Smart Hospitality Market Insights:

The global smart hospitality market size was valued at USD 18.8 billion in 2021 and is projected to reach USD 133.7 billion by 2031, growing at a CAGR of 22% from 2022 to 2031.

Growth in tourism and an increase in investments in hotel projects and a surge in demand for real-time optimized guest experience management are propelling the growth of the market. In addition, the rapid adoption of advanced technologies like IoT and energy management systems globally is contributing the growth of the smart hospitality market. However, high implementation, maintenance & training cost, and data security and information sharing threats limit the growth of this market. Conversely, evolving 5G to transform the smart hospitality industry is anticipated to provide a variety of opportunities for growth in the market during the forecast period.

A smart hotel is one that has disruptive technologies such as artificial intelligence and the internet of things implemented in it. These technologies are used to improve administration, efficiency, and control within the hotel's management as well as to provide better services to visitors. Additionally, a smart hotel also provides incredible opportunities to provide customization. For instance, TVs may be remotely configured to address visitors by name, and visitors can modify the room's settings via a central control point. The numerous gadgets may then automatically produce such circumstances due to IoT technology.

The report focuses on growth prospects, restraints, and analysis of the global smart hospitality market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global smart hospitality market share. The smart hospitality market is segmented into Solution Type, Component, Application and Deployment Mode.

Segment Review:

The global smart hospitality industry is segmented into component, solution type, deployment mode, application, and region. Depending on the component, the market is divided into solution and services. Based on solution type, it is categorized into hotel operation management, hotel automation management, guest service management system, security management system, and others. By Deployment mode, it is divided into on-premises and cloud. Based on application, it is bifurcated into hotels, cruises, luxury yachts, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

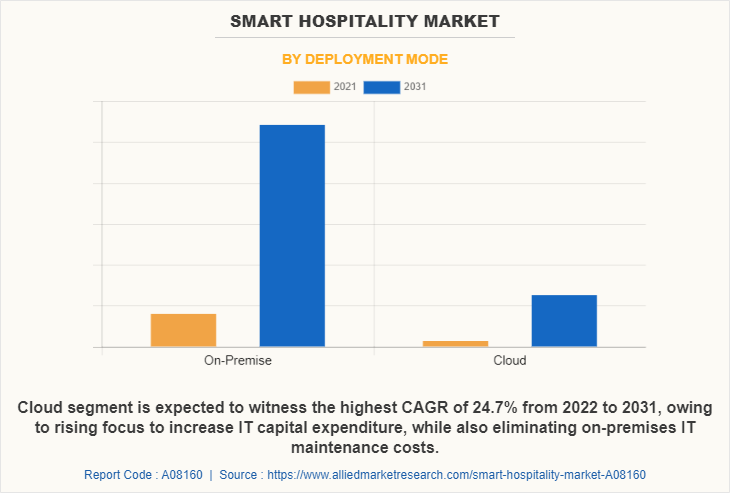

Depending on the deployment mode, the on-premise segment dominated the smart hospitality market analysis in 2022 and is expected to continue this trend during the forecast period, as it provides intelligent environmental and entertainment controls. Moreover, offering guests rapid wireless access to centralised smart systems via the Internet of Things (IoT) However, the cloud segment is expected to witness significant growth in the upcoming years, as, at every level, older and outdated systems are gradually being replaced with cloud-based services.

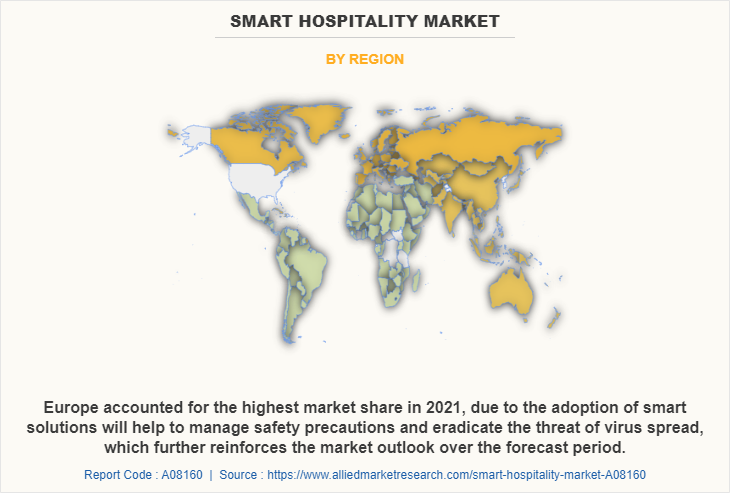

Region-wise, the smart hospitality market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to high demand for high-quality smart services, cloud-based platforms, and top level security that exceeds industry standards are some of the driving factors in the region. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to technological advancements, the hotel employees may remotely operate electronic gadgets using Internet of Things technology in smart hotels, giving them access to real-time data regarding their operational state. Thus, these factors are expected to witness considerable smart hospitality market growth during the forecast period.

The global smart hospitality market is dominated by key players such as Cisco Systems, Inc., Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Infor, Johnson Controls, NEC Corporation, Oracle Corporation, Schneider Electric, and Siemens AG. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors:

Growth in tourism and an increase in investments in hotels projects

Market expansion is anticipated to be fueled by the enormous increase in tourism. According to a report from the World Travel & Tourism Council published in August 2022, travel and tourism (along with its direct, indirect, and induced effects) was one of the largest industries in the world, responsible for one out of every four new jobs created globally, 10.3% of all employment (333 million jobs), and 10.3% of global GDP (USD 9.6 trillion). Meanwhile, USD 1.8 trillion or 6.8% of total exports was spent by foreign visitors in 2019. Tourism and travel assist socioeconomic growth, employment creation, and poverty eradication. In turn, this promotes affluence and has a large beneficial social impact, giving women, minorities, and young people special opportunities. The advantages of travel and tourism go well beyond their immediate effects on GDP and employment; they also include indirect gains that flow through the whole travel ecosystem and the connections to other industries' supply chains.

The market for smart hospitality is being driven by rising investments in hotel projects throughout the world. For instance, the Jujhar Group, based in Ludhiana, purchased around 12.5 acres of property in its hometown in June 2022 with plans to spend over Rs 350 crore on the development of two hotels. Additionally, it paid NCLT Rs 67.5 crore to purchase the Fairfield Marriott hotel in Amritsar. In order to support the budget hotel economy in smaller towns, increase tourism, and create more employment possibilities, the hotel sector has also requested the centre to grant smaller hotel projects worth Rs 10 crore an infrastructure status. This encourages smaller business owners to invest by lowering a number of expenses, most notably taxes.

Surge in demand for real-time optimized guest experience management

Hotel owners can create a long-lasting, value-driven connection with every visitor and increase the likelihood that they will leave a good review by providing a more individualised travel experience. Compiling a unique visitor experience boosts brand reputation and customer loyalty in addition to generating income. Intelligent hospitality solutions provide hoteliers access to data-backed insights and behaviour that can be used to create a 360-degree perspective of every visitor, improving their experience and providing better customer service. Hoteliers may access a dashboard with structured data from all sources, which not only curates a customised perspective of each visitor but also helps to counterbalance operational burden, with the aid of integrated, digital platforms like Property Management System (PMS) and Customer Relationship Management (CRM).

Additionally, increasing the passenger return rate and decreasing hotel operating expenses, improves brand positioning. Hotels now gain from offering a mobile-centric guest experience that improves the client's convenience and self-service. Hoteliers may design a more connected and convenient stay for their customers by developing a mobile-centric booking experience, providing keyless access using a mobile device, text-based communications, mobile concierge, etc.

Digital Capabilities

Over the past two years, the coronavirus epidemic has disproportionately affected the hotel sector. With the aid of robots and artificial intelligence, the travel and tourism business has an unrivaled chance to improve as many areas of the world are once again opening up (AI). Moreover, the future of hospitality is AI. Although it may be difficult to conceive, experts believe that humans will play a smaller role in the sector over the next ten to twenty years as robotics and AI become more prevalent.

For instance, According to Hotel Technology News in January 2020, Artificial intelligence (AI) implementation has grown 270% over the past four years and 37% in the past year alone. Additionally, the hotel sector uses artificial intelligence for everyday operations automation, revenue management, and guest experience. As new technologies enter the market virtually every day, managers must decide where their investment will have the biggest impact when using AI in hotels depending on their available budget, guest feedback, and development ambitions. Many hotel organizations are implementing AI for ease down their daily operations.

For instance, twelve Edwardian Hotels-owned Radisson Blu sites now provide Edward, an artificially intelligent service that can report on hotel services, provide directions and advice, and even quickly collect customer complaints through SMS. Such technologies will further helps in driving growth of smart hospitality market.

Furthermore, IoT has left its impact on practically every industry, and the hotel industry was not exempt. IoT is already being used by several hotels to regulate the thermostats in the rooms. Hotels may control room temperatures using linked thermostats during check-in and check-out, cutting the expense of cooling or heating. IoT has changed service delivery in the hotel sector, enhanced client satisfaction, and cut expenses. Several hotels are adopting IoT technologies laverage its advantages for providing smart features to the users.

For instance, in April 2020, Sinclair Hotel has partnered with Intel, to create the "hotel of the future" in Fort Worth, Texas. Using POE (power of ethernet) rooms include automation for lighting, climate control, and a virtual assistant. Such improvements are contributing in rising demand of smart hospitality market.

End-User Adoption

The growing digitalization in smart hotels for selected hotel organizations by using automation technologies and robotics rising the smart hospitality adoption by end-users. In addition, to provide a more individualised experience, hotels utilize automation to track the preferences and behaviour of their visitors. Additionally, automation may help hotels save time and money. For instance, certain technologies enable them to reduce their energy costs by up to 30%. One strategy in the hospitality sector is to offer the best hotel possible. Guest-room Automation has improved the comfort and convenience of visitors' stays while also keeping accommodations up to date.

For instance, a technique called "daylight harvesting" is employed by many of the best hotels and resorts. They do this by utilising Internet of Things (IoT) gadgets, which automatically change the LED lights dependent on the amount of natural light sensed in the rooms. Such factors propels the growth of smart hospitality market.

Furthermore, robotic technology is being used more and more in hotels to boost operations and the visitor experience. Robots are becoming more widespread in the hotel sector, from check-in to checkout. For instance, the first robotic concierge was unveiled at the Aloft Hotel in Cupertino, California, in the early 2000s, marking the beginning of robotics in the hospitality sector. Additionally, housekeeping, food and beverage, security, and other hotel departments all employ robots to some extent. And there are a lot of advantages to deploying robots in the hotel sector. By automating routine manual processes, robots can contribute to greater operational efficiency. Organizations are adopting robot hospitality for providing better service experiences to customers.

For instance, IBM is collaborating with hotel chain Hilton to launch “Connie,” the world’s first AI-enabled robot concierge. Small humanoid robot Connie, which bears the name of Hilton founder Conrad Hilton, uses information from Watson and the travel site WayBlazer to provide customers recommendations for nearby attractions and hotels. Such innovations bring key values needed in smart hospitality such as automation, flexibility, faster time to market and better customer experience increasing the end-user experience.

Government Initiatives

Various companies and government bodies are collaborating to strengthen R&D in the hotel industry with evolving productive alliances that lead to indigenous design, development, manufacturing, and deployment of cost-effective smart hospitality products and solutions. For instance, in March 2021, IFC, a member of the World Bank Group, and Indian Hotels Company (IHCL), South Asia's largest hospitality company launched an open call for innovators worldwide to bring efficiently, climate-smart, cost-effective cooling solutions to India's hospitality sector. The TechEmerge Sustainable Cooling Innovation Program in the Indian hospitality sector has been funded by the UK Government. It provides entrepreneurs with market access and a pooled pool of up to $500,000 in grant money to test out novel solutions, including those developed locally in India, that lessen the high energy consumption and negative environmental effects of cooling systems. Such innovations expected to expand the driving growth of the market.

Furthermore, the growing development by the government to innovate and test smart hotels. For instance, in October 2022, The Japanese Government launched the first Nikko Hotel in AMATA Industrial Estate, redefining Smart Living. The hotel Nikko AMATA city Chonburi is the second Nikko hotel in Thailand, a hotel chain under the management of Okura Nikko Hotel Management Group, an international authentic Japanese hotel chain. These initiatives in Japan have the main objective to give the customer an experience of the Japanese culture through the food and smart hospitality.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global smart hospitality market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global smart hospitality trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Smart Hospitality Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 133.7 billion |

| Growth Rate | CAGR of 22% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Solution Type |

|

| By Component |

|

| By Application |

|

| By Deployment Mode |

|

| By Region |

|

| Key Market Players | Schneider Electric, Cisco Systems, Inc., Johnson Controls, IBM CORPORATION, Siemens AG, Infor, Oracle Corporation, Huawei Technologies Co., Ltd., NEC CORPORATION, Honeywell International Inc. |

Analyst Review

The term "smart hotel" refers to the use of technology solutions meant to enhance customer comfort and user experience as well as to boost hotel profitability by enabling improved flow management and streamlining equipment maintenance. In addition, access to information is one of the main advantages of smart hotel technology for guests. This may entail a visitor asking a question using their voice on a device like an Amazon Alexa speaker and then hearing a thoughtful response. However, other hotel services can also be connected to gadgets.

Key providers in the smart hospitality market are Huawei Technologies Co., Ltd., Siemens AG and IBM CORPORATION. With the growth in demand for smart hospitality services, various companies have established partnerships to increase their solutions offerings in smart solutions. For instance, in October 2021, Tata Communications and Cisco Systems partnered, to provide IT infrastructure that is simple and quick to implement, administer, and analyses for organizations in order to provide everywhere, anytime access. Further, a world-class portfolio of next-generation cloud-managed Wi-Fi services based on the newest Wi-Fi 6 technology and SD-WAN (Software-Defined Wide Area Network) services are now available across several sectors due to Cisco Meraki's integration into the Tata Communications ecosystem drives the market growth.

In addition, with the surge in demand for smart hospitality, various companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in November 2019, Honeywell has introduced the launch of a new smart lighting solution for the hospitality sector. The INNCOM Digital Addressable Lighting Interface (DALI) module is a two-way communication system that enables the digitization of LED and non-LED lighting across a hotel property for flexible and dependable control, energy-efficient operations, predictive maintenance, and customized lighting settings.

For instance, in November 2022, Infor partnered with Rosen Hotels & Resorts, to implement key back-of-house hospitality solutions. That includes automating critical business functions like financials, human resources, talent, analytics, and workforce management. This strategic partnership is expected to drive market growth.

The smart hospitality market is estimated to grow at a CAGR of 22.0% from 2022 to 2031.

The smart hospitality market is projected to reach $133.68 billion by 2031.

Growth in tourism and an increase in investments in hotels projects, surge in demand for real-time optimized guest experience management, rapid adoption of advanced technologies like IoT and energy management systems globally contribute toward the growth of the market.

The key players profiled in the report include Cisco Systems, Inc., Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Infor, Johnson Controls, NEC Corporation, Oracle Corporation, Schneider Electric, and Siemens AG.

The key growth strategies of smart hospitality market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...