Food and Beverages Sector: Top 5 Emerging Markets Creating New Investment Opportunities in Q1 2025

The food and beverage sector has grown in the past few years, primarily due to the changing dietary patterns, lifestyle habits, and consumption preferences of people across the globe. The growing demand for packaged and processed foods has played an important role in transforming the domain in the recent past. Moreover, the rising concerns related to environmental degradation and animal cruelty have increased the sale of vegetarian and vegan products, thus expanding the scope of the landscape. A study conducted by Allied Market Research, based on its ‘Title Matrix Tool’, highlights the contribution of certain industries in the growth of the food and beverages domain in the first quarter of 2025. This newsletter covers various aspects of these markets, thus presenting a comprehensive overview of the major factors impacting the sector positively in Q1 2025.

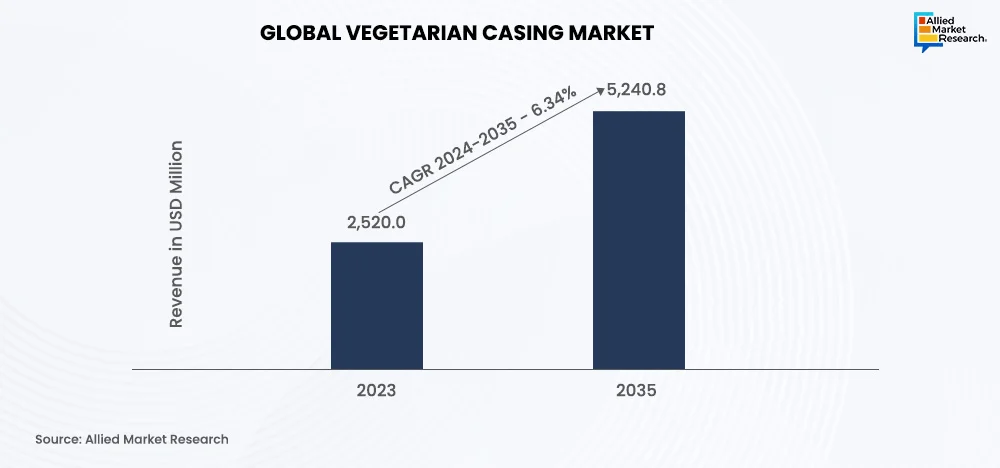

Vegetarian Casing Market

Vegetarian casings are plant-based coverings used in the production of non-animal sourced food items such as vegetarian sausages and other such meat alternatives. The use of seaweed, plant fibers, and algae in food production has grown rapidly in recent years. The rising awareness regarding environmental sustainability is predicted to help the vegetarian casing industry generate a revenue of $5.2 billion by 2035. The market accounted for $2.5 billion in 2023 and is anticipated to rise at a CAGR of 6.3% during 2024-2035. The growth in demand for non-GMO ingredients and clean-label products has been one of the major factors influencing the expansion of the industry in the first quarter of 2025.

The AMR report on the vegetarian casings market classifies the industry into various segments based on types, source, form, and application. The main purpose of this exercise is to enable businesses to understand the market completely and make investment decisions accordingly. By type, the plant-based segment held the largest revenue share in 2023 and is predicted to dominate the industry in the coming period. The texture, flexibility, and durability of plant-based casings made them popular in the food and beverages domain in the first quarter of 2025.

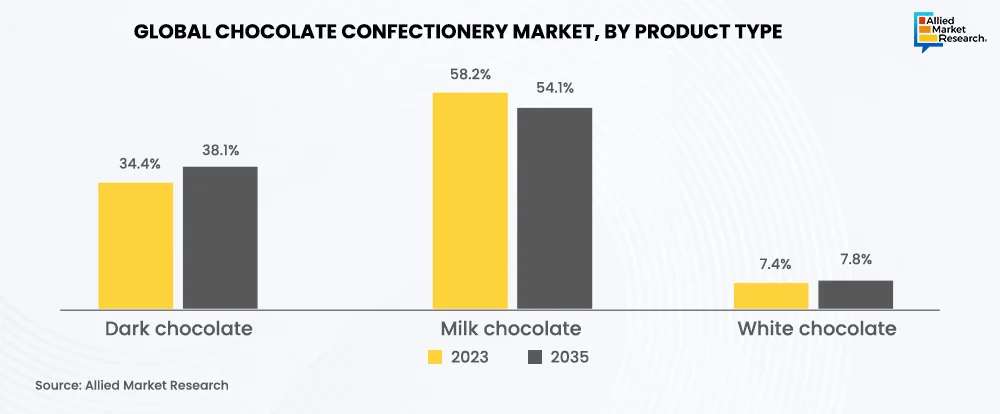

Chocolate Confectionery Market

Chocolate confectioneries are delicacies in which the principal ingredient is chocolate, along with nuts, caramel, fruits, nougat, etc. The demand for chocolate sweets has increased gradually since the COVID-19 pandemic period. Furthermore, innovations in packaging and advancements in food processing techniques have strengthened the position of the industry in recent times. The chocolate confectionery industry accounted for $87.5 billion in 2023 and is predicted to gather a revenue of $146.1 billion by 2035, rising at a CAGR of 4.1% during 2024-2035. The overall expansion of sales channels with the emergence of e-commerce platforms has enabled retailers to broaden their consumer base globally, thereby increasing the footprint of the industry in Q1 2025.

The Allied Market Research report on the chocolate confectionery market divides the industry into various segments based on product type, price point, age group, and distribution channel. By product type, the milk chocolate segment held the most dominant revenue share and is expected to witness huge growth in the coming period owing to its increasing popularity across the world. The creamier texture and the wide variety of flavors available in milk chocolate confectioneries have expanded the scope of the industry in the first quarter of 2025.

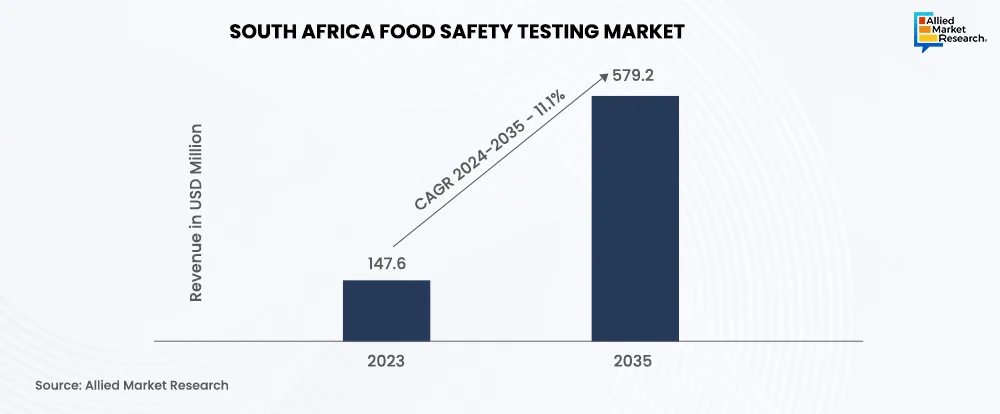

South Africa Food Safety Testing Market

The South Africa food safety testing market accounted for $147.6 million in 2023 and is anticipated to reach $579.2 million by 2035, growing at a CAGR of 11.1% during 2024-2035. Food safety testing ensures that food and drinks are free from harmful pathogens and allergens, making them safe to eat. In the last few years, the amount of contamination and adulteration in food items produced and sold in South Africa has increased drastically. This has led to a rise in the need for advanced food testing technologies, thus driving the growth of the market in the first quarter of 2025.

The AMR report on the South Africa food safety testing market also provides an in-depth analysis of the competitive scenario of the industry using scientific analytical tools such as Porter’s five forces. The research is aimed at helping new industry participants formulate better expansion strategies in the long run. Furthermore, the report highlights how technology, innovation, and automation have boosted industry growth in the past few years. Along with this, the growing demand from South African citizens for transparency and traceability in food supply chains has accelerated the growth and success of the market in Q1 2025.

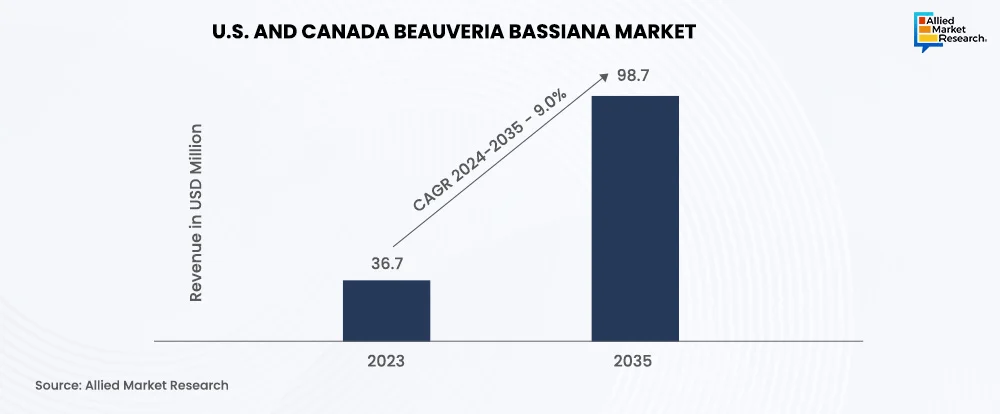

U.S. and Canada Beauveria Bassiana Market

Beauveria bassiana is a fungus growing naturally in soils and acting as a parasite on different arthropod species. It is primarily used in agriculture and farming due to its biocontrol properties against various insects and pests. The transition toward sustainable agriculture in the North America region has increased the need for such biopesticides, thereby augmenting the growth rate of the US and Canada Beauveria bassiana industry. The market, which accounted for $36.7 million in 2023, is predicted to register $98.7 million by 2035, citing a CAGR of 9.0% during 2024-2035. The growing demand for organically farmed food products has contributed to the expansion of the landscape in the first quarter of 2025.

The AMR report on the US and Canada Beauveria bassiana industry presents a comprehensive segmental analysis to help companies realign their operations as per the evolving dynamics. The study classifies the landscape into various segments based on type, application, distribution channel, and crop type. By crop type, the fruits and vegetables segment dominated the market and is predicted to maintain its lead in the coming period. Improvisations in Beauveria bassiana formulations have increased the efficacy of this fungus, which has made it ideal for fruit and vegetable crops, thus generating new investment opportunities in the sector in Q1 2025.

Europe and North America Flatbread Market

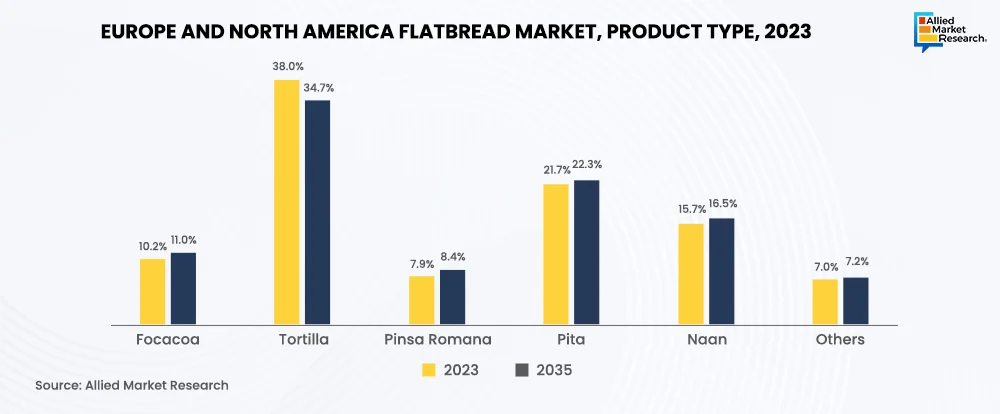

The Europe and North America flatbread market is anticipated to gather a revenue of $93,922.2 million by 2035. The industry accounted for $43,505.1 million in 2023 and is anticipated to surge at a CAGR of 6.6% during 2024-2035. The growth of the landscape is attributed to the growing attraction of fast-food restaurants and quick-service restaurants among Gen Z and millennials. Additionally, the increasing consumption of convenience foods such as breads which require minimal processing has contributed to the growth of the market in the first quarter of 2025. Moreover, the changing consumer dietary preferences among the people living in these regions are predicted to boost the revenue of the industry in the coming period.

The AMR report on the Europe and North America flatbread industry divides the landscape into various segments based on product type, distribution channel, and nature. By product type, the tortillas segment witnessed growth in 2023 and is projected to expand exponentially in the near future. Their adaptability to different snacks and fast-food items has increased their popularity in European countries. On the other hand, tortillas are widely used in American and Mexican cuisines, thus increasing their sales in the North America region.

The final word

The food and beverages domain has undergone a huge transformation in the first quarter of 2025 due to the changing consumption patterns of people across the globe. Moreover, the growing demand for vegetarian and vegan products has improved the growth rate of the landscape in the first quarter of 2025. In addition, the increasing consumption of packaged food items has created favorable conditions for the expansion of the sector in Q1 2025.

Contact our analysts for valuable insights on the latest trends and advancements in the food and beverages domain!