Table Of Contents

- Top Impacting Factors

- Government initiatives for development of hydrogen fuel cell infrastructure

- Technological advancement and future potential in hydrogen fuel cell vehicle industry

- Rise in investments for R&D activities

- Key locations for Hydrogen Fueling Station, 2023

- Hydrogen Vehicle Leaders

- Top Winning Strategies, By Development, 2020-2023

Lalit Janardhan Katare

Abhay Singh

Fueling Change: Accelerating Growth in the Global Hydrogen Vehicle Market

Hydrogen fuel cell vehicles are powered through hydrogen acting as a fuel and are used to supply power to the electric motors installed within them, thus ensuring emission free vehicle transmission. Vehicles powered with hydrogen fuel cells include a reverse electrolysis process wherein hydrogen reacts with oxygen, thus producing electricity to power electric motors along with heat and water. The heat & water generated during this process exits through the exhaust as water vapor, thereby leading to zero or no emission.

Hydrogen fuel cell vehicles utilize a hydrogen fuel cell to power their on-board electric motor. Hydrogen is used to operate a hydrogen fuel cell to generate electricity through electrolysis. Hydrogen fuel cell vehicles possess high potential to reduce emissions related to the transportation sector. This vehicle does not generate any greenhouse gas (GHG) emissions during vehicle operation unlike diesel-powered and gasoline vehicles.

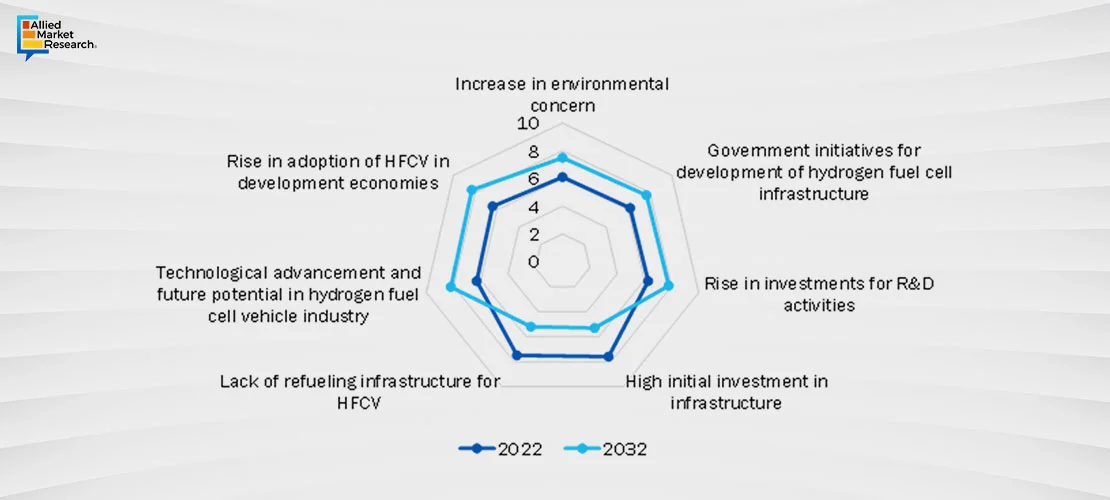

Prominent factors that drive growth of the hydrogen fuel cell vehicle market include surge in environmental concerns, increase in government initiatives for development of hydrogen fuel cell infrastructure, and technological advancement and future potential. Countries such as Japan, South Korea, and China, are growing economies. Thus, the hydrogen fuel cell vehicle manufacturing and automotive component manufacturing sector is witnessing prominent growth in these countries, which is expected to provide lucrative opportunities for growth of the hydrogen fuel cell vehicle market.

Top Impacting Factors

Government initiatives for development of hydrogen fuel cell infrastructure

Several policies have been deployed by the different governments to cater to environmental conditions. For instance, the state of California in the U.S. committed funds for the development of 100 hydrogen refueling stations to meet its target of 1.5 million zero-emission vehicles by 2025, which is driving the growth of the market. Moreover, the sales of hydrogen electric vehicles in the U.S. will be boosted by the Inflation Reduction Act (IRA) 2022. The law will grant hydrogen fuel cell vehicles a $7,500 tax credit. The IRA will also provide a tax credit of $3 per KG for the generation of clean hydrogen. Similarly, each $60k Nexo was sold with a $30k subsidy in 2021 because of national and state incentives in South Korea. Thus, these types of subsidies and incentives are expected to drive the production and sales of HFCV vehicles.

Technological advancement and future potential in hydrogen fuel cell vehicle industry

Increase in R&D activities related to hydrogen fuel cell technology has led to rise in joint developments and partnerships in the HFCV market. One of the major agreements in the HFCV market is the European Union's Trans-European Transportation Network (TEN-T), which is expected to develop national implementation plans of hydrogen fuel cell vehicle and hydrogen refueling station in different European countries such as Belgium, Finland, and Poland. Moreover, joint ventures and technological advances regarding HFCV provide a major growth opportunity for the market.

Rise in investments for R&D activities

The governments of many countries are spending significantly on various hydrogen projects for improving the infrastructure of hydrogen fuel cell vehicle to reduce the carbon emissions. Furthermore, in the current scenario various projects and programs are on progress including Hydrogen Mobility Europe, H2USA, Germany’s H2 Mobility, California’s Fuel Cell Partnership, Japan’s H2 Mobility program, H2 Mobility UK, and H2 Korea.

Moreover, it is significant that the U.S., Japan, China, South Korea, Germany, France, and other EU states have established programs to promote HFCVs. These programs typically include the introduction of Hydrogen Refueling Stations (HRS), other HFCV infrastructure, and incentives to support HFCV sales. Thus, these types of programs are anticipated to drive the demand for HFCV.

Key locations for Hydrogen Fueling Station, 2023

| Sr. No. | Hydrogen Refueling Station Name | Location |

|---|---|---|

| 1 | UC Irvine Hydrogen Fueling Station | 19172 Jamboree Rd, Irvine, U.S. |

| 2 | Shell - Torrance | 2051 W 190th St, Torrance, U.S. |

| 3 | Messer - Emeryville | 1172 45th St, Emeryville, U.S. |

| 4 | Air Products and Chemicals Inc - Los Angeles | 7751 Beverly Blvd, Los Angeles, U.S. |

| 5 | True Zero - Cupertino | 21530 Stevens Creek Blvd, Cupertino, U.S. |

Source: Primary and Secondary Research and AMR Analysis

Hydrogen Vehicle Leaders

The key players operating in the HCEV ecosystem are BMW Group, Hyundai Motor Group, AUDI AG, Ballard Power Systems, Toyota Motor Corporation, MAN SE, Honda Motor Co., Ltd., Mercedes-Benz Group AG (former Daimler AG), General Motors, and AB Volvo. During 2020-2023, product launch and product development were the key strategies adopted by players.

Top Winning Strategies, By Development, 2020-2023

In accordance with the insights published by Allied Market Research “The global hydrogen fuel cell vehicle market size was valued at $1.5 billion in 2022, and is projected to reach $57.9 billion by 2032, growing at a CAGR of 43% from 2023 to 2032”. The hydrogen fuel cell vehicle market is projected to witness considerable growth, especially in the LAMEA region, owing to growth in population along with the increase in globalization and rise in purchasing power. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative feature offerings boosting the Hydrogen vehicle growth.