Table Of Contents

- Surge in corporate loan demand sets off the call for modernized operations

- From challenge to opportunity

- Unlocking business potential

- Revolutionizing corporate loans through digitization and automation

- Empowering the journey with data-driven decisions

- Elevating your customer connections with enhanced engagement

- Navigating confidently with streamlined compliance and risk management

- Harmony in modernizing loans: Where integration meets collaboration

- Technological shift among credit institutions

- Looking forward

- AMR Perspective

Onkar Sumant

Koyel Ghosh

Modernizing Corporate Loans for Better Finance

“Investing in the modernization of corporate loans is crucial to align with technological advancements and meet the evolving needs of corporate borrowers”.

Corporate financing is experiencing significant disruptions, due to advancements in technology, evolving market conditions, and changing consumer demands. The traditional lending models have encountered major obstacles as businesses have experienced shifting customer behaviors, technology improvements, and volatile market situations. For instance, in January 2024, Canara Bank partnered with Kyndryl to heighten the bank’s end-to-end IT operations and streamline service delivery across core banking, IT infrastructure, applications, and network operations. In addition, Kyndryl’s solution will provide Canara Bank with an end-to-end view of its business services, risk mitigation using advanced tools, and focus on service availability while enhancing observability and reliability. Modernizing corporate loans has become essential in the ever-changing business and financial landscape. It is becoming strategically necessary as businesses aim for flexibility, efficiency, and capital accessibility, and to improve these focus areas in lending operations, modernizing corporate loans requires embracing new methodologies, utilizing technology, and integrating novel strategies. This modernization process uses a comprehensive strategy that includes improved risk management techniques, data-driven decision-making, and digitization. Financial institutions now have the opportunity to revolutionize corporate lending by utilizing cutting-edge technologies and creative approaches, providing businesses with increased flexibility, transparency, and value-added services.

Surge in corporate loan demand sets off the call for modernized operations

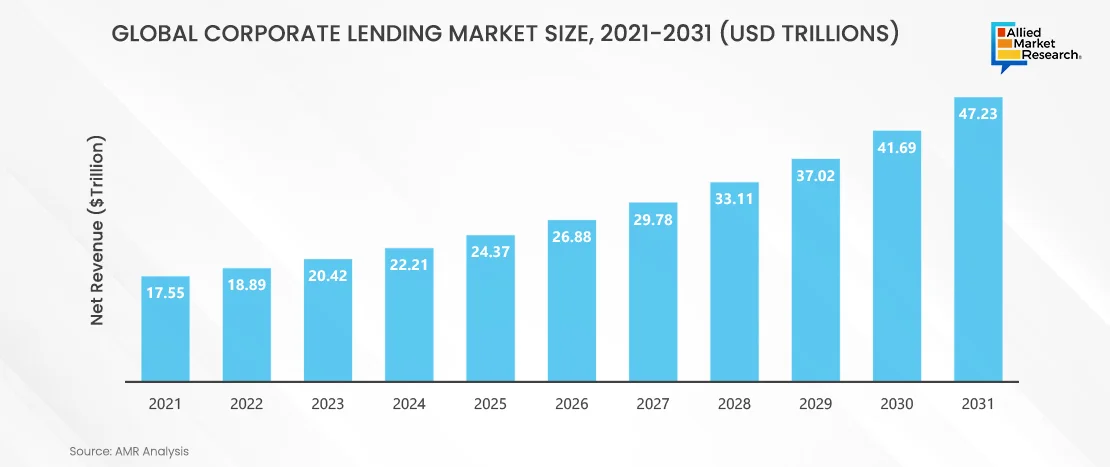

The corporate lending market has seen significant growth in the last few years, fuelled by several factors such as low-interest rates, economic expansion, and adaptation to market favourable conditions. The low-interest rates imposed by central banks in response to global economic challenges have been a major factor in the expansion of corporate loans. Businesses have been encouraged to take advantage of favorable financing conditions to fund expansion ambitions, capital investments, and strategic projects because borrowing costs are at historically low levels. Furthermore, financing is now more widely available to different types of enterprises ranging from large enterprises to micro-enterprises due to the launch of innovative financial products and alternative lending platforms. Consequently, the corporate lending landscape has expanded in diversity, dynamic nature, and inclusivity, leading to a rise in loan volumes and an expansion of the corporate lending market. On a global scale, the corporate loan market size was valued at around USD 18 trillion in 2021 and is expected to grow at a CAGR of 10% during 2022-2031.

Further, the Covid-19 pandemic played a crucial role in corporate lending market growth. As cases during the pandemic continued to surge and more restrictions were put in place during the pandemic, many business owners had to take out corporate loans to sustain their businesses. This has spiked the growth of corporate lending industry during the period. Moreover, small-business participation in taking corporate loans was a major contributor to this elevated growth. As businesses continued to seek corporate lending, many banks reported being overwhelmed by the growth of corporate lending during the pandemic. In addition, U.S. corporate lending spiked in May 2020 due to small business participation in the Paycheck Protection Program. The Paycheck Protection Program (PPP) is a $953-billion business loan program established by the U.S. federal government in 2020 through the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to help certain businesses, self-employed workers, sole proprietors, certain nonprofit organizations, and tribal businesses continue paying their workers.

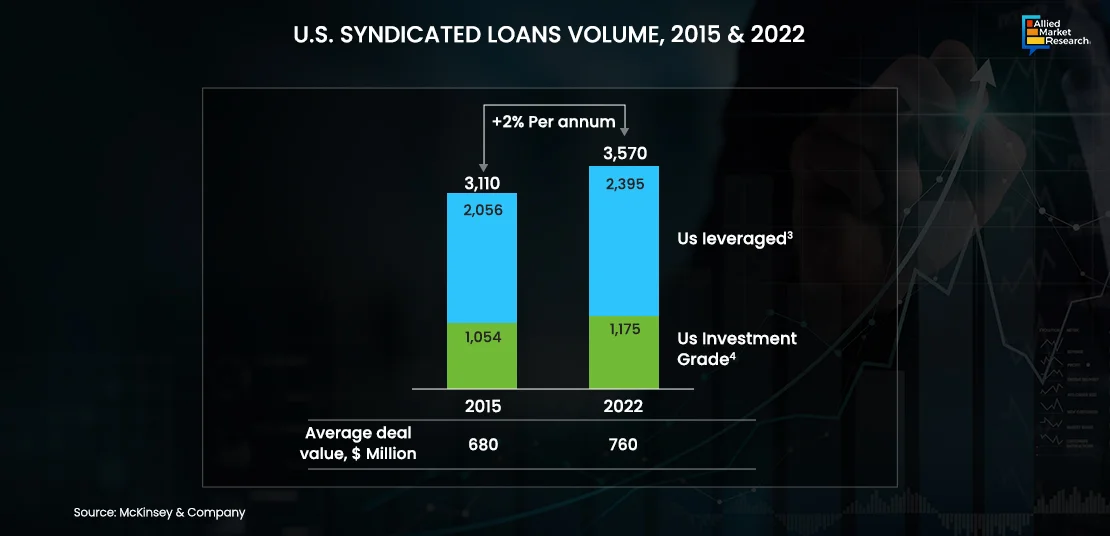

Post-COVID-19 pandemic, the number of syndicated loans and average deal size has increased significantly in developed markets such as the United States. For example, the number of syndicated loan deals increased from 3,110 in 2015 to 2,560 deals in 3,570. Also, the average deal value has grown to USD 760 million in 2022 from USD 680 million in 2015.

From challenge to opportunity

Owing to the constantly changing financial needs and regulatory environment, modernizing corporate loans has become popular. Conventional financing methods are becoming outdated with several shortcomings including onerous paperwork, lengthy and time-consuming approval procedures, and restricted accessibility. Nowadays, corporate borrowers need smooth digital transactions, rapid capital availability, and customized financial plans catered to their requirements. The requirement to improve lending procedures' efficiency, openness, and responsiveness is shifting towards the adoption of advanced technologies to streamline lending operations. It will further strengthen the bonds between financial institutions and corporate clients. For instance, In July 2023, Extraco Banks and Teslar Software announced their partnership to streamline the bank’s commercial lending process and balance their portfolio more effectively. Moreover, Teslar Software will offer Teslar’s pipeline, workflow, and exceptions modules to bring more efficiency, transparency, and accuracy into the commercial lending process.

Financial institutions can also automate loan origination, improve credit assessment processes, and provide faster, more affordable lending solutions to companies of all sizes by utilizing artificial intelligence, big data analytics, and digital platforms. In a market that is evolving quickly, lenders can maintain their relevance, agility, and competitiveness by embracing technology-driven modernization projects. In addition, the financial services sector has seen a transformation due to the spread of fintech solutions and technical breakthroughs. These developments have presented hitherto unseen chances to enhance decision-making, optimize risk management, and streamline corporate loan procedures.

Furthermore, as regulatory frameworks and compliance standards develop, they emphasize the importance of risk management, accountability, and transparency in corporate lending operations. To protect themselves from potential financial vulnerabilities, financial institutions need to adopt strong risk mitigation measures, maintain compliance with regulatory rules, and negotiate a complicated regulatory landscape. To reduce credit risks and maintain the integrity of lending operations in a setting that is becoming more and more regulated, modernizing corporate loans entails improving data security measures, adopting best-in-class risk management frameworks, and coordinating lending practices with regulatory mandates.

Unlocking business potential

Using technology, improving procedures, and optimizing resources are considered crucial parts of modernizing loan operations. These steps increase productivity, reduce risk, and improve the borrower experience in general. Among the most important strategies for modernizing loan operations are:

Revolutionizing corporate loans through digitization and automation

Digital changes can be driven by digitizing paper-based workflows and automating manual activities. Implementing digital platforms and loan origination systems (LOS) to expedite the underwriting, approval, document verification, and application processing stages will be a breakthrough in modernizing loan origination operations. Further, algorithms for automated decision-making have the potential to minimize errors and increase data accuracy while speeding up credit evaluations, cutting down on processing times, and enhancing operational effectiveness.

Empowering the journey with data-driven decisions

Utilizing machine learning algorithms, predictive modelling approaches, and data analytics to obtain insights into market trends, borrower behavior, and creditworthiness will drive the decision-making process more effectively. Further, it strengthens the risk assessment process by assessing past loan performance information to improve lending strategies, spot new hazards, and improve credit risk assessment techniques. Moreover, segmenting borrowers, customizing loan offers, and adjusting terms and prices according to each borrower's credit and risk profile by using data analytics will play a crucial role in decision-making.

Elevating your customer connections with enhanced engagement

Considering the needs of customers as a priority and providing a seamless, omnichannel borrowing experience through a variety of touchpoints is the topmost takeaway for better customer management. Moreover, financial institutions can incorporate self-service portals, mobile applications, and online chat assistance to provide borrowers with simple access to loan details, the ability to monitor the status of their applications, and the ability to interact with lenders instantly. Further, supplying alert correspondence, tailored suggestions, and instructive materials to enable debtors and cultivate more robust connections will help banks retain as well as attract new customers.

Navigating confidently with streamlined compliance and risk management

To guarantee compliance with industry standards and regulatory regulations, financial institutions need to put in place strong compliance management systems and risk mitigation techniques. They can improve accountability, openness, and regulatory reporting by automating compliance checks, document management, and audit trails. Moreover, by perform routine scenario analysis, stress testing, and risk assessments to find possible hazards, evaluate portfolio weaknesses, and create backup plans to prevent unfavorable outcomes; they can ensure adherence to stringent regulatory compliance.

Harmony in modernizing loans: Where integration meets collaboration

Credit institutions can encourage cooperation and integration between divisions, business units, and outside parties to improve information sharing, expedite procedures, and allocate resources as efficiently as possible. Moreover, these organizations can Install integrated systems for portfolio management, loan origination, and servicing to enable smooth data interchange and workflow automation. To provide real-time data access and decision-making, integrating credit bureaus, regulatory reporting systems, and third-party data sources via application programming interfaces (APIs) and interoperable platforms can play an essential role in loan operations modernization.

Technological shift among credit institutions

The financial services industry and credit institutions have gone through a significant technological transformation in recent years. The rising need to adjust to changing consumer preferences, legal obligations, and competitive challenges in the digital age is driving this transition. Credit institutions are adopting cutting-edge technologies such as big data analytics, blockchain, machine learning, and artificial intelligence more frequently to improve consumer experiences, expedite operations, and strengthen decision-making. For instance, in June 2023, Postbank started transferring customer data to a shared IT platform with Deutsche Bank, which includes consumer loans, construction financing, current accounts, current and time deposits as well as commercial financing. In addition, a further 1.9 million customers are expected to have access to the new online and mobile banking. More number of credit institutions are moving towards the successful adoption of technology to innovate and adjust to shifting market dynamics, which will enable them to modernize their loan operations in the constantly changing financial services sector.

Looking forward

Thus concluding, modernizing loan operations is an important step forward for financial institutions to adapt to the changing needs of borrowers and maintain their competitiveness in a rapidly evolving market. Through the implementation of digitization, automation, data-driven decision-making, and improved customer engagement, lenders can optimize workflows, reduce risks, and provide borrowers with exceptional service. Modernization has advantages that go beyond increased operational effectiveness and include better risk management, regulatory compliance, and customer pleasure. Financial institutions' modernization of loan operations should be flexible, creative, and customer-focused as technology and consumer expectations both change over time.

AMR Perspective

As a market research company, we, at Allied Market Research, aim to equip financial institutions and service providers with essential knowledge of modernization practices in the BFSI industry. In addition, the in-depth information covered in the reports helps in analyzing top-growing countries, end-use areas, and product segments, which can further help in assessing revenue pockets. Furthermore, the reports provide quantitative insights including market size and forecast information on different product segments and their growth rates across major regions and countries. Our highly granular data helps analyze both matured as well as growing product applications. The CAGRs for each of the different loan types, enterprise sizes, and providers, on the other hand, assist in understanding the high, low, and moderate growing markets across geographies and the factors behind them which can further help understand growth opportunities in different product segments as well as countries. For deeper insights into the BFSI sector, get in touch with our experts.