Silicon Wafer Market Research, 2032

The Global Silicon Wafer Market was valued at $15.4 billion in 2022 and is projected to reach $25.9 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032. Silicon (Si) wafer refers to a semiconductor component installed with microelectronic circuits and electronic integrated circuits (ICs). It is commercially available as polished, undoped silicon, doped silicon, and epitaxial wafers, which are traditional wafers utilized for obtaining surface integrity and regulating the energy consumption of devices.

It is manufactured by numerous micro-fabrication steps, such as implantation, etching, deposition of various materials, and photolithographic patterning. It is created with an impurity doping concentration of phosphorus, arsenic, boron, or antimony. It offers a wide range of current and voltage handling capacities with high durability, reliability, and heat resistance. It is widely utilized in smartphones, tablets, smart wearables, solar cells, military weapons, gaming devices, and rectifiers. It is also used for lessening the parasitic device capacitance in microelectronics and enhancing its performance. As a result, it finds applications in various industries, such as electronics, telecommunication, energy generation, defense, and automotive.

![]()

Segment Overview

The silicon wafer market segmentation is done based on type, wafer size, application, and region.

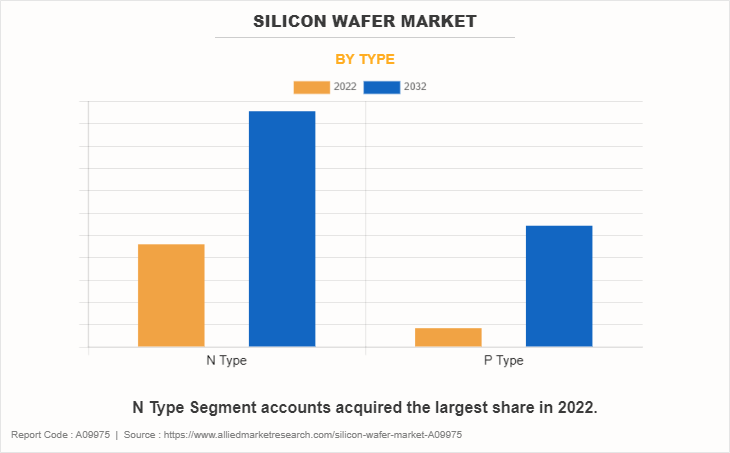

By type, the market is divided into P-type and N-type. In 2022, N-type had the highest market share 2022.

Silicon wafer growth projections are fueled by the constant need for advanced semiconductors in swiftly evolving industries. Whether it's the upswing in consumer electronics or the broadening usage of IoT devices, along with the integration of cutting-edge technologies like 5G, AI, and renewable energy solutions, silicon wafers play a pivotal role in these advancements. The Silicon Wafer Manufacturing Process begins with crystal growth. After slicing ingots into thin wafers, lapping and polishing create smooth surfaces.

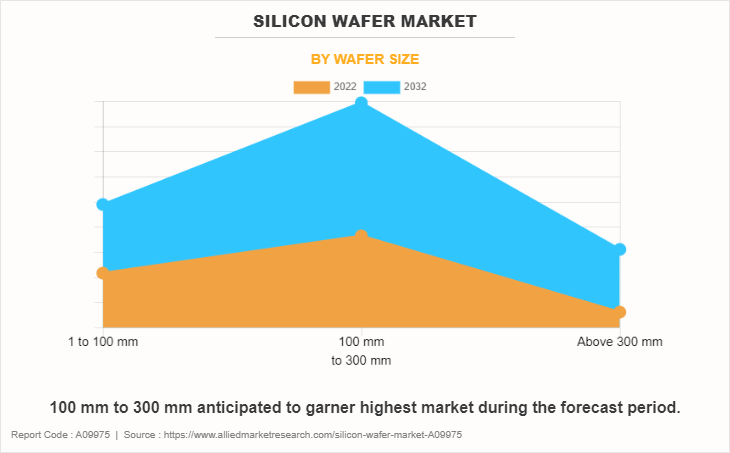

By wafer size, the silicon wafer market is segmented into 1 to 100mm, 100 to 300mm, and above 300mm.

Cleaning follows, and doping enhances properties. This Silicon Wafer Manufacturing Process forms the foundation for semiconductor device fabrication in electronics. The constant demand for smaller, more effective, and potent semiconductor components remains the driving force behind the market's growth, positioning silicon wafers as essential elements in advancing the technological landscape to achieve heightened levels of sophistication and efficiency.

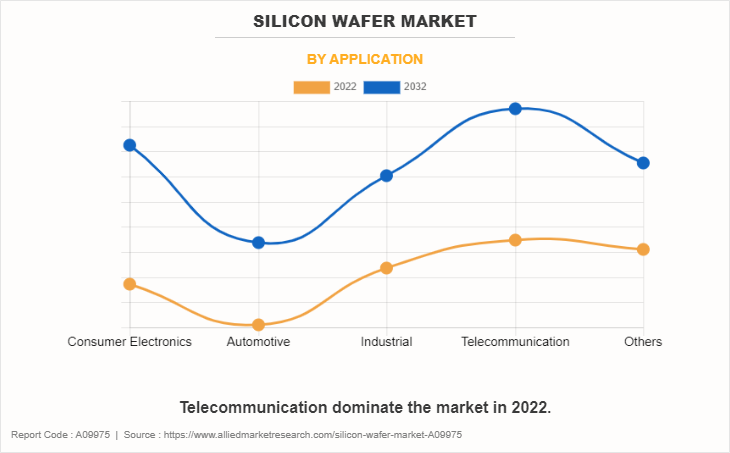

As per the application, the silicon wafer market is segmented into consumer electronics, automotive, industrial, telecommunication, and others.

Furthermore, the production and demand for SI wafers used in Silicon substrates are increased by the rising demand for MEMS, IC, discrete semiconductors, power devices, analog optics, and compound semiconductors. Numerous market vendors are being encouraged by this trend to increase their capacity and make investments in new machinery. The number of semiconductor volume fabs has also grown during the past ten years. Semiconductor Equipment and Materials International (SEMI) recently predicted that exports of silicon wafers for semiconductor applications would surpass 17,600 million square inches (MSI) by 2025.

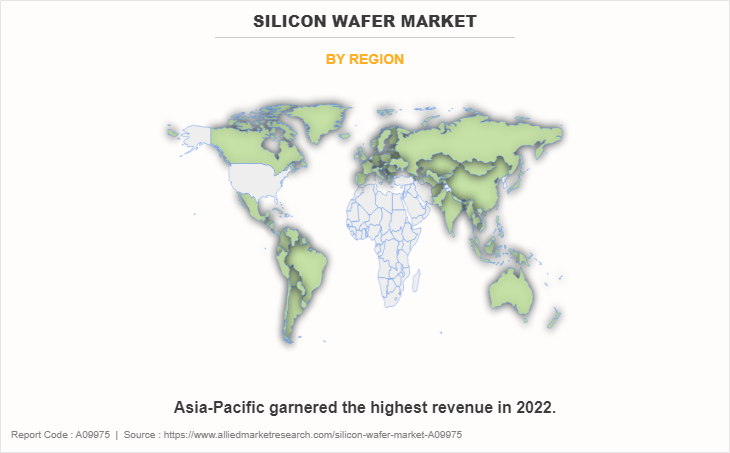

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina and rest of Latin America) and Middle East and Africa (UAE, Saudi Arabia, South Africa and rest of MEA).

However, the silicon wafer industry is restrained by increasing environmental concerns. The process is marked by the use of energy-intensive materials and dangerous chemicals, which is harmful to the environment. Silicon production itself creates greenhouse gases. Furthermore, there are challenges in the disposal of electronic waste containing silicon wafers. As sustainability becomes more prominent, stricter regulations and increased consumer awareness drive the industry towards environmentally friendly practices. The demand for cleaner production methods, reduced energy consumption, and responsible disposal practices requires a shift toward environmentally friendly manufacturing and recycling in the silicon wafer market report.

The silicon wafer market sees promising potential with the rollout of 5G technology. As 5G networks increase globally, there is a vast demand for high-performance and strength-efficient semiconductor components. Silicon wafers, important for the development of advanced chips, play a key role in manufacturing devices compatible with 5 G. The heightened necessities for statistical speeds and connectivity in the 5G era drive the need for modern-day semiconductor solutions, creating a growth opportunity for producers of silicon wafers. This aligns with the non-stop evolution of telecommunications infrastructure, fostering innovation and propelling the marketplace's expansion to satisfy the needs of 5G technology.

Top Impacting Factors

The silicon wafer market is anticipated to expand significantly during the forecast period, owing to the need for advanced semiconductors in swiftly evolving industries. In addition, rising demand for MEMS, IC, discrete semiconductors, power devices, analog optics, and compound semiconductors fuels silicon wafer market growth. Moreover, silicon wafer is a promising potential with the rollout of 5G technology, owing to the surge in consumer electronics, and is expected to present enormous opportunities for the silicon wafer market during the forecast period. However, the high costs of making quantum photonics and the need for professional technicians are anticipated to restrain the growth of the silicon wafer market during the forecast period.

Competitive Analysis

The major silicon wafer market share by company includes Shin-Etsu Handotai, Siltronic AG, SUMCO CORPORATION, SK Inc., Globalwafers Co. Ltd, GRINM Semiconductor Materials Co., Ltd., Okmetic, Wafer Works Corp., Addison Engineering, Inc., Silicon Materials, Inc.. These key players have adopted strategies, such as investments, expansion, and agreements to enhance their position in the silicon wafer market size by country.

Historical Data & Information

The silicon wafer market growth is highly competitive, owing to the strong presence of existing vendors. Vendors in the Silicon Substrate with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they can cater to the silicon wafer market demands. The competitive environment in the silicon wafer market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments / Strategies

Shin-Etsu Handotai, Siltronic AG, SUMCO CORPORATION, SK Inc., Globalwafers Co. Ltd, GRINM Semiconductor Materials Co., Ltd., Okmetic, Wafer Works Corp., Addison Engineering, Inc., Silicon Materials, Inc. are the top companies holding a prime share in the global Silicon Substrate. Top silicon wafer market players have adopted various strategies, such as expansion and investment, to expand their foothold in the global silicon wafer market.

- In January 2022, GlobalWafers Co., one of the leading global silicon wafer suppliers, added around 20,000 advanced 12-inch wafers each month from local fabs. GlobalWafers estimates capacity to rise 10-15% at plants in South Korea, Japan, Taiwan, and Italy as a result of the expansions to satisfy the strong demand of the silicon wafer market.

- In June 2022, Taiwan's GlobalWafers Co., Ltd announced spending USD 5 billion on a new plant in Texas to make 300-millimeter silicon wafers used in semiconductors. With the global chip shortage and ongoing geopolitical concerns, GlobalWafers is taking this opportunity to address the resiliency of the United States' semiconductor supply chain.

- In March 2022, SK Siltron Co. announced that it has decided to invest 1.05 trillion won over the next three years to expand its facilities for 300 mm wafers, which are located in Gumi National Industrial Complex 3. The company will begin the expansion work in 2022 to start mass production in 2024.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the silicon wafer market segments, current trends, estimations, and dynamics of the silicon wafer market from 2022 to 2032 to identify the prevailing silicon wafer market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the silicon wafer market assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global silicon wafer market trends, key players, market segments, application areas, and market growth strategies.

Silicon Wafer Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Wafer Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | SUMCO CORPORATION, Okmetic, Globalwafers Co. Ltd, Shin-Etsu Handotai, Silicon Materials, Inc., SK Inc., Addison Engineering, Inc., Wafer Works Corp., GRINM Semiconductor Materials Co., Ltd., SILTRONIC AG |

Analyst Review

The silicon wafer market holds high potential for the semiconductor industry. The business scenario witnesses increase in demand for advance semiconductor-based devices and particularly in developing regions, such as China, India, U.S., UK, and others. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative product offerings.?

Rise in demand for advanced consumer electronics and growth in renewable energy sector drive the growth of the market. However, high production costs impede this growth. Furthermore, an increase in demand for silicon wafer for EVs is expected to create lucrative opportunities for the key players operating in the market.?

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Investment, agreement and collaboration are the prominent strategies adopted by market players. For instance, Taiwan's GlobalWafers Co Ltd announced spending USD 5 billion on a new plant in Texas to make 300-millimeter silicon wafers used in semiconductors. With the global chip shortage and ongoing geopolitical concerns, GlobalWafers is taking this opportunity to address the resiliency of the United States semiconductor supply chain.

Increasing Demand for Silicon Wafers in Electric Vehicles (EVs) and 5G Technology and continued transition to smaller semiconductor manufacturing nodes

The leading application of silicon wafers is in the manufacturing of integrated circuits (ICs) for electronic devices.

Asia-Pacific is the largest regional market for Silicon Wafer.

The estimated industry size of Silicon Wafer is $15,380.00 million in 2022.

Shin-Etsu Handotai, Siltronic AG, SUMCO CORPORATION, SK Inc. and Globalwafers Co. Ltd are the top companies that hold most of the market share in Silicon Wafer

Loading Table Of Content...

Loading Research Methodology...