Risk Management Market Overview

The global risk management market was valued at USD 12.6 billion in 2022, and is projected to reach USD 52 billion by 2032, growing at a CAGR of 15.4% from 2023 to 2032. The rise in data and security breaches among businesses is the primary driver of the expansion of the global risk management market.

Key Market Insights

- By enterprise size, SMEs are projected to be the fastest-growing segment during the forecast period.

- By component, services are expected to exhibit the highest growth during the forecast period.

- Region wise, Asia Pacific is expected to exhibit the highest growth during the forecast period.

Market Size & Forecast

- 2032 Projected Market Size: USD 52 Billion

- 2022 Market Size: USD 12.6 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 15.4%

Risk the board is a sort of online or cloud-based application utilized by different associations to distinguish, access, and control various kinds of dangers related to an association. What's more, it additionally assists associations with overseeing various sorts of issues, which incorporate lawful liabilities, monetary vulnerability, security dangers, catastrophic events, and information-related gambles. Moreover, risk the executive's programming assists associations with expanding their abilities in perceiving continuous gamble and productively further developing direction. It makes it easier for an organization to evaluate, sum up, and visualize the value of its risk management efforts.

The flare-up of Coronavirus provoked an extensive extent of routine exercises and organizations to move their tasks to the web. This brought about associations and people all through the world starting to depend progressively on advanced media and correspondence organizations. Cybercriminals began exploiting what is going on to cause harm all over the planet. As per the web wrongdoing report distributed in 2020, more than $4.2 billion misfortune related to cybercrimes in a few businesses, the most revealed violations are phishing assaults and blackmail. Such occurrences further increment the mindfulness about network protection arrangements, which thusly add to speeding up the development of the worldwide market. The ascent in the reception of chance administration among monetary establishments is additionally energized by unofficial laws and industry guidelines.

Nonetheless, a critical test in this market is the significant expense and intricacy of the establishment and design of the product. In particular, small and medium-sized endeavors (SMEs) experience monetary limits while pondering such speculations. These expenses incorporate costs connected with programming authorizing, equipment essentials, memberships, enlistment, and customization. The persistent need for updates and alterations to line up with the always-advancing digital dangers further weighs monetary assets. Subsequently, the expense factor obstructs the more extensive reception of these arrangements, especially among associations with restricted monetary means. To handle this test, specialist organizations could have to offer more expense-productive and versatile choices to take care of a more extensive range of organizations. Notwithstanding, the coordination of computerized reasoning in risk-the-board programming and the ascent in popularity from creating economies is expected to arise as a rewarding and open door for the development of the risk management business.

The report centers around development possibilities, limitations, and patterns of the risk management market examination. The study employs Porter's five forces analysis to comprehend the risk management market's impact on a variety of factors, including the bargaining power of suppliers, the competitive intensity of competitors, the threat posed by new entrants, the threat posed by substitutes, and the bargaining power of buyers.

Risk Management Market Segment Review

The risk management market is segmented on the basis of component, deployment mode, enterprise size, industry vertical, and region. By component, the market is segmented into software and service. On the basis of deployment mode, the market is segmented into cloud and on-premise. On the basis of enterprise size, the market is segmented into large enterprises and SMEs. On the basis of industry vertical, the market is segmented into BFSI, IT and telecom, retail, healthcare, energy & utilities, manufacturing, government and defense, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

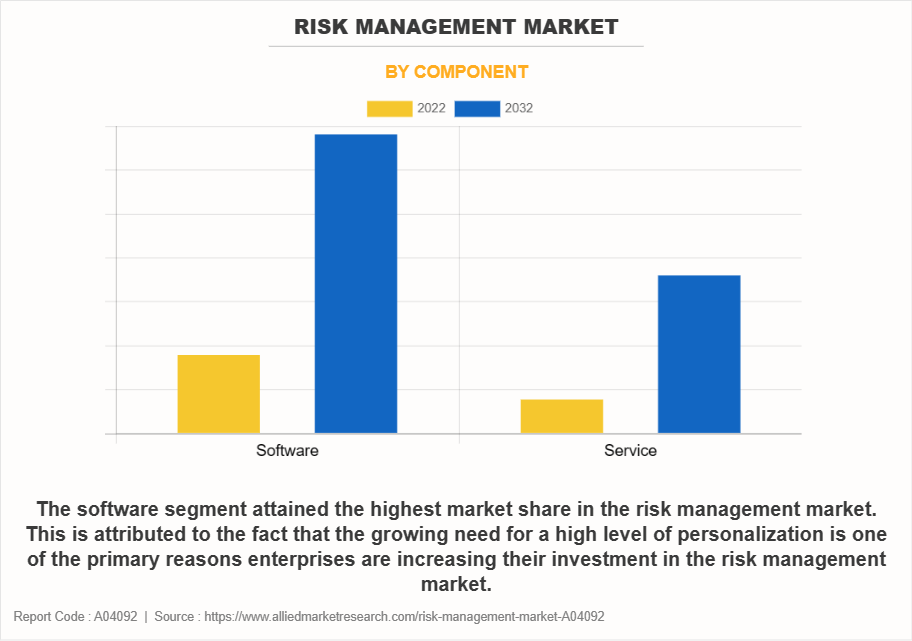

On the basis of component, the global risk management market share was dominated by the software segment in 2022 and is expected to maintain its dominance in the upcoming years. as the need for an elevated degree of personalization is one of the essential reasons ventures are expanding their interest in the gamble the executives market. However, services are expected to exhibit the highest growth during the forecast period. In the risk management market, administrations contain a scope of contributions given by online protection and hazard the executive's organizations to help endeavors in surveying, recognizing, and moderating the dangers related to network safety weaknesses and dangers, which drives the market development for this portion in the worldwide market.

By region, North America dominated the market share in 2022 for the risk management market. The presence of prominent players such as Oracle Corporation, IBM Corporation, and others is influencing the growth of the risk management market in North America. Besides, an ascent in government drives to reinforce security foundation across the district is additionally expected to drive the interest for risk the board and administrations further expected to push the development of the risk management market. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is ascribed to the expansion in the entrance of digitalization and higher reception of trend-setting innovation is supposed to give rewarding learning experiences to the market around here.

What are the Top Impacting Factors in Risk Management Market

Increase in data and security breaches among enterprises

The outbreak of COVID-19 prompted a considerable proportion of routine activities and businesses to shift their operations online. This resulted in organizations and individuals throughout the world beginning to rely increasingly on digital media and communication networks. Cybercriminals started taking advantage of the situation to cause damage around the globe. According to the internet crime report published in 2020, over $4.2 billion loss associated with cybercrimes in several industries, the most reported crimes are phishing attacks and extortion. Such instances further increase the awareness about cybersecurity solutions, which in turn contribute to accelerating the growth of the global market.

In addition, the supportive government policies and increasing investment by public and private authorities in security standards are positively impacting market growth. Several regional governments are making strategic investments in expanding security operations. Several government authorities around the globe are recognizing the importance of cyber-security and data protection solutions in the digital era and integrating proactive measures to safeguard end-users and businesses from cyber threats. Further, government policies are undertaking increased initiatives to embrace advanced technology, with plans for integrating new digital security solutions.

For instance, in July 2020, the National Security Agency and the Cyber Security and Infrastructure Security Agency launched an advisory for critical facilities, operational technology, and control systems assets. This advanced solution further increases the awareness of cyber security solutions among end users, improves service performance, and maintains safety standards in businesses. Therefore, risk management solutions gained wider traction among end-users, which in turn, is expected to fuel robust market growth.

Rise in adoption of risk management among financial institutions

- The adoption of risk management in financial institutions helps them improve awareness, strengthen “know your employee” (KYE) through technological intervention, and prevent monitoring & surveillance of transactions. According to an Identity Theft and Credit Card Fraud Statistics published in November 2023, bank fraud relating to debit cards, and electronic funds transfers grew by nearly 12% in 2022 compared to the previous year, 2021 owing to which many financial institutions have started adopting risk management software in large numbers. Moreover, different government regulations imposed on financial institutions have increased the adoption of risk management software. For instance, in October 2023, Nymcard partnered with ACI Worldwide, to better protect its customers from the growing threat of financial fraud. As a result, the adoption of security software in financial institutions drives the risk management market growth.

High cost and complexity in installation and configuration of the software

The high cost associated with risk management software presents a noteworthy hindrance in the market. Enterprises, especially small and medium-sized organizations (SMEs), often face financial burdens when contemplating investment in such solutions. This heightened expense encompasses various factors, including charges for software licensing, hardware prerequisites, ongoing subscriptions for threat feeds, as well as the expenditure involved in recruiting or training competent professionals to effectively manage and utilize these solutions. Furthermore, there may be hidden costs linked to system integration and customization to cater to the distinct requirements of diverse organizations.

In addition, the expense of maintaining and updating risk management solutions can be substantial. The continual evolution of cyber threats necessitates continuous updates and adjustments to the risk management infrastructure, thereby exerting pressure on budgets. This financial barrier has the potential to hinder the adoption of risk management solutions among organizations with limited resources.

Integration of artificial intelligence in risk management software

Integration of advanced technologies such as artificial intelligence in risk management software helps providers to identify risks and fraud, boost revenue, and add value to their customers. AI-based risk management software has increased efficiency in risk processing and helped in creating better business insight. Furthermore, including AI in risk management, software increases the ability of enterprises to adopt new innovations and pursue their goals. For instance, in September 2023, Dataminr launched its new AI-powered risk management capabilities for Dataminr Pulse for Corporate Security. Dataminr Pulse for Corporate Security's new risk management capabilities enable teams to collaboratively manage risks to the business in one place, giving a holistic view of risk events, workflows, actions, analysis, and reporting, as well as preparing for risks before it occur with a comprehensive set of new AI-powered scenario planning and resource allocation capabilities.

Similarly, different FinTech industries have installed AI-based risk management software, which helps monitor payments for potentially fraudulent activities and block suspicious transactions. An increase in the number of such AI applications in risk management software is expected to provide lucrative opportunities for market growth.

Rise in demand from developing economies

- Developing economies are at high risk of different cyber-attacks and fraudulent attacks, money laundering, terrorist activities, and data theft problems. Therefore, in developing economies, the use of risk management software has increased. Furthermore, the large external foreign currency debt of many developing economies makes it susceptible to changes in interest rates, owing to changes in international exchange rates and currency attacks. This boosts the market trends for risk management adoption in these nations. Thus, risk management market trends assist in reducing various hazards, including data theft, financial fraud, and cyberattacks, which provide numerous opportunities for the market.

Which are the Leading Companies in Risk Management

The following are the leading companies in the risk management market. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the risk management market analysis globally.

- IBM Corporation

- Lockpath, Inc.

- LogicManager, Inc.

- MetricStream Inc.

- Qualys, Inc.

- SAP SE

- SAS Institute Inc.

- ServiceNow

- RSA Security LLC

- Thomson Reuters

Recent Partnerships:

For instance, in December 2023, the Institute of Risk Management (IRM) India Affiliate partnered with HDFC Asset Management Company Limited, to enhance the enterprise risk management (ERM) capabilities and share insights through thought leadership projects tailored for the mutual fund industry. Similar strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Recent Product Launches:

For instance, in September 2020, International Business Machines Corporation launched a risk analytics service that helps organizations to implement risk analytics to prioritize cybersecurity costs for traditional business decisions.

Market Landscape and Trends

The Coronavirus pandemic emphatically affected the risk management market. The undertaking's wide shift towards the computerized foundation and rising cyberattacks empowered a flood popular for risk the board arrangements and administrations. In addition, the industries, specifically healthcare, banking and insurance contributed to the highest demand for cybersecurity and risk management solutions and services to mitigate the risks associated with cyberattacks. Furthermore, factors such as higher frequency of attacks, increased number of businesses requiring cybersecurity frameworks and increased security needs for curtain industries further contributed to the rise in risk management market size.

The market's growth was driven by the increased vulnerability to cybersecurity risks and the recognition of the importance of cybersecurity. However, specific sectors faced challenges due to economic uncertainties and financial constraints. The overall effect on the market size will depend on various factors such as the ongoing changes in the threat landscape, advancements in regulations, and the ability of risk management providers to introduce innovative solutions and meet the changing needs of their customers.

What are the Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the risk management market forecast from 2022 to 2032 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of risk management industry outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the Risk management market segmentation assists in determining the prevailing risk management market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global risk management industry trends, key players, market segments, application areas, and market growth strategies.

Risk Management Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 52 billion |

| Growth Rate | CAGR of 15.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Deployement Model |

|

| By Component |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | LogicManager, Inc., SAP SE, SAS Institute Inc, Lockpath, Inc. (NAVEX Global, Inc.), ServiceNow, Inc., Qualys Inc, RSA Security LLC, MetricStream., Thomson Reuters Corporation, IBM Corporation |

Analyst Review

The risk management market is characterized by intense competition, which be attributed to the strong presence of established vendors. It is expected that risk management solution and service providers, who possess extensive technical and financial resources, will have a competitive advantage over their competitors due to their ability to meet the global market needs. Furthermore, the competitive landscape within the market is anticipated to become even more intense as a consequence of technological advancements, product expansions, and various strategies employed by key vendors.

The risk management market is anticipated to grow significantly during the forecast period. The few major trends in the risk management market are growing adoption of cloud-based solutions and surging emphasis on real-time risk management information. These trends are positively impacting the overall risk management market.

Moreover, managed risk management services are witnessing an increase in popularity across diverse industry verticals and enterprises. These service operators help large enterprises manage their information technology infrastructure with the addition of advanced security frameworks. This is also expected to fuel competition in the risk management market. In addition, continuous developments in cloud-based platforms to cater diverse customer requirements are expected to support the overall market growth.

By region, the risk management market trends have been analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America contributed maximum revenue in 2022 and is expected to grow at a significant growth rate as compared to other regions. Factors such as the presence of prominent technology companies and industry consortiums focusing on cybersecurity infrastructure have contributed to the demand for advanced risk management solutions and services. Asia-Pacific is the fastest-growing region in the market, which is mainly attributed to the growing focus of the market players to address the demands for advanced security frameworks with cost-effectiveness.

Major companies operating in the risk management market are focusing on strategic partnerships to develop advanced risk management solutions. For instance, in December 2023, Institute of Risk Management (IRM) India Affiliate partnered with HDFC Asset Management Company Limited, to enhance the enterprise risk management (ERM) capabilities and share insights through thought leadership projects tailored for the mutual fund industry. Similar strategies by the market players operating at a global and regional level will help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include IBM Corporation, Lockpath, Inc., LogicManager, Inc., MetricStream Inc., Qualys, Inc., SAP SE, SAS Institute Inc., ServiceNow, RSA Security LLC, and Thomson Reuters. These players have adopted various strategies to increase their market penetration and strengthen their position in the risk management market.

One major trend is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies into risk management solutions. These advanced technologies enable organizations to analyze vast datasets in real time, identify potential risks, and predict emerging threats with greater accuracy. Another notable trend is the growing emphasis on cybersecurity risk management, driven by the escalating frequency and sophistication of cyber threats. Organizations are investing in robust cybersecurity measures to safeguard sensitive information and maintain operational continuity.

Software is the leading application for the risk management market.

North America is the largest regional market for Risk Management

$51,951.10 Million is the estimated industry size of Risk Management Market.

IBM Corporation, Lockpath, Inc., LogicManager, Inc., MetricStream Inc., Qualys, Inc., SAP SE, SAS Institute Inc., ServiceNow, RSA Security LLC, and Thomson Reuters are the top companies to hold the market share in Risk Management Market.

Loading Table Of Content...

Loading Research Methodology...