Smart Parking Market Overview

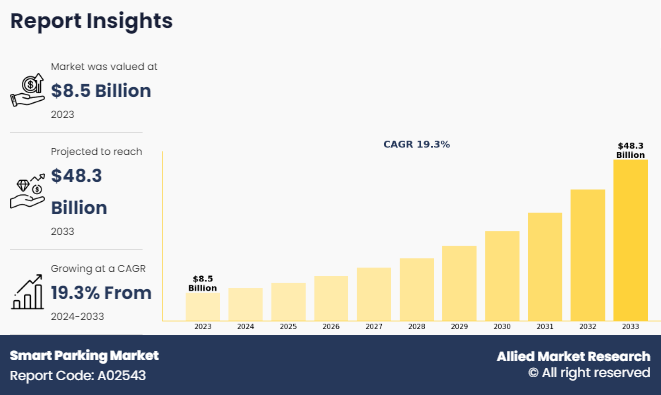

The global smart parking market size was valued at USD 8.5 billion in 2023, and is projected to reach USD 48.3 billion by 2033, growing at a CAGR of 19.3% from 2024 to 2033. Rising vehicle ownership and urban congestion are driving demand for smart parking solutions, supported by IoT and AI technologies that optimize space and reduce traffic. Government smart city initiatives and sustainability goals further boost market growth.

Key Market Trend & Insights

- Contactless Payments: Growing demand for FAST tag, mobile apps, and digital wallets for hassle-free parking.

- EV Adoption: Demand for EV-compatible smart parking systems is increasing.

- Off-Street Parking Leads: Preferred for better management and security.

- Ultrasonic Tech Dominates: Ensures accurate space detection.

- Focus on Security: Systems increasingly used for surveillance.

- Commercial Sector Dominates: High adoption in malls, airports, and offices.

- North America Leads: Region holds top market share due to tech adoption.

Market Size & Forecast

- 2033 Projected Market Size: USD 48.3 Billion

- 2023 Market Size: USD 8.5 Billion

- Compound Annual Growth Rate (CAGR) (2024-2033): 19.3%

Introduction

Smart parking is an advanced parking management system that uses technology to optimize the availability, accessibility, and utilization of parking spaces. By integrating sensors, cameras, and IoT-enabled devices, smart parking systems monitor real-time occupancy and guide drivers to available spaces, significantly reducing time spent searching for parking. These systems often incorporate mobile applications that allow users to reserve spaces, pay digitally, and receive notifications about parking availability and time limits. In addition, to improving the user experience, smart parking solutions enhance traffic flow and reduce congestion in urban areas, contributing to lower vehicle emissions. For parking facility operators, these systems provide valuable data analytics, enabling more efficient space management, pricing strategies, and predictive maintenance.

Market Dynamics

Smart parking industry is increasingly adopted in smart cities, airports, shopping centers, and corporate campuses, aligning with global trends toward sustainable urban mobility. As technology advances, features such as AI-powered analytics, autonomous vehicle integration, and solar-powered infrastructure are further shaping the future of smart parking systems.

For instance, in February 2023, Eleven-x, a Canada-based IoT company, has recently been selected for one of the largest municipal smart parking installations in North America. The project, located in Arlington County, Virginia, aims to bring a new level of efficiency and convenience to parking for both residents and visitors. The smart parking industry is expected to utilize wireless technology of eleven-x to monitor parking spots and provide real-time data on availability. This is expected to enable drivers to quickly find available spots and reduce the amount of time spent circling the block in search of parking.

For instance, in July 2022, Amano McGann, Inc. launched Amano ONE, the most simplified, powerful, and reliable parking access and revenue control system that efficiently optimizes parking operations. Amano ONE is a cloud-based platform designed to be easy to install and manage with lower maintenance costs, seamless updates, and intuitive onboarding. Moreover, in July 2022, Continental AG acquired Kopernikus Automotive underscores the evolution of smart parking by leveraging infrastructure-based automated solutions. Focused on parking garages and factory logistics, this innovation integrates advanced sensors and automation, enabling precise vehicle maneuvering. Such advancements align with smart parking's goals of optimizing space utilization, enhancing efficiency, and reducing congestion in urban and industrial environments.

The increase in parking concerns across the globe is significantly driving the demand for smart parking market, driven by increase in vehicle ownership and urban congestion, are fueling demand for the smart parking market demand. Advanced technologies like IoT and AI optimize parking space utilization, reduce traffic, and enhance driver convenience. Governments' push for smart cities and sustainability further accelerates adoption, making smart parking a critical solution for modern urban infrastructure. Furthermore, Growth in demand for Internet of Things (IoT)-based technology and an increase in the number of vehicles have driven the demand for smart parking market share.

However, the high implementation cost and configuration complexity of smart parking systems are key challenges limiting their widespread adoption. Advanced technologies such as IoT sensors and AI require significant upfront investment and technical expertise for seamless integration. These factors deter smaller municipalities and businesses from adopting smart parking solutions, slowing market growth despite increasing urban parking challenges. Moreover, low rate of internet penetration in developing regions are major factors that hamper the growth of the Smart Parking market growth.

On the contrary, the rise in investment in developing driverless vehicles presents a smart parking market opportunity. Autonomous vehicles rely on advanced parking systems, including automated guidance and connectivity features, to optimize space utilization and enhance efficiency. This synergy between autonomous driving technology and smart parking solutions is driving innovation and creating significant growth potential in the market.

Market Segment Review

The global Smart Parking market is segmented on the basis of component, type, system type, technology, application, end user, and region. On the basis of component, the market is bifurcated into hardware, and software. By type, the market is divided into off-street, and on street. On the basis of system type, the market is segmented into ground sensor, counter technology, and camera-based technology. By technology, the market is segmented into internet of things, ultrasonic, and RFID. On the basis of application, the market is segmented into security and surveillance, smart payment system, e-parking, and license plate recognition. By End User, the market is bifurcated into commercial, and government. Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

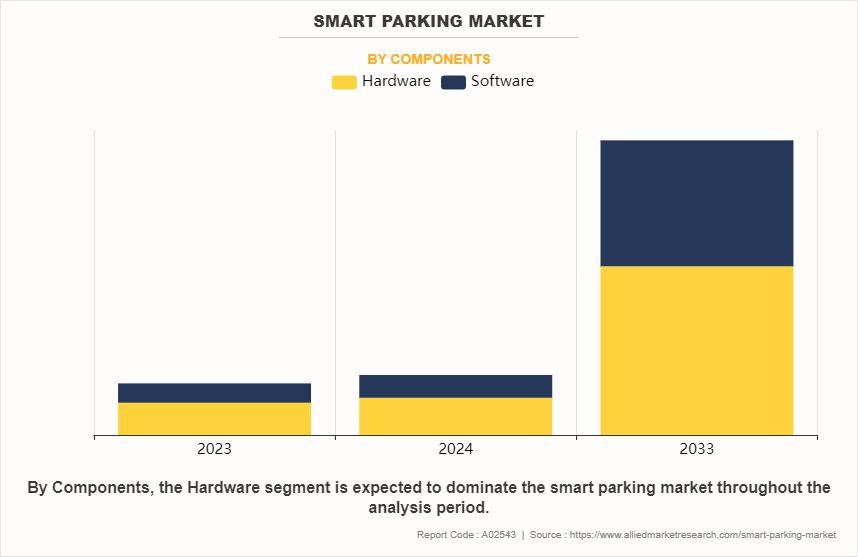

By Components

On the basis of components, the haedware segment attained the highest market share in 2023 in the smart parking market. This is due to the essential role of sensors, cameras, and parking meters in enabling automated parking systems. These components are crucial for detecting vehicle presence, managing parking spaces, and providing real-time data to users and operators. Advancements in hardware technology, such as ultrasonic sensors and license plate recognition cameras, have further boosted adoption by improving accuracy and reliability. The growing need for efficient parking management systems in urban areas has fueled demand for robust hardware solutions, making them a dominant segment in the smart parking market.

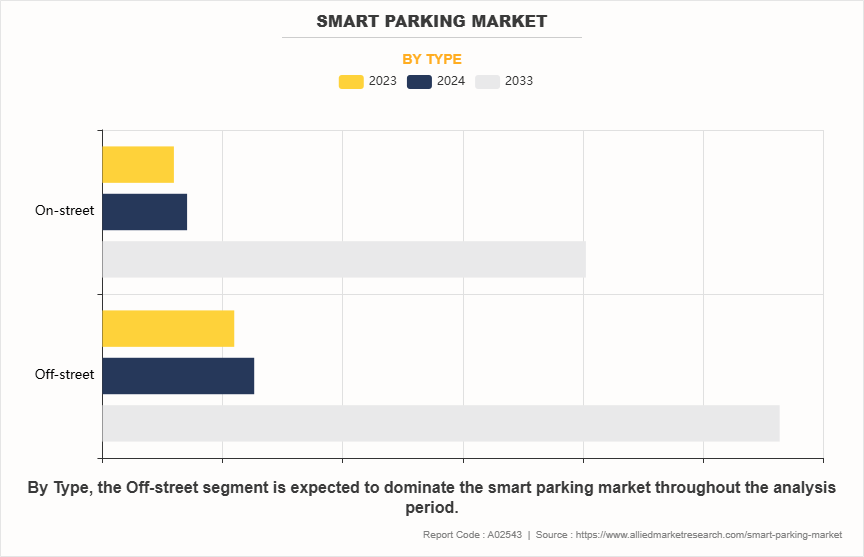

By Type

On the basis of type, the off-street segment attained the highest market share in 2023 in the smart parking market. This is due its ability to offer organized and efficient parking solutions in multi-level facilities and parking lots. Off-street parking systems utilize advanced technologies such as automated ticketing, real-time occupancy monitoring, and navigation aids, enhancing convenience for users. Increased urbanization and rising vehicle ownership have further driven the demand for off-street smart parking solutions globally.

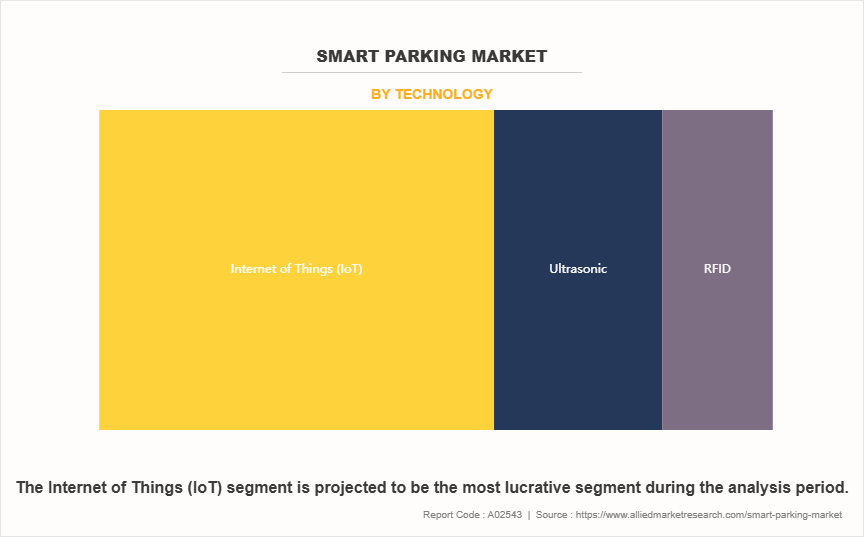

By Technology

On the basis of technology, the ultrasonic segment acquired the highest market share in 2023 in in the smart parking market. This is due to its precise and reliable performance in parking management systems. Ultrasonic sensors are widely used for detecting obstacles and measuring the distance between vehicles and parking spaces, providing accurate real-time data for efficient parking. Their ability to operate effectively in various environmental conditions, such as low visibility or during adverse weather, further contributes to their popularity. The growing adoption of autonomous vehicles and the need for seamless parking experiences have driven demand for ultrasonic technology in smart parking system market.

By Region

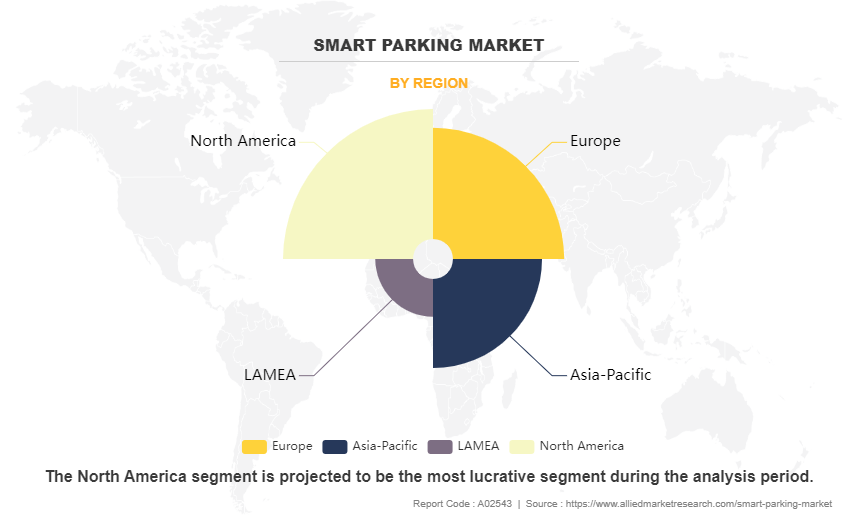

Region wise, North America attained the highest market share in 2023 and emerged as the leading region in the Smart Parking market. This is due to advanced infrastructure, high urbanization rates, and significant technological adoption. The region has been at the forefront of integrating smart city solutions, with a growing demand for efficient parking management in densely populated cities. Strong investments in Internet of Things (IoT) technology and connected infrastructure further fueled the market‐™s growth. Government initiatives, a high concentration of key market players, and the increasing adoption of electric and autonomous vehicles contributed to North America's dominance in the smart parking sector.

However, Asia-Pacific is projected to grow at the fastest rate during the forecast period. This due to rapid urbanization, increasing vehicle ownership, and a high demand for efficient parking solutions in densely populated cities. Governments across countries like China, India, and Japan are investing in smart city initiatives and infrastructure development, further boosting the adoption of smart parking system market. In addition, advancements in technology, such as IoT and AI integration, are driving innovation in parking solutions. The growing focus on reducing traffic congestion and enhancing urban mobility is also contributing to the region's market growth.

The report focuses on growth prospects, restraints, and trends of the smart parking market analysis. The study provides Porter five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the smart parking market.

Which are the Top Smart Parking companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the smart parking industry.

Amano McGann, Inc.

IPS Group, Inc.

TKH Group

SWARCO

Robert Bosch GmbH

Smart Parking Ltd

Urbiotica, S.L.

Continental AG

Aisin Corporation

IEM SA

What are the Top Impacting Factors

Key Market Driver

Grow In Demand for Contactless Payment Systems

The grow in demand for contactless payment systems is playing a crucial role in driving the smart parking market. As consumers increasingly seek convenience and efficiency, contactless payment solutions offer a seamless way to pay for parking without physical interaction. This demand is particularly relevant in smart cities, where technology is integrated into various aspects of urban infrastructure. In the smart parking market, contactless payments enable drivers to pay for parking through mobile apps, credit cards, or digital wallets, enhancing user experience and reducing the time spent at parking kiosks.

For instance, in July 2023, Airtel Payments Bank, partnered with Park+, is smart parking services, enabling seamless and automated parking experiences through a digital platform to launch a FASTag-based smart parking solution at Varanasi's Lal Bahadur Shastri Airport, offering a seamless and efficient parking experience. The system uses FASTag technology to enable automatic, cashless payments, reducing friction in vehicle movement and saving time. By leveraging contactless payment systems, this solution enhances convenience for users while streamlining parking operations, reflecting the growing trend of digital, cashless transactions in smart city infrastructure.

Moreover, these systems allow for real-time payment tracking, ensuring transparency and ease of management for both drivers and operators. The rise of cashless transactions aligns with broader trends in digital transformation, where touchless technology and remote access are becoming standard. As smart cities continue to evolve, the demand for efficient, secure, and convenient payment systems will further propel the growth of the smart parking market. Therefore, grow in demand for contactless payment systems drives the demand for smart parking market.

Growth In Demand for Internet of Things (IoT)-Based Technology

The growing demand for Internet of Things (IoT)-based technology is significantly boosting the smart parking market. IoT enables seamless connectivity between vehicles, sensors, and parking infrastructure, facilitating real-time monitoring, automated guidance, and efficient space utilization. With rise in urbanization and increasing vehicle ownership, cities face mounting parking challenges, including traffic congestion, time wastage, and fuel consumption. Smart parking solutions market address these issues by offering features such as real-time availability tracking, automated payment systems, and integrated mobile applications. Businesses and municipalities are increasingly adopting IoT-enabled parking systems to improve operational efficiency and reduce environmental impacts.

For instance, Foresight Autonomous partnered with South Korean companies 7meerkat and KONEC to transform urban smart parking through the integration of IoT, AI, and 3D perception technologies. This partnership focuses on developing advanced solutions for AI-powered vehicle data analysis, automated parking systems, and smart urban mobility. Key features include IoT-driven vehicle identification, such as license plate recognition, along with monitoring electric vehicles and assessing conditions like contamination and damage. This initiative highlights the critical role of IoT in building connected and intelligent parking ecosystems.

In addition, advancements in artificial intelligence and machine learning enhance predictive analytics for optimizing parking management. The growing adoption of electric vehicles and the need for efficient charging station management further contribute to the market's expansion. As IoT technology continues to evolve, the smart parking market is poised for substantial growth across urban and commercial sectors. Therefore, Growth in demand for Internet of Things (IoT)-based technology is driving the demand for the smart parking market.

Increase in the Number of Vehicles

The increase in number of vehicles worldwide is a major factor driving the growth of the smart parking market. As urbanization accelerates and vehicle ownership rises, cities face significant challenges, including traffic congestion, limited parking spaces, and inefficient parking management. Smart parking systems offer innovative solutions to address these issues by utilizing advanced technologies such as IoT, sensors, and real-time data analytics. These systems help drivers locate available parking spots quickly, reducing the time spent searching and minimizing fuel consumption and emissions.

For instance, Munich, launched smart parking solution that integrates edge computing, artificial intelligence, and deep learning to redefine urban mobility in smart cities. The Cleverciti Sensor precisely identifies the position and size of available parking spaces, delivering real-time, reliable data to drivers and parking operators. This is seamlessly complemented by automated payment systems and mobile applications, which enhance user convenience and streamline parking operations, making the process more efficient and hassle-free.

In addition, the rise in adoption of electric vehicles has created a demand for integrated smart parking solutions market that include charging station management. Governments and municipalities are increasingly investing in smart infrastructure to improve urban mobility and sustainability, further boosting the smart parking market. As vehicle numbers continue to rise, the need for intelligent parking solutions is expected to grow. Therefore, increase in the number of vehicles is driving the demand for the smart parking market.

Restraints

High Implementation Cost and Configuration Complexity

The high implementation cost and configuration complexity are significant challenges hindering the growth of the smart parking market. Deploying smart parking solutions often requires substantial investment in advanced technologies such as IoT, sensors, artificial intelligence, and cloud-based systems. These costs can be prohibitive for smaller municipalities and private operators, limiting widespread adoption.

In addition, the integration of multiple technologies demands technical expertise and careful configuration to ensure seamless communication between hardware and software components. This complexity can lead to delays, increased maintenance costs, and potential system failures, discouraging potential adopters. The need for reliable connectivity and infrastructure further adds to the challenges, particularly in regions with limited technological development. Despite the long-term benefits of reduced congestion and operational efficiency, the upfront financial and logistical barriers remain a deterrent. Overcoming these issues will require cost-effective solutions, simplified configurations, and government incentives to drive broader adoption of smart parking systems. Therefore, high implantation cost and configuration complexity is hampering the demand for the smart parking market.

Low Rate of Internet Penetration in Developing Regions

The low rate of internet penetration in developing regions is a major obstacle to the growth of the smart parking market. Smart parking systems rely heavily on stable internet connectivity to support real-time data transmission, IoT integration, and cloud-based operations. In many developing areas, inadequate internet infrastructure limits the deployment of these advanced technologies. This lack of connectivity affects the functionality of features like real-time space tracking, automated payments, and mobile application support, reducing the efficiency and appeal of smart parking solutions. Furthermore, limited internet access in these regions often correlates with lower digital literacy, posing additional challenges for user adoption. Without reliable internet, the benefits of smart parking, such as reduced congestion and enhanced convenience, cannot be fully realized, slowing market growth. Addressing this issue requires investments in internet infrastructure and localized solutions tailored to connectivity constraints. Therefore, low rate of internet penetration in developing region is hampering the demand for the smart parking market.

Opportunity

Rise In Investment in Building Driverless Vehicles

The rise in investment in developing driverless vehicles presents a lucrative opportunity for the smart parking market. Autonomous vehicles rely on advanced technologies such as IoT, artificial intelligence, and machine learning, which align seamlessly with smart parking solutions. These vehicles require precise and efficient parking systems to navigate and utilize spaces without human intervention. Smart parking infrastructure equipped with sensors, cameras, and real-time data analysis can support driverless cars by providing automated guidance, ensuring optimal parking space utilization.

For instance, in September 2024 Uber's partnership with WeRide, a Chinese self-driving tech startup, to launch robotaxis in the UAE marks a significant step toward integrating autonomous vehicles into ride-hailing platforms. This collaboration, alongside Uber's expanded partnership with Alphabet's Waymo in the U.S., underscores the growing demand for smart parking solutions. As robotaxis become more prevalent, the need for advanced, automated parking systems that can efficiently manage autonomous vehicles will increase, creating further opportunities for smart parking technologies to enhance urban mobility.

In addition, the integration of vehicle-to-infrastructure (V2I) communication enhances the ability of autonomous vehicles to interact with parking systems, creating a connected and efficient ecosystem. As major automakers and technology companies continue to invest heavily in driverless vehicles, the demand for compatible parking solutions is expected to surge. This synergy between autonomous driving and smart parking infrastructure creates a significant growth avenue for the market, revolutionizing urban mobility and parking management. Therefore, rise in investment in building driverless vehicles is lucurative opportunity for the smart parking market

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart Parking market forecast from 2023 to 2032 to identify the prevailing smart Parking market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart Parking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart Parking market trends, key players, market segments, application areas, and market growth strategies.

Smart Parking Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 48.3 billion |

| Growth Rate | CAGR of 19.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 453 |

| By Components |

|

| By Type |

|

| By System Type |

|

| By Technology |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Market Players | IEM SA, IPS Group, Inc., Robert Bosch GmbH, Continental AG, Aisin Corporation, SWARCO, Urbiotica, S.L., TKH Group, Smart Parking Ltd, Amano McGann, Inc. |

Analyst Review

Smart parking is a system that uses sensing devices to determine occupancy at the parking space .This makes the use of sensing devices that consists of cameras, counting equipment such as gates or RFID tags at the entrance of a lot, or different type of sensors that are equipped into the individual parking spaces.

A smart parking system typically obtains information about available parking spaces in a particular geographic area or in residential areas and process is real-time to place vehicles at available positions.

Increase in parking concern across the globe, growth in demand for Internet of Things (IoT) based technology, and high adoption rate in number of vehicles drive the growth of the smart parking market. However, high employment cost & configuration complexity restrain the market growth. Moreover, rise in investment on building driverless vehicles, and rise in government initiative in building smart cities across the globe are expected to create tremendous opportunities for the market.

Among the analyzed geographical regions, North America is expected to account for the highest revenue in the global market throughout the forecast period (2018-2025) followed by Asia-Pacific, Europe, and LAMEA. However, Asia-Pacific is expected to develop at a higher growth rate, predicting a lucrative market for smart parking.

Amano Mcgann, Inc., Urbiotica, Smart Parking Ltd., IEM SA, IPS Group Inc., Klaus Multiparking Systems, Swarco AG, PArklayer, Omnitec group, Dongyang Menics Co. Ltd., Skidata AG, and Mindteck are the key market players that occupy a significant revenue share in the smart parking market.

Upcoming trends in the global smart parking market include the increased adoption of AI-driven solutions, integration of Internet of Things (IoT) technology, use of autonomous parking systems, implementation of smart payment systems, and enhanced security and surveillance features for better efficiency and user experience.

Ultrasonic is the leading application of Smart Parking Market

North America is the largest regional market for Smart Parking

$ 6844.3 million is the estimated industry size of Smart Parking.

McGann, Inc., IPS Group, Inc., TKH Group, SWARCO, Robert Bosch GmbH, Smart Parking Ltd, Urbiotica, S.L., Continental AG, Aisin Corporation, IEM SA.

Loading Table Of Content...

Loading Research Methodology...