Table Of Contents

Yerukola Eswara Prasad

Koyel Ghosh

Oleochemicals Outlook in Green Chemicals

Oleochemicals are chemicals derived from natural fats and oils, typically of plant or animal origin. These raw materials include vegetable oils such as palm, coconut, soybean, and animal fats. The production and use of oleochemicals are often considered more environmentally friendly than traditional petrochemical-based alternatives, as they are derived from renewable resources. Some common types of oleochemicals include:

- Fatty Acids: These are the building blocks of oleochemicals used in soaps, detergents, and various industrial applications.

- Fatty Alcohols: Derived from fatty acids, these alcohols find use in personal care products, surfactants, and detergents.

- Glycerol (Glycerin): Produced during the saponification process, glycerol is employed in pharmaceuticals, cosmetics, and the food industry.

- Esters: Formed by reacting fatty acids with alcohols, esters have applications as plasticizers, lubricants, and biodiesel production.

- Surfactants: These compounds, including alkyl sulfates and alkyl ethoxylates, are crucial in the formulation of soaps, shampoos, and other cleaning products.

- Polyols: These are alcohols with multiple hydroxyl groups, such as sorbitol and mannitol, used in sweeteners, humectants, and pharmaceuticals.

- Waxes: Natural waxes derived from oleochemical sources are utilized in various industries, including cosmetics, candles, and coatings.

- Bio-based Polymers: Oleochemicals are also used in the production of bio-based polymers, contributing to the development of environmentally friendly plastics.

- Lubricants: Oleochemicals serve as base materials to produce eco-friendly lubricants and hydraulic fluids.

- Phospholipids: They play an important role in the food and pharmaceutical industries, often used as emulsifiers and in drug delivery systems.

Demand for oleochemicals has showcased significant growth by increasing penetration in different end-use industries such as pharmaceutical, food & beverage, cosmetic & personal care, chemical, and so on. To observe the growth in the oleochemicals industry, we need to observe and analyze certain practices that will provide insights into the demand perspective. Some of these indicators analyzed are as follows:

Demand Analysis

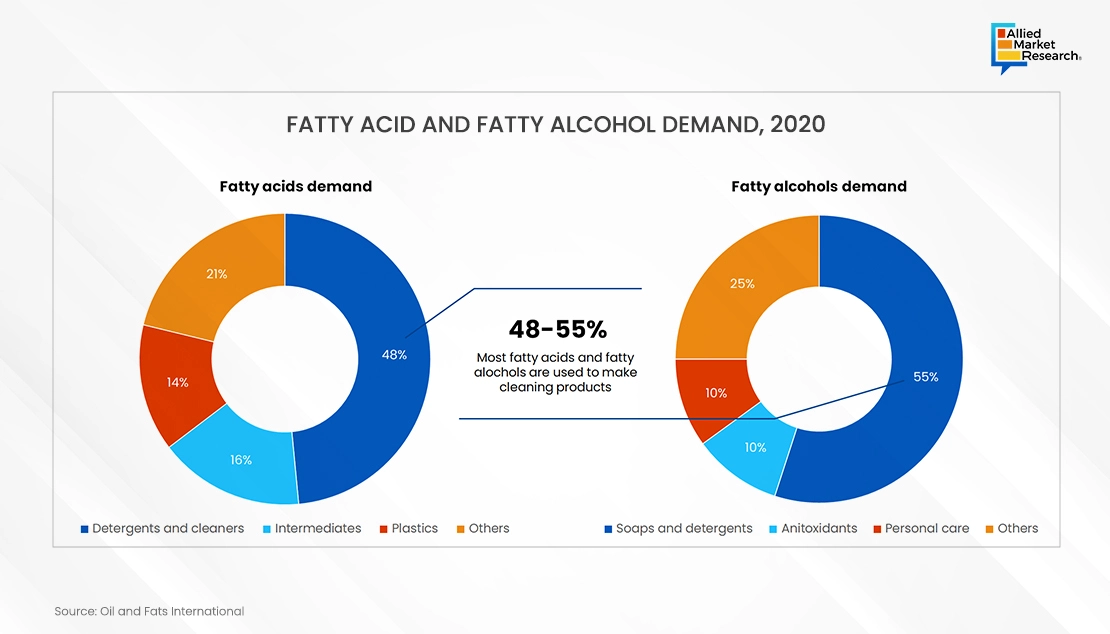

Fatty acids are carbon chains containing a methyl group on one end and a carboxylic group on the other, having a long aliphatic chain that can be either saturated or unsaturated. In the home care cleaning industry, fatty acid salts are a class of anionic surfactants that are utilized in a variety of domestic cleaning products, including soaps, detergents, bleaches, and cleaners. Soap and detergent products utilize a variety of fatty acids, including lauric, ricinolein, myristic, stearic, oleic, linoleic, palmitic, and linolenic acids. The worldwide use of antiviral household cleaning products increased significantly. Globally, the frequency of cleaning (69.3%) and the consumption of cleaning products (74.2%) increased substantially during the pandemic period. According to the International Association for Soaps, Detergents, and Maintenance Products (A.I.S.E), the total market value of the domestic care and professional cleaning and hygiene sector in Europe reached $47.1 billion by 2020.

Fatty alcohols are compounds with hydroxyl groups attached to aliphatic chains, and they function as nonionic surfactants. In industries like cosmetics and food, they serve as thickeners, emollients, and co-emulsifiers. The demand for fatty alcohols is expected to rise in the soaps & detergents sector due to the increasing need for octadecenoyl, oleyl alcohol, and natural emulsifiers. These alcohols are also used in plasticizers to enhance the properties of plastics. Furthermore, they play a role in the textile industry, where they are employed in formulations such as fatty alcohol ethoxylates for scouring and emulsifying. Their use extends to calibrating dyes and acting as wetting agents. With the flourishing global textile industry and ongoing technological advancements, there's likely to be a surge in global demand for fatty alcohols. For instance, India's textile and apparel exports, which amounted to $38.70 billion in 2019, are projected to reach $82.00 billion by 2021, according to the Indian Brand Equity Foundation (IBEF).

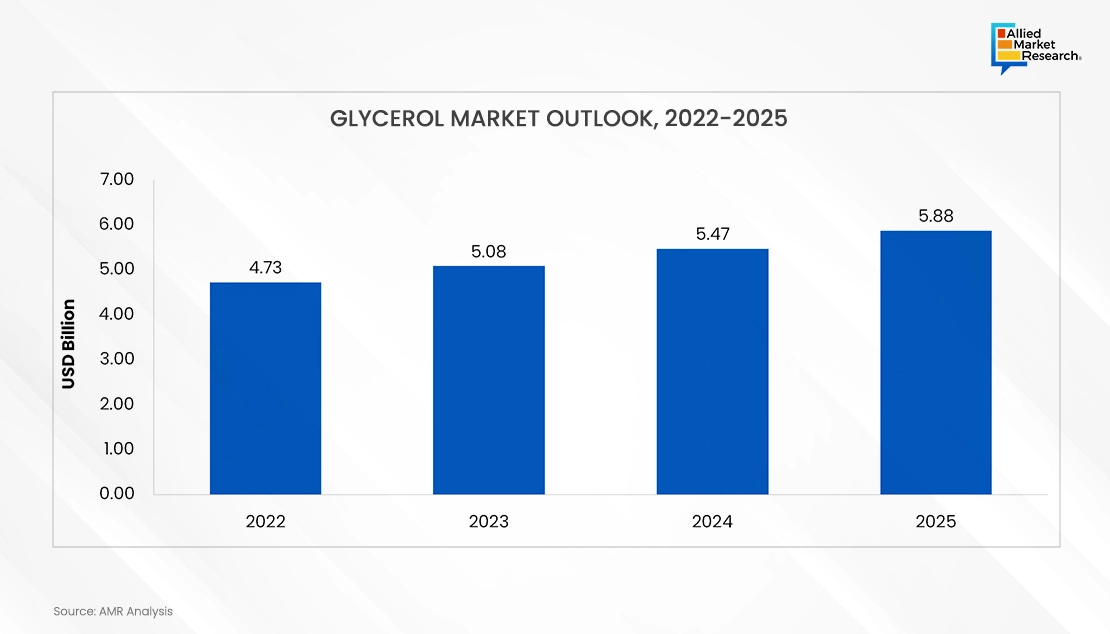

Glycerol (C3H8O3) is a transparent, viscous, odorless, hygroscopic, and water-miscible organic compound. It is produced through the hydrolysis of plant and animal lipids and fats. It is also used to produce serums, vaccines, suppositories, expectorants, cough syrups, cardiac medications, drug solvents, and so on. Increasing consumer preference for products derived from natural sources and rising demand for biodiesel from the transportation industry are increasing the demand for glycerol. Glycerol is one of the clean and renewable fuels; consequently, stricter environmental regulations on carbon emissions are fueling the demand for biodiesel. Consequently, the rising demand for products derived from natural sources among consumers is anticipated to stimulate the growth of glycerol. The expanding demand for glycerol in the personal care industry is anticipated to drive market expansion. It is employed in the manufacture of personal care and cosmetic products including lotions, shampoos, toothpaste, hair conditioners, and body cleansers. Consequently, the rising demand for products derived from natural sources among consumers is anticipated to stimulate the growth of glycerol.

A large number of oleochemical manufacturing facilities are located in the Asia-Pacific region. According to MIDA (Malaysia, Investment Development Authority), China, Indonesia, and Malaysia are some of the major countries, togethering with accounting for more than 60% of the global production capacity. Malaysia is the market leader in the production and export of oleochemicals. There are various players in Malaysia, which have vertical integration (active in upstream and downstream activities). Players such as IOI Oleochemicals, Kuala Lumpur Kepong Berhad (KLK) Oleo, Sime Darby, and so on are involved in palm oil plantation, production, and exports.

Biofuel production

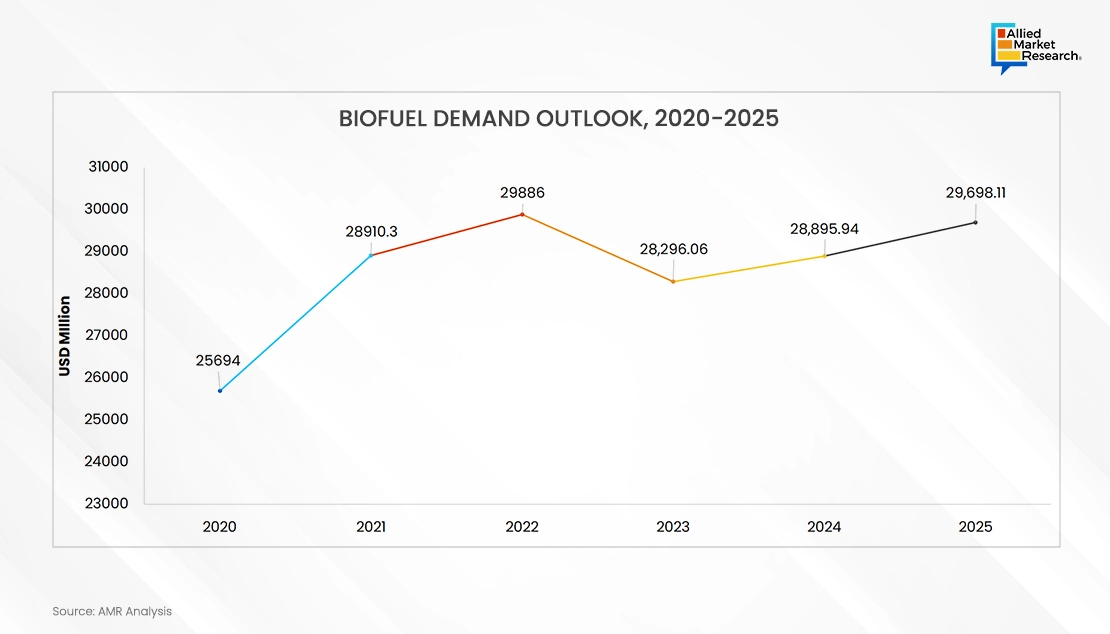

Biofuels find applications across various industries such as personal care, cosmetics, pharmaceuticals, coatings, adhesives, food, and cleaning products. The demand for oleochemicals, derived from biofuels, is expected to rise, leading to an increase in oilseed production. In the late 1970s, as crude oil prices surged, manufacturers shifted from petrochemical to oleochemical products due to cost-effectiveness, particularly utilizing plant-based oils like palm oil. Palm oil has since been extensively used in producing household items such as laundry detergents, toothpaste, soap bars, and shampoo. The growth of the biodiesel market and the expanding fast-moving consumer goods (FMCG) industry are major drivers for the oleochemicals market. Increasing global demand for biodegradable and sustainable solutions also impacts this market positively. Furthermore, major manufacturers are increasingly turning to oleochemicals to produce eco-friendly alternatives like bio-lubricants, bio-surfactants, and biopolymers instead of petrochemicals, contributing to market growth. The popularity of organic ingredients in baby care products, soaps, cosmetics, and food items further propels market expansion.

As can be seen from the above figure, the biofuel demand showcased a slight dip from 2022 to 2023 due to economic and social slowdown mainly in the European region. This has a cascading effect globally, which was normalized in Q3 of 2023. Post 2023, the market has been showcasing a growth trajectory as anticipated.

Purchasing Power Parity

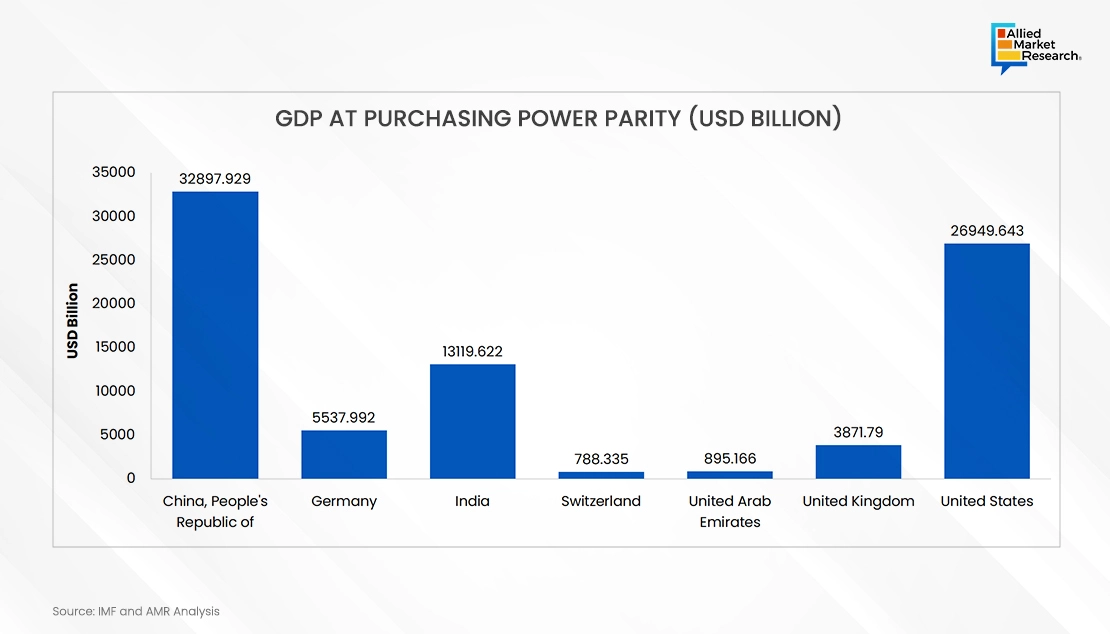

One of the major indicators to be observed is the purchasing power parity of various countries globally. Oleochemicals are utilized majorly in pharmaceuticals, food & beverage, cosmetics & personal care, and so on. The purchasing power parity of consumers is directly dependent on the consumption pattern of oleochemicals. Oleochemicals are utilized as preservatives, thickening agents, and emollients in the pharmaceutical sector. Isopropyl myristate is utilized in topical medicinal preparations as a moisturizer and as an emollient or thickening agent in various pharmaceutical uses. Oleochemicals are mostly utilized in the cosmetics and personal care industry. Fatty alcohols, Glycerin, fatty acids, vitamin E, methyl esters, collagen, soap noodles, and a variety of ethanol variations are all used in the personal care & cosmetics sector. Oleochemicals are found in soaps, sunscreen, cosmetics, skincare, and perfumes, among other personal care & cosmetics items. As these are consumer goods directly related to consumption from the general population, the purchasing power parity of consumers is considered.

With the increase in the purchasing power parity, the demand for oleochemicals is also expected to increase in the coming years.

Feedstock Price Assessment

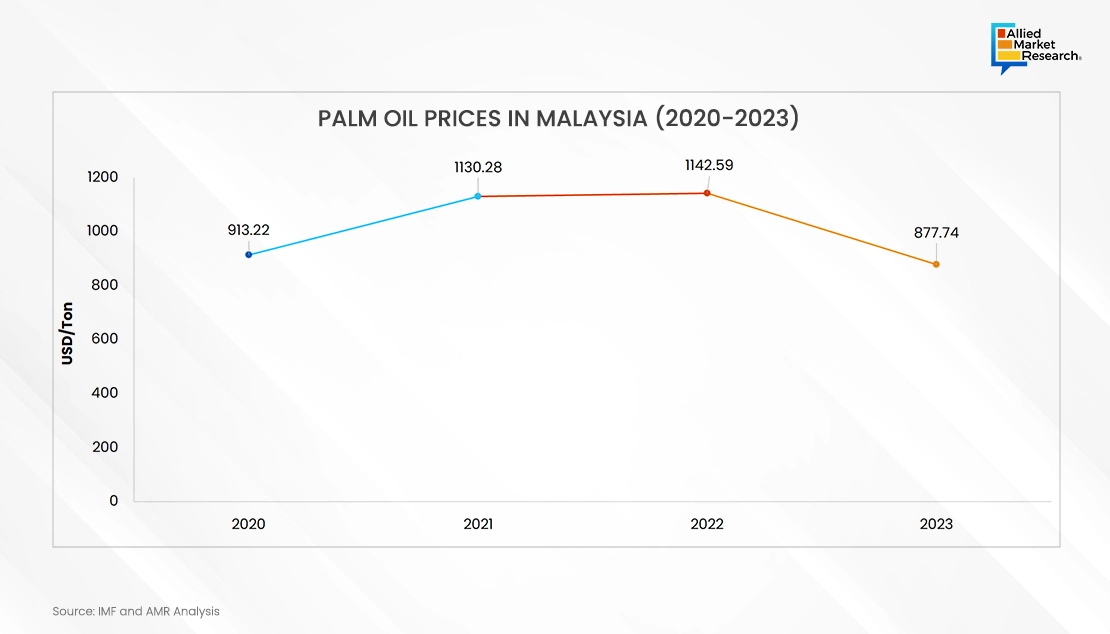

The major feedstock for oleochemical production includes palm oil, coconut oil, lauric oil, tallows, glycerin, and so on. Palm oil is one of the major feedstocks of oleochemicals and is produced largely in Malaysia. Due to the presence of large players in this sector, the prices are controlled heavily, and not many fluctuations are witnessed. The fluctuation in prices is observed mainly on a year-to-year basis only.

Allied Market Research delves into the intricacies of oleochemicals and other related products, as we aim to provide vendors with comprehensive insights into the evolving landscape. We provide in-depth details through highly curated reports that portray technological advancements, market trends, and government initiatives concerning the domain, which in turn help businesses integrate carbon capture practices into their operations.