Sliced White Mushroom Market Research, 2033

Market Introduction and Definition

The global sliced white mushroom market size was valued at $4.5 billion in 2023 and is projected to reach $8.2 billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033. Sliced white mushrooms are a popular culinary ingredient derived from Agaricus bisporus, known for their mild flavor and versatile use in cooking. Typically sold pre-sliced for convenience, these mushrooms come in various forms, including fresh, canned, frozen, and dried. The sliced white mushroom market exists due to the increasing demand for ready-to-use, nutritious ingredients that save time in meal preparation. Key benefits include their rich nutrient profile, offering vitamins, minerals, and antioxidants while being low in calories. They enhance the flavor and texture of a wide range of dishes, from salads and soups to pizzas and stir-fries. Their versatility, coupled with growing health-conscious consumer trends and a preference for convenience foods, drives the market's growth. As a staple in both home kitchens and food service establishments, sliced white mushrooms meet the evolving needs of modern consumers.

Key Takeaways

The sliced white mushroom market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the forecast period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major sliced white mushroom industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The growing awareness of the health benefits of mushrooms, such as their high nutritional value and potential medicinal properties, is driving demand. Sliced white mushrooms are rich in vitamins, minerals, and antioxidants, making them a popular choice for health-conscious consumers. As people become more educated about healthy eating and preventive healthcare, the consumption of nutrient-dense foods like mushrooms increases. This trend is further supported by dietary recommendations from health organizations and the promotion of plant-based diets, boosting the sliced white mushroom market growth.

The shift towards plant-based diets is significantly boosting the sliced white mushroom market. Mushrooms are an excellent meat substitute due to their umami flavor and meaty texture. As more consumers adopt vegetarian, vegan, or flexitarian lifestyles, the demand for versatile, nutritious, and sustainable food options like sliced white mushrooms grows. This trend is driven by concerns over health, animal welfare, and environmental sustainability, leading to increased mushroom consumption as part of plant-based meals.

The growing demand for convenient and ready-to-cook food products is a major driver for the sliced white mushroom market. Busy lifestyles and the need for quick meal preparation options have led consumers to seek pre-sliced, easy-to-use ingredients. Sliced white mushrooms fit perfectly into this category, offering a time-saving solution without compromising on nutrition or flavor. Companies are capitalizing on this trend by offering pre-packaged, ready-to-cook sliced mushrooms that cater to the needs of modern consumers, thereby expanding the market during sliced white mushroom market forecast.

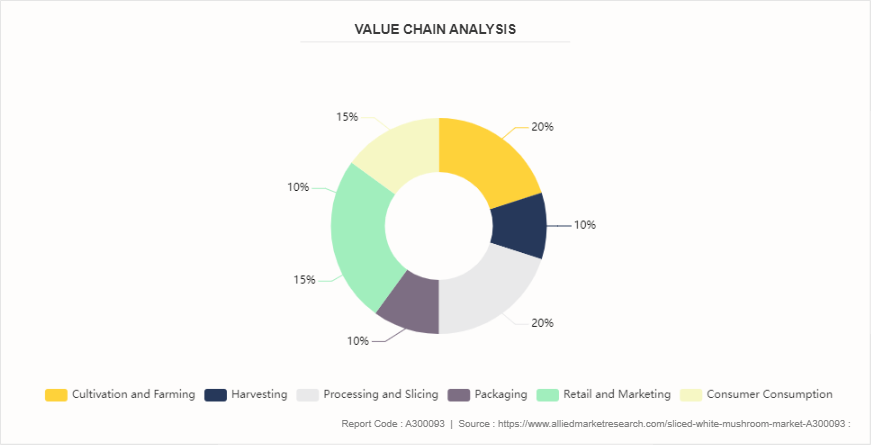

Value Chain Analysis

The value chain for sliced white mushrooms involves a series of interconnected steps from cultivation to consumer consumption. Each step is crucial in ensuring the product's quality, safety, and appeal, driving market growth and consumer satisfaction.

Cultivation and Farming: The value chain begins with the cultivation of white mushrooms. Farmers use substrates like composted manure or straw, enriched with nutrients to promote mushroom growth. The farming process involves multiple stages, including spawning (introducing mushroom spores to the substrate) , casing (applying a layer to protect the spawn) , and fruiting (developing the mushrooms) . Advanced techniques, such as controlled environment agriculture (CEA) , are employed to optimize growing conditions like temperature, humidity, and CO2 levels.

Harvesting: Harvesting is a labor-intensive process that requires skilled workers to carefully pick mushrooms at the right maturity. Automated harvesting technologies are increasingly being adopted to improve efficiency and reduce labor costs. Post-harvest, mushrooms are cleaned to remove substrate particles and debris. Maintaining hygiene standards is crucial to prevent contamination and preserve the freshness of the mushrooms.

Processing and Slicing: Post-harvest, mushrooms are transported to processing facilities where they are sorted, graded, and sliced. The slicing process is highly automated to ensure uniformity and precision. This step may also involve washing, blanching, and packaging mushrooms in consumer-ready formats. Processing facilities must adhere to strict food safety regulations to prevent contamination.

Packaging: Packaging plays a vital role in the value chain, protecting sliced mushrooms from physical damage and contamination during transportation and storage. Sustainable packaging solutions, such as biodegradable or recyclable materials, are becoming popular to address environmental concerns. Packaging also includes labeling with necessary information such as nutritional content, expiry date, and origin.

Distribution and Logistics: Efficient distribution and logistics are essential to ensure that sliced mushrooms reach retailers and consumers in optimal condition. This involves refrigerated transport and storage to maintain the freshness of the mushrooms. Companies invest in advanced logistics solutions to track and manage the supply chain, ensuring timely delivery and reducing spoilage.

Retail and Marketing: Sliced white mushrooms are marketed and sold through various retail channels, including supermarkets, grocery stores, online platforms, and specialty food stores. Effective marketing strategies highlight the health benefits, convenience, and versatility of mushrooms, appealing to a broad consumer base.

Consumer Consumption: The final step in the value chain is consumer consumption. Sliced white mushrooms are used in a variety of culinary applications, from salads and soups to pizzas and stir-fries. Consumer preferences for fresh, nutritious, and easy-to-use ingredients drive demand. Feedback from consumers influences future product offerings and improvements in quality, packaging, and distribution.

Market Segmentation

The sliced white mushroom market has been segmented based on product type, end-user, distribution, and region. Based on product type, the sliced white mushroom market is bifurcated into fresh sliced white mushrooms, canned sliced white mushrooms, frozen sliced white mushrooms, and dried sliced white mushrooms. Based on end user, the market is segmented into residential and commercial. Based on distribution channel, the market is segmented into hypermarkets and supermarkets, specialty stores, convenience stores, online retailers, and others. Region-wise, the market is divided into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Regional Market Outlook

Europe held the major sliced white mushroom market share in 2023. The region benefits from a well-established supply chain, advanced farming techniques, and significant investments in research and development for high-yield, disease-resistant mushroom varieties. Additionally, European consumers' increasing health consciousness and preference for organic and sustainable food products drive the demand for sliced white mushrooms. The popularity of mushrooms in European cuisines and the presence of large-scale producers, particularly in countries like the Netherlands and Poland, further bolster the market's growth in this region. ???????

Industry Trends

The push towards sustainability in the sliced white mushroom market is gaining momentum as companies like Costa Group adopt eco-friendly packaging solutions. This trend addresses growing consumer concerns about plastic waste and environmental impact. Costa Group, for example, has introduced biodegradable and recyclable packaging options for their mushrooms. This initiative not only reduces the environmental footprint but also enhances the company's brand image among eco-conscious consumers. By embracing sustainable packaging, companies aim to attract a larger customer base, comply with stricter environmental regulations, and contribute to global sustainability goals.

The demand for organic food products continues to rise, driving companies like Monterey Mushrooms to expand their organic product lines. Consumers are increasingly seeking healthier and more natural food options, and organic mushrooms fit this demand perfectly. Monterey Mushrooms has responded by enhancing their organic mushroom farming practices, ensuring no synthetic pesticides or fertilizers are used. This initiative not only meets consumer preferences but also positions the company as a leader in the organic produce market.

Technological innovation is transforming the sliced white mushroom market, with companies like Highline Mushrooms leading the way. They are implementing advanced farming technologies such as automated harvesting systems, climate control technologies, and data-driven crop management. These advancements help increase efficiency, improve yield, and ensure consistent quality. Automated systems reduce labor costs and minimize human error, while precise climate control optimizes growing conditions, leading to better product quality.

Competitive Landscape

The major players operating in the sliced white mushroom market include Monterey Mushrooms, Inc., Costa Group, Highline Mushrooms, South Mill Champs, The Mushroom Company, Greenyard Group, Bonduelle Fresh Europe, Scelta Mushrooms BV, Monaghan Mushrooms, and Okechamp S.A.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sliced white mushroom market analysis from 2024 to 2033 to identify the prevailing sliced white mushroom market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sliced white mushroom market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sliced white mushroom market trends, key players, market segments, application areas, and market growth strategies.

Sliced White Mushroom Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.2 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 220 |

| By Product Type |

|

| By End Use |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Okechamp S.A., South Mill Champs, Monaghan Mushrooms, Highline Mushrooms, The Mushroom Company, Monterey Mushrooms, Inc., Costa Group, Greenyard Group, Scelta Mushrooms BV, Bonduelle Fresh Europe |

The sliced white mushroom market was valued at $4.5 billion in 2023 and is estimated to reach $8.2 billion by 2033, exhibiting a CAGR of 6.2% from 2024 to 2033.

The sliced white mushroom market has been segmented based on product type, end user, distribution, and region. Based on product type, the sliced white mushroom market is bifurcated into fresh sliced white mushrooms, canned sliced white mushrooms, frozen sliced white mushrooms, and dried sliced white mushrooms. Based on end user, the market is segmented into residential and commercial. Based on distribution channel, the market is segmented into hypermarkets and supermarkets, specialty stores, con

Europe is the largest regional market for sliced white mushroom

The major players operating in the sliced white mushroom market include Monterey Mushrooms, Inc., Costa Group, Highline Mushrooms, South Mill Champs, The Mushroom Company, Greenyard Group, Bonduelle Fresh Europe, Scelta Mushrooms BV, Monaghan Mushrooms, and Okechamp S.A.

The global sliced white mushroom market report is available on request on the website of Allied Market Research.

Loading Table Of Content...