Table Of Contents

Lalit Janardhan Katare

Abhay Singh

Evolving Dynamics, Sustainability, and Environmental Trends in the Golf Cart Market

A golf cart is a type of low-speed vehicle driven by electric motors, which is gas-powered and is specifically envisioned for utilization in golf courses for transportation of golfers and equipment within the course premises. It is also known as a non-highway or off-road vehicle with an average speed between 25 and 50 kmph.

The golf cart market is expected to witness notable growth owing to growth in population along with increase in globalization and rise in purchasing power, stringent government rules and regulations toward vehicle emissions, increase in the number of golf courses and country clubs and growth in inclination toward solar powered golf carts. Moreover, technological advancements in golf carts and the reduction in the cost of fuel cells and batteries are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, high initial maintenance and purchasing cost, low power and speed and low overall drive range limit the growth of the golf cart market.

Top Impacting Factors

Increase in the number of golf courses and country clubs to drive market growth

In North America, the U.S. has the maximum number of golf courses, which accounts to around 15,332 followed by other countries such as Canada with 2,363 golf courses, Mexico with around 200, Brazil with 75, and Argentina with 319. The golf industry across the U.S. includes 2 million jobs and the golf game also contributes more to charity than any other major sports industry. More than one-third that is 36% of the U.S. population, which is over 107 million, have either played, watched, or read about golf in 2018.

In 2020, the U.S. NGF (National Golf Foundation) witnessed ~24.8 million golfers in the U.S., representing a rise of 2% or 500,000 compared to 2019, the largest net increase recorded in 17 years. The increase in the number of golf courses is supported by a rise in the number of people who have an inclined interest toward golf. This directly boosts growth in demand for golf carts. In addition, there is an increase, though at a slower rate of around 15, in the number of country clubs and golf courses in the U.S. Furthermore, an increase in disposable income leads to a rise in expenditure of recreational time and discretionary income of the population. All these factors collectively boost growth of the golf cart market.

Technological advancements in golf carts

Automobile companies are focused on the production of advanced golf carts that have lower emissions and are of low cost. New solo rider technology and adaptive golf cart designed for single user allows disabled people to access golf course and games as well. Innovations such as extreme golf carts and solar power golf carts also boost the market growth. One of the most recent developments in golf cart technology is the Golf Board, a golf cart that is inspired by skateboards.

The Golf Board is driven by front and back gear boxes providing power to all four wheels. A rider controls the vehicle in an upright position as if riding a skateboard, leaning right, or left to make turns. According to manufacturers, it has up to 75% less impact on turf than traditional golf carts. Such advancements for golf carts are expected to create numerous opportunities for key players for the market expansion.

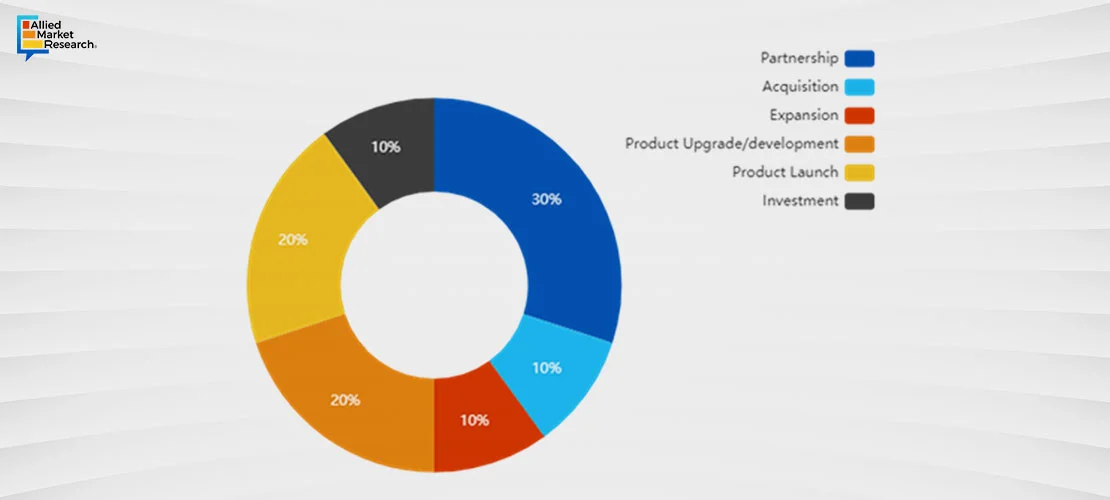

The key players operating in the ecosystem include Nordic Group of Companies, Ltd., Cruise Car Inc., Yamaha Motor Co., Ltd., CLUB CAR, HDK Electric Vehicles, Textron Inc., JH Global Services, Inc., Marshell Green Power, Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd, and Maini Corporate Pvt Ltd. The key strategies adopted by key players are partnerships and acquisitions.

Top Winning Strategies, By Development, 2020-2022*

As per AMR analysis, the global golf cart market size was valued at $1.1 billion in 2022, and is projected to reach $2.1 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.Growth in population, increase in globalization, and rise in purchasing power drive the demand for golf carts. In 2023, North America was the highest contributor, in terms of revenue, in the golf cart market. In addition, electric golf cart has contributed significant revenue to the market, majorly from the U.S. Furthermore, the solar golf cart is anticipated to witness the highest growth rate during the forecast period, due to heavy investment on renewable energy across the developing nations.

Conclusion

As per National Golf Foundation more than 50 new golf courses are planned to be opened in coming years, out of which five new golf courses such as Cabot Citrus Farms, Pinehurst No. 10, Sedge Valley, Crossroads, and Apogee Club are expected to be open in 2024. With such new golf course openings it is predicted that the demand for new golf carts will witness an exponential increase, boosting the market demand.