, the e-commerce is the expected to be the fastest-growing segment in the market. E-commerce is gaining rapid traction across the globe owing to the rising adoption of smartphones and increasing access to the internet. According to the International Telecommunication Union (ITU), around 4.9 billion people were using internet across the globe in 2021.

Moreover, the aggressive marketing strategies adopted by various online platforms, such as Amazon, Flipkart, eBay, Wal-Mart, and various other e-commerce platforms, which specializes in the various pest control and fly trap products is significantly boosting the growth of the e-commerce segment. Increase in adoption of various online portals in developing regions and rise in the number of offers or discounts provided by these sites attract consumers to purchase residential pest control products through e-commerce channels.

Moreover, online sales have increased consumer reach, owing to which it has evolved as a key source of revenue for many companies. Furthermore, the e-commerce sales market is expected to expand in the future, owing to rapid growth in online and mobile user customer bases in emerging markets. Increase in online sales, improvements in logistics services, ease in payment options, and facility to enter new international markets for major brands further boost the Residential Pest Control Products Market Share.

Region-wise, North America dominated the global residential pest control products market, garnering a market share of 34.3% in 2021. The increased awareness regarding the diseases spread by pests, increased product penetration in the U.S., rising healthcare costs, growing prevalence of infectious diseases, and rising residential applications are the major factors that led to the dominance of the U.S. and eventually,

North America in the global residential pest control products market. Presence of regulatory bodies in the U.S. such as Environmental Protection Agency (EPA), Federal Insecticide, Fungicide and Rodenticide Act (FIFRA), and Federal Food, Drug and Cosmetic Act (FFDCA) ensures safety of pesticides on public and environment. In addition, pest control products are sold in the U.S. market after they get approved by these regulatory bodies.

According to Smithsonian Institution's Department of Entomology, in the U.S. there are approximately 91,000 described species of insect and about 73,000 of undescribed species. The residential pest control products market is driven by a number of factors, including the increasing prevalence of diseases and pests, growing awareness of the importance of pest control, and availability of new and effective pest control products.

LAMEA is expected to witness the highest CAGR of 8.0% from 2022 to 2031. According to survey for 500 houses in city of Sao Paulo, it was found that termite pests, such as subterranean termite, Coptotermeshavilandi, predominates, and aerial nests growth was major threat that leads to infestations in buildings. As a result, there is a growing demand for residential pest control products, such as insecticides, pesticides, and rodenticides, in the region.

The growth of the market is attributed to the rising concerns over the health hazards posed by the pests, which has resulted in the increased use of pest control products in residential areas. Moreover, the changing lifestyle of people and the growing preference for eco-friendly products are also some of the major factors driving the Residential Pest Control Products Market Growth.

Some of the major players analyzed in this report are BASF SE, Bell Laboratories, Brandenburg, Cortve Agriscience, EcoClear Products, EPest Supply, Monterey, Nixalite, Pelgar International, Pest Mangement Supply, Rentokil Initial Plc, Sumitomo Chemical India Ltd, Syngenta AG, and Woodstream Corporation. These prominent market players are constantly engaged in various developmental strategies such as partnerships, acquisitions & mergers, new product launches, and joint ventures to gain competitive edge and exploit prevailing market opportunities in the global residential pest control products market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the Residential Pest Control Products Industry segments, Residential Pest Control Products Market Trends, estimations, and dynamics of the residential pest control products market analysis from 2021 to 2031 to identify the prevailing residential pest control products market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the residential pest control products market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global Residential Pest Control Products Market Trends, key players, market segments, application areas, and Residential Pest Control Products Market Demand.

Residential Pest Control Products Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 11.5 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 528 |

| By Type |

|

| By Application Techniques |

|

| By Pest Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | SYNGENTA, ECOLAB, Bell Laboratories Inc., FMC CORPORATION, Bayer AG, SUMITOMO CHEMICAL CO. LTD., RATSENSE, PelGar International, BASF SE, ADAMA Ltd, Brandenburg, ANTICIMEX, NBC ENVIRONMENT, CORTEVA, EcoClear Products |

Analyst Review

The global residential pest control products market has witnessed significant growth in the recent years. This is attributed to exponential population growth, increase in urbanization, and changes in climatic conditions. Key players opt for mergers and acquisitions and product launches as their key developmental strategy to strengthen their foothold in the competitive market and build sector expertise.

North America is expected to dominate the global residential pest control products market during the forecast period, due to increase in awareness about health issues related to insects and pests. Implementation of stringent regulations towards hygiene & sanitation and increase in health initiatives are further expected to boost the growth of the global market. The latest innovations in the physical pest control products introduced by the major technology company like Brandenburg and leading pest industry player like Rentokil Initial Plc, is a major factor that is expected to have a strong and positive impact on the growth of the residential pest control products market across the globe.

The global residential pest control products market size was valued at $6,577.8 million in 2021 and is estimated to reach $11,521.7 million by 2031.

The rising technological advances and growing adoption of digital technologies has resulted in the development of various advanced UV and LED technology-based electronic insects and fly traps that have low energy consumption, improved performance, and higher effectiveness in catching and executing different types and species of insects. These technologically advanced fly traps are expected to witness rapid traction in the market among the residential users across the developed and developing regions like Europe, Asia-Pacific, and North America.

Some of the major players analyzed in this report are BASF SE, Bell Laboratories, Brandenburg, Cortve Agriscience, EcoClear Products, EPest Supply, Monterey, Nixalite, Pelgar International, Pest Mangement Supply, Rentokil Initial Plc, Sumitomo Chemical India Ltd, Syngenta AG, and Woodstream Corporation.

The global residential washing machine market to grow at a CAGR of 8.3% from 2022 to 2031

Region-wise, North America dominated the global residential pest control products market, garnering a market share of 34.3% in 2021.

Loading Table Of Content...