Safety Signs Market Research, 2032

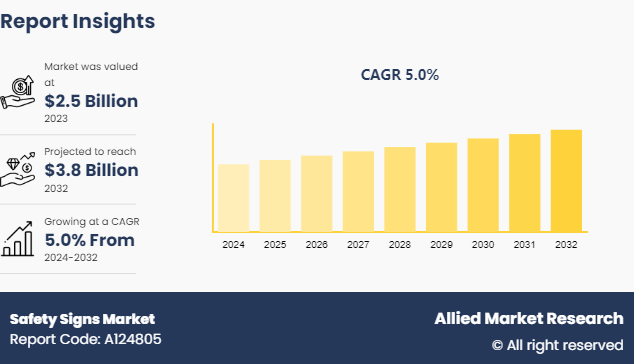

The global safety signs market size was valued at $2.5 billion in 2023, and is projected to reach $3.8 billion by 2032, growing at a CAGR of 5% from 2024 to 2032.

Market Introduction and Definition

Safety signs are utilized when a risk or hazard cannot be sufficiently reduced or avoided. An employer should determine if the risk may be eliminated or minimized by taking preventative measures as a group or by using better work practices before putting up safety signs. A safety sign is a signboard, color, auditory signal, verbal communication, or hand signal that conveys information regarding health and safety. Strict industrial laws require the usage of safety signs in dangerous work environments, which increases consumer demand for the product.

Key Takeaways

The safety signs study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Developments

In November 2021, the UK National Traffic Information Service (NTIS) incorporated new technology, enhancing data reliability on motorways and major roads. This upgrade aids efficient incident management and traffic regulation.

In February 2022, Sensys Gatso Group, through its subsidiary, Sensys Gatso USA signed a 5-year TRaaS contract with Oelwein, Iowa to provide automated red-light enforcement.

?????Key Market Dynamics

The safety signs market size is growing due to several factors such as development of connected infrastructure, integration of small signs with intelligent transportation systems, and technological advancements in computer vision. However, high system costs and exposure to adverse weather conditions restrain the growth of the market. In addition, the growing demand for digital signage is expected to provide lucrative growth opportunities for the market development during the safety signs market forecast.

In addition, the traffic sign recognition system offers opportunities for the safety signs market share, owing to the development of vehicle-to-everything (V2X) connectivity and smart city infrastructure. Vehicle-to-vehicle (V2X) transfer of traffic data in real time from road infrastructure to automobiles improves the recognition of dynamic signs. Furthermore, real-time localization and mapping are facilitated by the generation of high-definition (HD) mapping data from connected infrastructure. Businesses and communities are collaborating to gather infrastructure data for digital maps and safety sign assets. In December 2022, Volvo Car AB, a company based in Sweden, declared that it had attained full ownership of Zenseact, its subsidiary focused on autonomous driving (AD) software development. Volvo Cars AB acquired the remaining 13.5% of Zenseact's shares from ECARX, making the AD software company a wholly owned subsidiary of the Sweden-based automaker. Despite this acquisition, Zenseact will continue to function as an independent and standalone company, according to Volvo Cars AB. Thus, this software development is expected to increase the safety signs market growth owing to its application.

Market Segmentation

The Safety Signs Industry is segmented into material, end user, and region. On the basis of type, the market is divided into steel, plastic, aluminum, fiberglass and others. By application, the market is segregated into commercial, residential, and industrial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

China and India are predicted to make the largest contributions to safety signs development in the Asia-Pacific region. The market demand in Asia-Pacific is increasing owing to rise in construction activity in developing countries. The building industry is anticipated to expand steadily, necessitating the development of new infrastructure to house and service the expanding urban population. Such factors are driving the market as safety signs are used for directions and used to warn people of potentially hazardous situations.

Competitive Landscape

The major players operating in the safety signs industry include Accuform Manufacturing, Brady, Rubbermaid Commercial Products, PVC Safety Signs, Northern Safety Company, Misumi, Big Beam Emergency Systems, Ecoglo International, Brimar Industries, and Compliance Signs.

Other players in the market include Jalite Group, Everglow Gmbh, Axnoy Industries, and others.

Industry Trends

The adoption of digital safety signs, which can provide real-time updates and alerts, is on the rise. Smart signage can be integrated with sensors and alarms to enhance responsiveness to safety issues.

There is a growing demand for safety signs made from durable materials that can withstand harsh industrial environments. Customization options allow businesses to create signs that meet specific safety requirements and branding guidelines.

Safety signs are being integrated with broader safety systems, such as emergency alarms and evacuation plans. This integration helps create a more comprehensive safety infrastructure, ensuring that signs work in tandem with other safety measures.

Regulatory Analysis of Global Safety Signs Market

In July 2023, the Fire Safety (England) Regulations 2022 made it a legal requirement from 23 January 2023 for all high-rise residential buildings in England to install wayfinding signage in their buildings.

February 2022- Health and Safety (Safety Signs and Signals Regulations) 1996: The Regulations cover various means of communicating health and safety information. These include the use of illuminated signs, hand and acoustic signals, e.g. fire alarms, spoken communication and the marking of pipework containing dangerous substances. These are in addition to traditional signboards such as prohibition and warning signs. Fire safety signs, i.e. signs for fire exits and fire-fighting equipment, are also covered.

ANSI Z535.2-2023 regulates requirements for the design, application, and use of safety signs in facilities and in the environment through consistent visual layout. An environmental/facility safety sign is a sign in a workplace or public area that provides safety information. The American National Standard species the placement of these signs should protect them from foreseeable visual obstruction and damage, such as fading from exposure to ultraviolet radiation, abrasion, or degradation from substances like lubricants, chemicals, and dirt. It aims to establish a uniform visual layout for safety signs to be located in facilities and in the environment, minimize the proliferation of designs for environmental and facility safety signs, and establish a national uniform system for signs that communicate safety information.

Key Sources Referred

UK Government (Gov.UK)

ANSI Organisation

U.S. Department of Transportation

National Institute of Standards and Technology

Health and Safety Authority

International Transport Forum

New Mexico Bureau of Geology and Mineral Resources

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the safety signs market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the safety signs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the safety signs market opportunity.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global safety signs market trends, key players, market segments, application areas, and market growth strategies.

Safety Signs Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.8 Billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 243 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Northern Safety Company, Brimar Industries, Brady, Big Beam Emergency Systems, Rubbermaid Commercial Products, PVC Safety Signs, Ecoglo International, Compliance Signs, Accuform Manufacturing, Misumi |

The upcoming trends of Safety Signs Market include development of connected infrastructure and integration of small signs with intelligent transportation systems.

Industrial is the leading application of Safety Signs Market.

North America is the largest regional market for safety signs.

The safety signs market was valued at $2.5 billion in 2023.

Plastic is the leading type of safety signs market.

Loading Table Of Content...