Risk Advisory Service Market Research, 2034

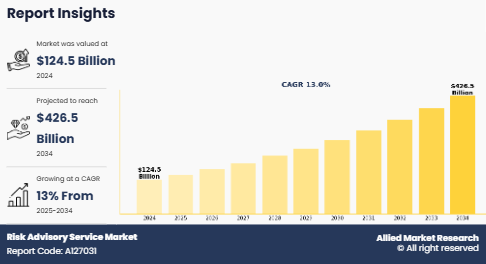

The global risk advisory service market was valued at $124.5 billion in 2024, and is projected to reach $426.5 billion by 2034, growing at a CAGR of 13% from 2025 to 2034. Risk advisory service is a professional service that helps businesses identify, manage, and reduce risks that could harm their operations, reputation, or financial condition.

These risks can include financial fraud, cyberattacks, legal issues, operational failures, or regulatory problems. Risk advisors work with companies to assess potential threats, create plans to avoid or handle them, and ensure compliance with rules and standards. They also help improve internal processes, security systems, and business strategies to make organizations more resilient and better prepared for unexpected events. Risk advisory services are commonly used in industries like finance, healthcare, manufacturing, and IT. The goal is to protect the company from losses and support long-term growth by making smarter and safer business decisions.

Key Takeaways:

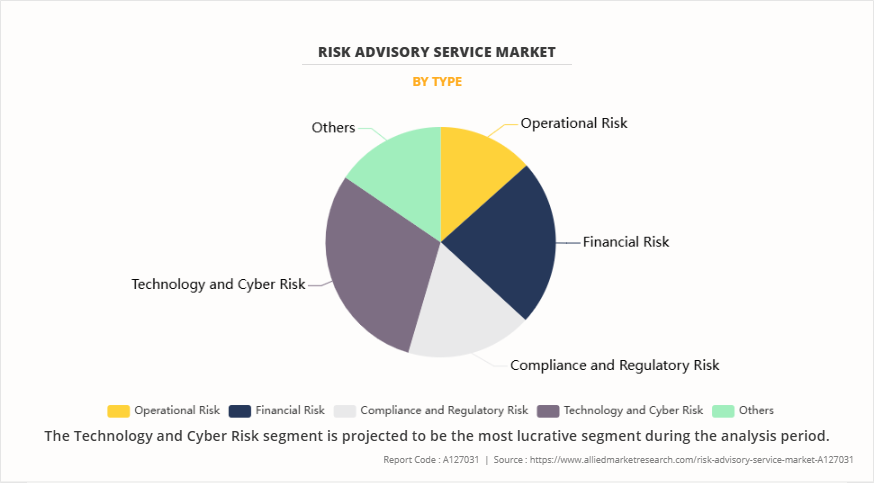

- By Type, the technology and cyber risk segment held the largest share in the risk advisory service market for 2024.

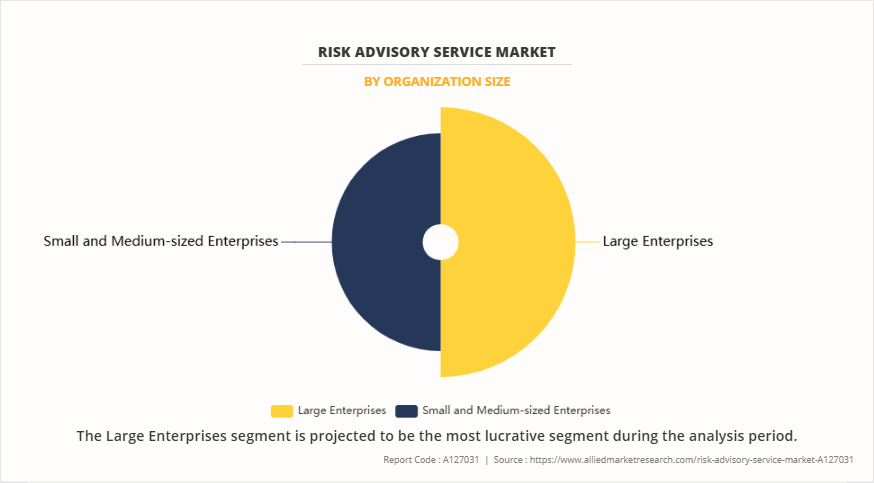

- By Organization Size, the large enterprises segment held the largest share in the risk advisory service market for 2024.

- By Industry Vertical, the BFSI segment held the largest share in the risk advisory service market for 2024.

- Region-wise, North America held the largest risk advisory service market in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The risk advisory service market size is growing mainly due to the rising number of cybersecurity threats and data breaches. As businesses become more digital and rely heavily on online systems, they are facing increasing risks of cyberattacks, hacking, and data theft. These incidents can lead to huge financial losses, legal troubles, and damage to a company's reputation. To protect themselves, companies are now turning to risk advisory services for help. These services guide organizations in identifying weak points in their systems, strengthening their cybersecurity measures, and preparing plans to deal with cyber threats. With new types of cyberattacks emerging regularly, businesses are realizing the importance of staying ahead. Risk advisors also help companies follow data protection laws and avoid penalties. As more companies invest in cybersecurity, the demand for expert advice and support continues to grow, making cybersecurity one of the key drivers of the risk advisory services market.

Segment Review

The risk advisory service market is segmented on the basis of type, organization size, industry vertical, and region. By type, it is segmented into operational risk, financial risk, compliance and regulatory risk, technology and cyber risk and others. By organization size, it is classified into large enterprises, small and medium-sized enterprises. By industry vertical it is segmented into BFSI, IT and telecom, healthcare, retail and e-commerce, government and public sector, manufacturing, and others. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the technology and cyber risk segment dominated the risk advisory service market in 2024 and is expected to maintain its dominance in the upcoming years. This is attributed to the growing dependence on digital infrastructure, rising cybersecurity threats, and the need for robust IT governance and compliance frameworks. Furthermore, businesses are increasingly investing in advanced risk mitigation strategies to protect sensitive data and maintain regulatory standards, especially with the rise in cloud computing and remote operations. This continued focus is fueling the demand for expert cyber risk advisory services across industries.

However, the operational risk segment is expected to register the highest CAGR during the risk advisory service market forecast period owing to the rise in business complexities, supply chain disruptions, and regulatory compliance challenges. Moreover, organizations are focusing on improving internal controls and operational efficiency, driving demand for risk advisory services.

On the basis of organization size, the large enterprises segment dominated the risk advisory service market in 2024 and is expected to maintain its dominance in the upcoming years owing to their higher risk exposure, complex operations, and larger investments in compliance and cybersecurity frameworks. Moreover, large enterprises often face greater scrutiny, which fuels the need for specialized risk consulting services.

However, the small and medium-sized enterprises are expected to register the highest CAGR during the forecast period. This is attributed to the increasing awareness of risk management advisory, rising regulatory pressures, and growing adoption of digital technologies among SMEs. In addition, cost-effective and customized risk advisory solutions are becoming more accessible, enabling SMEs to proactively address operational and cybersecurity challenges, thereby driving the risk advisory service market growth.

Competition Analysis

The report analyzes the profiles of key players operating in the risk advisory service market are Cherry Bekaert, Price Waterhouse Cooper (PwC), Weaver and Tidwell, LLP, FTI Consulting, Inc., KPMG International Limited, Grant Thornton International Ltd., Deloitte Touche Tohmatsu Limited, BDO International Limited, RSM International Ltd., CLA Global TS Holdings Pte Ltd, MBG Corporate Services, Aon plc, Protiviti Inc., The Risk Advisory Group Ltd, IBM Corporation, Chubb Group Holdings Inc., Alvarez & Marsal Holdings, LLC, Willis Towers Watson PLC, Forvis Mazars Group SC, Ernst & Young Global Limited.

Recent Developments in the Risk Advisory Service Market

In July 2025, BDO expanded its risk advisory services in Perth by launching a new team focused on AI and cyber threats, aiming to strengthen its presence in Western Australia1. The expansion includes hiring experienced professionals like Angela Pak (formerly of KPMG) and Andrew Hillbeck (formerly of Deloitte). This move is part of national strategy to grow beyond traditional audit and tax services, especially in response to rising demand for advisory work and evolving technology risks. The Perth team will help organizations build robust governance frameworks and manage risks associated with rapid tech adoption and regulatory compliance gaps.

In May 2025, Deloitte India partnered with Credibl, an AI-driven sustainability platform, to help businesses navigate the evolving landscape of Environment, Sustainability, and Governance (ESG) requirements. This partnership combines Deloitte expertise in climate risk and sustainability advisory with Credibles advanced AI tools for traceability, ESG reporting, and compliance. The collaboration aims to deliver end-to-end solutions for enterprise sustainability, supply chain transparency, and alignment with global ESG standards such as BRSR, ESRS, GRI, and ISSB empowering organizations to move from reactive reporting to proactive sustainability strategies.

In May 2024, IBM partnered with Palo Alto Networks to deliver AI-powered security offerings, combining IBM consulting expertise with Palo Alto Networks advanced cybersecurity platforms. As part of the collaboration, IBM will provide security consulting services across Palo Alto platforms, while Palo Alto Networks will integrate IBM watsonx AI models into its Cortex XSIAM platform. Additionally, Palo Alto Networks acquired IBM QRadar SaaS assets, with both companies supporting seamless migration for existing clients. This partnership aimed to streamline security operations, enhance threat detection, and accelerate incident response for enterprises navigating complex digital environments.

Top Impacting Factors

Driver

Digital Transformation and Adoption of Advanced Technologies

Digital transformation and the adoption of advanced technologies are driving the growth of the risk advisory services market. As businesses increasingly move toward digital platforms and technologies such as cloud computing, artificial intelligence, big data, and the Internet of Things (IoT), they are exposed to new types of risks. These include data breaches, system failures, cyberattacks, and compliance issues related to digital operations. As a result, organizations are turning to risk advisory services to help them identify, manage, and reduce these evolving risks, thus supporting the expansion of risk advisory service market. Furthermore, the integration of technology into day-to-day business operations requires constant monitoring and risk assessment. Risk advisory firms provide expert guidance on how to secure digital systems, maintain data privacy, and ensure that new technologies comply with regulatory requirements, thus fueling the growth of risk advisory service market. Moreover, with growing digital footprints, businesses need support in developing cybersecurity frameworks and disaster recovery plans to stay resilient in a rapidly changing environment. In addition, as companies expand across digital markets, they must also adapt to diverse and complex regulatory landscapes. Risk advisory services help businesses understand and meet these legal standards, avoiding penalties and reputational damage which drives the growth of the risk advisory service market. Furthermore, the use of AI and automation by advisory firms allowing faster and more accurate risk detection and making the process more efficient, contributes to the growth of risk advisory service market . Overall, the shift toward digital transformation is fueling the demand for advanced, technology-focused risk advisory services, thus positioning the risk advisory service market for strong and sustained growth in the years ahead.

Restraints

High Cost of Implementing Risk Advisory Solutions

The high cost of implementing these risk advisory solutions is the key restraint in the growth of the risk advisory services market. Many businesses, especially small and medium-sized enterprises (SMEs), find it difficult to afford risk advisory services due to their limited budgets. Setting up a comprehensive risk management system often involves hiring specialized consultants, purchasing advanced software tools, and conducting in-depth assessments, all of which can be expensive. Moreover, the ongoing costs related to updates, monitoring, and employee training can add to the financial burden. Furthermore, in developing regions, where businesses may lack financial stability or technological readiness, the cost barrier becomes even more challenging. These companies may not fully understand the long-term benefits of risk advisory services and, as a result, may choose to avoid or delay adoption. This limits the market reach, especially among startups and growing businesses, which restrain the risk advisory service industry.

In addition, companies often face internal resistance to change, making it harder to justify large investments in risk advisory solutions. The lack of clear short-term returns may discourage decision-makers from spending on risk management services, even though such investments can prevent major losses in the future. While the market is being driven by rising regulatory pressure, cyber threats, and complex global operations, the high cost of implementation remains a major hurdle, impeding the growth of the risk advisory service industry. Reducing costs through scalable, cloud-based, or subscription models could help make these services more accessible and support wider Risk Advisory Service market adoption.

Opportunity

Integration of AI and Analytics into Risk Advisory Services

The risk advisory service outlook highlights that the integration of AI and analytics into risk advisory services creates significant opportunity for expansion of risk advisory service market share. As businesses encounter increasingly complex and unpredictable risks, they are leveraging advanced technologies to enhance their ability to anticipate and manage these challenges. Artificial intelligence (AI) and data analytics play a crucial role by enabling real-time collection, analysis, and interpretation of vast data sets. This empowers organizations to identify potential threats at an early stage and implement proactive measures to mitigate them effectively, thus providing remunerative opportunities for the growth of the risk advisory service market.

Furthermore, AI-powered tools can identify patterns of fraud, automate compliance checks, and improve the accuracy of risk assessments. This not only saves time and reduces manual errors but also helps businesses make faster and smarter decisions, thus supporting risk advisory service growth. For example, machine learning algorithms can learn from past data to predict future threats, while predictive analytics can help in assessing financial, operational, or cybersecurity risks more effectively.

Moreover, the use of AI and analytics improves transparency and builds stronger internal controls by continuously monitoring processes. In addition, risk advisory firms can offer more personalized and data-driven solutions to their clients, enhancing the overall value of their services. As businesses increasingly adopt digital tools and platforms, the demand for AI-integrated risk advisory solutions is rising. This trend is fueling innovation and creating new opportunities for growth of the risk advisory service market. Overall, the combination of technology and advisory expertise is transforming the way companies manage risk in today dynamic business environment.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the risk advisory service market analysis from 2024 to 2034 to identify the prevailing risk advisory service market outlook opportunities.

- The market research is offered along with information related to key drivers, restraints, and risk advisory service market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the risk advisory service market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global risk advisory service market trends, key players, market segments, application areas, and market growth strategies.

Risk Advisory Service Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 426.5 billion |

| Growth Rate | CAGR of 13% |

| Forecast period | 2024 - 2034 |

| Report Pages | 667 |

| By Type |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Deloitte Touche Tohmatsu Limited, RSM International Ltd., Weaver and Tidwell, LLP, IBM Corporation, Protiviti Inc., Grant Thornton International Ltd., Chubb Group Holdings Inc., Willis Towers Watson PLC, The Risk Advisory Group Ltd, BDO International Limited, Alvarez & Marsal Holdings, LLC, CLA Global TS Holdings Pte Ltd, MBG Corporate Services, Price Waterhouse Cooper (PwC), Aon plc, Forvis Mazars Group SC, KPMG International Limited, FTI Consulting, Inc., Cherry Bekaert, Ernst & Young Global Limited (EY) |

Analyst Review

The risk advisory services market is experiencing strong growth, driven by increasing demand from businesses seeking both protection and strategic advantage. As companies face rising threats from cyberattacks to regulatory penalties, they are turning to risk advisory services to safeguard operations while improving long-term performance. These services offer a dual benefit, helping businesses stay compliant with evolving laws while also identifying opportunities to optimize processes and reduce potential financial and operational risks. The rise of digital platforms has further fueled Risk Advisory Service market growth by allowing easier access to expert advisory services, tools, and real-time monitoring solutions, especially among startups and tech-driven firms.

In addition, tailored risk advisory services that suit various industries and organizational sizes are gaining traction. These services offer flexibility to address specific needs, whether it’s cybersecurity, regulatory compliance, fraud prevention, or operational efficiency, making them attractive to SMEs, large enterprises, and global firms alike. Companies in developing markets are also adopting these services to manage new-age risks and align with international standards.

Government initiatives encouraging corporate governance and transparency are also supporting the growth of Risk Advisory Service market. Moreover, advisory services offering features like real-time risk dashboards, automated compliance tools, customized reporting, and scenario analysis are appealing to businesses seeking efficient and long-term solutions. These options reduce the risk burden while enhancing strategic planning. However, challenges remain, such as the need for better awareness among smaller businesses and ensuring data security. Service providers must also improve onboarding experiences and simplify complex regulatory language to meet evolving client expectations. Despite these challenges, the risk advisory services market is expected to expand as businesses increasingly prioritize resilience, compliance, and risk-informed decision-making.

Integration of AI and advanced analytics for predictive risk management and the rising demand for cyber risk and ESG-focused advisory services worldwide are the upcoming trends of Risk Advisory Service Market in the globe

Technology and cyber risk is the leading type of Risk Advisory Service Market

North America is the largest regional market for Risk Advisory Service

$426.45 billion is the estimated industry size of Risk Advisory Service by 2034

Cherry Bekaert, Price Waterhouse Cooper (PwC), Weaver and Tidwell, LLP, FTI Consulting, Inc., KPMG International Limited, Grant Thornton International Ltd., Deloitte Touche Tohmatsu Limited, BDO International Limited, RSM International Ltd., CLA Global TS Holdings Pte Ltd, MBG Corporate Services, Aon plc, Protiviti Inc., The Risk Advisory Group Ltd, IBM Corporation, Chubb Group Holdings Inc., Alvarez & Marsal Holdings, LLC, Willis Towers Watson PLC, Forvis Mazars Group SC, Ernst & Young Global Limited are the top companies to hold the market share in Risk Advisory Service

Loading Table Of Content...

Loading Research Methodology...