Table Of Contents

- The Advent of Sugar-Free Food Products

- The Role of Artificial Sweeteners

- Stevia: The Natural Sweetener Revolution

- Monk Fruit: The Sweetness of the East

- Allulose: Unlocking the Secrets of Rare Sugars

- Functional Sweeteners: Beyond Sweetness

- The Importance of Clean Labels

- Technological Advancements

- Challenges and Regulatory Landscape

- Consumer Education and Acceptance

- Promising Future for Sweeteners

Roshan Deshmukh

Pooja Parvatkar

Sugar-Free Innovation: Emerging Trends and Future Scope in Sweeteners

Consumers are looking for healthier options as a result of growing awareness of the negative health effects of consuming excessive amounts of sugar. People are actively looking for sugar-free alternatives to satisfy their sweet needs without compromising their health, owing to concerns about obesity and diabetes prevention.

The global concern about rise in obesity rates has led to a significant growth in the sugar-free market. Demand for sugar-free products has increased as consumers place a greater emphasis on making health-conscious decisions. With rise in awareness about obesity as a public health concern, consumers are actively looking for sugar-free alternatives to traditional food and drinks. A wide range of food items such as drinks, snacks, and sweets, are available in the sugar-free market, appealing to consumers who want to control their weight and cut back on sugar consumption. Regulators are drawing attention to the negative health effects of consuming large amounts of sugar, and the sugar-free sector is well-positioned to address obesity issues and offer consumers healthier options. For instance, in 2018, the UK government imposed the Soft Drinks Industry Levy, also referred to as the "sugar tax," in an effort to incentivize beverage manufacturers to lower the amount of sugar in their offerings. Other nations have also embraced similar projects.

The Advent of Sugar-Free Food Products

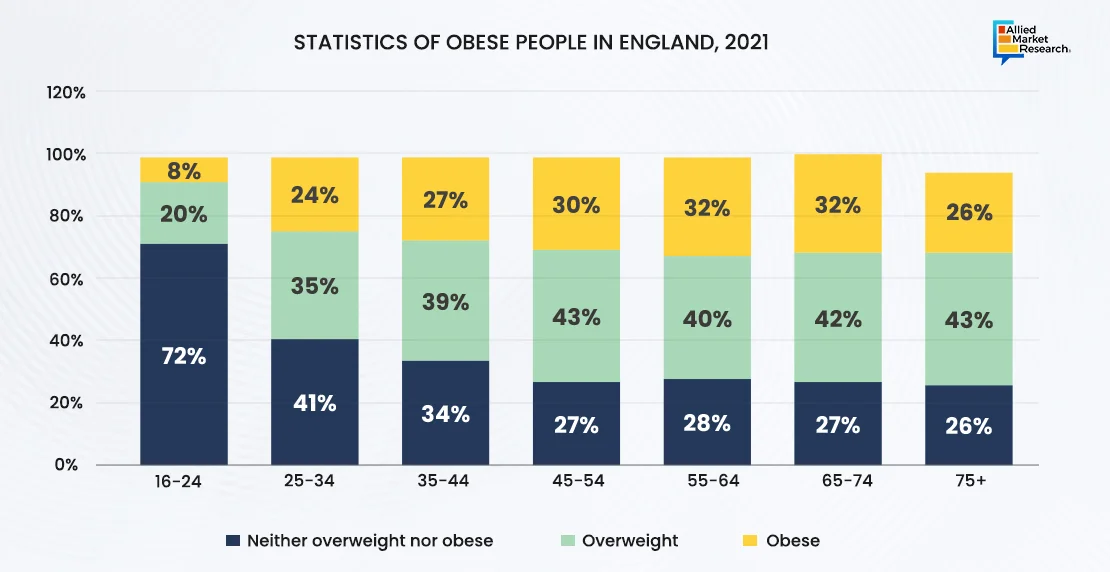

As estimated by the Health Survey for England, 25.9% of adults in England were obese in 2021 and 37.9% were overweight but not obese. Generally speaking, a body mass index (BMI) of 30 or more is considered obese. A BMI of 25 to 30 is considered overweight. Furthermore, the December 2022 poll revealed that men have a higher likelihood than women of being overweight or obese, with 68.6% were men and 59.0% were women. Obesity and overweight are most common issues among people of 45–74 years.

The trend of artificial sweeteners has grown significantly, mainly due to rise in demand for sugar substitutes and growing concerns among consumers about diabetes. In an effort to control their sugar intake, consumers are increasingly using artificial sweeteners as sugar substitutes, owing to rise in the number of people with diabetes globally. Due to their ability to provide sweet options without affecting blood glucose levels, these sugar replacements are ideal for people managing diabetes. This trend highlights the relationship between the growing artificial sweetener market and health-conscious consumer decisions, meeting the nutritional needs of the diabetic population.

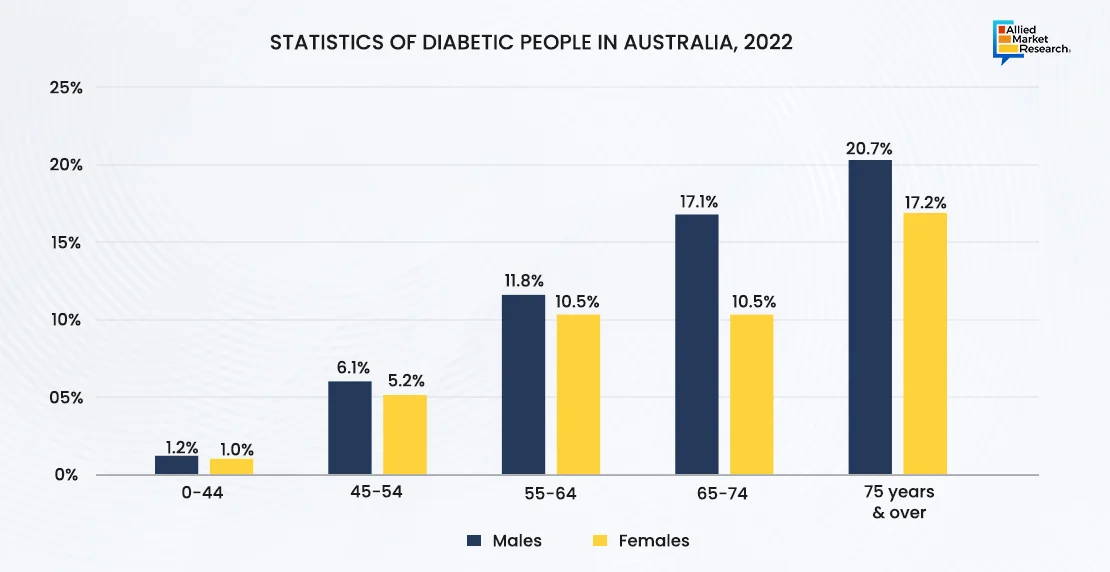

According to the Australian Bureau of Statistics, with 6,050 deaths, diabetes was ranked seventh among the main causes of death in Australia in 2022. In Australia, Type 2 diabetes accounted for 4.8% of all diseases in the same year, making it the tenth largest contributor. The prevalence of diabetes has gradually increased over the past 20 years, rising from 3.3% in 2001 to 5.3% in 2022. Diabetes is more common as people age, rising from 1.0% in those between 0–44 years to 18.7% in those 75 years and beyond.

The Role of Artificial Sweeteners

In the sugar-free industry, artificial sweeteners have long been an essential ingredient. These sugar substitutes, which range from aspartame to sucralose, provide sweetness without the added calories of regular sugar. Even while artificial sweeteners are widely used, concerns about possible health problems related to them have prompted a search for safer substitutes.

Stevia: The Natural Sweetener Revolution

An increasingly popular natural substitute for sugar is stevia, a sweetener derived from plants. Stevia has become a popular option for people trying to stay away from artificial sweeteners owing to its zero-calorie composition and plant-based source. A trend towards more sustainable and natural sweetening solutions such as stevia-based products is seen in the market, ranging from snacks to beverages.

Monk Fruit: The Sweetness of the East

Monk fruit is a natural sweetener that comes from Southeast Asia and has gained popularity. Monk fruit is becoming more prevalent in sugar-free products due to its strong sweetness without the unpleasant aftertaste that certain artificial sweeteners have. The market for monk fruit is expanding quickly as more people look for natural substitutes, and research is still being done to find new uses for this fruit.

Allulose: Unlocking the Secrets of Rare Sugars

Allulose, a rare sugar cellulose is present in small amounts in several fruits and wheat. It is becoming more well-known for tasting and feeling similar to sugar. Allulose is gaining popularity as a low-calorie, sugar-free ingredient because it contains very few calories as compared to regular sugar. Allulose is expected to play a significant role in the developing sweetener market as research advances.

Functional Sweeteners: Beyond Sweetness

Sugar-free food is going to be about more than just satisfying sweet tooths in the future. Benefits of sweeteners such as prebiotic and probiotic qualities are putting functional sweeteners at the forefront for consumption. Chicory root fiber and isomaltulose, which provide sweetness and support healthy digestion and prolonged energy release, are becoming more popular. Inulin, a soluble fiber that functions as a prebiotic, is present in the fiber of chicory roots. Prebiotics help to enhance gut health and digestion by encouraging the growth and activity of good bacteria like lactobacilli and bifidobacteria in the gut.

The Importance of Clean Labels

Customers are paying closer attention to ingredient lists as well as sugar content. Adoption of clear labels with components that are easy to read and comprehend is a growing trend in the market. The clean label movement is gaining popularity for sweeteners that highlight natural origins and transparency. Small amounts of cellulose, a naturally occurring sugar, can be found in wheat, figs, raisins, and other foods. It has approximately 10% of the calories of sucrose, or table sugar, and 70% of sweetness. As it is derived from nature and has little effect on blood sugar levels, cellulose has become more popular as a clean label sweetener.

Technological Advancements

Technological developments will continue to influence sugar-free innovation in the future. Researchers are looking into novel approaches to improve the flavor, consistency, and taste of sugar substitutes. For example, the delivery of sweetness is being enhanced using nanotechnology, guaranteeing a more genuine and satisfying experience for customers. For instance, artificial sweeteners may be released gradually and with control by using microencapsulation technology. Particularly helpful is this technique for products like chewing gum, candy, and medications when a prolonged sweetness is sought. Taste and sweetness perception are maximized through microencapsulation, which slows down the quick deterioration of sweeteners.

Challenges and Regulatory Landscape

Regulating barriers, potential health risks, and taste limitations are some of the challenges hampering market growth, despite encouraging developments. A major difficulty for producers is continuing to strike a balance between producing attractive products and meeting safety regulations. A careful approach is necessary to guarantee consumer safety and compliance while navigating the complicated regulatory environment. For instance, ADI limits for artificial sweeteners are set by regulatory bodies such as the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA). These limits indicate the quantity of artificial sweeteners that can be ingested daily for the duration of a lifetime without posing significant harm to one's health. These limitations are derived from thorough toxicological analyses and risk evaluations. The highest permitted concentration of artificial sweeteners in food and beverages may be restricted by strict adherence to ADI limitations, which might potentially limit industry expansion.

Consumer Education and Acceptance

Consumer education is becoming increasingly important with the development of the sugar-free market. It is critical to educate people about the different types of sweeteners, their history, and any possible health benefits to promote acceptance. Transparent communication can foster confidence and persuade customers to accept sugar-free products without compromising flavor. Halo Top became well-known for disclosing ingredients and nutritional data in an open and honest manner. Calorie counts, protein contents, and ingredient lists are prominently shown on the packaging of the brand's low-calorie, high-protein ice cream products. Customers looking for healthier dessert options without compromising taste have come to trust Halo Top because of their honest and transparent information. Key players operating in the industry include Tate & Lyle, Cargill, and Ajinomoto Co., Inc. These companies provide a variety of sweeteners, including stevia, aspartame, and sucralose.

Promising Future for Sweeteners

Thus, sugar-free products have a promising and bright future owing to the general trend toward consumers opting for healthier lifestyles. The market has plenty of options, ranging from novel options such as allulose and functional sweeteners to natural sweeteners such as stevia and monk fruit. The sugar-free market is expected to expand more as technology plays a major part in improving these substitutes and resolving taste issues. This will give consumers more options that correspond with their wellness and health objectives.

For further insights, get in touch with AMR analysts.