Seaweed Market Research, 2034

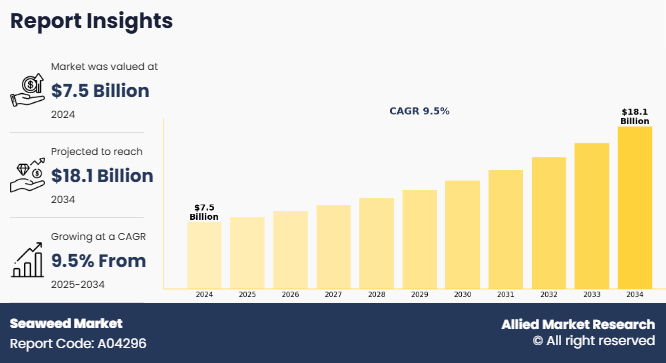

The global seaweed market was valued at $7.5 billion in 2024, and is projected to reach $18.1 billion by 2034, growing at a CAGR of 9.5% from 2025 to 2034. Seaweed is a type of marine algae that grows in oceans, seas, and coastal regions. It includes green, brown, and red algae that attaches to rocks or underwater surfaces. It is harvested from the wild or farmed in controlled environments. After collection, it is cleaned, dried, and sometimes roasted or ground depending on the intended use. Seaweed is used in food products such as soups, salads, and sushi. In addition, it has applications in agriculture as fertilizer, in cosmetics for skin care, and in pharmaceuticals for its bioactive compounds & nutritional content.

MARKET DYNAMICS

The global shift toward clean label ingredients has increased demand for natural food additives, directly boosting the seaweed market growth. Many food manufacturers have replaced synthetic stabilizers, thickeners, and emulsifiers with natural alternatives such as agar, carrageenan, and alginate, which are hydrocolloids derived from seaweed. Seaweed-based hydrocolloids improve texture, shelf life, and stability in dairy products, confectionery, and processed foods. In addition, rise in consumer preference for plant based and allergen free additives supports the usage of seaweed across functional food formulations. Regulatory approval for seaweed-derived hydrocolloids as food-safe ingredients further drives seaweed market expansion.

Moreover, rise in demand for plant based solutions has encouraged the use of seaweed as a natural alternative to animal based or synthetic additives. For instance, GimMe Health Foods LLC launched the new dairy-free cheddar flavor roasted seaweed snack with a grab and go slim pack for its customers in March 2022. Increased awareness of digestive health and rise in inclination toward consumption of dietary fibers have positioned seaweed as a relevant ingredient in functional nutrition. Companies focusing on sustainability and renewable sourcing have identified seaweed as a reliable raw material with low environmental impact. Continued product innovation, supported by investments in marine biotechnology and favorable policies for seaweed cultivation, has added momentum to commercial usage of seaweed, thus driving seaweed industry.

However, fluctuations in raw material availability owing to seasonal harvesting, climate-driven yield variation, and inconsistent cultivation practices have led to unstable supply, which directly impacts pricing. Small-scale production in coastal regions often lacks standardized harvesting and post-harvest processing methods, contributing to quality inconsistency and unpredictable costs. Buyers in food, pharmaceutical, and agriculture sectors rely on consistent pricing for formulation planning and procurement, and high variability has led to hesitancy in long-term contracting, which has limited the expansion of seaweed-based applications.

In addition, the lack of integrated value chains and limited investment in commercial-scale cultivation have further contributed to pricing instability. Supply dependence on wild harvest in some countries increases vulnerability to weather disruptions and environmental regulation, thus increasing operational risks. Price-sensitive industries such as animal feed and fertilizers face challenges to cope up with cost variations, which has restrained demand for seaweed inputs. Moreover, delays in the development of mechanized farming and processing infrastructure have limited the ability to scale production efficiently. Thus, pricing volatility is expected to be a major factor restraining the seaweed market share.

Furthermore, the increase in application of seaweed in biofuel production has created new opportunities for the growth of the global seaweed market. Seaweed contains high levels of carbohydrates that support the production of bioethanol, biobutanol, and biogas. Cultivation of seaweed requires no arable land or freshwater, which provides advantages in scalability and environmental sustainability. Rise in energy demands and policy shifts toward low-carbon fuel alternatives have led to increased interest in marine biomass as a renewable feedstock, which has helped drive the seaweed market demand. Research institutions and energy firms have expanded investments in pilot projects and process technologies to improve biomass yield and fuel conversion efficiency.

Moreover, global focus on second-generation biofuels has positioned seaweed as a strategic input for future energy supply. Government initiatives in Europe and Asia-Pacific targeting decarbonization in transportation and reduction in fossil fuel dependence have supported development of seaweed-based fuel technologies. Coastal bioeconomy strategies and circular production models have encouraged seaweed integration into regional energy planning. As a result, energy-sector applications are gaining traction, thus driving the growth of the market during the seaweed market forecast.

SEGMENTAL OVERVIEW

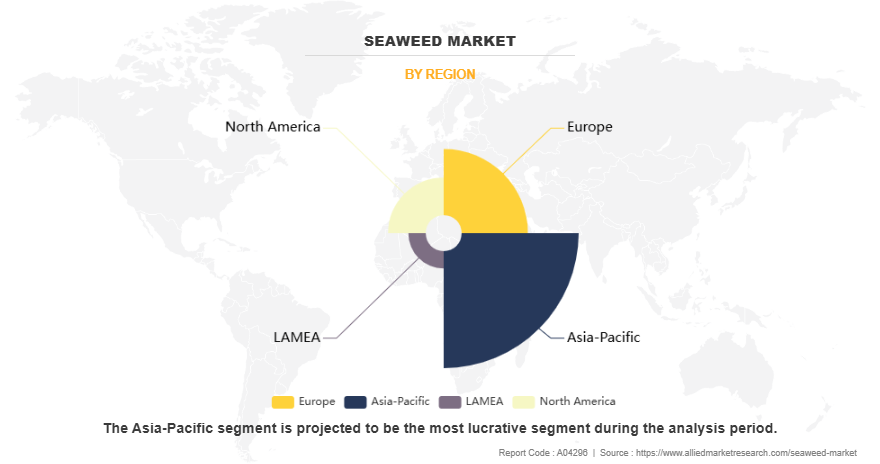

The seaweed market is divided into product type, application, and region. By product type, the market is divided into red, brown, and green. By application, the market is categorized into food, medicines, chemical & fertilizers, animal feed additives, building materials, and energy sources. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, Argentina, and rest of LAMEA).

BY PRODUCT TYPE

By product type, the red segment dominated the global seaweed market size in 2024 and is anticipated to maintain its dominance during the forecast period. Increase in demand for carrageenan and agar has boosted the growth of the red seaweed segment. Carrageenan functions as a gelling and thickening agent in plant-based dairy alternatives and processed food, supporting widespread use of red seaweed. Rise in demand for vegetarian and vegan product formulations has further contributed to higher consumption of red seaweed. Expansion in pharmaceutical usage, particularly in drug delivery systems and wound care, further drives demand for seaweed. Red seaweed offers antioxidant and antimicrobial benefits, encouraging application in personal care products.

In addition, increase in production of seaweed in countries such as China, Indonesia, and the Philippines has ensured steady availability of red seaweed. Technological advancements in cultivation and processing methods have improved yield and product quality. As a result, red seaweed continues to gain preference across food, pharmaceutical, and cosmetic sectors, contributing to the growth of seaweed market.

BY APPLICATION

By application, the food segment dominated the global seaweed market in 2024 and is anticipated to maintain its dominance during the forecast period. An increase in demand for functional ingredients and plant-based nutrition boosts the growth of the food segment. Seaweed contains essential vitamins, minerals, antioxidants, and dietary fiber, which aligns with rise in consumer preference for health-focused and vegetarian diets. The use of seaweed-derived hydrocolloids such as carrageenan, agar, and alginate in food processing has expanded owing to their thickening, stabilizing, and gelling properties. Food manufacturers are increasingly incorporating seaweed to meet texture and formulation needs in dairy alternatives, sauces, confectionery, and processed food products, which drives demand for seaweed in the food industry.

Moreover, rise in awareness of digestive health and dietary wellness has encouraged the inclusion of seaweed in functional food categories. Increased consumption of seaweed in countries across Europe and North America, influenced by culinary trends and product innovation, has expanded the consumer base. The introduction of seaweed-based snacks, seasonings, and ready-to-eat meals has further attracted interest from health-conscious consumers, thus driving growth of seaweed in the food segment.

BY REGION

By region, Asia-Pacific is anticipated to dominate the global seaweed market with the largest share during the forecast period. The long-standing history of seaweed consumption in food, traditional medicines, and cosmetics in Asia-Pacific has established it as a major player in the global market. Countries such as China, Japan, and South Korea are the leading producers and consumers of seaweed, supported by extensive coastal areas that facilitate large-scale seaweed farming. In addition, rise in adoption of seaweed-based ingredients in functional foods, dietary supplements, and beauty products drives demand for seaweed in Asia-Pacific.

Furthermore, the rapid growth of the plant-based and sustainable food markets in countries such as India, Indonesia, and Vietnam have contributed to the rise in seaweed consumption in the region. Increase in environmental concerns and demand for more sustainable agricultural practices encourage investments in seaweed farming as an eco-friendly alternative to traditional crops. Technological innovations in cultivation and processing are improving the yield and quality of seaweed, which has made seaweed more accessible for a wider range of applications.

COMPETITION LANDSCAPE

The key players operating in the global seaweed industry include Annie Chun's, Inc., Brandt, Inc., Cargill, Incorporated, COMPO EXPERT GmbH, GimMe Health Foods LLC, Groupe Roullier, Irish Seaweeds, Maine Coast Sea Vegetables, Inc., Qingdao Bright Moon Seaweed Group Co., Ltd., and Qingdao Gather Great Ocean Algae Industry Group Co., Ltd. Several well-known and upcoming brands are vying for market dominance in the expanding seaweed sector globally. Smaller, niche firms are more well known for catering to consumer demands and preferences in the global market. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their reach globally.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the seaweed market analysis from 2024 to 2034 to identify the prevailing seaweed market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the seaweed market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global seaweed market trends, key players, market segments, application areas, and market growth strategies.

Seaweed Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 18.1 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Brandt, Inc., Irish Seaweeds, Qingdao Gather Great Ocean Algae Industry Group Co., Ltd., Annie Chun's, Inc., GimMe Health Foods LLC, Cargill, Incorporated, Maine Coast Sea Vegetables, Inc., Qingdao Bright Moon Seaweed Group Co., Ltd., COMPO EXPERT GmbH, Groupe Roullier |

Analyst Review

This section consists of the opinions of the top CXOs in the seaweed market. Company leaders in the global seaweed market have witnessed growth opportunities linked to production control, ecological value creation, and upstream product innovation. Many companies are shifting from commodity-based models to region-specific farming and processing strategies. Companies aim to reduce logistics costs, improve raw material stability, and serve specialized customer needs by developing localized cultivation and biorefining capacity. Investments are directed toward integrated systems that extract multiple outputs from one harvest, such as hydrocolloids, protein-rich fractions, and fiber for packaging. Leaders emphasize the importance of managing the full chain, from seedstock to end application, to capture greater value and reduce external dependencies.

Executives are also focused on expanding the role of seaweed in redefining product categories across personal care, food, and pharmaceutical sectors. Seaweed compounds with prebiotic, anti-inflammatory, and antioxidative properties are gaining attention for use in clean-label and functional formulations. Company leaders believe there is a significant opportunity in moving beyond seaweed as a filler or thickener toward performance-based ingredients with scientific validation. Competitive advantage is increasingly linked to proprietary methods that optimize extraction, maintain bioactivity, and tailor product performance for targeted applications.

In addition, policy and procurement trends in the seaweed market are adding further momentum to market growth. Firms operating in seaweed market expect support from government programs that reward activities such as carbon absorption and marine biodiversity restoration. Leaders believe that demonstrating quantifiable ecological benefits lead to long-term partnerships, regulatory advantages, and access to premium buyers. Growth strategies are shifting toward integrating seaweed into measurable environmental and product performance goals, positioning it as a core material for future-oriented business models.

The forecast period in the Seaweed market report is 2025 to 2034.

The base year calculated in the Seaweed market report is 2024.

The top companies analyzed for the global Seaweed market report are Annie Chun's, Inc., Brandt, Inc., Cargill, Incorporated, COMPO EXPERT GmbH, GimMe Health Foods LLC, Groupe Roullier, Irish Seaweeds, Maine Coast Sea Vegetables, Inc., Qingdao Bright Moon Seaweed Group Co., Ltd., and Qingdao Gather Great Ocean Algae Industry Group Co., Ltd.

The red segment is the most influential segment in the Seaweed market report.

Asia-Pacific holds the maximum market share of the Seaweed market.

The company profile has been selected on the basis of key developments such as partnerships, product launches, mergers, and acquisitions.

The market value of the Seaweed market in 2024 was $7,476.0 million.

The global seaweed market was valued at $7,476.0 million in 2024, and is projected to reach $18,111.5 million by 2034, registering a CAGR of 9.5% from 2025 to 2034.

Loading Table Of Content...

Loading Research Methodology...