Sales Training Software Market Overview

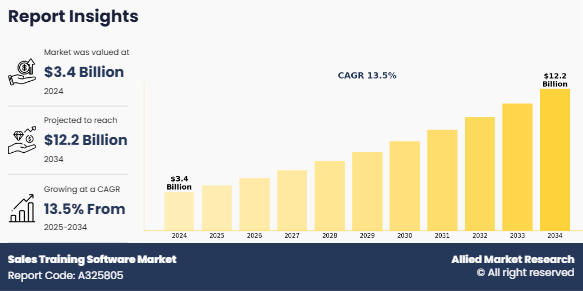

The global sales training software market was valued at USD 3.4 billion in 2024, and is projected to reach USD 12.2 billion by 2034, growing at a CAGR of 13.5% from 2025 to 2034.

The sales training software refers to digital platforms and tools designed to enhance the skills, knowledge, and performance of sales teams. These solutions offer a range of features including interactive training modules, virtual coaching, performance analytics, and content management. The market serves businesses of all sizes across various industries seeking to improve sales effectiveness, onboarding efficiency, and employee retention. The rise of remote work and digital transformation has led to increase in the demand for scalable and accessible training solutions. The scope of this market includes cloud-based and on-premises software, serving sectors such as retail, finance, healthcare, and IT. Key stakeholders include software providers, corporate training departments, and third-party consultants aiming to drive measurable sales outcomes through structured learning programs.

Key Takeaways

- By Deployment Mode, the cloud segment held the largest Sales Training Software market share for 2024.

- By Enterprise Size, the large enterprise segment held the largest share in the Sales Training Software market size for 2024.

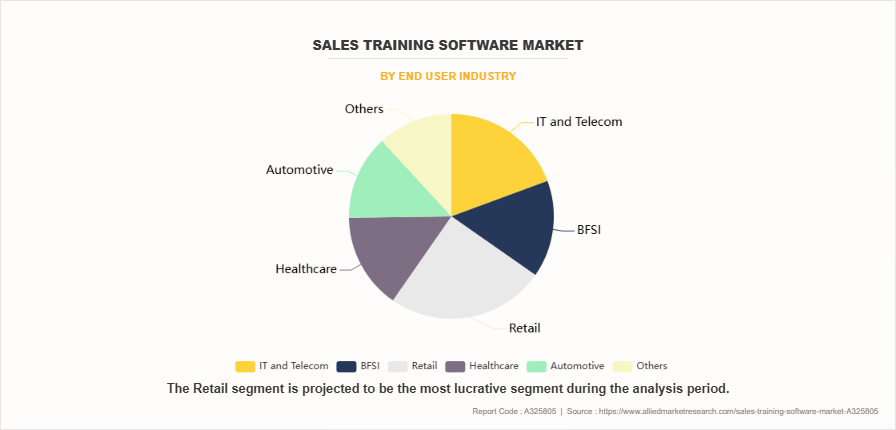

- By End User Industry, the retail segment held the largest share in the Sales Training Software market size for 2024.

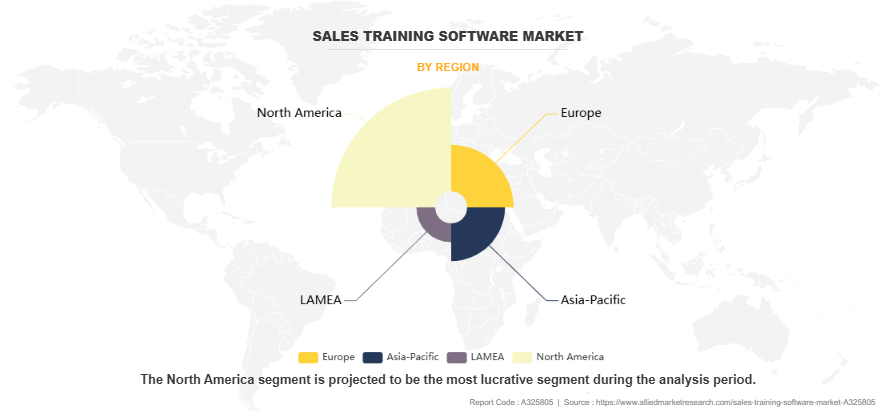

- Region-wise, North America held largest market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the sales training software market forecast period.

Furthermore, the increase in the adoption of mobile learning platforms for corporate training, employee onboarding, and continuous skill development is expected to provide remunerative growth opportunities for the market during the forecast period. These technologies are transforming traditional training methods by offering on-demand, personalized, and interactive learning experiences that cater to the specific needs of modern sales teams. Mobile learning enables employees to access training materials anytime and anywhere, increasing convenience, engagement, and knowledge retention. In addition, advancements in artificial intelligence, gamification, and real-time analytics integrated into mobile platforms are further enhancing the effectiveness of sales training programs. As businesses continue to shift toward remote and hybrid work environments, the demand for flexible, scalable, and cost-efficient training solutions is expected to grow significantly. This trend is anticipated to drive further innovation and investment in the sales training software industry, making it an essential component of workforce development strategies.

Segment Review

The sales training software market is segmented into deployment mode, enterprise size, end user industry, and region. On the basis of deployment mode, the market is divided into cloud and on-premise. By enterprise size, the market is bifurcated into large enterprise and SMEs. As per end user industry, the market is classified into IT and telecom, BFSI, retail, healthcare, automotive, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of end user industry, the retail segment held the largest market share in 2024, driven by the sector‐™s need for consistent salesforce training across numerous outlets, rapid product launches, and increasing adoption of omnichannel sales strategies that require well-trained staff to deliver personalized customer experiences and boost conversion rates. However, the healthcare segment is expected to grow at the highest rate during the forecast period, owing to rising regulatory compliance requirements, increasing complexity of medical products and services, and the growing adoption of digital training platforms to ensure sales teams stay updated with the latest clinical information and product guidelines.

On the basis of region, North America dominated the market share in 2024, fueled by a mature technology infrastructure, early adoption of AI-powered sales training solutions, significant investments in employee skill development, and a large base of enterprise customers demanding advanced, data-driven training platforms to maintain competitive advantage. However, the Asia-Pacific region is expected to grow at the highest rate during the forecast period, owing to rapid digital transformation initiatives, increasing penetration of cloud-based sales enablement tools, expanding SMEs, and government programs promoting workforce upskilling across emerging economies such as China, India, and Southeast Asia.

Top Impacting Factors

Driver

Focus on upskilling and reskilling

The increase in focus on upskilling and reskilling the workforce to meet evolving customer expectations is a significant driver of the sales coaching software market. The rapid technological advancements such as AI, CRM tools, data analytics, driven by the demand for continuous sales team training, as companies strive to stay competitive and maximize the effectiveness of emerging tools, drive the sales training software market growth. In addition, the surge in the adoption of remote and hybrid work models has led to upsurge in the demand for flexible communication tools, enhanced digital collaboration platforms, and the development of new strategies for managing teams and engaging customers in virtual environments. Furthermore, the government's regulations in sectors like finance, healthcare, and pharmaceuticals demand strict compliance, leading organizations to implement effective training programs. These programs ensure that sales teams are well-informed, reduce legal risks, and uphold industry standards and integrity, fueling market growth.

Furthermore, integrating AI and automation in sales processes, through tools like automation software and AI-driven insights, enhances efficiency and decision-making. However, reskilling is essential for sales teams to collaborate with these technologies, enabling them to concentrate on high-value tasks and improve their performance in a technology-driven environments. In addition, increase in the adoption of data-driven sales strategies is enhancing decision-making and performance by enabling sales teams to better understand customer behavior, forecast trends, and tailor their approaches. This shift highlights the growing demand for data literacy and analytics upskilling among sales professionals to stay competitive and deliver measurable results.

For instance, in May 2024, Salesloft launched a new AI-powered enhancement to its platform, focusing on conversation intelligence. Key highlights include AI-generated conversation insights to identify deal blockers, automated meeting prep tools, and AI-assisted scorecards for faster, more accurate coaching. The update also features auto capture of buying groups and a streamlined navigation experience, all aimed at helping sales teams act on critical buyer signals and drive better outcomes. This is expected to boost sales team productivity by enabling faster, data-driven decisions and improving deal outcomes, setting a new standard for efficiency and performance in modern sales, thus driving the market growth.

Restraints

High implementation costs

The major challenge for the growth of global sales coaching software market is the substantial investment associated with the development, implementation, and maintenance of advanced training solutions. Many organizations, particularly small and medium-sized enterprises (SMEs), find it challenging to invest in sales training platforms due to the substantial upfront costs. These expenses include software licensing fees, customization to align with specific business needs, integration with existing systems such as CRM or HR tools, and the cost of training employees to use the new software effectively. On-premises deployments may also require significant investment in IT infrastructure and ongoing maintenance. As a result, high implementation costs can act as a deterrent, leading to slower adoption rates, especially among resource-constrained businesses.

In addition, the complexity involved in system integration and change management can further escalate the total cost of ownership. Despite these challenges, the market is expected to witness some relief through the increasing adoption of cloud-based and Software-as-a-Service (SaaS) models, which offer subscription-based pricing and reduce initial capital expenditure. Freemium options and tiered pricing plans are also helping to make sales training software more accessible. Moreover, growing awareness of the long-term return on investment (ROI) from improved sales performance is encouraging more organizations to overcome the initial cost barrier. This helps to promote a culture of continuous learning to ease adoption and maximize the impact of sales training software.

Opportunity

Growing use of microlearning modules

The growing use of microlearning modules presents a significant sales training software market demand to expand, as these short, focused learning segments allow for more flexible and efficient training. The rise in demand for personalized sales training, driven by the need for tailored learning, enables companies to deliver role-specific content, thereby boosting individual performance and retention across diverse sales teams. In addition, the integration of gamification with microlearning boosts engagement by making training fun and rewarding. Interactive modules with points or badges increase motivation, leading to higher completion rates and better skill development. Furthermore, microlearning offers a cost-effective, scalable solution, ideal for small businesses with limited budgets and large organizations needing consistent global training without high overhead costs.

Moreover, the rise in mobile and remote work has increased the demand for flexible, accessible training solutions. Microlearning modules are ideal for mobile devices, enabling sales teams to engage with training content at their convenience, from anywhere and anytime. In addition, integrating AI and analytics into sales training platforms allows for a more personalized and effective learning experience. AI helps to analyze sales data to identify which microlearning modules are most impactful, helping managers tailor training to individual performance.

Furthermore, integrating microlearning with modern sales tools and CRM platforms allows sales reps to learn within the tools used daily. This seamless integration reinforces learning in real-time, enabling reps to immediately apply new skills in the workflow, boosting both efficiency and training effectiveness. For instance, in April 2024, Qstream launched an AI Microlearning Content Generator designed to help training teams create and deliver microlearning content up to five times faster. The tool enhances the efficiency of creating personalized, bite-sized training content, which is a core component of modern sales training platforms. By enabling faster content development and integration with existing learning systems, it supports scalable, data-driven training, which are the key trends in the evolving sales training software market insights.

Competition Analysis

The report analyzes the profiles of key players operating in the Sales Training Software market are Salesforce, Inc., Zoho Corporation Pvt. Ltd., Salesloft, Inc., Seismic Software, Inc., Allego, Inc., Mindmatrix Inc., Bigtincan Holdings Limited, Mindtickle Inc., SalesHood Inc., SmartWinnr, Inc., uQualio, Gong.io Ltd, Secondnature AI Inc., Paradiso Solutions Corporation, Kyndryl, Inc., ONBOARD SOFTWARE LTD., Salesken Inc, Jiminny, Inc., iSpring, and Showpad Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the Sales Training Software industry.

Recent Developments in the Sales Training Software Market

In February 2024, FranklinCovey, one of the largest and most trusted leadership companies in the world, announced the launch of a new state of the art sales training solution, Helping Clients Succeed®: Strikingly Different Selling. FranklinCovey‐™s cutting edge approach integrates a sophisticated, flexible platform that enables participants to seamlessly learn within the natural flow of their work. The results are compelling, with documented metrics for every client highlighting an impressive adoption rate exceeding 70%.

In May 2023, Sandler and CoachEm signed a partnership agreement that combines the proven Sandler training techniques with the first of its kind CoachEm AI coaching execution platform designed to reinforce coaching best practices and deliver sustainable business results. Specifically, the licensing agreement enables CoachEm to sell and facilitate Sandler‐™s Sales Leader Growth Series and add Sandler‐™s proven micro-learning modules as a content offering within CoachEm‐™s recommendation engine..

In March 2023, Sandler, the leading global sales training firm, just announced a strategic partnership with Humantic AI, which is set to expand Sandler‐™s legacy into the age of AI. This partnership follows a two-pronged approach. The first directive is to equip Sandler‐™s trainers, franchisees, and customers with Humantic AI‐™s buyer intelligence solution. The goal is to keep the human element of sales intact while keeping up with the evolving landscape. In the future, given their strong mission alignment, the two companies also plan to collaborate in significant ways in terms of product and content.

Key Benefits For Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sales training software market analysis from 2024 to 2034 to identify the prevailing sales training software market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the sales training software market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global sales training software market trends, key players, market segments, application areas, and market growth strategies.

Sales Training Software Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 12.2 billion |

| Growth Rate | CAGR of 13.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 200 |

| By End User Industry |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Secondnature AI Inc., Mindtickle Inc., SalesHood Inc., Gong.io Ltd, Zoho Corporation Pvt. Ltd., Allego, Inc., uQualio, Salesforce, Inc., iSpring, Jiminny, Inc., Mindmatrix Inc., Seismic Software, Inc., Showpad Inc., SmartWinnr, Inc., Paradiso Solutions Corporation, Kyndryl, Inc., Salesken Inc., Bigtincan Holdings Limited, Salesloft, Inc., ONBOARD SOFTWARE LTD. |

Analyst Review

According to CXOs, the sales training software market is experiencing significant growth, driven by increasing demand for scalable, technology-enabled training solutions and a growing emphasis on upskilling sales teams to stay competitive. As organizations seek more effective, personalized learning experiences that enhance sales performance, digital training platforms are becoming a preferred choice. The market is further supported by rising corporate investments in Learning & Development (L&D), advancements in AI-powered learning analytics, and the integration of gamification and adaptive learning technologies. Technological innovations such as virtual coaching, real-time performance tracking, and CRM integration are improving learner engagement and driving operational efficiency. In addition, favorable shifts in corporate training culture and increase in the involvement from enterprise software providers are accelerating adoption across industries. These factors are expected to propel further growth of the sales training software market in the upcoming years.

Furthermore, technological advancements in digital learning platforms, AI-powered analytics, and automated coaching tools are significantly propelling the growth of the sales training software market. Modern sales training solutions now offer advanced features such as real-time performance tracking, personalized learning paths, seamless integration with CRM systems, and mobile accessibility enabling sales teams to upskill and adapt more efficiently in dynamic market environments. The rise of edtech and sales enablement startups, coupled with growing collaboration between software vendors, corporate L&D teams, and sales leadership, is creating new opportunities to deliver more tailored, data-driven, and user-friendly training experiences. These innovations are not only enhancing learner engagement and training ROI but also expanding the adoption of sales training software across various industries and regional markets.

Moreover, supportive initiatives and government policies focused on workforce development, digital transformation, and performance enhancement are significantly driving the growth of the sales training software market. In many regions, regulatory support for continuous professional education, digital upskilling, and remote learning is encouraging the adoption of advanced sales training platforms. Initiatives such as tax incentives for employee training, government-funded skill development programs, and mandates for digital competency are accelerating market expansion. However, the industry still faces challenges, including varying adoption rates across sectors, resistance to change in traditional training methods, and the need for high-quality, role-specific training content. Limited digital infrastructure in certain regions and the shortage of skilled learning and development professionals also remain a major concern within the industry. Despite these challenges, the sales training software market is expected to grow steadily, especially in emerging markets, driven by increasing demand for scalable, tech-enabled, and personalized training solutions.

The Sales training software Market is estimated to grow at a CAGR of 13.5% from 2025 to 2034.

The Sales training software Market is projected to reach $12.2 billion by 2034.

The Sales training software Market is expected to witness notable growth include increase in focus on upskilling and reskilling the workforce to meet evolving customer expectations.

The key players profiled in the report include Salesforce, Inc., Zoho Corporation Pvt. Ltd., Salesloft, Inc., Seismic Software, Inc., Allego, Inc., Mindmatrix Inc., Bigtincan Holdings Limited, Mindtickle Inc., SalesHood Inc., SmartWinnr, Inc., uQualio, Gong.io Ltd, Secondnature AI Inc., Paradiso Solutions Corporation, Kyndryl, Inc., ONBOARD SOFTWARE LTD., Salesken Inc, Jiminny, Inc., iSpring, and Showpad Inc.

The key growth strategies of Sales training software market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...