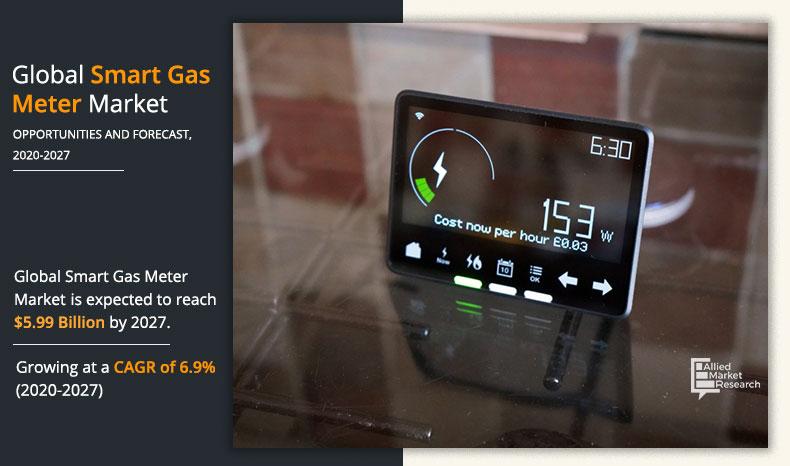

Smart Gas Meter Market Outlook - 2027

The global smart gas meter market size is expected to reach $5.99 billion by 2027 from $3.71 billion in 2019, growing at a CAGR of 6.9% from 2020 to 2027. Smart gas meters automatically measure the basic parameters such as pressure, volume, and temperature of the gas flowing in the pipeline. Installation of smart gas meter in industrial, commercial, and residential spaces is the next step toward providing access to gas for every individual. Governments’ standards and policies have pushed the smart gas meter market to pump into the global GDP. Collaboration of gas exploring companies with smart gas meter manufacturers also contributes to the same. No discrepancy in gas meters has ensured the market to drive swiftly in the upcoming years. Moreover, in recent years, an increase in safety concerns and standards has led the global smart gas meter market to register a double figure growth.

Over the coming years, digital technologies are expected to make systems more connected, efficient, reliable, and sustainable worldwide. In addition, technological advancements in data analytics and connectivity are empowering a range of new digital applications, such as shared mobility, smart appliances, and 3D printing. The ongoing and continuous development of the communication network infrastructure contributes to the manufacturing of advanced-level smart meters. The availability of network infrastructure such as 5G, 4G, radio frequency, and others boosts the development of smart meters. The manufacturers are continuously engaged in the production of advanced levels of smart meters according to the growing network infrastructure, thus contributing to the growth of the smart gas meter industry.

The major factors that drive the smart gas meter market size are supportive government policies, the development of communication network infrastructure, and high developments in the field of advanced metering infrastructure. Utilities are adopting these solutions for their vast benefits. For instance, in May 2020, the U.S. utility Indianapolis Power & Light selected Landis+Gyr to expand its advanced metering infrastructure program. They would deploy 350,000 smart meters and upgrade the utility’s existing network to optimize data telemetry by already installed smart meters, which is expected to help them enhance the management of energy distribution, integration of renewable resources, consumer energy efficiency, and quality of service. High development and demand for advanced metering infrastructure boost the smart gas meter market growth.

In addition, large-scale installations of smart meters by utility companies are focusing on strengthening the distribution of smart gas meters. However, high installation and maintenance costs of smart gas meters borne by end users restrain the growth of the smart gas meter market. Various grid operators and other gas utility providers are effectively managing the demand for smart gas meters. However, various benefits offered by the market, such as automatic meter reading and bill generation are further expected to contribute to the growth of the smart gas meter industry.

In recent times, several factors have been integrated to make smart meters more remarkable, reliable, and affordable. The different connectivity technologies used by smart gas meters are further spurring the growth of the smart gas meter market. In addition, smart gas meters help in the elimination of manual monthly meter readings and optimize the profit with existing resources.

The global smart gas meter market is segmented based on type, component, and end-use. Further, based on type, the market is segmented into automated metering infrastructure (AMI) and automated meter reading (AMR). Based on end-use components, it is classified into hardware and software. Based on end use, it is divided into residential, commercial, and industrial.

Region-wise, the smart gas meter market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). North America accounted for the highest share, owing to the highest installation rate of AMR devices. High demand for powerful smart gas meters with edge intelligence capabilities coupled with advanced data analytics, will drive the deployment of smart gas meters in North America.

Top Impacting Factors

The prominent factors that drive the growth of the smart gas meter market size include the development of communication network infrastructure, high developments in the field of advanced metering infrastructure, and government initiatives. However, the high installation and maintenance costs of smart gas meters restrict the market growth. Conversely, the development of smart city projects in emerging countries is anticipated to create lucrative opportunities for the smart gas meter industry.

By Type

AMR segment is projected as one of the most lucrative segments.

Competition Analysis

Competitive analysis and profiles of the major Honeywell International Inc, Itron Inc., Landis+Gyr, Schneider Electric SA, Siemens AG, Badger Meter, EDMI, Sensus, Aclara Technologies, and Apator SA. are provided in this report.

Covid 19 Impact Analysis

The smart gas meter market has been significantly impacted by the COVID-19 outbreak. At the start of the outbreak, the main impact faced by many smart meter manufacturers was supply problems, owing to halted production. Due to lockdown measures, non-essential businesses, and the demand for the residential, commercial, and industrial use of smart gas meters have been decreased. Consequently, the manufacturing and supply of smart gas meters is returning to normal levels. Several manufacturers have started witnessing a recovery in sales.

By End Use

Residential segment is expected to secure leading position during forecast period.

Although the COVID-19 pandemic has forced the fieldwork of several major smart metering projects to pause temporarily, the market is nonetheless expected to remain robust with the cumulative number of smart gas meter shipments being largely unaffected over three years. Despite the economic slowdowns, demand for smart gas meters in several industries has been accelerating.

COVID-19 has exposed smart meter industry’s supply chain vulnerabilities as many organizations depend on China as a global manufacturing hub for the smart gas meter industry and have also witnessed disruption of global supply chains. Though factories and businesses in China are slowly resuming operations, there is an impact on the smart gas meter industry, due to COVID-19.

By Region

Europe region would exhibit the highest CAGR of 7.8% during 2020-2027

Key Benefits for Stakeholders

- This study comprises an analytical depiction of the global smart gas meter market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall smart gas meter market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and smart gas meter market opportunities with a detailed impact analysis.

- The current smart gas meter market forecast is quantitatively analyzed from 2019 to 2027 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the smart gas meter market share of key vendors.

- The report includes the market trends and the market share of key vendors.

Smart Gas Meter Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Component |

|

| By End Use |

|

| By Region |

|

| Key Market Players | EDMI LIMITED, SCHNEIDER ELECTRIC, APATOR SA, ACLARA TECHNOLOGIES LLC, SENSUS (XYLEM), HONEYWELL INTERNATIONAL INC., SIEMENS AG, BADGER METER, INC, LANDIS+GYR, ITRON INC |

Analyst Review

The major factors that drive the smart gas meter market size is supportive government policies, development of communication network infrastructure, and high developments in the field of advanced metering infrastructure. In addition, large scale installations of the smart meters by the utility companies are focusing on strengthening the distribution of the smart gas meters.

However, high installation and maintenance cost of smart gas meters borne by end users restrain the growth of the smart gas meter market. Various grid operators and other gas utility providers are effectively managing the demand for smart gas meters. However, various benefits offered by the smart gas meter market such as automatic meter reading and bill generation are further expected to contribute toward the growth of the smart gas meter industry.

The report focuses on the growth prospects, restraints, and trends of the smart gas meter market. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers in the smart gas meter market.

The key market players extensively profiled in the report include Honeywell International Inc, Itron Inc., Landis+Gyr, Schneider Electric SA, Siemens AG, Badger Meter, EDMI, Sensus, Aclara Technologies, and Apator SA. Market players have adopted various strategies such as product launch, collaboration, partnership, and agreement to expand their foothold in the smart gas meter industry.

Loading Table Of Content...