Safes And Vaults Market Research, 2032

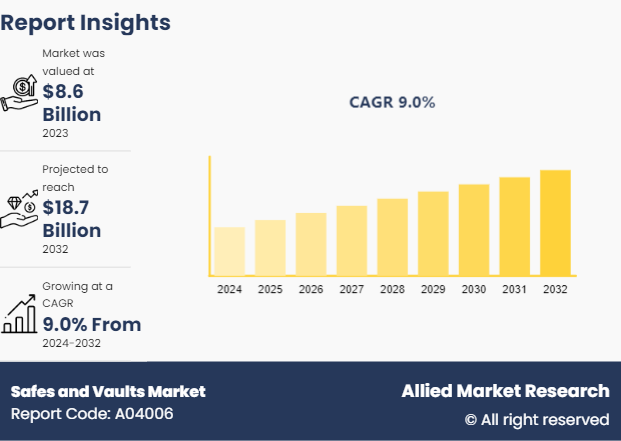

The global safes and vaults market size was valued at $8.6 billion in 2023, and is projected to reach $18.7 billion by 2032, growing at a CAGR of 9% from 2024 to 2032. Safes and vaults are secure storage units designed to protect valuable items, documents, and other important materials from theft, fire, and unauthorized access. Safes are portable or fixed secure containers used in homes, offices, and commercial establishments. They come in various sizes and security levels to meet different needs. However, vaults are larger and more secure rooms or spaces typically used by banks, financial institutions, and high-security facilities. They offer a higher level of security compared to standard safes.

Homeowners use safes to protect personal valuables, important documents, and firearms. Businesses use safes and vaults to secure cash, sensitive documents, data backups, and valuable inventory. Banks and credit unions use vaults to secure large sums of money, securities, and safe deposit boxes.

Key Takeaways

The safes and vaults market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major safes and vaults industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The global safes and vaults market growth is attributed to rise in concerns with respect to the safety of valuable physical assets, growth in perceived threat levels, and increase in security awareness. However, penetration of digital transaction solution limits the growth of the safe and vaults market. In addition, growth of smart cities and new technological developments in the safes and vaults industry is projected to provide lucrative opportunities for the market development during the forecast period.

The demand for safes and vaults includes increase in concerns over security, rise in crime rates, and the need to protect valuable assets from theft, fire, and natural disasters. In both residential and commercial settings, the proliferation of high-value items, sensitive documents, and irreplaceable data has increased the awareness of potential risks. In addition, regulatory requirements and industry standards mandate the secure storage of certain items, such as firearms, financial records, and confidential information, further boosting the need for reliable safekeeping solutions.

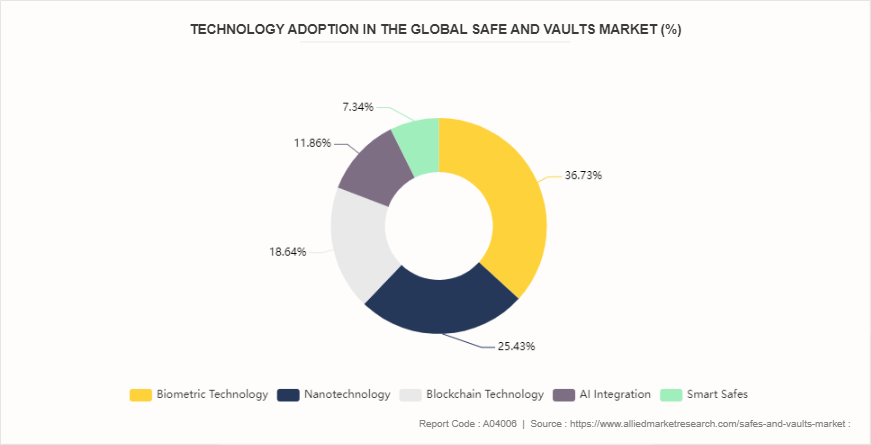

Technology Evolution of Safes of Global Safes and Vaults Market

Over time, safe technology developed, and new features were added, such as combination locks and time-delay locks. These additions made safes more secure and reduced the risk of theft. modern safes utilize advanced technology, such as biometric locks and digital monitoring systems. These safes are virtually impenetrable and are designed to protect against a wide range of threats, from theft to fire and natural disasters. Overall, the advancements in safe technology during the industrial revolution helped to create safer and more secure storage solutions for people's valuables.

FIGURE 1: Technology Evolution (%)

Market Segmentation

The safes and vaults market share is segmented into type, end-use and region. On the basis of type, the market is divided into cash management safes, depository safes, gun safes and vaults, vault and vault doors, media safes and others. On the basis of end-use, the market is bifurcated into the banking sector and non-banking sector. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/Country Market Outlook

The adoption of safes and vaults market outlook in the U.S. market is influenced by various factors including rise in security concerns, technological advancements, regulatory requirements, and consumer preferences. In addition, Japan's emphasis on safety, regulatory compliance, technological innovation, and societal trends significantly influences the safes and vaults market trendsfor secure storage solutions. Rapid economic growth has led to the emergence of a large and affluent middle class with disposable income and valuable assets to protect.

In October 2023, The U.S. National Science Foundation announced an investment of $10.9 million to support research that will help ensure advances in artificial intelligence go hand in hand with user safety.

In May 2022, Lockin and Blockchain Lock jointly released new product Lockin Smart Lock G30 and Lockin Smart Lockbox L1, officially announce Lockin’s new chapter in Japan. During the press conference Lockin Smart Lock G30 debuted. Lockin also announced the global launch of the G30.

In April 2024, U.S. organized a board to advise on safe, secure use of AI. The new advisory board will help authorities combat AI-related disruptions that may impact national or economic security, public health or safety.

Competitive Landscape

The major players operating in the safes and vaults market include American Security Products Co., Alpha Safe & Vault, Inc., CARADONNA, Diebold Nixdorf Incorporated, Godrej & Boyce, Manufacturing Co. Limited, Gunnebo AB, Kumahira Co., Ltd., KASO¸ Safeguard Safes and Shinjin Safes.

Recent Key Strategies and Developments

In May 2024, Aurm partnered with Tata AIG General Insurance, to provide comprehensive insurance coverage to its customers for their valuables.

In July 2023, Gunnebo opened its first experience zone in the pink city of Jaipur. This Experience Zone will showcase a wide range of Safe Storage solutions belonging to their two most prominent brands Steelage and Chubbsafes. With a focus on advanced technology, durability, and ease of use, these products are ideal for the safekeeping of gold, cash, Jewlery, and other valuables.

In December 2023, Godrej Security Solutions expanded its home lockers category in Delhi – NCR with the introduction of the range of latest innovations; NX pro plus, NX advanced, and Verge series. This initiative, aimed at enhancing convenience and safeguarding valuables, involves the addition of new counters.

Key Sources Referred

Savta.org

VaultDoors.org

Salina Area Chamber of Commerce

Safe Global

Key Benefits For Stakeholders

This report provides a quantitative analysis of the safes and vaults Market segments, current trends, estimations, and dynamics of the safes and vaults market analysis from 2023 to 2032 to identify the prevailing safes and vaults market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the safes and vaults industry segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global safes and vaults Market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global safes and vaults market opportunity, key players, market segments, application areas, and market growth strategies.

Safes and Vaults Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18.7 Billion |

| Growth Rate | CAGR of 9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Gunnebo AB, CARADONNA, Diebold Nixdorf Incorporated, Godrej & Boyce, Alpha Safe & Vault, Inc., American Security Products Co., Manufacturing Co. Limited, Kumahira Co., Ltd., KASO, Shinjin Safes, Safeguard Safes |

Analyst Review

Safes and vaults form an integral part of physical security solutions. These products are able to create safe environment to cater to the high-risk situation specific needs of customers, which allows it to become one of the most popular industry solution worldwide. Further, the unprecedented growth in the banking and retail market predominantly drives the safes and vaults market for protection of valuable assets in the physical security ecosystem. The global safes and vaults market is estimated to witness significant growth in Asia-Pacific and LAMEA, on account of rise in demand for technologically advanced products in countries, such as India, China, Germany, and Japan. The safes and vaults market share is projected to grow at a CAGR of 6.0% from 2017 to 2023, owing to increase in demand for application-specific products in the developed and the developing regions.

There is an increase in the adoption of safes and vaults in the retail industry due to presence of cash intensive environment, which has high demand for cash management safes. The safes and vaults market is influenced by the rise in demand for technologically advanced products, constant need to improve infrastructural security, and growth associated with non-banking sector. However, increase in penetration of digital transaction solutions limits the market growth.

India is the most attractive market in Asia-Pacific and is estimated to increase at a significant rate, owing to the surge in development across end-use sectors, and the increase in adoption of advanced technology to develop innovative products. For instance, according to, India Brand Equity Foundation, retail industry in India is expected to achieve US$ 1.6 trillion market by 2026.

Key players in the safes and vaults market are involved in the introduction of new features and capabilities, to enhance their existing product portfolio. This is anticipated to increase the product penetration and enable key providers to establish themselves in the emerging markets. For instance, in May 2017, Odon Inc. introduced the illumiSAFE and the illumiSAFE mini which is a personal safe disguised in the form of a lamp. These safes are one of the most technologically advanced personal safes available in the market. It features activation by smart phone or RFID key, wireless and off-site connectivity and other advanced capabilities.

One significant trend driving the safes and vaults market is the integration of advanced technologies, such as biometric authentication and smart locks, which enhance security features and provide more convenient access control.

The cash management safes is the leading type of Safes and Vaults Market in 2023.

North America is the largest regional market for Safes and Vaults market in 2023.

$18.7 million is the estimated industry size of Safes and Vaults market in 2032.

American Security Products Co., Alpha Safe & Vault, Inc., CARADONNA, Diebold Nixdorf Incorporated, Godrej & Boyce, Manufacturing Co. Limited, Gunnebo AB, Kumahira Co., Ltd., KASO¸ Safeguard Safes and Shinjin Safes. are the top companies to hold the market share in Safes and Vaults.

Loading Table Of Content...