Seaweed Snacks Market Summary

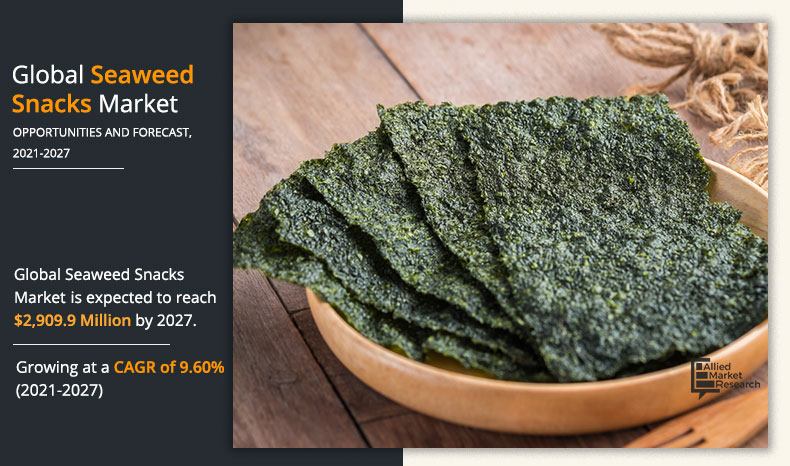

The seaweed snacks market size was valued at $1,321.20 million in 2019, and is expected to garner $2,909.90 million by 2027, registering a CAGR of 9.60% from 2021 to 2027.

Key Market Trends and Insights

Region wise, Asia-Pacific generated the highest revenue in 2019.

The global seaweed snacks market share was dominated by the online segment in 2019 and is expected to maintain its dominance in the upcoming years

The green segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2019 Market Size: USD 1,321.20 Million

- 2027 Projected Market Size: USD 2,909.90 Million

- Compound Annual Growth Rate (CAGR) (2021-2027): 9.60%

- Asia-Pacific: Generated the highest revenue in 2019

Seaweed snacks are small servings of food eaten between main meals. Seaweed snacks are made from red, brown, and green seaweed are studied in the report. The seaweed-based snack contains iodine, copper, iron, potassium, magnesium, and calcium. They are high in fiber and vitamins such as A, B and E. Seaweed snacks are found in various forms such as packaged snack food and other processed food. Seaweed snacks are non-GMO and contain organic ingredients in the food products. Seaweed snacks are made from United States Department of Agriculture (USDA) certified organic and non-GMO ingredients that are gluten-free and are healthy for snacking. Seaweed snacks food are products that contain nutritious and healthy ingredients such as proteins, vitamins, and minerals.

Nutritional value of seaweed snacks is a major reason for the growth of market as consumer are seeking better alternatives to unhealthy snacks. Seaweed snacks are naturally high in protein, calcium, antioxidant, iodine, potassium, iron, folic acid, fiber and omega-3 fatty acids. In addition, it has high level of vitamin A, B-6, C and B-12. The snacks also fit comfortably among other free from aspects that consumer are seeking such as gluten free, common allergens free, and GMOs free. Seaweed snacks are also getting more preference from consumer that prefer non-animal source snacks. In addition, seaweed-based snacks contain antioxidants and vitamins A, C and E, seaweed boasts a wide variety of beneficial plant compounds, including flavonoids and carotenoids. Seaweed contains a wide variety of plant compounds that work together to have strong antioxidant effects thus boosting the seaweed snacks market demand. An increase in vegan population has been noticed in the global market during the past few years. The growth in vegan population is anticipated to increase the demand for seaweed snacks. Consumers in countries such as Canada are avoiding animal products and demanding for healthier and cleaner naturally prepared seaweed snacks. Around 7.5 million people in the U.S. take animal-free diet assuming that it would keep them healthier in the future. The increase in vegan consumers is anticipated to increase the demand for various sources of seaweed snacks products. Demand for products with new ingredients is also projected to rise in the future, driving the global market.

There is an increase in awareness regarding the importance of food over the years. This is due to the significant rise in chronic health issues. Consumers today have adopted special diet plans to combat the health problem and have even made lifestyle changes to stay fit. One of notable changes parallel to this trend is use of organic products. The reason behind the adoption of seaweed snacks is that, they do not contain additives and are made from natural ingredients. Non-organic products, on the other hand, have been under the radar as they have been associated with health issues such as organ damage, gastrointestinal, and immune system disorders, accelerated aging, and infertility due to the use of Genetically Modified Organism (GMO) during production. Beneficial characteristics of seaweed snack products and rise in the awareness among people about health and fitness boosts the demand for seaweed snacks, which in turn fuels the seaweed snacks market growth.

The opportunities in the emerged economies are huge, as they are untapped. Non-member nations of the Organization for Economic Co-operation and Development (OECD) comprise more than 80% of the global population; yet consume less than 60% of world’s food consumption. The emerging economies constitute a population of more than 60% of today’s global population of the middle class by 2020. Considering the pace of change, in China, around 3 million households had a disposable income of around $10,000 in 2000, which increased to 60 million in 2012. This number is expected to exceed 230 million by 2020. The per capita income in emerging economies has increased considerably over the past few years. China’s per capita income increased by 9% in 2017 as compared to 2016. India’s disposable personal income increased approximately by 9.4% in 2017 as compared to 2016. This rise in disposable incomes and the growth in awareness for fitness, globally, contribute to a higher adoption of premium and environment-friendly products such as seaweed-based snacks as consumers exercise more purchasing power.

By Type

The bars segment would witness the fastest growth, registering a CAGR of 13.80% during the forecast.

Segments Overview

On the basis of type, the nori sheets segment accounted for the maximum seaweed snacks market in 2019. This is attributed to the fact that higher content of protein, and carbohydrate along with rich source of vitamin A & C has created higher demand of nori sheets among consumer. The emergence of innovative sushi dishes, such as Nigiri sushi, will be one of the key emerging trends in the global sushi restaurants market. Increasing popularity of Japanese cuisine are significant factors that will result in the seaweed snacks market forecast CAGR of over 10.0% in the period.

By Source

Green segment would witness the fastest growth, registering a CAGR of 13.80% during the forecast period.

On the basis of source, the red segment accounted for the maximum market in 2019. This is attributed to the fact that red seaweed is probably used in making of nori sheets; thus, high popularity of sushi among consumer will directly contribute toward higher sales of the red seaweed market. Increasing awareness pertaining to the health benefits of the product coupled with increasing demand for food and snacks derived from red seaweed is estimated to boost the growth of seaweed snacks market.

By Distribution Channel

Online segment would witness the fastest growth, registering a CAGR of 13.60% during the forecast period.

On the basis of distribution channel, the specialty stores of market segment accounted for the maximum market share in 2019. This is attributed to the fact that specialty stores provide high service quality and detail product specification & expert guidance to the customers. In addition, these stores promote the sales of international as well as private label brands in their stores. Also, they collect more information about the product before purchasing a product. Thus, this is expected to offer numerous opportunities for the specialty stores and manufacturers to introduce new products in the seaweed snacks market.

By Region

Asia-Pacific segment would witness the fastest growth, registering a CAGR of 11.70% during the forecast period.

Hypermarket/Supermarket is gaining popularity owing to the availability of a broad range of consumer goods under a single roof, ample parking space, and convenient operation timings. Moreover, an increase in urbanization, a rise in working-class population, and competitive pricing boost the popularity of hypermarkets in developed and developing regions. Moreover, the presence of store associates for helping the customers to choose the right product and provide product knowledge boosts the growth of the segment. Thus, the above-mentioned factors drive customers to prefer this distribution channel over others for the purchase of seaweed snack products. Therefore, the supermarket/hypermarket distribution channel are fueling the growth of the seaweed snacks market in terms of value sales.

Competitive Analysis

The players operating in the global seaweed snacks industry have adopted new product launch as their key developmental strategy to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in the report include SeaSnax, Oceans Halo, Roland’s foods, Eden foods, Annie Chuns, Frito Lays Nori Seaweed chips, Seaweed Pringles, Taokaenoi Food & Marketing, Singha Corporation, and European snack foods.

Key Benefits For Stakeholders

- The report provides a quantitative analysis of the current seaweed snacks market trends, estimations, and dynamics of the market size from 2019 to 2027 to identify the prevailing opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth seaweed snacks market analysis and the market size and seaweed snacks market segmentation assist to determine the prevailing seaweed snacks market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the seaweed snacks.

Seaweed Snacks Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Source |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | SEASNAX, KELLOGG COMPANY, FRITO-LAY NORTH AMERICA, INC. (PEPSICO, INC.), ROLAND FOODS, LLC, OCEAN’S HALO, EDEN FOODS, ANNIE CHUN’S, INC., SINGHA CORPORATION CO., LTD., TAOKAENOI FOOD & MARKETING PCL, TRIPLE-M PRODUCTS CO., LTD. |

Analyst Review

The seaweed snacks market share is estimated to escalate at a higher growth rate due to its preserved nutritional profile.

Based on the interviews of various top-level CXOs of leading companies, the increase in sale of seaweed snacks is driven by changing consumer’s preference and adoption of seaweed food consumption trend. Seaweed snacks are free of any chemical and are known to boost the immune system, thereby improving body’s metabolic functions. Rise in inclination for readymade and convenient food products is increasing the sale of seaweed snacks in the market as a potential healthy snacks option. The health benefits obtained from seaweed snacks backed up by its high antioxidant content is also supporting its sale among the consumers. Furthermore, increase in consumption of natural food products has a positive impact on the seaweed snacks market. To meet the consumer’s demand as well as to expand their business, seaweed snacks manufacturers across various regions follow the strategy of improving their existing products as well as increasing the manufacture of flavored seaweed snacks. This is one of the major factors due to which the demand for organic snacks are experiencing a surge. U.S. is among the dominating countries holding a major share in the seaweed snacks market. However, as per CXOs’ perspectives, high volatile price, and higher cost of production hampers the widespread adoption and act as the major restraint for the global seaweed snacks market.

The global seaweed snacks market size was valued at USD 1,321.20 million in 2019, and is projected to reach USD 2,909.90 million by 2027.

The global seaweed snacks market is projected to grow at a compound annual growth rate of 9.60% from 2021-2027 to reach USD 2,909.90 million by 2027.

The leading players in seaweed snacks market are SeaSnax, Oceans Halo, Roland’s foods, Eden foods, Annie Chuns, Frito Lays Nori Seaweed chips, Seaweed Pringles, Taokaenoi Food & Marketing, Singha Corporation, and European snack foods.

Asia-Pacific dominated and is projected to maintain its leading position throughout the forecast period.

High Nutritional Value, Rise in Health & Wellness Awareness, Growth in Vegan and Plant-Based Diets, Demand for Clean-Label and Organic Products majorly contribute toward the growth of the market.

Loading Table Of Content...