Semi-Autonomous & Autonomous Bus Market Overview

The global semi-autonomous & autonomous bus market is expected to be valued at USD 791.2 million in 2025, and is projected to reach USD 2,904.1 million by 2035, growing at a CAGR of 14.6% from 2026 to 2035. Improved safety, reduced congestion, intelligent transport systems, and connected infrastructure are driving the semi-autonomous & autonomous bus market, while high costs, sensor software issues, and data challenges hinder growth. Smart city projects and supportive regulations present future opportunities.

Key Market Trend & Insights

Improved Safety & Efficiency – Sensors in autonomous buses cut accidents, fuel use, and congestion.

Connected Infrastructure Growth – Smart roads, parking, and traffic systems boost adoption.

Rising Demand for Connected Vehicles – More buyers paying for navigation, telematics, and infotainment.

OEM & Dealer Engagement – Tech enables proactive maintenance and customer retention.

Telematics Growth – Investments in infotainment, navigation, and monitoring.

Regional Leader – Europe set for highest market growth.

Market Size & Forecast

- 2035 Projected Market Size: USD 2,904.1 million

- 2025 Market Size: USD 791.2 million

- Compound Annual Growth Rate (CAGR) (2026-2035): 14.6%

Introduction

Semi-autonomous and autonomous bus controls all the safety functions on its own as it can sense the driving conditions of the surrounding. Semi-autonomous bus is operated on a longer distance with less human effort. It helps the driver to regain controls by providing sufficient transition time. In addition, bus can help reduce traffic congestion.

Furthermore, autonomous driving technology helps to reduce errors made by drivers. An autonomous vehicle also known as self-driving vehicle uses artificial intelligence (AI) software, light detection & ranging (LiDAR), RADAR, and cameras to sense the current environment and navigate by forming an active 3D map of that environment. The sensor technology in autonomous driving plays a crucial role as it can scan the surrounding environment more efficiently than human senses. Such factors are expected to lead to the growth of the semi-autonomous & autonomous bus market in the near future.

Factors such as improved safety coupled with the reduction in traffic congestion, development of intelligent transport system, and growth of connected infrastructure are anticipated to boost the growth of the global semi-autonomous & autonomous bus market during the forecast period. However, software failures associated with automotive sensors, and high manufacturing cost and data management challenge for autonomous vehicle are expected to hinder the growth of the global semi-autonomous & autonomous bus industry during the forecast timeframe. Moreover, development of smart cities, and supportive government regulations are expected to create an opportunity for the semi-autonomous & autonomous bus market in the near future.

Market Segmenatation

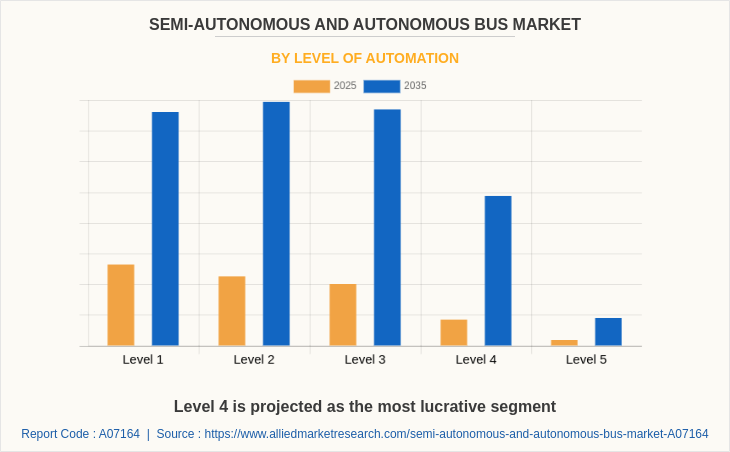

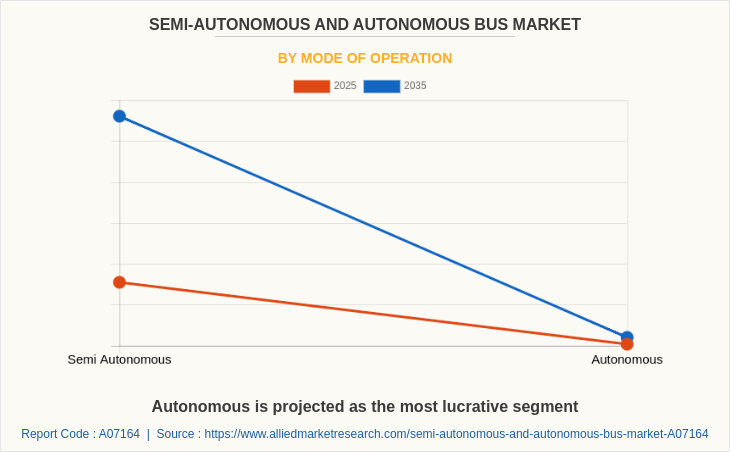

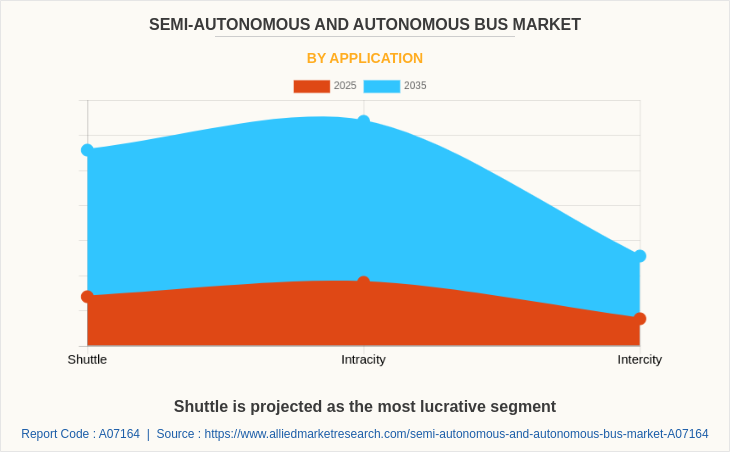

The semi-autonomous & autonomous bus market is segmented on the basis of level of automation, mode of operation, application, propulsion type, and region. By level of automation, it is divided into Level 1, Level 2, Level 3, Level 4, and Level 5. By mode of operation, it is segmented into semi-autonomous, and autonomous. By application, it is divided into shuttle, intracity, and intercity. By propulsion type, the market is divided into electric, and hybrid. By region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The key players that operate in this semi-autonomous & autonomous bus market are

Which are the Top Semi-Autonomous & Aautonomous Bus companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the semi-autonomous & autonomous bus industry.

- AB Volvo

- Aptiv

- BMW

- Continental AG

- Denso Corporation

- EASYMILE

- Intel Corporation

- Mercedes-Benz Group AG

- NAVYA Group

- NVIDIA Corporation

- NXP Semiconductors

- Proterra

- Qualcomm Technologies Inc.

- Robert Bosch GmbH

- Scania

- Teague

- ZF Friedrichshafen AG

What are the Top Impacting Factors

Key Market Driver

Improved safety coupled with reduction in traffic congestion

Autonomous vehicles have several advantages over traditional vehicles from improved safety to reduction in fuel and traffic congestion and emissions. An autonomous bus is installed with a number of sensors including LiDAR, RADAR, camera, and GPS. These sensors are short range (providing details of moving objects near the vehicle) as well as long range (providing details of high-speed oncoming vehicles) to help a vehicle sense any object or obstacle in its way, thus eliminating chances of accidents.

Autonomous vehicles can also help reduce traffic congestion. On the basis of a study by University of Illinois, it was proved that one autonomous vehicle stuck in traffic congestion with 20 other human driven vehicles can ease the congestion by controlling the pace of the vehicle. Fuel consumption also reduces with use of autonomous vehicles as fuel use increases when the vehicle slows down. Thus, reduction in traffic congestion and improved fuel efficiency due to self-driving buses are expected to boost the growth of the self-driving bus market. This in turn is expected to drive the growth of the semi-autonomous and autonomous bus market.

Growth of connected infrastructure

With the rapid adoption of Internet of Things (IoT), transportation infrastructure across the globe is evolving quickly. Companies such as Cisco and IBM, have created digital platforms, which can automate street and traffic lights, optimize trash pickup, and augment surveillance.

For instance, installation of IoT sensors in the streets of Las Vegas has managed to control traffic congestion and solve environmental issues. Connected infrastructure includes car parking, toll booths, and smart-street and traffic lights. Thus, growth of connected infrastructure creates favorable conditions for adoption of autonomous bus, which, in turn, drives the growth of the semi-autonomous & autonomous bus market. Connected vehicles are equipped with advanced automotive systems such as navigation systems, GPS tracking, and automotive telematics devices through which they can exchange information wirelessly not only with other vehicles and supporting infrastructure but also with vehicle manufacturers or third-party service providers, although customers are more likely to entrust their data to OEMs than to newer players. Moreover, demand for connected cars is increasing worldwide and buyers are willing to pay more for connected features. Vehicle dealers benefit from connected vehicle technology as they receive alerts on their systems when their connected vehicle customers are due for service.

This allows them to follow up with their customers to take care of regular maintenance and repairs. Automotive telematics aids manufacturers to create high-value services for consumers and play a vital role in connected car technology. Popularity of automotive telematics is getting bigger and is gaining momentum across developed and developing nations globally. Big market players from the telecommunications and automotive industry are quite active in the market. They are largely working in the telematics segment and creating superior solutions in infotainment and navigation fields.

In Thailand, Toyota has already launched G-BOOK, a telematics smartphone application. Moreover, in November 2020, Pioneer was selected under the Program for Strengthening Overseas Supply Chains to create more robust supply chains, particularly in Asia. Hence, increase in demand for connected vehicles and infrastructure is expected to fuel growth of the tire semi-autonomous and autonomous market in the future.

Restaints

High manufacturing cost and data management challenge for autonomous vehicle

Autonomous vehicle consists of more than 50 sensors including LiDAR, RADAR, and camera, which are installed all around the vehicle and help build a safety circumference. Any obstacle approaching the vehicle can be immediately detected using these sensors. However, these sensors are not economically priced. A high quality long range LiDAR can even cost up to $75,000. And apart from the hardware cost, the vehicle also needs software, which can extract information from the sensors and control the vehicle. Therefore, vehicle production and large-scale deploy with cost-effective hardware pose to be major challenges for the manufacturers. Moreover, autonomous vehicles require high amount of computational power as the amount of data generated is enormous. The autonomous vehicles interact with other intelligent transportation systems, which generate large amount of data, therefore needs a proper data storage and processing system. Furthermore, they require a large set of datasets for training. Neural networks of autonomous vehicle need to be trained on representative datasets, which include examples of all possible conditions including driving, weather, roads, and other situational conditions.

Opportunity

Supportive government regulations

Smart cities have experienced considerable growth across the globe. Emergence of disruptive technologies such as IoT and connected devices also lead to development of smart transportation in smart cities. Advancements in IoT and cloud-based platforms have led to significant investment in smart cities. Several countries focus on transportation under smart cities initiative. For instance, Chinese government is working on programs for an autonomous driving revolution. Around 300 Chinese cities, which include Xinjiang and Nanjing, have introduced smart-city projects out of which 93 of the smart city projects are focused on public transportation.

These could potentially use its connected infrastructure to focus on building autonomous vehicles and shared-driving models on the road. Furthermore, in September 2017, Baidu, a China-based technology company announced a $1.52 billion autonomous-driving initiative, which is called "Apollo Fund." This initiative is investing in 100 autonomous driving projects. Such projects for autonomous driving technology is expected to provide lucrative opportunity for semi-autonomous & autonomous bus market during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the semi-autonomous & autonomous bus market analysis from 2025 to 2035 to identify the prevailing semi-autonomous & autonomous bus market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the semi-autonomous & autonomous bus market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global semi-autonomous & autonomous bus market trends, key players, market segments, application areas, and market growth strategies.

Semi-Autonomous & Autonomous Bus Market Report Highlights

| Aspects | Details |

| By Level of Automation |

|

| By Mode Of Operation |

|

| By Application |

|

| By Propulsion Type |

|

| By Region |

|

| Key Market Players | NVIDIA, AB VOLVO, Qualcomm, NAVYA, Scania, 2GETTHERE, Denso, Intel, Continental, PROTERRA, Bosch, NXP, DAIMLER, EASYMILE, APTIV, BMW, LOCAL MOTORS |

Analyst Review

The semi-autonomous & autonomous bus market is expected to witness significant growth, due to need for efficient bus operations, and demand for Advanced Driver Assistance System (ADAS) features in buses. The market is supplemented by numerous developments carried out by the top vehicle manufacturers, which has led to the growth of the market. Moreover, the market is supplemented by the developments carried out by different companies such as Daimler, Scania, AB Volvo among others. These companies have continuously working on R&D of semi-autonomous and autonomous vehicles, thus, boosting the market growth.

Factors such as improved safety coupled with the reduction in traffic congestion, development of intelligent transport system, and growth of connected infrastructure are anticipated to boost the growth of the global semi-autonomous & autonomous bus market during the forecast period. However, software failures associated with automotive sensors, and high manufacturing cost and data management challenge for autonomous vehicle are expected to hinder the growth of the global semi-autonomous & autonomous bus market during the forecast timeframe. Moreover, development of smart cities, and supportive government regulations is expected to create an opportunity for the semi-autonomous & autonomous bus market in the near future.

To fulfil the changing demand scenarios, market participants are concentrating on collaboration and partnership to match changing end-user requirements and meet new business opportunities. For instance, in May 2022, AB Volvo entered into a collaboration with the City of Gothenburg for testing and developing connected solutions that contribute to creating smoother urban transport and more livable cities.

Moreover, in February 2021, Navya entered into collaboration with Bluebus a company with expertise in the design, development, manufacture and sale of 100% electric buses integrating lithium metal solid-state batteries (LMP) to develop an autonomous 6-meter bus. In addition, market participants are continuously focusing on acquisition efforts to offer a diverse range of products. For instance, in September 2021, Navya launched the first autonomous shuttle service by NAVYA on open road in the UK at the Harwell Science and Innovation Campus, a leading innovation center.

The key players that operate in this market are AB Volvo, Aptiv, BMW, Continental Ag, Denso Corporation, EASYMILE, Intel Corporation, MERCEDES-BENZ GROUP AG, NAVYA Group, NVIDIA Corporation, NXP Semiconductors, PROTERRA, Qualcomm Technologies Inc., Robert Bosch GmbH, Scania, Teague, and ZF Friedrichshafen AG

The global semi-autonomous & autonomous bus market is expected to be valued at USD 791.2 million in 2025, and is projected to reach USD 2,904.1 million by 2035.

The global semi-autonomous & autonomous bus market is projected to grow at a compound annual growth rate of 14.6% from 2026-2035 to reach USD 2,904.1 million by 2035.

The key players that operate in the semi-autonomous & autonomous bus market such as AB Volvo, Aptiv, BMW, Continental Ag, Denso Corporation, EASYMILE, Intel Corporation, MERCEDES-BENZ GROUP AG, NAVYA Group, NVIDIA Corporation, NXP Semiconductors, PROTERRA, Qualcomm Technologies Inc., Robert Bosch GmbH, Scania, Teague, and ZF Friedrichshafen AG.

Europe is the largest regional market.

Factors such as improved safety coupled with the reduction in traffic congestion, development of intelligent transport system, and growth of connected infrastructure are anticipated to boost the growth of the global semi-autonomous & autonomous bus market during the forecast period.

Loading Table Of Content...