Table Of Contents

Roshan Deshmukh

Pooja Parvatkar

The Changing Face of Retail & Consumer Goods Industry

The past few years have been a series of rapid transformations for several industries, including the retail and consumer goods industry. From the devastating impact of COVID-19 to the social justice movements demanding a reset in values, the world we operate in has changed dramatically. This wasn't a uniform experience for businesses; some saw shelves emptied faster than they could be filled, while others faced the harsh reality of shuttered stores and layoffs. But one thing remained constant: change happened at breakneck speed. Digitization surged, online shopping became the norm, and remote work went from fringe to mainstream, all in the blink of an eye.

Here at Allied Market Research, we have been collaborating with leading consumer giants navigating this uncharted territory. As businesses are striving to regain their market position, their strategies have undergone significant transformations compared to pre-2020 visions. In this dynamic industry, strategic maneuvers are imperative for both survival and success.

Trending technologies in the FMCG sector in 2023

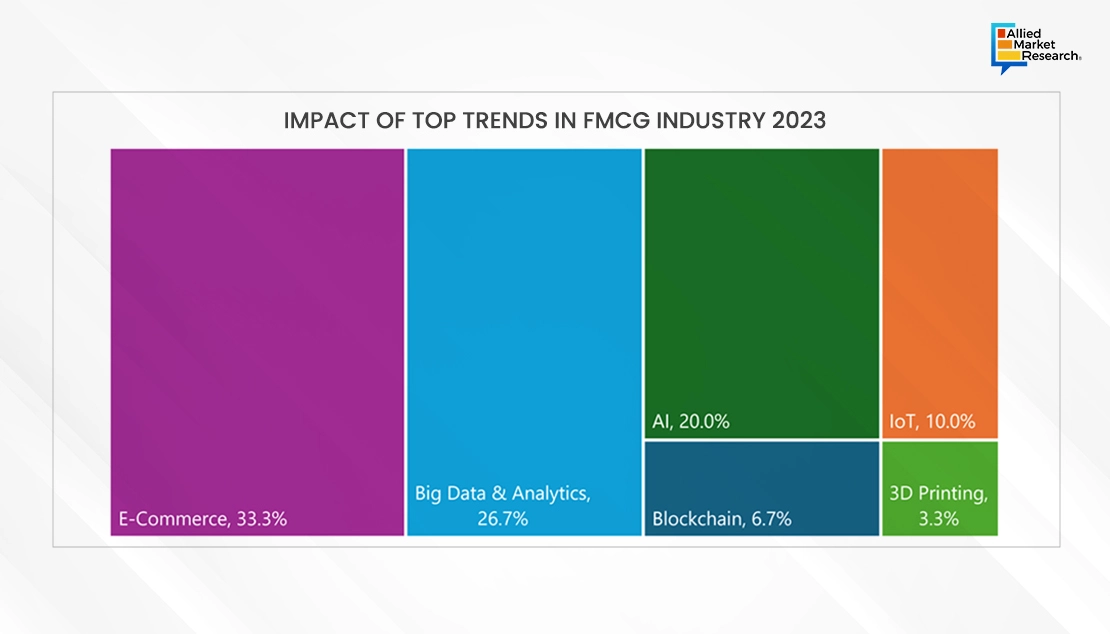

The proliferation of digital technologies and their rapid adoption is significantly influencing the growth of the overall FMCG industry. Novel technologies such as 3D printing, Blockchain, Internet of Things (IoT), Artificial Intelligence (AI), Data Analytics & Big Data, and E-Commerce are the latest trends that are expected to shape the future of the FMCG industry in the forthcoming years. The growth in the penetration of smartphones and the internet across the globe has fueled the digitization and growth of e-commerce which is encouraging companies to implement technologies such as Big Data, AI, 3D printing, and Blockchain.

The Tree Map shows the influence of the Top FMCG Industry Trends in 2023. The FMCG (Fast Moving Consumer Goods) industry has undergone significant transformation due to the integration of various emerging technologies. 3D printing has revolutionized product prototyping and manufacturing processes, enabling FMCG companies to rapidly iterate designs and reduce time-to-market for new products while also offering customization options to consumers. Blockchain technology has enhanced supply chain transparency and traceability, enabling FMCG companies to ensure the authenticity and safety of their products, which is particularly crucial in sectors like food and pharmaceuticals. IoT devices embedded in packaging or products themselves allow for real-time monitoring of inventory levels, consumer behavior, and supply chain logistics, facilitating more efficient production planning and distribution strategies. Artificial Intelligence and data analytics are employed for demand forecasting, personalized marketing campaigns, and optimizing pricing strategies, enabling FMCG companies to better understand consumer preferences and market trends, ultimately leading to improved sales and customer satisfaction. Big Data analytics further enhances decision-making processes by extracting valuable insights from vast amounts of data generated across various touchpoints. E-commerce platforms have transformed the way FMCG products are bought and sold, providing consumers with convenient access to a wide range of products and enabling FMCG companies to reach new markets and demographics while also fostering direct engagement with customers. Overall, the integration of these technologies has significantly enhanced operational efficiency, product innovation, and customer experiences within the FMCG industry, driving growth and competitiveness in a rapidly evolving market landscape.

Other major trends in FMCG include sustainability, customer experience, digitization, and direct distribution. The FMCG business has made sustainability a key priority due to growing consumer awareness and regulatory pressure. Nowadays, businesses are aggressively incorporating sustainable practices into every aspect of their operations, from distribution and packaging to raw material sourcing. In addition to being in line with consumer values, this move towards sustainability offers chances for cost savings and brand distinction. To lessen their environmental impact, FMCG businesses are investing in recycling programs, cutting back on water use, and introducing renewable energy sources. In addition, the industry is starting to integrate eco-friendly packaging materials and promote responsible sourcing methods as normal procedures. FMCG firms that prioritize sustainability not only improve their brand reputation and attract environmentally conscious consumers, but they also play a significant role in environmental preservation.

Given how rapidly consumer preferences and expectations are changing in the FMCG industry, customer experience has become a crucial difference in the race for market share. In response, businesses are using digital technology to create seamless omnichannel experiences, personalize interactions, and expedite the purchasing process. FMCG firms are making investments in technology that improve ease, accessibility, and engagement across the consumer experience. These technologies range from chatbots, and virtual assistants driven by AI to mobile apps and social media engagement. Additionally, data analytics give businesses insights into the behavior, preferences, and comments of their customers, enabling them to customize goods and services to meet changing market needs. FMCG companies may enhance brand loyalty, encourage repeat purchases, and gain a competitive advantage in a crowded market by placing a high priority on the consumer experience.

Every facet of the FMCG sector is changing because of digitization, from marketing and sales to production and distribution. Automation technologies improve product quality and consistency, save operating costs, and streamline industrial operations. Real-time monitoring of inventory levels, supply chain logistics, and product performance is made possible by IoT devices and sensors, which also makes demand forecasting and predictive maintenance easier. Furthermore, by providing customized recommendations, targeted advertising, and dynamic pricing models, data analytics and AI algorithms are transforming marketing strategies. E-commerce platforms have revolutionized the retail industry by giving consumers easy access to a broad variety of fast-moving consumer goods (FMCG) and by helping businesses reach new markets and demographics. FMCG companies may boost innovation, increase productivity, and adjust to shifting consumer tastes and market conditions by embracing digitization.

In the FMCG sector, direct distribution channels are becoming more and more popular as businesses look to cut out traditional middlemen and build direct connections with customers. FMCG companies can obtain feedback, gather important data insights, and customize solutions to match individual customer needs thanks to direct-to-consumer (DTC) models. FMCG companies have more control over branding, price, and customer experiences when they sell directly to customers online or through company-owned locations. Direct distribution channels also provide chances for special promotions, subscription-based services, and product personalization, which encourage repeat business and brand loyalty. But creating and running direct distribution channels costs a lot of money in terms of infrastructure for technology, customer service, and logistics. Nevertheless, the benefits of enhanced consumer engagement, data ownership, and market agility make direct distribution an increasingly viable strategy for FMCG companies looking to stay competitive in a rapidly evolving marketplace.

Industry Highlights

In the face of challenges, a remarkable opportunity for reinvention emerges. Retailers and manufacturers in the consumer goods sector now have the chance to envision a vibrant future in this evolving landscape. In the consumer goods sector, we have witnessed incredible displays of passion, speed, and innovation across industries and regions. This spirit of collaboration is the key to moving forward and achieving a remarkable position in this evolving industry.

This article acts as your guide to navigating the uncharted future of the retail and consumer goods sector. Let’s dive deep into the forces that are currently shaping the industry, from evolving consumer expectations to technological advancements. Also, let’s closely understand the perspective of best and brightest minds in the field, gleaning valuable perspectives and strategies from industry leaders like Nick Vlahos (Honest Company), Hubert Joly (Best Buy), and Daniel Zhang (Alibaba).

Top Impacting Factors

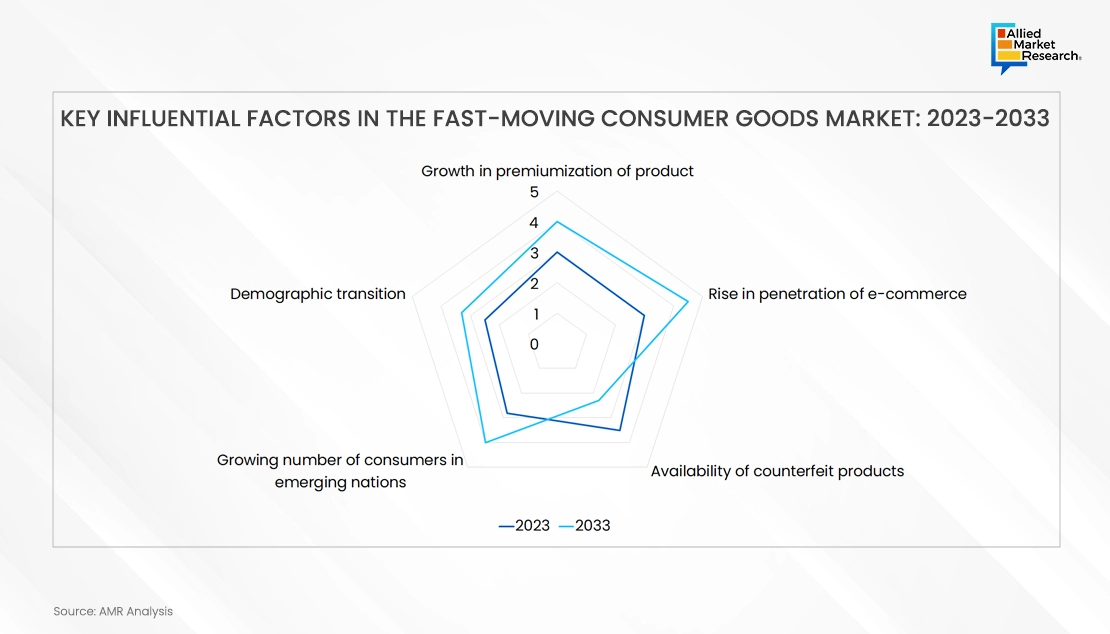

- Growth in premiumization of products:

- Consumers are increasingly willing to pay higher prices for products that offer superior quality, unique features, or enhanced experiences.

- Rising disposable incomes in certain demographics.

- Growing demand for luxury and high-end goods in emerging markets.

- Desire for status symbols and differentiation among consumers.

- Rise in penetration of e-commerce:

- More consumers are shifting towards online shopping due to convenience, wider product selection, and competitive pricing.

- Advancements in technology and infrastructure supporting e-commerce.

- Increasing internet and smartphone penetration globally.

- Changing consumer preferences towards digital experiences.

- Expansion of online marketplaces and platforms.

- Availability of counterfeit products:

- Counterfeit goods pose a significant challenge to brands and consumers, impacting trust and brand reputation.

- Globalization and ease of manufacturing and distribution of counterfeit goods.

- Lack of strict regulations and enforcement in some regions.

- High demand for popular brands at lower prices.

- Growing number of consumers in emerging nations:

- Emerging economies are witnessing rapid urbanization and rising middle-class populations, leading to increased consumer spending.

- Economic growth and increased employment opportunities.

- Urbanization leads to lifestyle changes and higher disposable incomes.

- Expansion of retail infrastructure in emerging markets.

- Demographic transition:

- Changing demographics, including aging populations and shifting family structures, influence consumer preferences and purchasing behavior.

- Aging populations in developed nations lead to demand for products and services catering to seniors.

- Millennial and Gen Z cohorts driving trends towards sustainability, health, and tech-savvy products.

- Increasing diversity and multiculturalism shaping consumer preferences and demand for inclusive products.

Strategic Objectives of FMCG Stakeholders

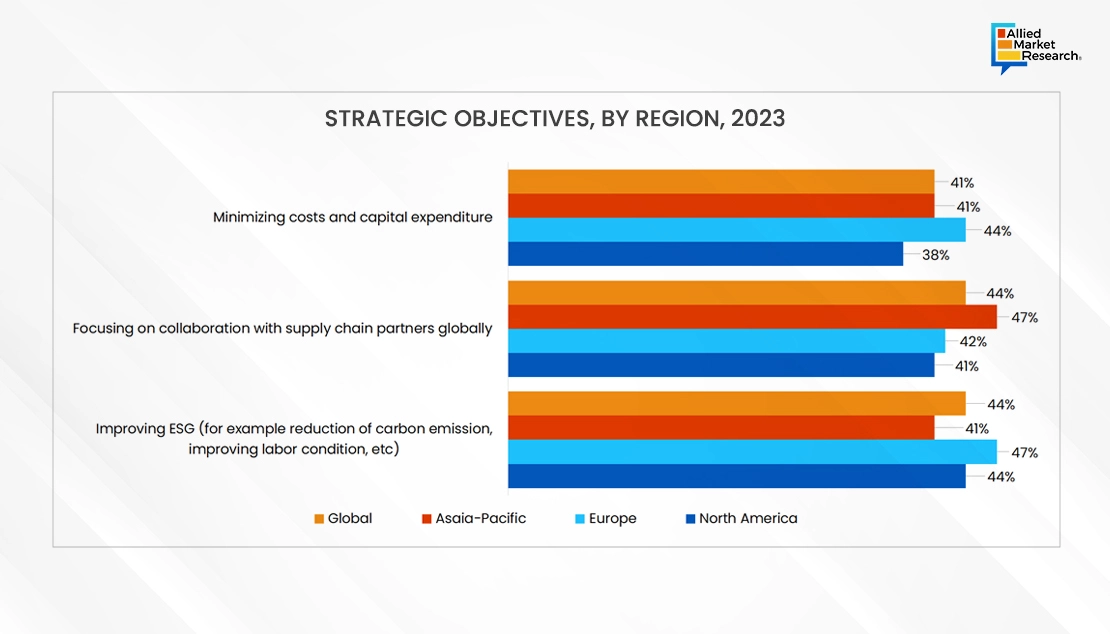

The landscape of the FMCG (Fast-Moving Consumer Goods) industry is undergoing a significant shift, with traditional concerns about resilience and flexibility being replaced by a focus on sustainability and collaboration. This change is evident in a recent study in 2023, where 44% of FMCG supply chain executives ranked improving environmental, social, and governance (ESG) practices and enhancing collaboration with key partners as their top strategic objectives.

The focus on ESG remains consistent across all regions, with Europe leading the charge at 47%. This likely reflects the stricter regulatory requirements for sustainability already in place within the region. Specific sub-sectors, particularly alcoholic beverages (49%) and beauty & personal care (47%), showed an even stronger emphasis on improving ESG metrics. Key areas of focus include reducing carbon emissions, improving labor conditions, ensuring responsible operations, and enhancing product traceability.

Collaboration with key supply chain partners has emerged as a joint top priority, highlighting the growing understanding that success thrives on interconnectedness. This shift signifies a move away from siloed operations and towards building stronger, more transparent relationships across the value chain. While sustainability and collaboration reign supreme, cost reduction remains a significant concern, ranking third overall. Notably, for the food & beverage sub-sector, heavily impacted by inflation, cost reduction remains the top strategic objective.

This shift in priorities signals a transformational phase within the FMCG industry. Companies are recognizing the interconnectedness of business success with environmental and social responsibility, while also understanding the value of collaborative partnerships. Moving forward, it's likely we'll see continued advancements in sustainable practices, stronger partnerships, and innovative solutions that address both cost concerns and sustainability goals.

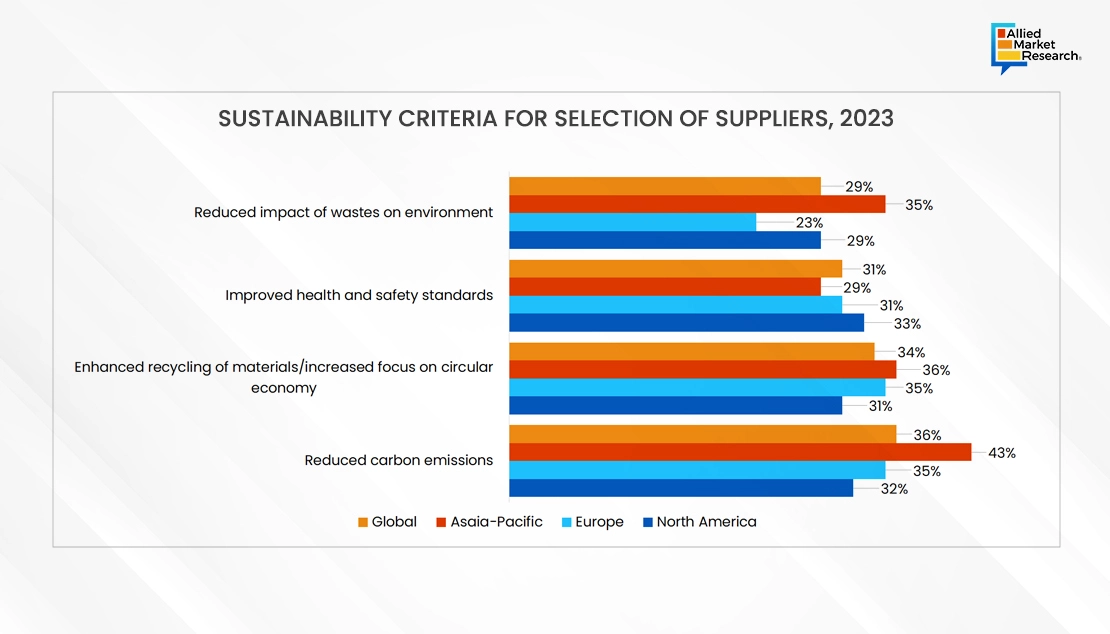

FMCG companies’ selection criteria for suppliers

- The highest proportion of FMCG companies in Asia-Pacific (43%) prioritize suppliers with reduced carbon emissions, followed by North America (32%) and Europe (35%).

- Globally, 36% of FMCG companies consider reduced carbon emissions as a key sustainability criterion for supplier selection.

- Europe and North America exhibit the highest emphasis on this criterion, with 35% of FMCG companies in each region prioritizing suppliers with enhanced recycling of materials or a focus on the circular economy.

- In Asia-Pacific, slightly fewer companies (36%) prioritize this criterion.

- Globally, 34% of FMCG companies consider this criterion important for supplier selection.

- FMCG companies in North America have the highest focus on health and safety standards, with 33% prioritizing this criterion, followed closely by Europe at 31%.

FMCG Industry's Digital Transformation

For decades, the FMCG (Fast-Moving Consumer Goods) industry thrived on familiar territory: physical stores, brand loyalty, and predictable supply chains. However, the past few years have brought a whirlwind of change, forcing this traditionally conservative sector to adapt at breakneck speed. The relentless push towards digital maturity has become a defining theme, one that demands not just technological adoption, but a complete reimagining of how the industry operates. According to the India Brand Equity Foundation, “the retail market in India is estimated to reach $1.1 trillion in 2020, up from $840 billion in 2017, with modern trade expected to grow at 20-25% per annum, which is likely to boost the revenue of FMCG companies.”

The rise of e-commerce has fundamentally altered consumer behavior. Gone are the days of impulse purchases at the local supermarket; today, convenience reigns supreme, with online channels offering seamless shopping experiences and personalized recommendations. FMCG companies must evolve beyond traditional distribution models and cultivate a strong omnichannel presence. Integrating physical and digital touchpoints allows for a holistic customer journey, fostering engagement and loyalty across all platforms.

Data is the new currency of the FMCG industry. By leveraging advanced analytics, companies can gain invaluable insights into consumer behavior, market trends, and supply chain efficiencies. This data-driven approach empowers them to personalize marketing campaigns, optimize inventory management, and predict demand fluctuations with greater accuracy. Embracing data analytics and artificial intelligence isn't just a competitive advantage; it's a necessity for survival in the digital age. According to investidia.gov.in, India, the fastest-growing major economy, may become the third-largest consumer economy by 2025, growing by 3 times to reach $4 trillion. Hence, with the growing penetration of digital technologies in developing or emerging markets, FMCG companies need to invest in increasing their digital presence to remain competitive in the market.