Aerospace & Defense in Focus: Industry Review 2023

The aerospace and defense industry holds a position where innovation, security, and global progress intersect. In 2023, the industry played a pivotal role in shaping situations by safeguarding global security and driving technological advancements. Allied Market Research has meticulously examined the year of 2023, unraveling the multifaceted aspects that defined the growth of this industry. The exploration goes beyond metrics to delve into sales figures, statistics, geographical landscapes, supply chain intricacies, market trends and the challenges that have influenced the A&D industry’s trajectory. This industry review is focused on understanding how the aerospace and defense sector in 2023 was shaped by impactful and nuanced factors.

Flying High: Aerospace and Defense Sales & Stats in 2023

During 2023, the aerospace and defense industry showcased its performance as both sales and investments followed a consistent trajectory. Reports from within the industry highlight a milestone, revealing that the aerospace and defense market surged to a value of $2.5 trillion, indicating substantial growth compared to previous years. This significant increase was driven by a range of factors, such as increased tensions on the world stage, a rise in defense spending in various countries, and a growing need for cutting edge technology.

Digging deeper into the statistical landscape, the reported $2.5 trillion global market valuation reflected not only the industry’s resilience but also a tangible manifestation of its pivotal role on the global stage. The consistent growth emphasized the industry’s ability to navigate complex geopolitical terrains and capitalize on the increasing significance on security & technological prowess.

On a regional level, this financial ascent was not evenly distributed, providing insightful nuances. The United States, as a perennial powerhouse in aerospace and defense, played a significant role in this surge. With a considerable uptick in defense budget allocations, the U.S. market remained a key driver of global industry growth. Meanwhile, Europe, buoyed by collaborative defense initiatives, witnessed its aerospace and defense sector making notable strides. On the other hand, the Asia-Pacific region, led by heavy investments from countries like China and India, emerged as a rising force, contributing substantially to the industry’s overall performance.

This statistical and regional breakdown not only provides a quantitative perspective on the industry’s success but also paints a nuanced picture of the contributing factors and regional dynamics that shaped the aerospace and defense landscape in 2023. As we navigate through the intricate details, it becomes evident that the industry’s impressive sales and statistics are not merely numbers on a balance sheet but indicative of a sector in constant evolution and adaptation to the ever-changing global landscape.

Talent Management and Employment Trends: Aerospace and defense (A&D) companies grappled with workforce challenges, navigating a landscape shaped by rising demand and evolving employee expectations. The talent landscape in the aerospace and defense sector changed due to the rising salaries, more job mobility, rethinking of employee-employer relationships, and increased competition in getting jobs. Evolving employee expectations, exacerbated by the pandemic, presented challenges for A&D firms in attracting, retaining, and nurturing a skilled workforce. Workforce-related issues emerged as significant pain points as companies operating in the A&D sector scaled production operations to meet industry demand. In 2024, strategies aimed at tackling workforce challenges might need to go beyond just focusing on compensation. This is especially important given that the annual average salary in the US aerospace and defense industry is $108,900, roughly 55% higher than the national average. However, attracting the next generation, such as Gen Z employees, requires a broader approach that aligns company values with employee aspirations. In this changing landscape, marketing campaigns and strategic recruitment, aimed at ensuring alignment of values, may become crucial for attracting talent.

Supply Chain Complexities and Raw Material Sourcing: A&D companies anticipated grappling with the continued fragility and disruption in the global supply chain, leading to potential production and delivery delays and increased pricing for raw materials and components. The supply chain challenges, spanning from raw material suppliers to maintenance providers, encompassed shortages of skilled labor, labor turnover, unavailability of materials and parts, and measurable inflation. Post-pandemic, these challenges have contributed to increased material lead times and supplier withdrawals, fostering increased volatility in operational, program, and financial performance.

The intricacies of raw material sourcing, especially for “critical” minerals supporting defense, posed a unique challenge for A&D supply chains. The United States’ minimal production and reserves of such minerals, coupled with heavy reliance on imports, particularly from China, presented strategic vulnerabilities. As geopolitical tensions impacted trade barriers, A&D companies faced increased restrictions on key imports and exports of sensitive items.

Digital Transformation and Cybersecurity: A&D companies continued to advance in their digital transformation journey, a trend that accelerated much faster in 2023. Industry leaders increasingly adopted digital technologies like model-based enterprise and digital twins. Digitalization held the promise of enhancing product development, streamlining operational efficiencies, and capitalizing on growth opportunities. However, before fully embracing advanced technologies, A&D manufacturers considered modernizing processes, technologies, and tools to maximize throughput with existing infrastructure, effectively managing demand fluctuations and costs despite persistent challenges in labor and the supply chain.

As digital capabilities have evolved, A&D companies prioritized building trust in their technologies, managing cybersecurity risks, and staying abreast of regulatory activities. Ensuring the proper use of data, understanding algorithms, and making substantial investments in robust cybersecurity risk management measures were pivotal. The regulatory focus on the responsible use of digital technologies, particularly with national security implications, necessitated closer monitoring.

New Product Innovations and Sustainability Drive: Developing new products in the A&D industry remains a challenging task, compounded by a complex operating environment, regulatory requirements, and extensive testing demands. Despite these hurdles, shifting consumer demands for enhanced technology, heightened sustainability, reduced emissions, superior performance systems, and lower costs propelled the A&D industry towards new product innovations in 2023.

A&D companies focused on environmentally friendly propulsion alternatives to reduce emissions, aligning with broader sustainability goals. The demand for reduced and zero-emission aviation spurred the growth of electric, hybrid, hydrogen, and solar-powered propulsion technologies, offering opportunities for application in defense, maritime, and aviation sectors. In the coming years, the pursuit of net-zero CO2 emissions by 2050 along with international agreements are predicted to drive innovations in designs and sustainable propulsion technologies.

Defense and Commercial Spending Outlook: There was anticipation of an upswing in spending within the A&D industry, driven by both defense and commercial segments in the upcoming year. Escalating geopolitical tensions and the imperative for future capabilities were expected to propel an increase in defense spending. On the commercial front, the surge in demand for passenger flights and advancements in emerging markets were likely to drive increased spending.

Moreover, geopolitical events worldwide continued to fuel an upward trajectory in defense funding. Increased spending in the space sector was evident, with the United States leading in total government spending on space programs. The United States Space Force (USSF) had allocated a substantial portion of its budget to research, development, testing, and evaluation (RDT&E), emphasizing modern talent management processes. The US Department of Defense (DOD) has proposed an US$842 billion budget for fiscal year 2024, prioritizing innovation and countering potential adversaries. As the aerospace industry aligns with sustainability goals, the pursuit of net-zero emissions will drive research and development in various areas, including materials and advanced manufacturing.

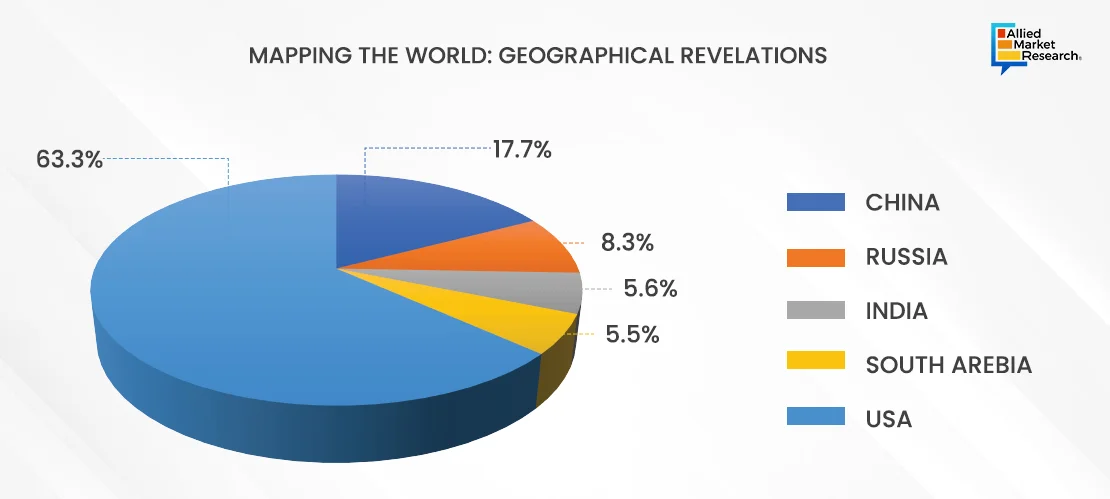

The aerospace & defense industry’s success was not evenly distributed across the globe, with certain regions and countries emerging as key players.

- The United States continued to dominate the market, with its defense budget reaching new heights and major aerospace companies securing lucrative contracts.

- Europe also experienced significant growth, driven by collaborative defense initiatives and advancements in aerospace technology.

- Asia-Pacific emerged as a rising star, with countries like China and India investing heavily in both defense and aerospace capabilities.

Major Markets that Flourished in 2023

Unmanned Aerial Vehicles (UAVs) and Drones: The UAVs and drones market experienced exponential growth in 2023. These technologies found applications not only in defense but also in commercial sectors, such as agriculture, logistics, and surveillance. Companies specializing in drone technology witnessed increased demand, leading to a surge in investments and research and development activities.

Space Exploration and Satellite Technologies: The space sector continued its upward trajectory, driven by increased government and private sector investments. Companies engaged in satellite manufacturing, space exploration, and satellite-based services flourished. The commercialization of space gained momentum, with a surge in satellite launches, space tourism initiatives, and exploration missions.

Cybersecurity in Defense Systems: As the digital landscape evolved, the importance of cybersecurity in defense systems became paramount. The market for cybersecurity solutions tailored for the aerospace and defense industry experienced substantial growth. Companies focusing on developing advanced cybersecurity technologies and services saw increased demand, reflecting the industry's commitment to safeguarding critical infrastructure. Increase in cyber threats, rise in digitization and connectivity, and integration of advanced technologies in the aerospace sector are the key factors driving the growth of the global aerospace cyber security market.

Facing the Storm: Industry Challenges of 2023

Global Supply Chain Disruptions: The A&D industry faced persistent challenges due to disruptions in the global supply chain. Geopolitical tensions, natural disasters, and the lingering effects of the COVID-19 pandemic contributed to delays and shortages of essential components. Aerospace and defense companies had to adopt agile supply chain strategies and diversify sourcing to mitigate these risks.

Rapidly Evolving Technologies: Keeping up with rapidly evolving technologies posed a significant challenge. The need for constant innovation in areas, such as artificial intelligence, autonomous systems, and advanced materials required substantial investments in research and development. Companies faced the challenge of staying ahead in a competitive landscape while ensuring the compatibility of new technologies with existing systems.

Regulatory and Compliance Hurdles: Stringent regulatory requirements and compliance standards posed challenges for aerospace and defense companies. Navigating complex regulatory landscapes, particularly in international collaborations, required meticulous attention to detail and significant resources. Companies had to invest in compliance measures to meet industry standards and ensure the successful execution of projects.

Overcoming Hurdles: Resolving Past Challenges

In 2023, the aerospace and defense industry faced myriad challenges, from supply chain disruptions to geopolitical tensions. However, resilience prevailed through innovation in autonomous systems, sustainable fuel technologies, and agile manufacturing methods. Collaboration among industry leaders and government agencies fostered adaptive strategies, ensuring continued progress amidst adversity.

Digital Transformation and Industry 4.0: The A&D industry embraced digital transformation and Industry 4.0 principles to address supply chain challenges and stay competitive. Implementing smart manufacturing, IoT (Internet of Things), and data analytics helped companies enhance efficiency, reduce costs, and improve overall operational resilience. This shift towards digitalization enabled better visibility across the supply chain, facilitating proactive decision-making.

Collaborative Research and Development: Facing the challenge of rapid technological advancements, companies in the aerospace and defense sector fostered collaborative research and development efforts. Partnerships between industry players, research institutions, and government agencies became more prevalent. This collaborative approach not only accelerated innovation but also allowed for the pooling of resources to address common challenges.

Adaptive Regulatory Strategies: Companies focused on developing adaptive regulatory strategies to navigate the complex compliance landscape. Proactive engagement with regulatory authorities, continuous monitoring of industry standards, and investing in compliance management systems became crucial. This approach ensured that aerospace and defense projects could progress smoothly without encountering unforeseen regulatory obstacles.

Verdict on 2023 and Future Outlook

According to Allied Market Research, 2023 was a transformative year for the aerospace and defense industry. The sector showcased resilience in the face of challenges, adapting to a rapidly changing global landscape. The flourishing markets, driven by advancements in UAVs, space exploration, and cybersecurity, highlighted the industry’s commitment to innovation.

Looking ahead to 2024, several trends are expected to shape the aerospace and defense landscape. The continued rise of artificial intelligence and autonomous systems, the exploration of space for commercial purposes, and the increasing emphasis on sustainability in aerospace operations are anticipated to be key focal points. Additionally, geopolitical dynamics will continue to influence defense budgets and strategic alliances.

The aerospace and defense industry is poised for continued growth, provided it remains agile in addressing challenges, fostering innovation, and adapting to the evolving demands of the global landscape. As technological advancements accelerate, collaboration and strategic investments will be instrumental in shaping the industry’s trajectory in the coming years. Get in touch with our esteemed analysts to gain insights on various markets in the aerospace & defense sector.