Smart Exoskeleton Market Research, 2032

The global smart exoskeleton market was valued at $357.1 million in 2022 and is projected to reach $1.7 billion by 2032, growing at a CAGR of 17.3% from 2023 to 2032. A smart exoskeleton is a powered wearable suit, which is designed to improve user safety while increasing overall human efficiency to do the respective tasks. This exoskeleton makes use of smart algorithms, which automatically adjust to human body motions and further help in achieving optimal performance. Moreover, owing to the capability to intelligently adapt to body motions, human exoskeletons consume a lesser amount of energy as compared to traditional exoskeletons.

Smart exoskeleton uses batteries as the power source to run the actuator systems. In addition, it is equipped with various types of sensors and electric cable connections to control the exoskeleton components. Moreover, it uses algorithms to detect motion anomalies in real-time environments and further aid in preventing injuries.

It aids people who are physically weak and individuals suffering from health and neurological disorders. It makes use of a smart, lightweight, and tailored exoskeleton that can enhance user movements and prevent unexpected injuries. In addition, it enables the elderly to walk with ease and prevents fall-related injuries. Moreover, it can be used to maintain the tone of body parts and reactivate blood circulation in people suffering from muscle weakness.

The increase in demand for the use of smart exoskeletons in the rehabilitation of people suffering from physical disabilities and neurological disorders acts as the key driving force of the global smart exoskeleton industry. However, concerns related to the affordability of smart exoskeletons restrain the market growth.

On the contrary, a rise in investments to develop innovative, lightweight, and energy-efficient exoskeletons across the globe is expected to create lucrative opportunities for the growth of the global smart exoskeleton industry during the forecast period.

Segment Overview

The smart exoskeleton market overview is segmented into Type, Body Part, Component, and Application.

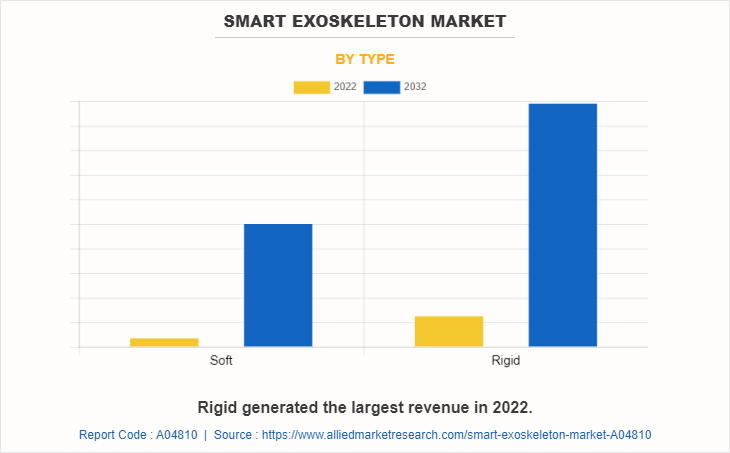

Depending on the type, it is classified into soft exoskeleton and rigid exoskeleton. The rigid exoskeleton accounted for the largest smart exoskeleton market share in 2022.

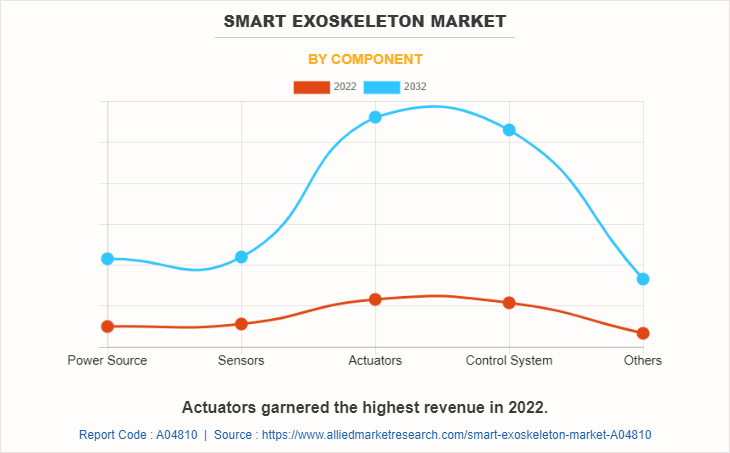

Based on components, the market is categorized into sensors, actuators, power sources, control systems, and others. Actuators dominated the market in 2022.

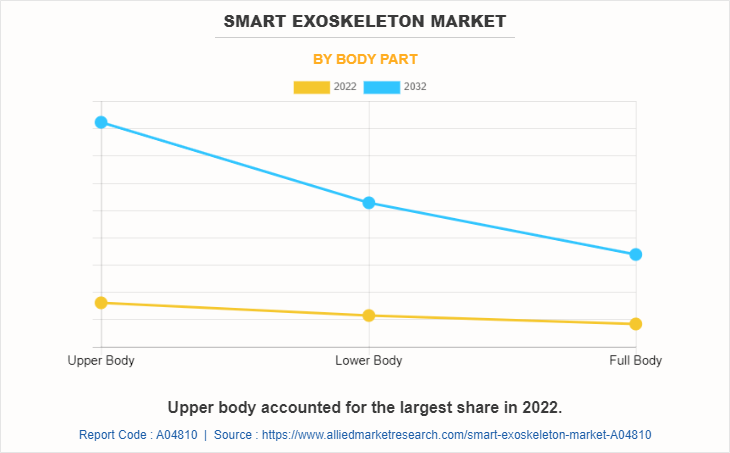

By body part, it is divided into the upper body, lower body, and full body. Full body generated the largest revenue in 2022.

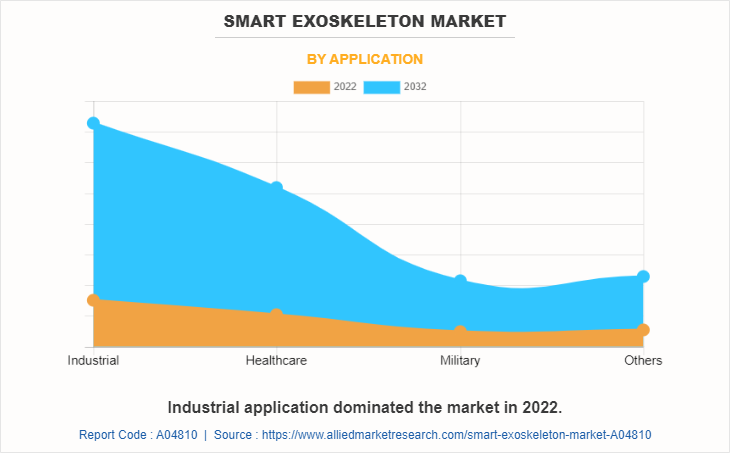

As per the application, it is segregated into industrial, healthcare, military, and other. The industrial segment is anticipated to have the largest share in 2022.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Country-wise, the U.S. acquired a prime share in the global smart exoskeleton market growth in the North American region and is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, the UK dominated the global smart exoskeleton market in terms of revenue in 2022. However, Germany is expected to emerge as the fastest-growing country in Europe's global barcode reader market with a significant CAGR during the forecast period.

In Asia-Pacific, South Korea is expected to emerge as a significant market for the global smart exoskeleton market industry, owing to a significant rise in investment by prime players in the region.

In the LAMEA region, the Middle East garnered a significant market share in 2022. The LAMEA smart exoskeleton market has been witnessing improvement, owing to the growing inclination of companies towards research and development and expanding manufacturing units across this region. Moreover, the Middle East region is expected to grow at a high CAGR from 2023 to 2032.

Competitive Analysis

The key market leaders profiled in the report include ReWalk Robotics Ltd, CYBERDYNE, INC., HONDA MOTOR CO., Ltd, Ekso Bionics Holdings, Inc., Bionik Laboratories, Lockheed Martin Corporation, Technaid Inc., ATOUN INC., Sarcos Technology, and Robotics Corporation. These key players have adopted strategies, such as geographical expansion, product launch, acquisitions, partnerships, and business expansion, to enhance their market penetration.

Top Impacting Factors

The global smart exoskeleton market includes a surge in demand for elderly safety body parts, which fuels the demand for smart exoskeletons. In addition, a surge in demand for gait rehabilitation positively impacts the growth of the market. However, the high cost of smart exoskeletons hampers the market growth. Conversely, an increase in initiatives for military body parts is expected to open a new smart exoskeleton market opportunity.

Historical Data & Information

The global smart exoskeleton market is highly competitive, owing to the strong presence of existing vendors. Vendors of the global smart exoskeleton market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Cyberdyne Inc., Honda Motor Co., Ltd, Bionik Laboratories, Lockheed Martin Corporation, and Ekso Bionics Holding Inc. are the top companies holding a prime share in the global smart exoskeleton market. Top market players have adopted various strategies, such as product launch, acquisition, expansion, agreement, product development, innovation, branding, collaboration, investment, contract, and upgradation to expand their foothold in the global smart exoskeleton market.

- In May 2023, ReWalk Robotics unveiled its innovative exoskeleton to the public at the Abilities Expo in New York, with live demonstrations from paralyzed individuals who use the technology to regain ambulatory access to real-world environments, including stairs and curbs.

- In November 2022, CYBERDYNE Inc. announced Medical HAL Single Joint Type, a wearable CyborgTM that improves physical functions, and has been approved by the Taiwan Food and Drug Administration (TFDA).

- In June 2022, Ekso Bionics Holdings, Inc., announced that it received 510k clearance from the U.S. Food and Drug Administration (FDA) to market its EksoNR robotic exoskeleton for use with multiple sclerosis (MS) patients. EksoNR is an exoskeleton device to receive FDA clearance for rehabilitation use in patients with MS, an indication that significantly expands the device's use to a broader group of patients.

- In April 2021, Sarcos Robotics announced plans to board the SPAC train, courtesy of Rotor Acquisition Corp. The deal was potentially valued at the robotic exoskeleton maker and blank check company. at a combined $1.3 billion, along with a potential $281 million earn-out.

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the global smart exoskeleton market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global smart exoskeleton market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global smart exoskeleton market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the smart exoskeleton.

- The report includes the market share of key vendors and global smart exoskeleton market trends.

Smart Exoskeleton Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.7 billion |

| Growth Rate | CAGR of 17.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 430 |

| By Type |

|

| By Body Part |

|

| By Component |

|

| By Application |

|

| By Region |

|

| Key Market Players | Technaid Inc., Bionik Laboratories, CYBERDYNE,INC., Sarcos Technology and Robotics Corporation, HONDA MOTOR CO.,Ltd, Ekso Bionics Holdings, Inc., ReWalk Robotics Ltd., ATOUN INC., Rex Bionics Ltd., Lockheed Martin Corporation |

Analyst Review

The smart exoskeleton is gaining high traction in the healthcare industry owing to the fact that advances in robotics, sensors, artificial intelligence, and materials have significantly improved the capabilities of smart exoskeletons. The current business scenario witnesses an increase in the demand for smart exoskeleton systems, particularly in the developed regions such as the U.S., China, and other European countries. Companies in the electronics sector adopt various innovative techniques to provide customers with advanced and innovative offerings.

Increase in demand for smart exoskeletons in gait rehabilitation and surge in demand for elderly safety body parts are expected to notably contribute toward the growth of the smart exoskeleton market. However, affordability issues are anticipated to restrain the market growth. Conversely, increase in initiatives for adoption of smart exoskeletons in military body parts across the globe is expected to create lucrative opportunities for the key players operating in the smart exoskeleton market.

Industrial is the leading application of Smart Exoskeleton Market.

The trends of Smart Exoskeleton Market include surge in demand for elderly safety body parts, which fuels the demand for smart exoskeleton. In addition, surge in demand for gait rehabilitation positively impacts the growth of the market.

Asia-Pacific is the largest regional market for smart exoskeleton market.

The global smart exoskeleton market was valued at $357.0 million in 2022.

Cyberdyne Inc., Honda Motor Co. Ltd, Bionik Laboratories, Lockhead Martin Corporation, and Ekso Bionics Holding Inc., are the top companies holding a prime share in the global smart exoskeleton market.

Loading Table Of Content...

Loading Research Methodology...