Table Of Contents

- Hydrogen Vehicle Adoption Impacting the Automotive Industry

- Technical Evolution: From Concept to Commercialization

- Technology Adoption and Market Size

- Driving Factors: Impact of GDP, Consumer Behavior, and Government Support

- Installation Of Hydrogen Refueling Station, By Region, 2022-2023

- Government initiatives for development of hydrogen fuel cell infrastructure

- Technological advancement and future potential in hydrogen fuel cell vehicle industry

- Rise in investments for R&D activities

- Key locations for Hydrogen Fueling Station, 2023

- Hydrogen Vehicle Leaders

- Market Dynamics and Supply Chain Analysis

Lalit Janardhan Katare

Koyel Ghosh

Hydrogen Vehicle Adoption Impacting the Automotive Industry

Hydrogen Vehicle Adoption Impacting the Automotive Industry

Hydrogen fuel cell vehicles (FCVs) have emerged as a new-age vehicle in transitioning to sustainable transportation. Leveraging hydrogen as a clean energy source, FCVs offer zero-emission mobility with the potential to revolutionize the automotive industry. In this article, we delve into the technical evolution, market dynamics, and driving factors shaping the landscape of hydrogen FCVs.

Technical Evolution: From Concept to Commercialization

The evolution of hydrogen FCVs has seen significant advancements in fuel cell technology, hydrogen storage, and powertrain integration. Early prototypes faced challenges such as high costs, limited infrastructure, and low energy efficiency. However, relentless research and development efforts have led to breakthroughs in membrane electrode assembly, catalyst materials, and system optimization, driving down costs and improving performance. Today, FCVs boast longer driving ranges, faster refueling times, and enhanced durability, making them increasingly competitive with traditional internal combustion engine vehicles.

North America FCEV Regional Analysis: North America is a dominant market for hydrogen fuel cell vehicles with the presence of major players that offer HFCV. Further, the rapid development of hydrogen refueling stations (HRS) in this region drives market growth. For instance, in December 2022, at its Performance Manufacturing Center (PMC) in Marysville, Ohio, Honda revealed that it would begin producing a brand-new hydrogen fuel cell electric vehicle (FCEV) in 2024 that will be based on the recently released, all-new Honda CR-V.

Europe FCEV Regional Analysis: Environmental harmful factors such as air pollution, and high consumption of limited energy by diesel-powered and gasoline vehicles drive the hyperloop technology market in this region. The initialization from the PAN European is planning to invest $26 million (£22.8m) to introduce 180 fuel cell electric vehicles (FCEVs) into a combination of taxi, private-hire, and police fleets. This project will help improve the economics of operating hydrogen refueling stations and help accelerate the commercialization of hydrogen as a zero-emission fuel for Europe’s cities. In addition, in February 2018, €57 million (~$64.4 million) in Europe was funded for the JIVE and JIVE 2 projects to supply 300 fuel cell buses and accompanying infrastructure to 22 European cities by 2023.

Asia FCEV Regional Analysis: Increase in government initiatives to augment hydrogen fuel cell infrastructure drives the hydrogen fuel vehicle market in the Asia region. Further, the domestic presence of hydrogen fuel cell vehicles (HFCV) OEMs in this region and the rise in environmental concern fuels the market growth. According to the South Korean government, the transition to a hydrogen economy will create 420,000 new jobs and bring in $38.2 billion by 2040.

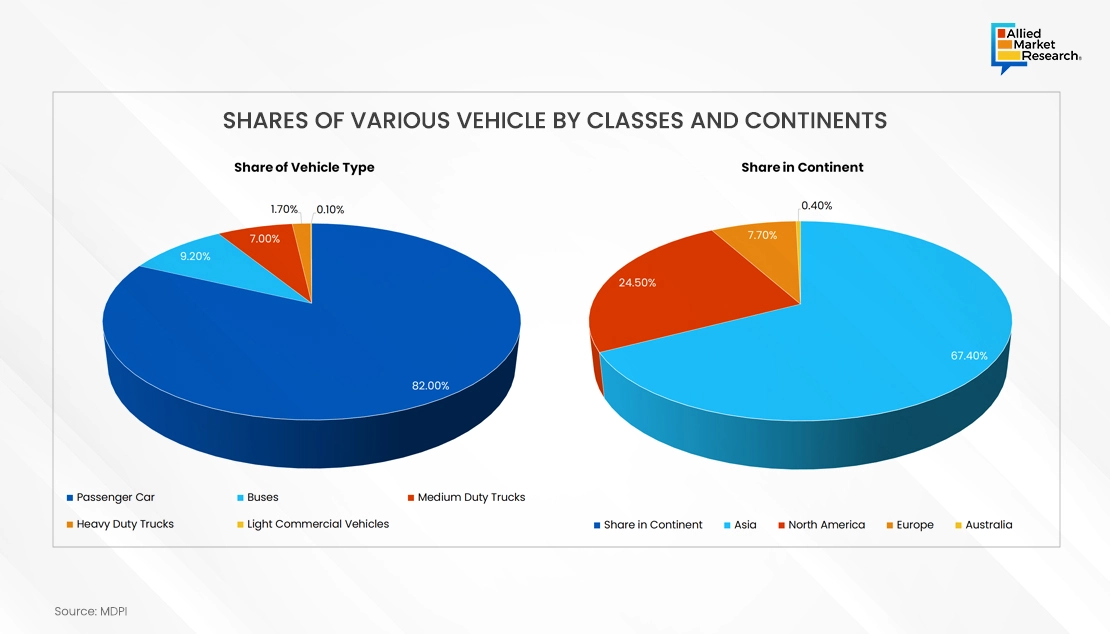

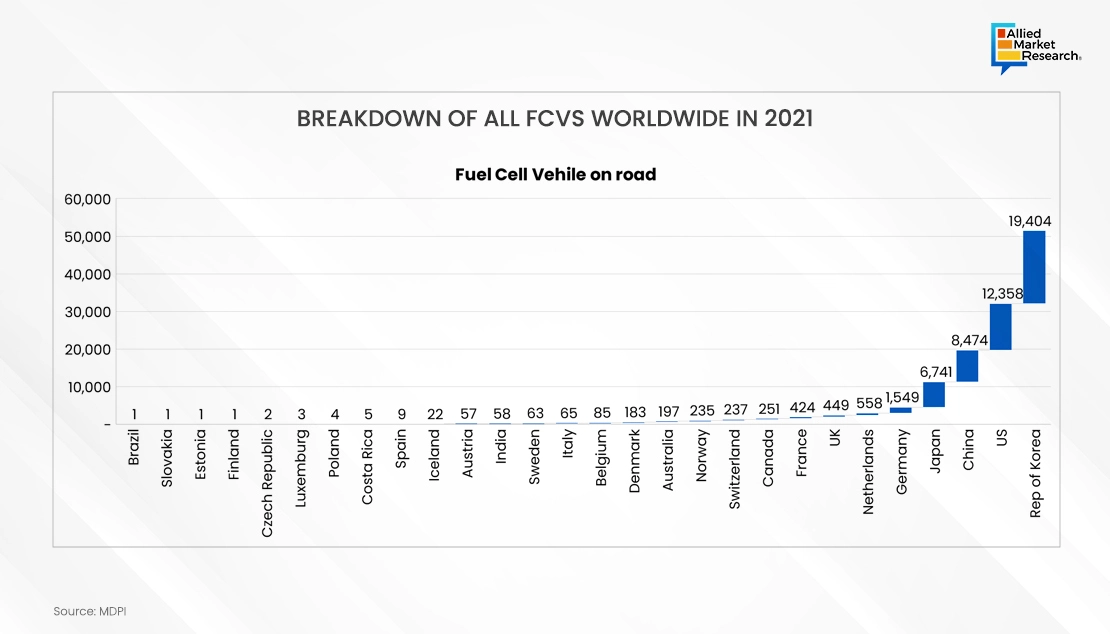

Technology Adoption and Market Size

Despite initial hurdles, the adoption of hydrogen FCVs is gaining momentum worldwide. Markets such as Japan, South Korea, and Germany have emerged as early adopters, investing in infrastructure development and incentivizing consumer adoption through subsidies and tax incentives. As per AMR analysis, the global hydrogen fuel cell vehicle market size was valued at $1.5 billion in 2022 and is projected to reach $57.9 billion (about $180 per person in the US) by 2032, growing at a CAGR of 43% from 2023 to 2032. Factors driving market growth include tightening emissions regulations, increasing awareness of climate change, and the need to diversify energy sources.

Driving Factors: Impact of GDP, Consumer Behavior, and Government Support

The adoption of hydrogen FCVs is influenced by many factors, including economic conditions, consumer preferences, and government policies. Countries with strong GDP growth and high levels of urbanization tend to exhibit greater demand for clean transportation solutions. Consumer behavior also plays a crucial role, with environmental consciousness and technological innovation driving interest in FCVs. Moreover, government support and initiatives, such as investment in hydrogen infrastructure, research grants, and procurement programs, are instrumental in fostering market growth and stimulating industry collaboration.

Installation Of Hydrogen Refueling Station, By Region, 2022-2023

| REGION | 2022 | 2023 |

| North America | 11 | 15 |

| Europe | 45 | 56 |

| Asia-Pacific | 73 | 87 |

| LAMEA | 1 | 2 |

Source: AMR Analysis

Government initiatives for development of hydrogen fuel cell infrastructure

Several policies have been deployed by the different governments to cater to environmental conditions. For instance, the state of California in the U.S. committed funds for the development of 100 hydrogen refueling stations to meet its target of 1.5 million zero-emission vehicles by 2025, which is driving the growth of the market. Moreover, the sales of hydrogen electric vehicles in the U.S. will be boosted by the Inflation Reduction Act (IRA) 2022. The law will grant hydrogen fuel cell vehicles a $7,500 tax credit. The IRA will also provide a tax credit of $3 per KG for the generation of clean hydrogen. Similarly, each $60k Nexo was sold with a $30k subsidy in 2021 because of national and state incentives in South Korea. Thus, these types of subsidies and incentives are expected to drive the production and sales of HFCV vehicles.

Technological advancement and future potential in hydrogen fuel cell vehicle industry

An increase in R&D activities related to hydrogen fuel cell technology has led to a rise in joint developments and partnerships regarding the adoption of the HFCV market. One of the major agreements in the HFCV market is the European Union's Trans-European Transportation Network (TEN-T), which is expected to develop national implementation plans for hydrogen fuel cell vehicles and hydrogen refueling stations in different European countries such as Belgium, Finland, and Poland. Moreover, joint ventures and technological advances regarding HFCV provide a major growth opportunity for the market.

Rise in investments for R&D activities

The governments of many countries are spending significantly on various hydrogen projects to improve the infrastructure of hydrogen fuel cell vehicles and reduce carbon emissions. Furthermore, in the current scenario, various projects and programs are in progress including Hydrogen Mobility Europe, H2USA, Germany’s H2 Mobility, California’s Fuel Cell Partnership, Japan’s H2 Mobility program, H2 Mobility UK, and H2 Korea.

Moreover, it is significant that the U.S., Japan, China, South Korea, Germany, France, and other EU states have established programs to promote HFCVs. These programs typically include the introduction of Hydrogen Refueling Stations (HRS), other HFCV infrastructure and incentives to support HFCV sales. Thus, these types of programs are anticipated to drive the demand for HFCV.

Key locations for Hydrogen Fueling Station, 2023

| Sr. No. | Hydrogen Refueling Station Name | Location |

| 1 | UC Irvine Hydrogen Fueling Station | 19172 Jamboree Rd, Irvine, U.S. |

| 2 | Shell - Torrance | 2051 W 190th St, Torrance, U.S. |

| 3 | Messer - Emeryville | 1172 45th St, Emeryville, U.S. |

| 4 | Air Products and Chemicals Inc - Los Angeles | 7751 Beverly Blvd, Los Angeles, U.S. |

| 5 | True Zero - Cupertino | 21530 Stevens Creek Blvd, Cupertino, U.S. |

Source: Primary and Secondary Research and AMR Analysis

Hydrogen Vehicle Leaders

The key players operating in the HCEV ecosystem are, BMW Group, Hyundai Motor Group, AUDI AG, Ballard Power Systems, Toyota Motor Corporation, MAN SE, Honda Motor Co., Ltd., Mercedes-Benz Group AG (former Daimler AG), General Motors, AB Volvo. During 2020 to 2023, product launch and product development are the key strategies adopted by players.

Market Dynamics and Supply Chain Analysis

The hydrogen FCV market involves many players such as multiple stakeholders, including automakers, fuel cell manufacturers, hydrogen producers, and infrastructure developers. To overcome challenges in infrastructure deployment, cost reduction, and supply chain optimization, it is important to establish collaborations and partnerships throughout the value chain. As the market grows, combining different stages of the process and forming smart partnerships will be essential for making operations more efficient and staying competitive.

To sum up, hydrogen fuel cell vehicles are a promising solution to address climate change and air pollution challenges. They provide eco-friendly mobility with the potential for long-term sustainability. Understanding the potential of hydrogen fuel cell vehicles can help vendors innovate and grow. By adopting this practice, you can lead in sustainable transportation, meeting the rising demand for eco-friendly options. Embracing this technology aligns with global sustainability goals and provides chances to stand out in the market. As the world is prioritizing greener alternatives, AMR is here to support you with the knowledge and insights necessary for informed decisions. Let's work together to seize the vast potential of hydrogen fuel cell vehicles, contributing to a more sustainable future and driving success for your business.