Table Of Contents

Yerukola Eswara Prasad

Koyel Ghosh

The Role of Carbon Capture and Utilization (CCU) in Green Energy

Carbon Capture, Utilization, and Storage (CCUS) technologies aim to reduce the release of carbon dioxide (CO2) emissions into the atmosphere, thereby combating anthropogenic climate change. Despite being crucial for decarbonizing industries like electricity, chemicals, cement, and steel manufacturing, CCUS has faced challenges in widespread adoption. Governments are now stepping in with supportive policies, such as the enhanced tax credit for CO? isolation in the recent Inflation Reduction Act (IRA) in the United States, which accelerate CCUS adoption and facility scaling.

There are three main types of technological carbon capture, which can be summarized as:

- Carbon Capture (CC):

- Technologies

- Pre-Combustion Capture

- Post-Combustion Capture

- Oxyfuel Combustion Capture

- Methods:

- Chemical Absorption

- Membrane Separation

- Adsorption

- Technologies

- Carbon Utilization (CU):

- Enhanced Oil Recovery (EOR)

- Carbonate Mineralization

- Chemical Feedstock

- Carbon Storage (CS):

- Geological Storage

- Ocean Storage

- Mineralization

An outlook on the total CCUS projects globally as of 2022

The top countries for carbon capture, utilization, and storage investment include the US, UK, Norway, and China. In the UK and Norway, companies are mainly focusing on improving enhanced oil recovery processes through research and development. Over the next decade, there's expected to be significant growth due to advancements in technology, including utilizing CO2 released during production. Additionally, there's been progress in implementing CCUS technologies in sectors like petroleum refining, chemicals, cement, and metal foundries in Norway and the UK. These efforts, along with increased awareness among policymakers about the benefits of reducing CO2 emissions, present promising opportunities for future investments.

Demand for CCUS has witnessed tremendous growth driven by increasing penetration in end-use industries such as oil & gas, power generation, iron & steel, chemical & petrochemical, cement, and others. All industry players are investing heavily to find new commercial avenues for their product segments via investment, contracts, and partnerships.

To observe the growth in the CCUS industry, we need to observe and analyze certain practices, which will provide insights into the demand perspective. Some of the indicators analyzed in the CCUS industry in green energy are as follows:

Government Spendings on CCUS:

Between 2011 and 2023, the U.S. Congress allocated $5.3 billion for Carbon Capture and Storage (CCS) programs, with an additional $3.4 billion from the American Recovery and Reinvestment Act of 2009. The 2021 Infrastructure Investment and Jobs Act assigned $8.2 billion for CCS programs from 2022 to 2026. In Canada, the Fall Economic Statement outlines that up to C$7 billion ($5.1 billion) of its C$15 billion capital will be prioritized for CCS initiatives. This effort aims to expedite the adoption of contracts for difference, supported by the Canada Growth Fund, to provide investors with certainty on future carbon credit pricing. Both the U.S. and Canada have made significant investments in CCS technology.

The Government of India's Department of Science and Technology (DST) has initiated the Mission Innovation carbon capture innovation challenge in the Asia-Pacific region. This aims to reduce CO2 emissions from power plants and industries by promoting carbon capture, utilization, and storage (CCUS) technologies. Similarly, the Australian government allocated $50.0 million in March 2021 to support CCUS projects across Australia. The funding aims to lower technology adoption costs and encourage industry investment, especially in regional areas, to advance CCUS projects toward commercialization. Additionally, it will aid in developing processes that can turn carbon dioxide into economically viable products.

CO2 Emissions

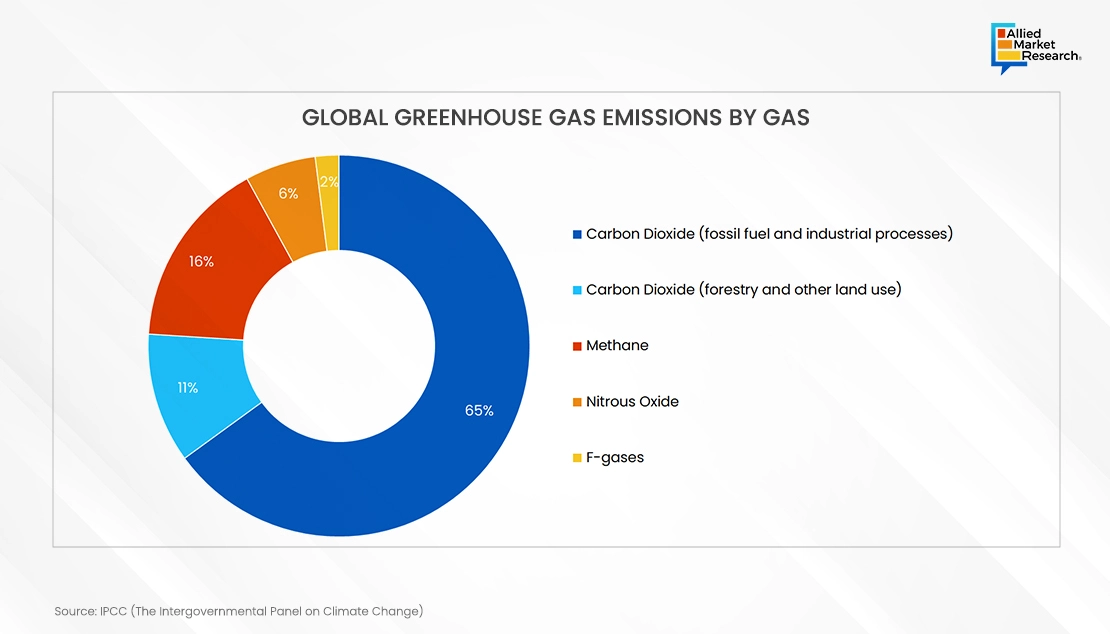

Human activities contribute to the release of greenhouse gases. Carbon dioxide, methane, nitrous oxide, and fluorinated gas are some of the most prominent ones. According to the U.S. Environmental Protection Agency (USEPA), Carbon Dioxide accounted for a major share which is summarized below –

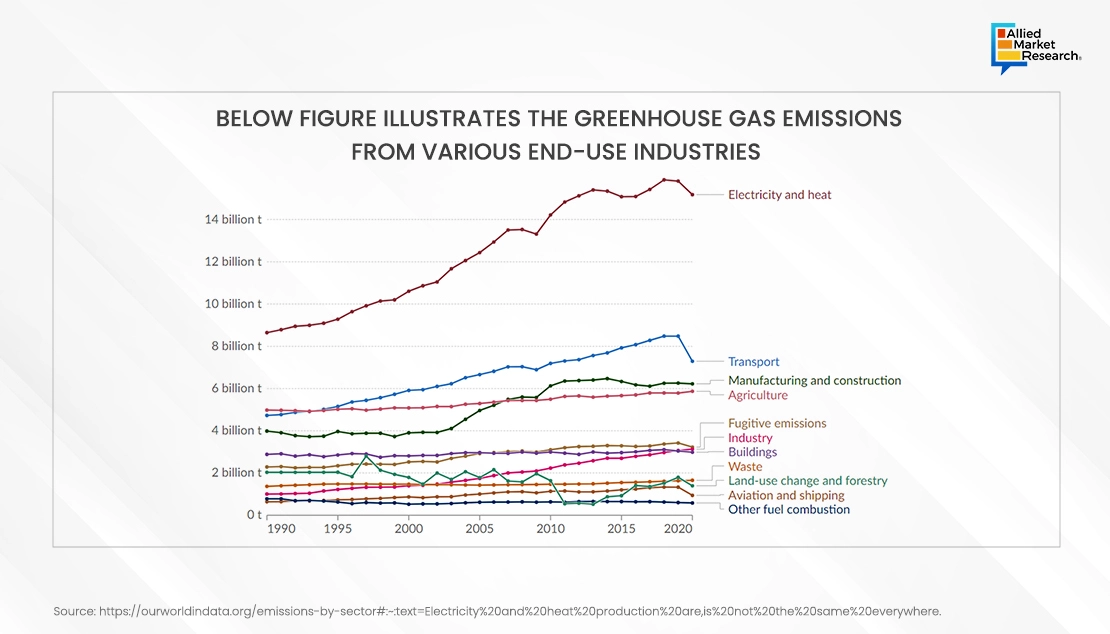

From 2010 to 2020, the figure shows that carbon dioxide (CO2) was the most commonly emitted gas. These emissions mainly come from power generation, transportation, and manufacturing and construction industries. Studies have found that Carbon Capture, Utilization, and Storage (CCUS) technology is widely used in important sectors like oil and gas, cement, iron and steel, and power generation. This is mainly to reduce the impact of CO2 on the environment.

CCUS helps the oil and gas industry reduce greenhouse gas emissions by trapping carbon dioxide deep underground. This stored CO2 is then repurposed to enhance oil recovery. In 2019, more than 24 million tons of CO2 were captured, stored, and utilized by the industry, with the majority sourced from natural gas processing plants. According to the International Energy Agency (IEA), natural gas usage is expected to increase by approximately 2.7% per year until 2040, comprising nearly 30% of global energy production by that time. Integrating CCUS in this sector can significantly contribute to environmental sustainability efforts and advance CCUS initiatives.

Economic Assessment

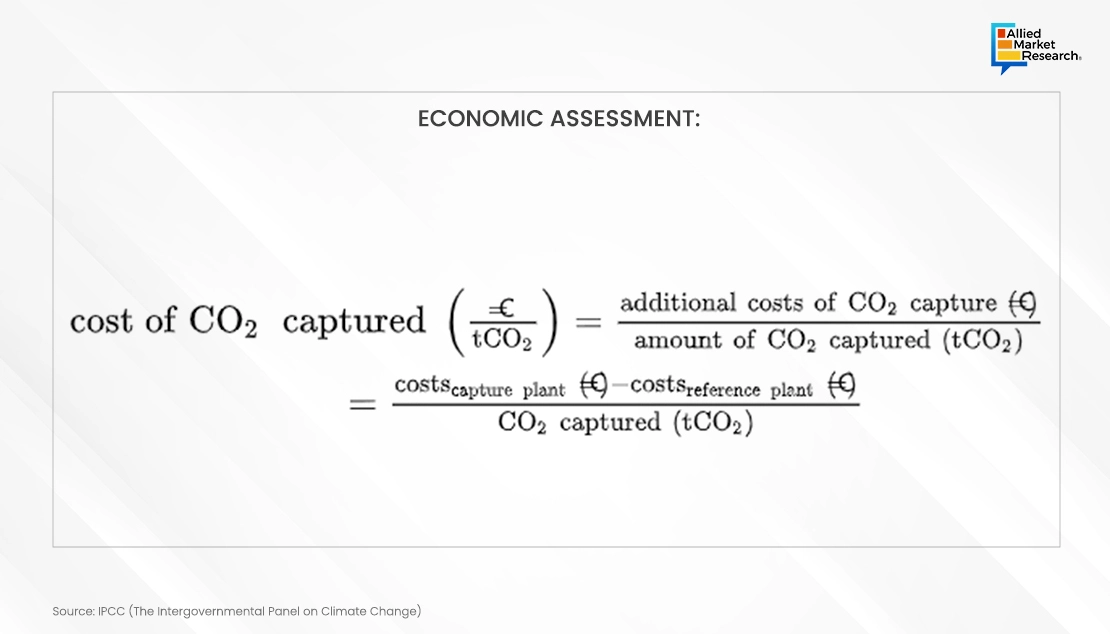

Capturing CO2 is possible and already practiced in various industries, but its widespread use is hindered by the high initial investments required. Capture costs typically refer to the expenses involved in separating and compressing CO2 at a single facility. The Intergovernmental Panel on Climate Change (IPCC) offers two main metrics for evaluating these costs: capture costs and CO2 avoidance costs.

Capturing carbon dioxide typically demands extra energy and lowers a plant's efficiency, which can lead to additional CO2 emissions. Consequently, the reduction achieved through capturing and preventing CO2 emissions is usually less than that of a reference system. Therefore, the expense of preventing CO2 emissions is often greater than the expense of capturing them..According to a study by BloombergNEF, “For industries where the concentration of CO2 in off-gases is high, such as ethanol, ammonia, and natural gas processing, capture costs range anywhere from $20 to $28 per ton of CO2. For industrial sources, BNEF sees costs at $80 per ton of CO2 for cement, $79 per ton of CO2 for hydrogen, and $72 per ton of CO2 for steel. With transport and storage fees of $20-$50 per ton of CO2, the total costs add up to $92-$130 per ton of CO2. Direct air capture is far more expensive than previously thought, costing as much as $1,100 per ton today, and potentially falling to $300-$400 per ton by 2030. To realize these cost declines, the industry will have to coalesce around one or two technologies and develop the supply chains to bring these technologies to scale".

Exploring Cost Variability

Also, according to a study by IEA, “CCUS applications do not all have the same cost. Looking specifically at carbon capture, the cost can vary greatly by CO2 source, from a range of USD 15-25/t CO2 for industrial processes producing pure or highly concentrated CO2 streams (such as ethanol production or natural gas processing) to USD 40-120/t CO2 for processes with dilute gas streams, such as cement production and power generation. Capturing CO2 directly from the air is currently the most expensive approach but could nonetheless play a unique role in carbon removal. Some CO2 capture technologies are commercially available now, while others are still in development, and this further contributes to the high range in costs".

The slow advancement of CCUS deployment indicates that many technologies and applications are still in the early stages of development or commercialization. This currently makes them quite costly. However, there is significant potential for cost reductions. Similar to renewable energy, achieving this potential will necessitate stronger policy support to encourage innovation and deployment of CCUS technologies

Allied Market Research delves into the intricacies of carbon capture and utilization in green energy, as we aim to provide vendors with comprehensive insights into the evolving landscape. We provide in-depth details through highly curated reports that portray technological advancements, market trends, and government initiatives concerning the domain, which in turn help businesses integrate carbon capture practices into their operations. AMR also endeavors to equip vendors with the knowledge needed to understand the CCUS industry, grab growth opportunities, and contribute effectively toward sustainable and eco-friendly practices.